We Were Due for a Pullback

Today’s the March triple witching expiration

Follow @MrTopStep on Twitter and please share if you find our work valuable.

Our View

I’m sorry, I had a feeling that we could see a letdown yesterday and most of it was based on the overall price action of the NQ (weakness on Wednesday). Additionally, my conversation with PitBull is that everyone is trying to pile into today’s $2.7 trillion options expiration — the March triple witching.

All I can say is that volatility is picking up and the selloff is/was overdue.

The PitBull was having a pretty good time. Here’s what he sent the Mr. Top Step chat after the close:

-

IMPRO: PITBULL (4:29:17 PM): At 10am the NYA was 17,887 and then nothing happened for 6 hours because at 4pm it closed at 17,886

-

IMPRO: PITBULL (4:30:07 PM): Pretty funny, that is why trading is so much fun!!

Our Lean

I did a livestream on Twitter where I talked about a lot of things, but the main part was the $10 million hit I took during the Flash Crash.

I am not saying that is going to happen again, but when you see the ES drop 20 or 30 points in a few minutes, who is to say that can’t be 60 or 80 or for that matter 100 to 300 points. Hell, in the Flash Crash the Dow fell 1000 in 30 minutes.

What the longs need to understand is that nothing goes up forever. That said, today is the March Triple Witching. First, I’m going to say that it’s usually busy for the first hour and a half and the last hour with a big volume print on the open and close which will make up a large percentage of the day’s volume. The other part is if NVDA and friends are weak, it will make for a very difficult expiration.

Our Lean: Look for a good pullback to buy and see if I can hold it. If the price action resembles yesterday, I’ll be selling the rips as I believe there will be two-way price action.

According to the Stock Trader’s Almanac, the March Triple Witching has been ‘mixed’ the last 30 years, but the Nasdaq has been up 7 of the last 9. That’s what I will be looking at.

You know how I always talk about a feel for the markets? Well I found this and I think it is a good description of how I read the markets, it’s an old story but it makes sense. Give it a read today or this weekend if you’d like.

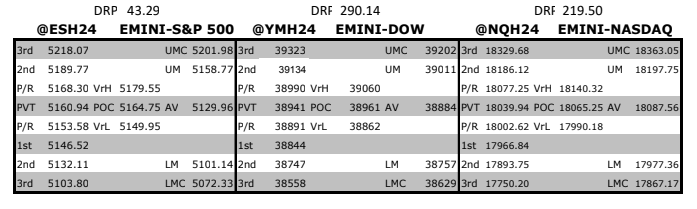

MrTopStep Levels:

