This post goes out as an email to our subscribers every day and is posted for free here around 2 PM ET. To get your real-time copy, sign up for the free or premium version here: Opening Print Subscribe.

From April Panic to May Momentum: ES Hits Escape Velocity

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Our View

Was it really the art of the deal or a world uproar that pushed President Trump to make a tariff deal with China?

There are no shoulda, woulda, coulda’s in trading, but I tried to get long Friday to hold over the weekend and kept getting out when the ES didn’t go my way. One of the things the Trump administration does very well is providing tip-offs. One big one was back on April 9th, 2025, when Trump posted on Truth Social, saying, “THIS IS A GREAT TIME TO BUY!!!” The post was made just before announcing a 90-day pause on most tariffs (except those on China). And last Friday’s tip-off was Treasury Secretary Scott Bessent saying the US-China trade talks in Switzerland had made substantial progress.

Late in the day, the ES made a new high at 5876.25. In the end, a month ago it was sell every headline and now it’s buy every headline. While I have been consistent with my “still going higher”, I didn’t think the last 200 points would come so quickly. They say the S&P goes down quicker than it goes up. I beg to differ, I have a trading rule that says that it takes days and weeks to knock the S&P down and only a few to bring it back— that may be an underestimation.

The March close for the SPX cash was at 5611.85, the April close was 5569.06, so April was down 0.76%. But here is the kicker: the April low was 4835.04, down 13.84% from the March close but up 4.94% from the last trading day of April, and we are now up 20.87% from the year low as of yesterday’s close.

From the last trading day of 2024, the SPX cash is still down 0.64%, and only 4.8% from the all-time high. Since 1970, when April was the low of the year, May has been up 100% of the time.

Our Lean

The ES has been up 11 and down 3 of the last 14 sessions, with one of the 3 down days off by only 4 points. The index markets are on a roll and went blowing through 5700 and 5750. The bulls are winning big time.

The US dollar gained 1.26% yesterday and Bitcoin fell 1.89% to 102,462.00. According to FactSet, CPI is forecast to have risen by 0.3% in April and 2.3% on a year-over-year basis, according to consensus estimates. Core inflation, which excludes food and energy costs, is expected to have risen 0.3%, or 2.8% year over year.

Goldman Sachs economists Ronnie Walker and Elsie Peng said in a report last week that underlying inflation will rise to 3.8% at the end of 2025 before decelerating to 2.7% at the end of 2026—up from previous estimates of 3.5% and 2.3%. They project that the U.S. will have the lowest growth and the highest inflation of any developed economy in 2025. I don’t know how the markets can overlook this, but as I have always said, I am not here to fight City Hall. And if the ES is going up, I want to go for the ride.

BUT… the news is out, and the ES has rallied 748.50 points off its April 7th low of 5127.75, and up over 1000 pts off its 4835.04 low. I don’t know if the ES has another 30 to 50 points on the upside, but I think there’s a 100 to 150 point pullback coming.

