Hey! It’s Fed Day

Here’s a lesson on game plans.

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Every week, MrTopStep invites traders to an “Own the Close” contest where the closest guesstimate where the SPX will settle on Friday’s 4:00 cash close.

The winners get a free week’s access to the MrTopStep Chat and trading tools. Enter your guess now!

Our View

I want to share something and this goes back to following your trading game plan. I usually write the Opening Print at night, as I did on Monday evening. However, on Tuesday morning, I changed my mind about the Lean.

A fellow trader was warning me about the downside and seeing the ES fall. Ultimately, I changed the Lean — something I never like to do. I even told our editor that: “You know what happens when I do this.” He said it was a dice roll, but we went with it anyway thinking that it’s what made the most sense.

When I do this, it almost always blows up in my face. If I have done it 20 times in 30 years, I’m wrong changing it probably 85% of the time.

The moral of the story is to stick to your plan. Generally, your first instinct will be the correct one.

Our Lean

As always no one knows for sure where the S&P is going next, but what I do know is the ES is back trending higher again and the stats for the Fed’s first day of the two-day meeting was bullish. So are the stats for today. We all know March is known for its rips and dips, but who said it has to close down on the month?

Our Lean is simple: I think higher prices, but I also think this is fair to say: there will be dips.

As you know I am a strength/weakness trader, meaning I like selling the rallies and buying the pullbacks but when the ES is trending higher it’s sometimes easier to just buy the drops. I know it’s hard to do, and it’s not without some pain but I like catching the falling knife and that’s what I am looking for today. I also think if the ES closes higher tomorrow we see another rip into the week 4 FRYday options expiration. Yeah, the ES rallied but there are more shorts to FRY.

One word of caution.

HandelStats says Fed decision days are one of the least predictable trading days of the year.

MrTopStep Levels:

MiM and Daily Recap

ES Recap

The ES traded up to the 5226 level after 4:00 yesterday and sold off down to 5186.00 on Globex at 8:30 am and then traded back up to 5206.50 at 9:29 and opened Tuesday’s regular session at 5205.75.

After the open, the ES traded 5206.50 and then sold off down to 5195.25 — I lost data from 9:43 to 11:38 — and traded up to 5218.50, and pulled back a few points down to 5212.50 at 11:59. The ES then traded up to 5239.00 and then back down to 5227.75, and then up to a lower high at 5237.00 at 1:46 before selling off down to 5226.25 at 3:16.

From there, the ES rallied back up to 5244.75 at 3:49 and traded 5339.50 as the 3:50 cash imbalance showed $511 million to sell and traded 5241.50 on the 4:00 cash close. After 4:00, the ES traded 5239.75 and then rallied up to 5244.00 and settled at 5239.50, up 25 points or +0.45% on the 5:00 futures close.

In the end, yes the markets rallied but it was slow. In terms of the ES’s overall tone, the pullbacks were being bought. In terms of the ES’s overall trade, volume was LOW: Only 241k ES traded on Globex, and only 792k traded on the day session for a total of 1.033 million contracts traded.

Technical Edge

-

NYSE Breadth: 56% Upside Volume

-

Nasdaq Breadth: 54% Upside Volume

-

Advance/Decline: 68% Advance

-

VIX: ~14

ES Daily

Guest Post

Topic: PTG/Taylor 3 Day Cycle

Author: David D Dube’ (a.k.a. PTGDavid)