MiM and Daily Recap

ES recap

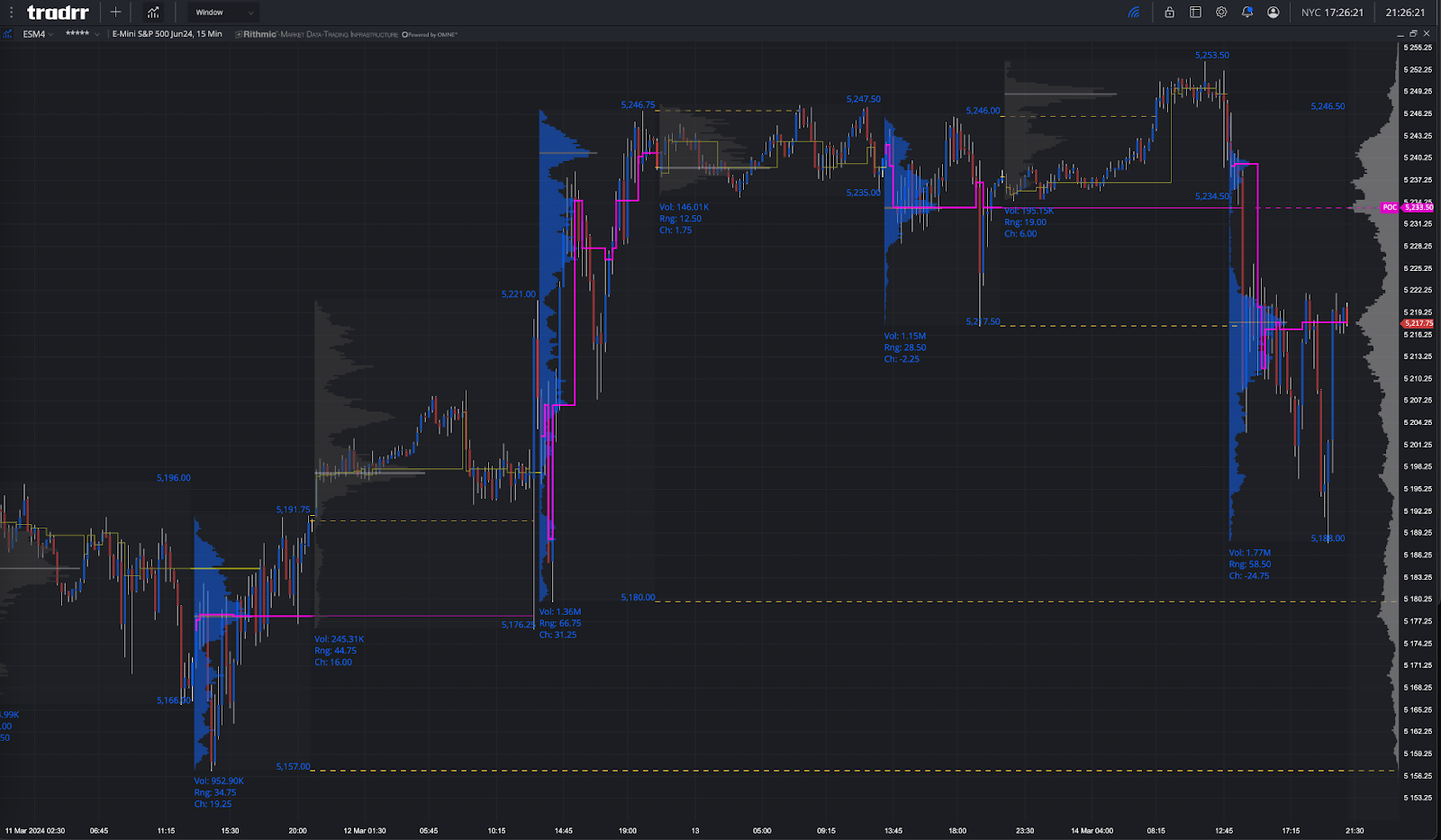

After falling over 20 points late in the day Wednesday, the ES traded up to 5253.50 on Globex and opened Thursday’s regular session at 5240.00. After the open, the ES traded 5241.50 at 9:40, dropped 21.25 points down to 5218.75 at 9:46:28, up-ticked to 5223.00, and then did a slow slide down to 5210, up-ticked and then dropped down to 5203.00 in one of the biggest stop runs in a long time as the bonds and notes tumbled (shown below):

ZB recap (bonds)

After the low, the ES rallied up to 5222.75, pulled back to 5214.00, and traded up to 5226.00 at 10:38, sold off down to a 5210.25 double bottom at 11:33, rallied up to a lower high at 5221.75 at 12:02, traded down to 5208.25, rallied back up to another lower high at 5219.75 at 12:38 and sold off down to a new low at 5196.75 at 1:32. It was that low that set off a ~25 point rally up 5222.00 at 2:17. From there, the ES dipped back down to 5212.25 at 2:38, then fell all the way down to 5188.00 at 3:37 before rallying back up to 5204.75 at 3:46.

The ES traded 5205.75 as the 3:50 cash imbalance showed $4.9 billion to buy and rallied up to 5219.00 and traded 5219.50 on the 4:00 cash close and traded 5222.00 at 4:00:13. The ES rallied 34 points in 27 minutes. After 4:00, the ES pulled back to the 5216.50 level and settled at 5217.75 close, down 20 points or -0.38%. The NQ settled at 18,226.25, down 89.75 points or -0.49%, crude oil (CLJ4) settled at 81.11, up 1.39% or +1.74%, Bitcoin (BTCJ4) settled at 71,800, 3,000 or -4.01%, 10 yr note (ZNM4) settled at 110.075, down 0.225 points or -0.63% and bonds (ZBM4) settled at 118.26, down 1.14 points or 1.17% on the day.