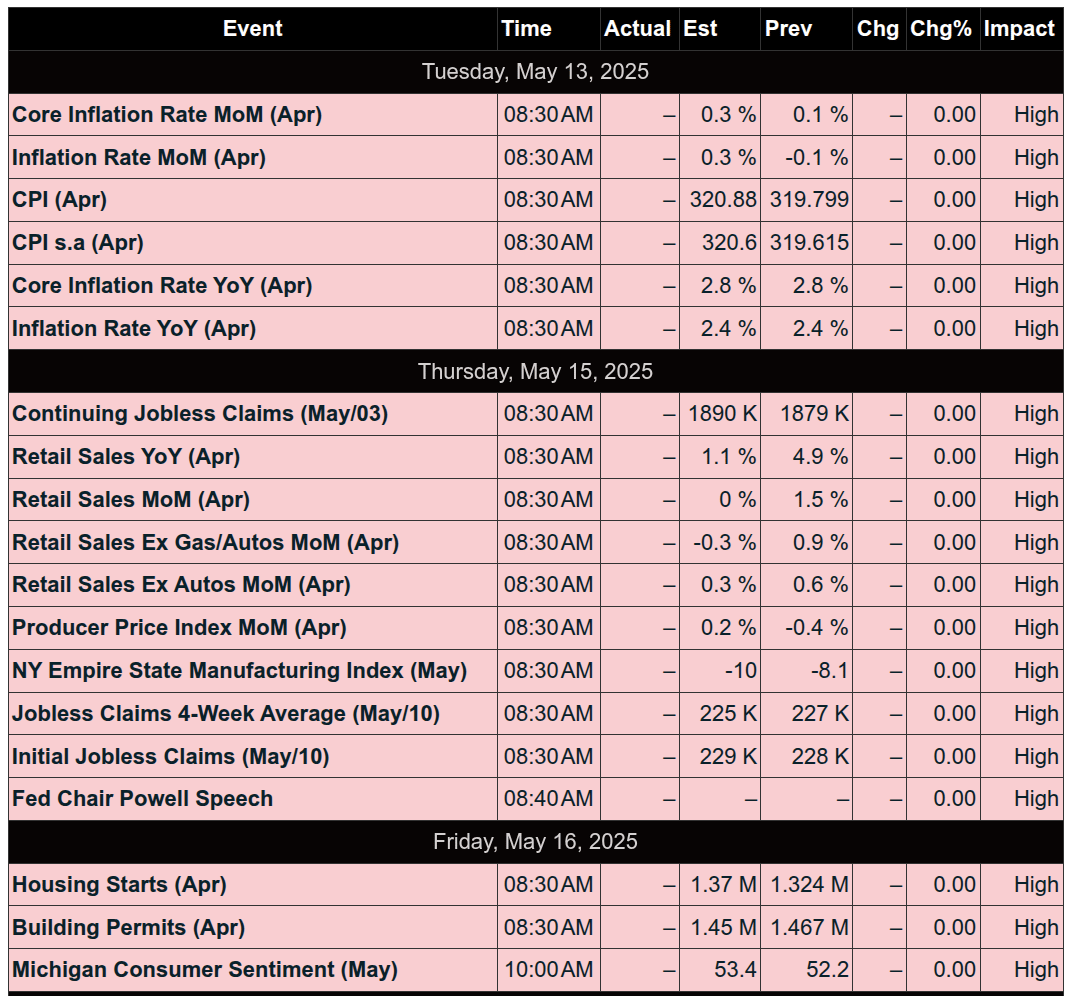

After today’s CPI number, the next big thing is Powell on Thursday. I think you can sell the early rallies and see how it goes.

5900–5930: BRICK WALL.

