TODAY’S GAME PLAN: from the trading

desk, this is not research

DATA/HEADLINES 8:30ET Personal Income/Spending, PCE*, 10:00ET U. of Mich. Sentiment; 10:30ET Kansas City Fed

Services Activity

TODAY’S HIGHLIGHTS:

- NYC offers migrants free travel anywhere to move

- Squad of female IDF combat troops eliminated nearly 100 Hamas terrorists – JP

- Hamas: Approx. 50 Israeli hostages killed in Gaza

- Tel Aviv apartment building hit by rocket as region targeted in successive barrages

- Bear attacks have soared to a record in Japan, prompting officials to put a bounty on them

Global shares are higher at the end of a turbulent week, as the latest results from US tech majors and positive data on the China economy helped drive a rebound.

The earnings season has proved a mixed bag so far, with investors punishing misses more severely than rewarding beats. In the US, 78% of companies reporting so far beat estimates, compared with 57% in Europe, according to JPMorgan strategists. Key points to

watch next week include policy meetings at the Federal Reserve and Bank of Japan. Tokyo’s headline and ex-fresh food CPIs for October came in hot, adding pressure on the BOJ. Meanwhile, Iran’s deputy foreign minister met with a Hamas official in Moscow and

said the militant group wants an immediate ceasefire.

EQUITIES:

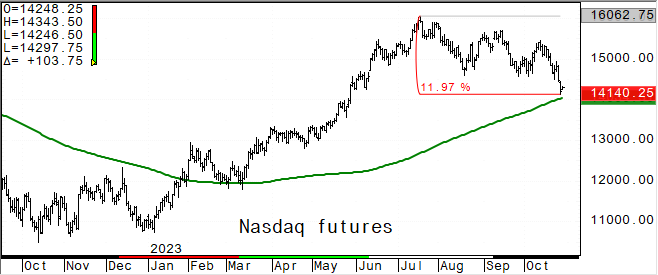

US equity futures climbed after positive earnings reports from Amazon.com and Intel helped lift sentiment one day after a selloff that was partly fueled by dismal

results from Meta and others. The focus now turns to a raft of reports today, including the Federal Reserve’s preferred measure of underlying price pressures. Headline PCE is set to come in at about 3.4%, giving the Fed reason to keep rates on hold.

Futures ahead of the bell: E-Mini S&P +0.15%, Nasdaq +0.6%, Russell 2000 -0.05%, Dow -0.25%.

In pre-market trading, Amazon (AMZN) rose 6.0% after posting robust sales and profit growth and indicated that its cloud unit is regaining momentum. Intel (INTC) gained 7.3% after the

chipmaker forecast adjusted EPS and revenue for the fourth quarter above estimates. Ford (F) fell 3.6% after the automaker reported adjusted earnings per share for the third quarter that missed estimates. Enphase Energy (ENPH) shares slumped 22% after the

solar-equipment manufacturer forecast fourth-quarter revenue below expectations. Rivian (RIVN) rose 2.7% as Cantor Fitzgerald raises the recommendation on the EV startup to overweight from neutral. Roblox (RBLX) shares gained 2.8% after Raymond James initiated

coverage with a strong buy recommendation. Dexcom (DXCM) rallies 17% after raising its revenue guidance for the full year, allaying Wall Street’s fears on the impact of weight-loss drugs on the diabetes-device maker. Deckers Outdoor rallies 10% post-market

after the apparel company boosted its full-year net sales forecast and posted second-quarter results that beat analyst estimates.

