Stay in Vogue: Follow the Trend

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Every week, MrTopStep invites traders to an “Own the Close” contest where the closest guesstimate where the SPX will settle on Friday’s 4:00 cash close.

The winners get a free week’s access to the MrTopStep Chat and trading tools. Enter your guess now!

Our View

As always, the Fed did a Switch-A-Rooney.

On the second day of his testimony; Powell said the central bank is “not far” from being able to cut interest rates, and repeated his view that the Fed is looking for greater confidence that inflation is nearing its 2% target.

After a big pump higher Wednesday, the ES rose to its 16th record close of the year while European Central Bank President Christine Lagarde signaled officials would likely wait until June to be confident enough to start cutting rates. The Nasdaq led the gains, rising 1.18%, while the ES 500 rose 0.84%, the YM rose about 133 points or 0.29%, Bitcoin traded above $67,000, gold extended its climb to another record, and the10-year note yield settled at 4.09%, it’s lowest level in more than a month. All I have to say is all the markets are moving.

Our Lean

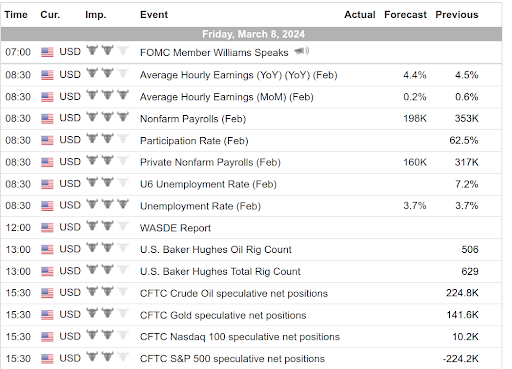

Today the labor department will give its final reading for the February employment report. According to Goldman Sachs, the jobs number should come in higher than expected due to workers returning from strikes in the auto industry and Hollywood and could bolster the November total by as much as 38,000. Goldman economists expect that the report will be considerably above the Wall Street estimate – for a total of 238,000 that could potentially harden the Fed’s position.

I’m not a Wall Street economist, and even if they’re correct, I doubt the market will behave as they predict. The key is to focus on two things:

-

Stop thinking about a crash and

-

Keep buying the pullbacks until there is a clear reversal of the trend.

Our Lean: 1040

Do you know what that number represents?

That is the total number of points the ES has rallied since its October 27th, 2023 low of 4122.

No matter how you see it, that is a lot of wood to chop. I am going to keep this simple; MrTopStep Trading Rules 101 https://mrtopstep.com/trading-101/ says that if the ES gaps lower after the jobs number on ES volume of 250k to 300k or more, I am buying the open, putting in a stop, and going to hold all day. Should the ES gap be sharply higher, I have to sell it. If this is right, it is a hold-all-day trade. Ideally, I hope for a down open because if that happens, it will be a clear shot to 5200-5220. If neither happens, I will reassess after the open.

I hope you have been enjoying the Opening Print, I know it’s not perfect and it’s not meant to be. Have a good weekend.

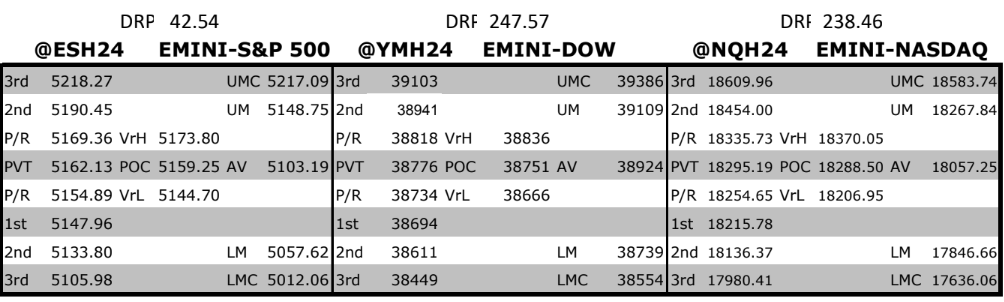

MrTopStep Levels

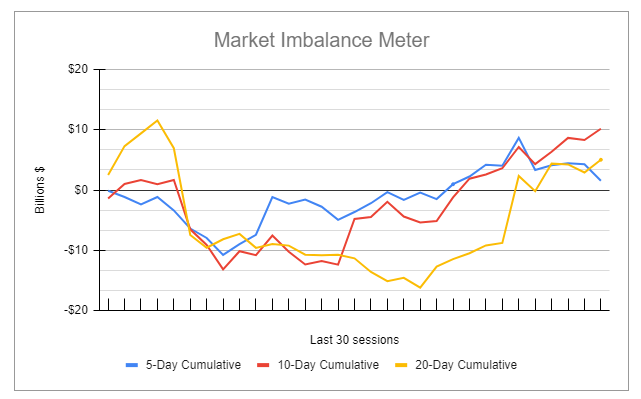

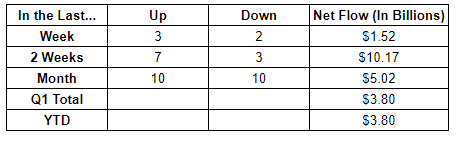

MiM and Daily Recap

The ES sold off down to 5086.50 on Globex and rallied to a 5141.00 high at 9:22 am and opened Thursday’s regular session at 5153.00.

