Q1 Comes to a Close

Can small caps outperform?

Follow @MrTopStep on Twitter and please share if you find our work valuable.

Our View

The end of the first quarter rebalance has been all-encompassing.

No matter if it’s a gap-up open or just a small short-covering rally, the sellers are sitting on top. I could have made up my entire loss had I sold the ES open, but I kept thinking two things:

-

You can’t sell weakness into the close 3 days in a row, and

-

I thought everyone was short looking for a big MOC sell.

I was right and between my scalps and my late day long I made 85% of my loss back. Had I held for 10 more minutes I would have made over double my loss back. But that’s the markets for you.

Our Lean

This goes until further notice: You can get the ES to close down one day, and you may be able to get the ES to close down two days…but getting three down days in a row is almost impossible. Every Joe Schmoe in the world thought there was another big MOC sell — I didn’t. What I saw today, I saw hundreds of times on the floor.

The big rotation over the last few days was selling the S&P and Nasdaq and buying the Russell 2000 small caps. Tom Lee from Fundstat says the Russell can go up 50%. I am not ready to say that, but maybe buy some IWM calls on a pullback.

Our Lean

The day before Good Friday (today) has been up 8 of the last 9 occasions. I can’t rule out some selling tied to the rebalance, but it looks like that train left the station. Our lean is for higher prices, but that doesn’t rule out some downside raids.

As you see below in the recap section, I put out live (in the MTS chat room) where all the buy stops were and the ES grabbed all of them — but there is another large line of buy stops from 5318.50 to 5328-30.

Remember, after big initial moves, the ES tends to go to sleep and/or pull back. I think buying 10-point pullbacks under the VWAP would be a great trade location. (remember that trading strategy? It’s right here).

Someone asked me if I still do my own levels, and yes I do.

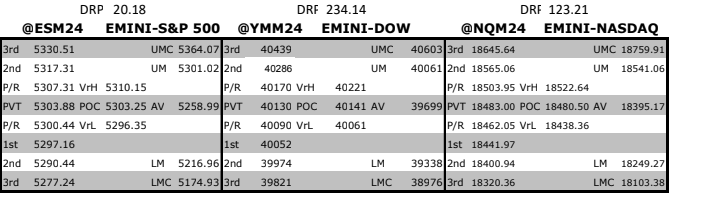

Support: 5300, 5292.25 to 5294.25, 5285 to 5287.50, 5276, 5271

Resistance: 5314-5316, 5319-5321, 5328, 5346, 5351, 5360

MrTopStep Levels:

MiM and Daily Recap

ES Recap

After a weak close and $5 billion to sell, the ES rallied all the way up to 5288.75 on Globex and opened Wednesday’s regular session at 5293.00. After the open, the ES traded 5244.00, sold off down to 5287.25, rallied up to a lower high at 5293.25 at 9:5 and then sold off down to 5274.00 at 10:05. From there, the ES popped back up to 5280.50 and then sold off down to 5271.75 at 10:54.

After the low, the ES did a small sideways-to-up back-and-fill to the 5277.25 level, sold off down to a 5270.75 low at 12:07, rallied up to 5281.50 at 1:05 (just above the VWAP) and then sold off down to 5273.50 at 1:13. After that, some small buy programs hit that pushed the ES up to 5287.00 at 2:33, then pulled back to the 5275.75 level at 3:21, rallied up to 5302.75 t 3:46 and traded 5299 as the 3:50 cash imbalance showed $650 million to buy to buy. The ES traded 5310.25 on the 4:00 cash close and after 4:00, it rallied up to 5313.75 and settled at 5308.25, up 43 points or +0.82%. The NQ settled at 18,505.25, up 56.50 points or 0.31% and oil closed at $81.71, up 0.09%.

3 Parts To The Trading Day

In the end, everything went according to the script.

-

The ES closed on its lows Tuesday (never sell a weak close), rallied 31 points from its 5263 low up to 5294

-

Opened on its high, and then sold off 33 points

-

From 5278.50 at 3:29 to the 5313.75 high, the ES rallied 32.75 points.