European gauges have been choppy today, reversing early losses only to tumble again as reports of a direct rocket impact in Tel Aviv spooked investors. The Stoxx 600 index is lower with

healthcare and food & beverage leading declines while energy and chemicals outperform. French drugmaker Sanofi plunged as much as 16% after an earnings miss and downbeat outlook, while UK lender NatWest Group slumped after cutting margin guidance. Universal

Music Group NV, the record label for Taylor Swift, dropped after missing profit estimates. Electrolux AB shares fell as much as 14% after reporting. Italy’s Moncler became the latest luxury company to disappoint this season as analysts noted weaker trends

into the latter part of the year. On the plus side, energy majors advanced. Ubisoft Entertainment SA rose as much as 12% after the French video games manufacturer reported an earnings beat. Stoxx 600 -0.5%, DAX -0.1%, CAC -1.1%, FTSE 100 -0.3%. Healthcare

-2.4%, Food & Bev -1.3%, Media -1.2%. Energy +1.2%, Chemicals +0.9%.

Asian stocks rose with the MSCI Asia Pacific Index gaining 1.1%, capping the busiest week in the Asia Pacific region this earnings season. Alibaba, Tencent and Toyota led gainers, while

Nexchip Semiconductor and Loongson Technology slumped after reporting slides in revenue for the third quarter. China’s industrial profits in September rose 11.9% from a year earlier, marking the second straight month of expansion, helped boost risk appetite.

Philippine banks fell after the nation’s central bank resumed tightening monetary policy in an off-cycle move. Hang Seng Tech +2.5%, Hang Seng Index +2.1%, CSI 300 +1.4%, Topix +1.4%, Thailand +1.2%, Sensex +1%, Vietnam +0.5%, Taiwan +0.4%. Singapore -0.3%,

Philippines -0.9%.

FIXED INCOME:

Treasuries are slightly cheaper across the curve, with the long-end leading losses on the day. US yields cheaper by up to 3bp across long-end of the curve with 2s10s,

5s30s spreads steeper by 1bp and 2bp on the day; 10-year yields around 4.76%. The US session will focus on data including personal income and spending along with PCE deflator.

METALS:

Gold fluctuated as the conflict in the Middle East continues to offer support, although choppy moves in Treasuries are muddying the outlook. Bullion has risen more than 8% since the Oct.

7 attack by Hamas on Israel increased demand for safe-haven assets. The US economy accelerated at the fastest pace since 2021 last quarter, data showed Thursday, with gold paring gains after the figures. Spot gold -0.2%, silver -0.4%.

ENERGY:

Crude oil rose, paring its weekly loss, as the US conducted strikes on Iran-linked facilities in Syria, stirring investor concerns that the Israel-Hamas war may spark

a wider conflict and disrupt crude supplies. Iran’s foreign minister warned yesterday that the US won’t escape unaffected if the Hamas-Israel war turns into a broader conflict, responding after the Biden administration said Iran was ultimately to blame for

a recent spate of drone attacks on American forces. An unprecedented gasoline glut is building along the US Gulf Coast as fuel makers face the prospect of curbing production. WTI +1.8%, Brent +1.6%, US Nat Gas +3%, RBOB +1.5%.

CURRENCIES:

The dollar is steady before the release of key US economic data as focus turns to next week’s Federal Reserve meeting. The yen is up first day in four as data showed

consumer price growth in Tokyo unexpectedly quickened for the first time in four months in October. US $Index ~flat, GBPUSD -0.03%, USDJPY -0.2%, EURUSD -0.15%, AUDUSD +0.35%, USDNOK +0.1%.

Bitcoin -0.3%, Ethereum -0.7%.

TECHNICAL LEVELS:

|

ESZ23 |

10 Year Yield |

Dec Gold |

Dec WTI |

Spot $ Index |

|

|

Resistance |

4322.00 |

6.000% |

2100.0 |

93.10 |

110.000 |

|

|

4288.00 |

5.750% |

2081.0 |

92.13 |

108.970 |

|

|

4255.00 |

5.500% |

2056.0 |

89.85 |

107.990 |

|

|

4235.00 |

5.325% |

2028.6 |

88.13 |

107.350 |

|

|

4202.00 |

5.000% |

2012.7 |

86.38 |

106.785 |

|

Settlement |

4156.50 |

1997.4 |

83.21 |

||

|

|

4134.50 |

4.800% |

1956.0 |

81.50 |

105.270 |

|

|

4111/14 |

4.490% |

1945.2 |

80.20 |

104.380* |

|

|

4104.00 |

3.925% |

1921.2 |

79.35 |

103.800 |

|

|

4068/74 |

3.870% |

1894.0 |

78.26 |

103.330 |

|

Support |

4030.00 |

3.500% |

1863.0 |

75.63 |

|

Colors within the report:

Green is always the 200 period (day, week).