After the open, the ES traded up to 5145.00 and pulled back to 5133.25 at 9:47.

IMPRO : Dboy : (10:11:33 AM) : es stops 5149.5 up to 5161.00

The ES rallied up to 5154.25 at 10:30, did a small dip, rallied up to a 5160.25 double top at 10:50, and then traded sideways to down over the next 46 minutes and traded 5148.75 at 11:36. After the pull back, the ES rallied up to a new high at 5061.25 at 12:21, exactly where I said the buy stops ran to.

After the high, the ES did another sideways to lower chop trading down to 5151.75 and then slowly back and filled its way up to 4 new highs at 5161.25 at 1:13, 5163.00 at 1:31, 5164.25 at 1:42 and then up to 5170.50 at 2:00.

Post the highs, the ES made 4 lower highs and then dropped down to 5152.00 at 3:00, slowly rallied up to 5165.75 at 3:43, pulled back to the 5161.25 level at 3:48, traded 5173 as the 3:50 cash imbalance showed $1.358 billion to buy, traded up to 5167.75, sold off back down to 5159.75, and traded 5158.00 on the 4:00 cash close.

After 4:00, the ES dropped 14 points down to 5143.75, rallied to 5154.25, sold off to 5146.75 at 4:24, and then rallied back up to 5158.50 at 4:53 and settled at 5157.25 on the 5:00 futures close, up 44 points or 0.86% on the day. The NQ settled at 18,254.00, up 212.75 points or 1.18%.

In the end, it was all upside until just after 2:00. In terms of the ES’s overall tone, it was firm. In terms of the ES’s overall trade, 287k ES traded on Globex and 1.277 million traded on the day session for a total of 1.277 million contracts traded.

Guest Post

AM Turn:

Disclaimer: For educational use only. I’m not dispensing financial advice. We are having an intellectual conversation (you and I) on the topic of trading the Emin futures using the Lens of Wyckoff Principles and the Eyes of WB’s Clock. The clock that controls all turns intraday, every day!

Yesterday’s Technical Review using

WB’s Emini Clock and Wyckoff’s Tape Reading Principles

The high probability trade yesterday was getting long at the spill down yesterday. You had many reasons to do it. Price sold off hard the previous day. Globex took price back up and was trading above the high of that day. The day was S4H. This day is a strong bullish trend day, when the wind is to the bulls sails. And who was speaking in the Senate?

The spill down just kissed the previous day’s high. So, you probably paid up as I mentioned on page three, yesterday:

“JP speech at 10:00 am will move markets and you may not see a clear path to victory. You may find yourself paying up. Ideal trade wait till the 5135 is held or pay up.”

The other opportunity would have been at 10:00 am when his speech began as price showed it wasn’t going down. Then around 10:20 am when the opening range indicated a break out. You would had long cause the AM HIGH was in your sights. It sealed just around 10:45 am as price gave way to the next window.

The MID AM LOW seal was round 10:30 am. Notice as strong 55 minute move up followed by a 45 minute move down. Price holds at the 3/8 retracement. This indicates more bullish activity to follow. By 12:20 pm it looks like that is not going to happen. Price wetbeaks the previous high.

It ideal would have to have gotten out of our long position at the AM HIGH, that is if you were still in the trade.

Wyckoff Trader,

If you’ve read this analysis, you might be curious when the best time to consider a long position. Based on the information provided, the best time to have gotten long the eMini futures market from the perspective of a seasoned trader for a day trade would have been:

-

At the spike down yesterday, which kissed the previous day’s high. This was the initial high probability trade opportunity.

-

At 10:00 am when JP’s speech began, as price showed it wasn’t going down.

-

Around 10:20 am when the opening range indicated a break out. This was the most opportune time to have gotten long, as the AM HIGH was in sight.

These times were identified based on the analysis of market trends, price movements, and the impact of external events (such as JP’s speech) on the market. A seasoned trader would have identified these opportunities as they arose and acted accordingly to maximize their chances of a successful day trade.

Trading in the eMini futures market is risky and can change rapidly, and several factors can impact the market. To minimize potential losses, always use stops when placing trades, but understand that there is always the risk that a market gap could result in a larger-than-expected loss.

Be sure to use a stop with every trade placed to help mitigate potential losses, and only trade with risk capital that can be afforded to lose.

Looking Forward to March 8, 2024

I. Market analysis – Cautiously Bullish: CASH grind to higher highs. Retail Village MLCO, MSCO, SBSH, and JPMS among five or more all bought the highs. All was well till the lunch high. Mid pm diped down to center time and then bulls dropped the soap. Bears broke the AM HIGH. Potential inversion yesterday. Change of price behavior signals turn in the trend.

II. Trade entry – After the state of the Union last night, price rallied up to recover the MID AM LOW from yesterday. It’s trading above the daily pivit, so that gives a lean to the bulls. If price dips down into the 5154 to 5148 consider a long if a bid comes back in. Adjust stops accordingly.

III. Trade exit – I can’t imagine the bulls could bring it. If opportunity presents, take a little off at the weekly and R1 pivot 5152. A little more at the 5190 handle. Then perhaps, if a strong bullish trend, close out the rest on market on close. Next week will end the H contract.

To learn more, subscribe to my AM TURN newsletter

Less than a cup of coffee. In your email inbox

before the opening bell.

Economic Calendar

For a more complete calendar see:

https://mrtopstep.com/economic-calendar/

Comments are closed