In terms of the ES’s overall tone, the futures were under selling pressure until late in the day and then staged a mammoth rally. In terms of the ES’s overall trade, volume was still low (although it was the highest volume day this week): 160k traded on Globex and 1.189 million traded on the day session for a total of 1.349 million contracts traded.

I had a feeling there was going to be a rip… and here are a few of the post from the MTS feed. Notice the time stamps:

-

IMPRO : Dboy : (1:58:35 PM) : my fear is a ripper buy program

-

IMPRO : Dboy : (1:59:14 PM) : they could rally right back to 5304

-

HANDEL : Dboy : (2:24:19 PM) : buy lottos for tomorrow’s positive day?

-

-

HANDEL : Dboy : (2:24:39 PM) : acts so bad u gotta buy

-

HANDEL : Dboy : (2:26:12 PM) : everyone trying to ride the rebalance sales

-

IMPRO: Dboy: (2:32:29 PM): buy stops above 88.50 up to 96.00 & above 5299.00 up to 5209

-

IMPRO : Dboy : (2:56:05 PM) : ES doesn’t want to go down

-

IMPRO : Dboy : (3:21:03 PM) : trickeration coming

-

IMPRO : Dboy : (3:21:50 PM) : ES not going down

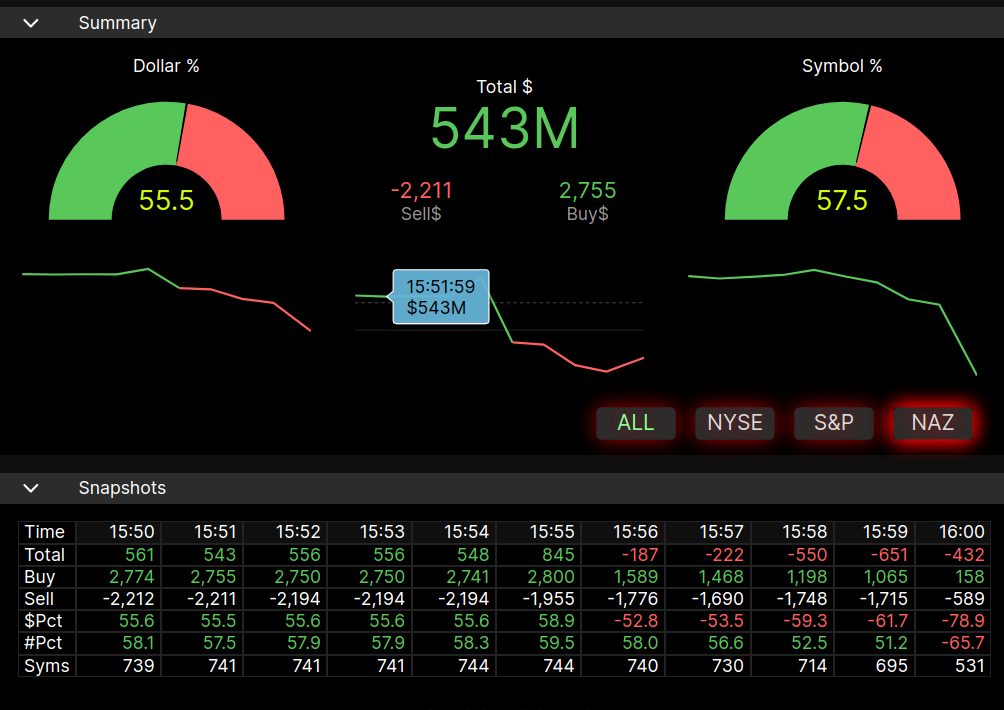

MIM Snapshot

Technical Edge

-

NYSE Breadth: 83% Upside Volume (!)

-

Nasdaq Breadth: 72% Upside Volume

-

Advance/Decline: 82% Advance (!)

-

VIX: ~13.00

Guest Post — Tick Titan Trading

GC

I am currently monitoring a Daily GC chart for further upside movement. It is clearly making HH’s and HL’s, so I would not be surprised to see prices reach the High made on March 21st.

From there, who knows? Nothing in the way, so it could potentially grind higher (of course pullbacks are to be expected) and quite possibly reach the High made on March 8th, 2022!