Everything is moving …. and not all of it is good.

In the end, I did call for selling the early rallies and buying weakness, but very early I posted the following levels: 5193, 5196, 5175. In terms of the ES’s overall tone, it was weak but had a 34-point rally off the 5188 low. In terms of the ES’s overall trade, 257k traded on Globex and 1.699 million traded on the day session for a total of 1.956 million contracts traded, including the ESM/ESH rolls.

Technical Edge

-

NYSE Breadth: 19% Upside Volume (!)

-

Nasdaq Breadth: 25% Upside Volume

-

Advance/Decline: 21% Advance

-

VIX: ~14.25

Guest Post

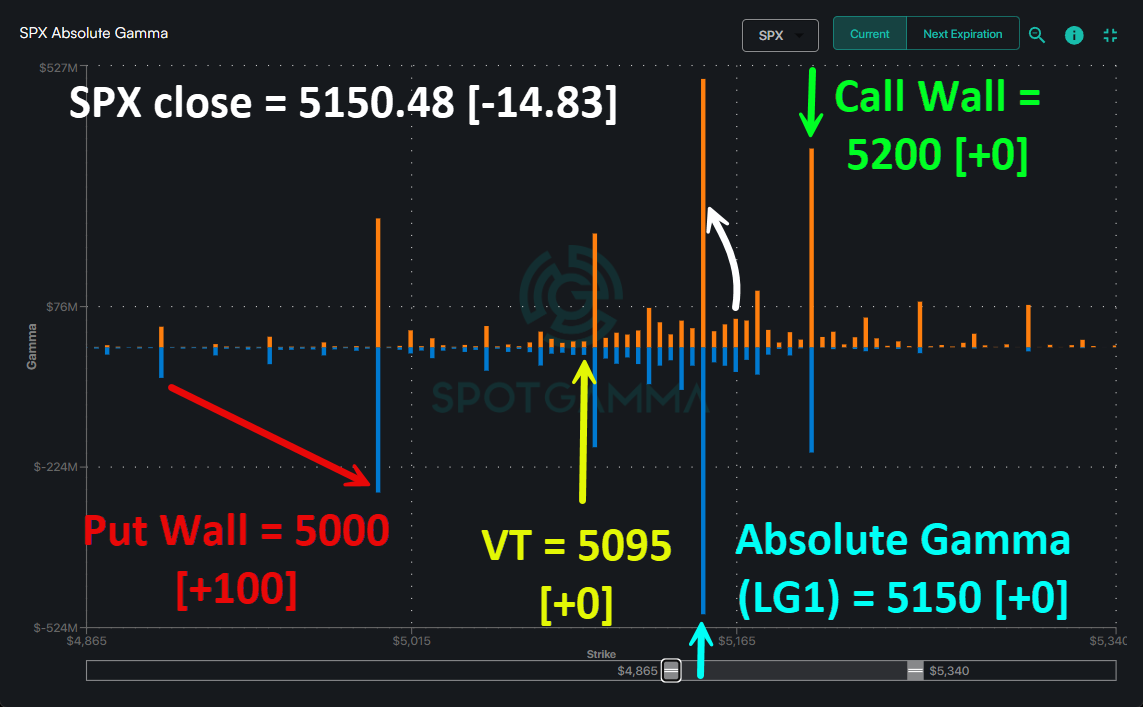

SpotGamma is one the the shining stars of the options markets. If you have never heard of them or already know of them and have never signed up for their options flow products or the SG Academy, I fully suggest you check them out and add them to your trader’s toolbox.

Here’s a snippet from them:

Concluding with structural considerations, most of the key levels are still in place, except for the Put Wall which moved up. The price also converged into Absolute Gamma, which is interesting. Another big development is that 5150 is no longer receiving major Open Interest rotations like it was on Monday and Tuesday. Now, most of the calls are rotating into 5200, therefore strengthening this Call Wall level. However, market structure will start being thrown asunder tomorrow, and it might not be until next week that we have renewed structural clarity.