MiM and Daily Recap

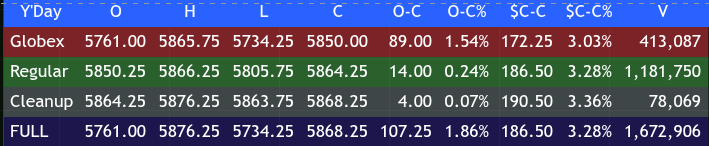

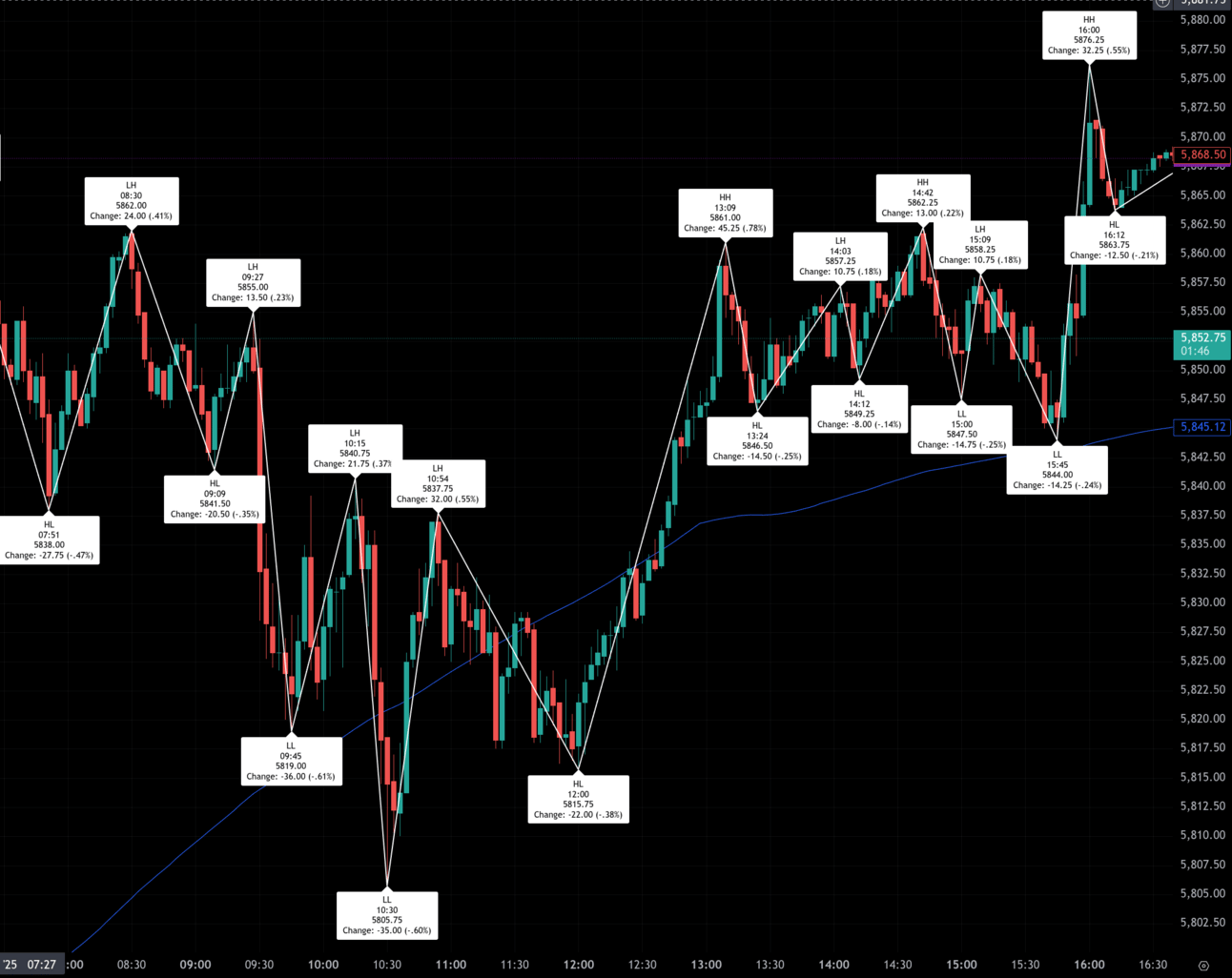

The ES futures opened Monday’s regular session at 5850.25 after a strong Globex rally that took prices from a Sunday open of 5761.00 up to 5850.00—a gain of 172.24 points (+3%) from Friday’s cash close. The overnight session low came early at 5734.25 and was followed by a sharp advance into the 08:30 ET mark where ES printed 5862.00.

ES opened at 5850.25 and immediately fell to the ES to its regular session low of 5805.75 by 10:30—a 49.25-point slide from the premarket 9:25 am peak.

After bottoming midmorning, buyers stepped in. ES steadily climbed through midday, reaching a high of 5862.25 by 14:40—a 56.50-point advance off the morning low. A shallow retreat followed into 15:45, where the ES found support at 5844.00, before surging into the close.

The final push brought the session’s high to 5876.25 right at the 16:00 bell, marking a 32.25-point rip from the late pullback low. The regular session settled at 5864.25, up 14.00 points from the open (+0.24%), and up 186.50 points (+3.28%) from the prior day’s close.

The Cleanup session tacked on another modest 4.00 points, closing at 5868.25, with the full session logging a net gain of 107.25 points or +1.86%.

Monday’s tone was distinctly bullish, led by a strong Globex bid and midday continuation higher after early pullbacks were absorbed. Volume was solid with 1,181,750 contracts traded during regular hours and over 1.67 million across the full session, reflecting healthy participation.