Personally, I will be looking to buy any dips on GC. If I do spot a setup which I call Athena, I will drop a quick note into the Newsletter so that we can all take advantage of this grind higher.

With all of the current geo-political events unfolding around us on what seems a Daily basis, it stands to reason that GC will climb higher. Let’s take advantage of every pullback.

Should you wish to join us in our trading room, here are some links for you:

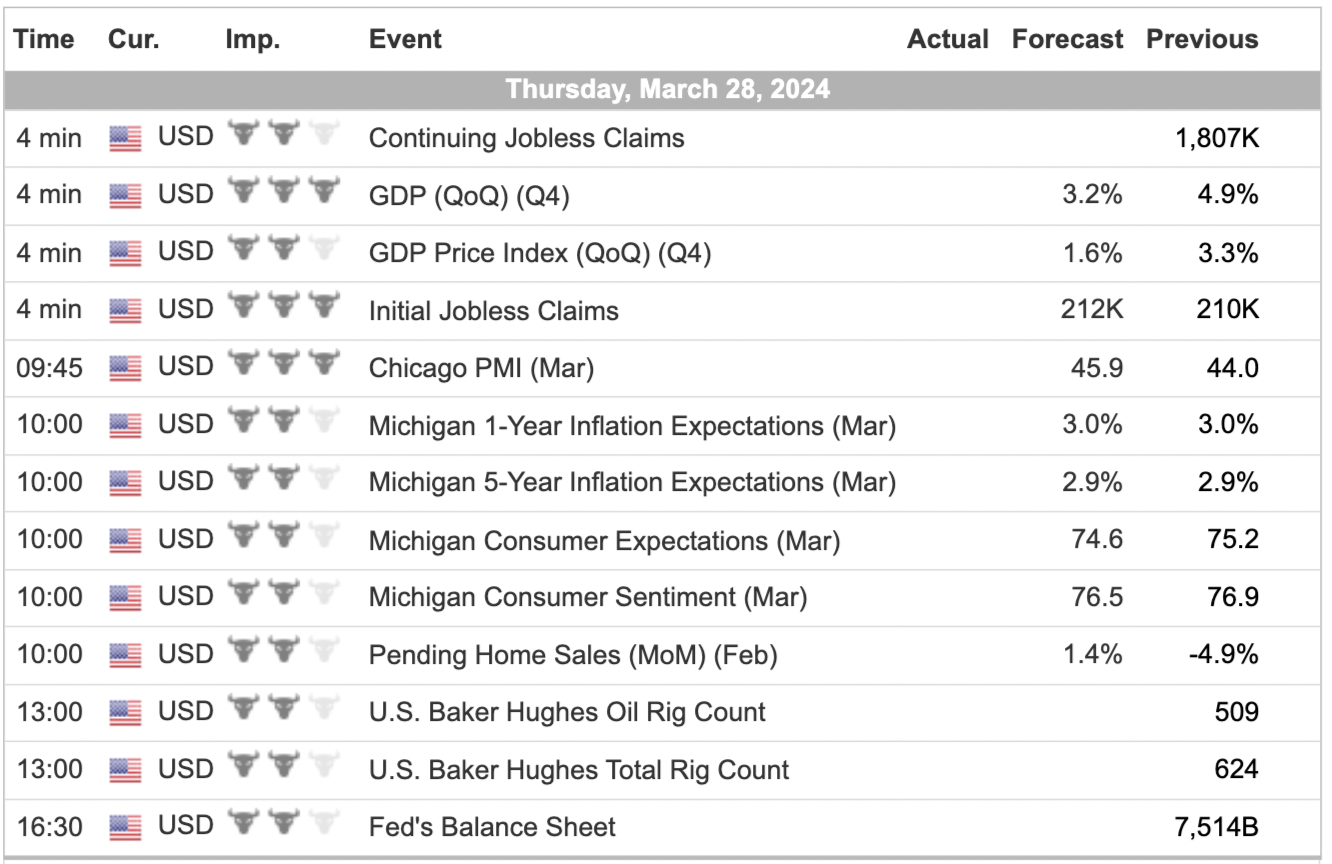

Economic Calendar

For a more complete Economic Calendar see: https://mrtopstep.com/economic-calendar/

Comments are closed