Website: https://polaristradinggroup.com/

Here’s What to Expect From Powell

-

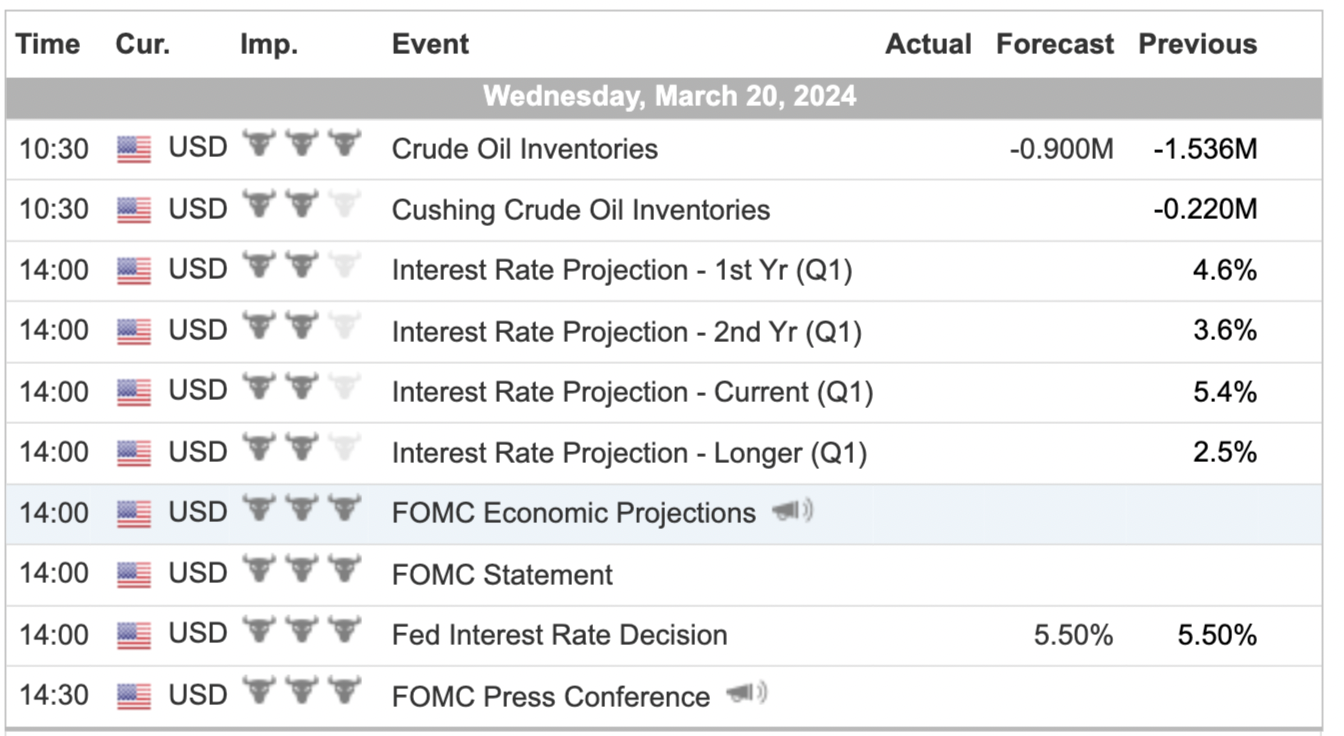

Interest Rates: The Federal Reserve is expected to maintain interest rates at the highest level in 23 years, ranging between 5.25% and 5.5%. This aims to control inflation, but investors hope for a swift rate cut. Inflation has retreated from its peak in 2022 but remains above the Fed’s 2% target.

-

Dot Plot and Projections: Powell will present the dot plot during the press conference, illustrating interest rate projections until 2026.

-

Balancing Decisions: Powell must balance a gradually slowing labor market with a robust consumption trend.

Source: Investing.com

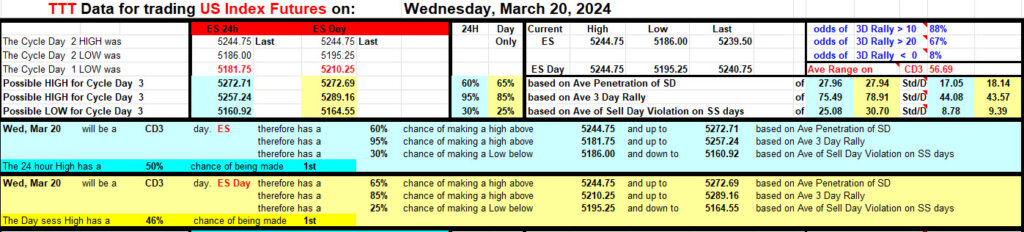

Prior Session was Cycle Day 2: Trend Day Up unfolded fulfilling some upper cycle levels. Range was 58 handles on 1.318M contracts exchanged.

…Transition from Cycle Day 2 to Cycle Day 3

This leads us into Cycle Day 3: The MAIN EVENT for today’s session is FOMC / Presser. Expectations are noted in the section above. 3 Day Cycle objectives have been fulfilled, so we’ll mark today’s session as a “wild-card” given the high potential for sharp volatility-induced price swings.

As always, our tactical trade plan remains unchanged…Stay in alignment with dominant intra-day forces. As such, scenarios to consider for today’s trading.

Bull Scenario: Price sustains a bid above 5235, initially targets 5260 – 5265 zone.

Bear Scenario: Price sustains an offer below 5235, initially targets 5215 – 5205 zone.

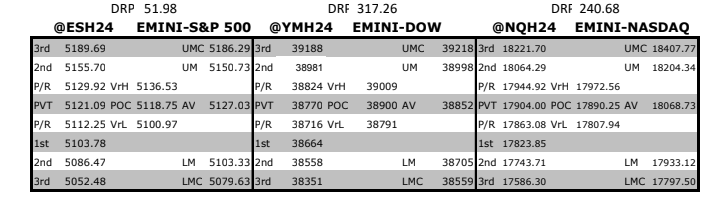

PVA High Edge = 5244 PVA Low Edge = 5200 Prior POC = 5233

*****The 3 Day Cycle has a 90% probability of fulfilling Positive Cycle Statistics covering 12 years of recorded tracking history.

Click image for full spreadsheet:

Thanks for viewing,

PTGDavid

Economic Calendar

For a more complete Economic Calendar see: https://mrtopstep.com/economic-calendar/

Comments are closed