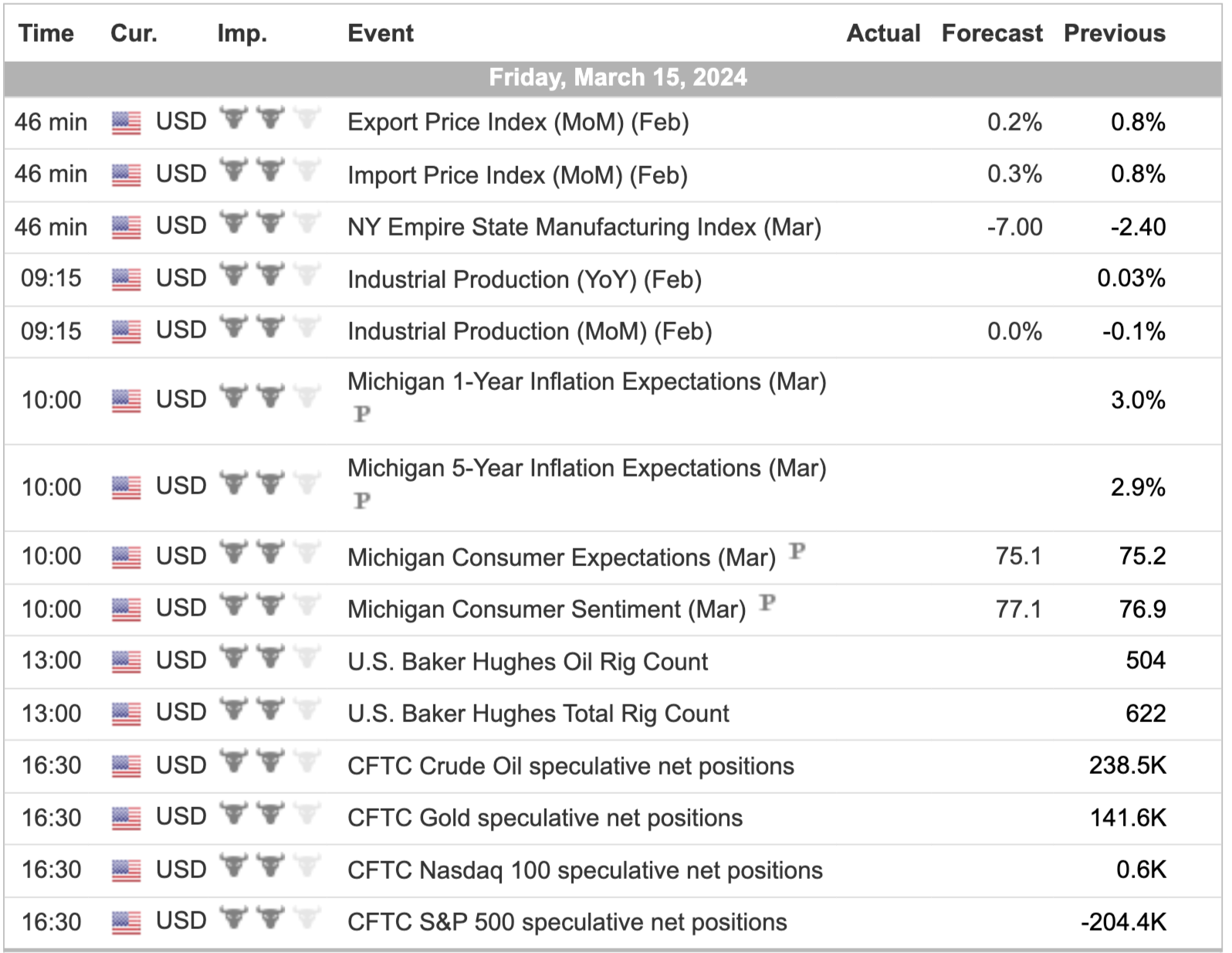

Economic Calendar

For a more complete Economic Calendar see: https://mrtopstep.com/economic-calendar/

Comments are closed