Red is always 21,

Blue = 50,

Brown =

100 *Stars have added importance

- Upgrades

- Adtalem (ATGE) Raised to Outperform at Baird; PT $55

- Blueprint Medicines (BPMC) Raised to Outperform at Oppenheimer; PT $85

- Bristol Myers (BMY) Raised to Hold at HSBC; PT $53

- CCU (CCU CI) ADRs Raised to Buy at HSBC; PT $15

- EastGroup (EGP) Raised to Outperform at Raymond James

- Intel (INTC) Raised to Hold at HSBC; PT $33

- Merck & Co (MRK) Raised to Outperform at BMO; PT $132

- Old Dominion (ODFL) Raised to Buy at Stifel; PT $416

- Origin Bancorp (OBK) Raised to Outperform at Raymond James

- ResMed (RMD) Raised to Overweight at Morgan Stanley

- Rivian (RIVN) Raised to Overweight at Cantor; PT $29

- Roblox (RBLX) Raised to Buy at Truist Secs; PT $37

- Varonis Systems (VRNS) Raised to Neutral at JPMorgan; PT $35

- Yelp (YELP) Raised to Neutral at JPMorgan; PT $39

- Downgrades

- Bristol Myers (BMY) Cut to Market Perform at William Blair

- Cut to Market Perform at BMO; PT $60

- Comcast (CMCSA) Cut to Sector Perform at Scotiabank; PT $49

- Datadog (DDOG) Cut to Equal-Weight at Wells Fargo; PT $95

- Enphase Energy (ENPH) Cut to Market Perform at Oppenheimer

- Cut to Neutral at Piper Sandler; PT $75

- Frontier Airlines (ULCC) Cut to Hold at Deutsche Bank; PT $5

- Hasbro (HAS) Cut to Neutral at BofA

- Hershey (HSY) Cut to Market Perform at Cowen; PT $200

- Hub Group (HUBG) Cut to Neutral at JPMorgan; PT $84

- PTC Therapeutics (PTCT) Cut to Sell at Citi; PT $17

- Regions Financial (RF) Cut to Neutral at JPMorgan; PT $16.50

- Shyft Group Inc/The (SHYF) Cut to Neutral at BTIG

- Southwest Air (LUV) Cut to Market Perform at Cowen; PT $20

- Transocean (RIG) Cut to Hold at Arctic Securities; PT $7

- Tronox (TROX) Cut to Neutral at JPMorgan; PT $11

- Initiations

- Coupang (CPNG) Rated New Buy at Baptista Research; PT $22.30

- Griffon (GFF) Reinstated Buy at Deutsche Bank; PT $65

- HUTCHMED China (HCM LN) ADRs Rated New Buy at BOC Intl; PT $29

- Idacorp (IDA) Rated New Buy at Guggenheim; PT $104

- Inventiva SACA (IVA FP) ADRs Rated New Buy at Canaccord; PT $12

- Oneok (OKE) Rated New Hold at Baptista Research; PT $71.30

- Roblox (RBLX) Rated New Strong Buy at Raymond James; PT $41

- Scorpio Tankers (STNG) Rated New Buy at Cleaves Securities; PT $77

- Tko Group (TKO) Rated New Overweight at JPMorgan; PT $100

- Zion Oil (ZNOG) Rated New Overweight at Guotai Junan Sec; PT $154.80

Data sources: Bloomberg, Reuters, CQG

No responses yet