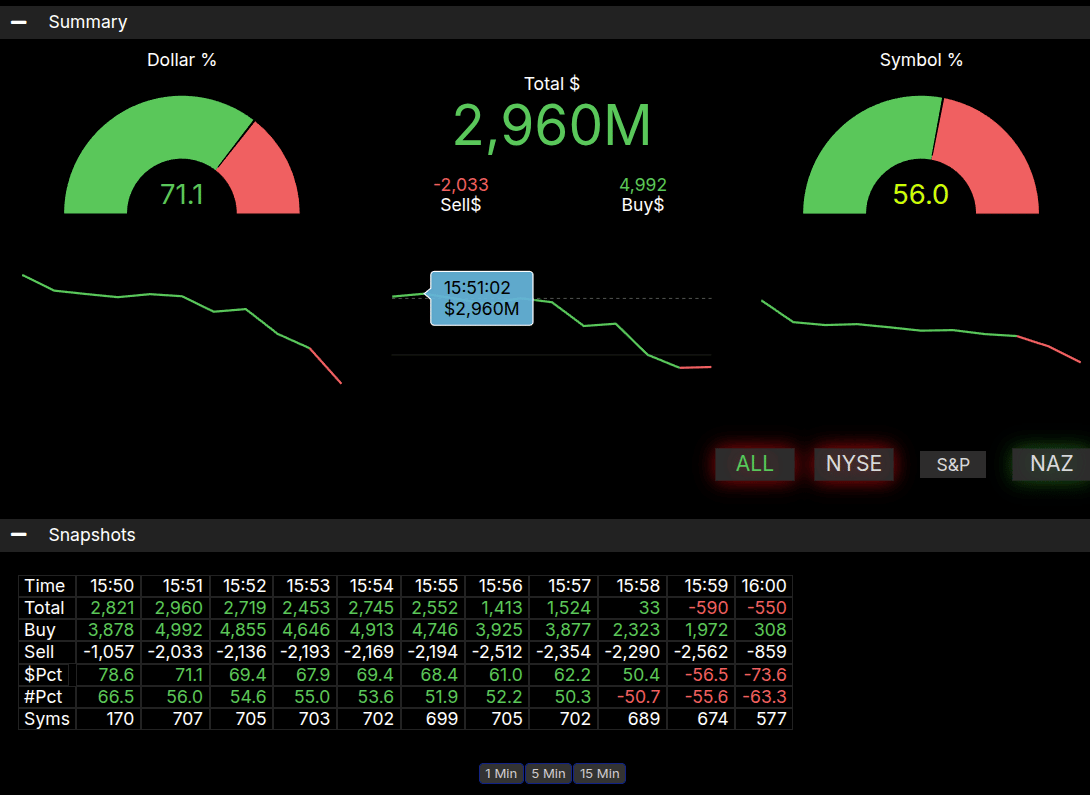

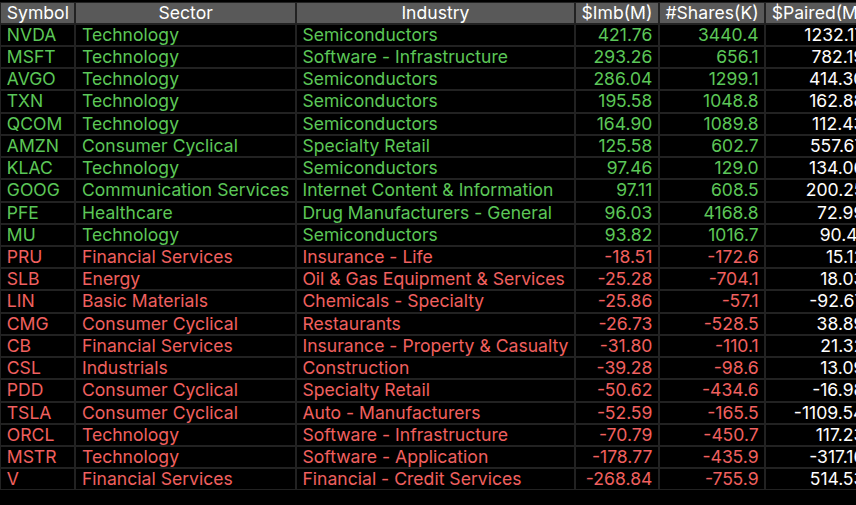

The Market-on-Close (MOC) imbalance leaned heavily to the buy side, with 71.1% of the dollar imbalance in favor of buyers. The symbol imbalance ended at 56.0%, under the 66% threshold for a strong signal, but early imbalances between 15:50–15:54 did exceed 66%, peaking at 66.5% with over $2.9B in notional flow. While that influence began to fade just ahead of the bell, it likely helped fuel the late-day run to 5876.25.

Overall, the session maintained a constructive bias with higher lows and strong closes across all time segments. Bulls controlled the tape despite intermittent profit-taking, and the continued resilience near highs keeps upside momentum intact heading into Tuesday’s trade.

Technical Edge

MrTopStep Levels:

Fair Values for May 13, 2025:

-

SP: 19.29

-

NQ: 81.28

-

Dow: 91.59

Daily Market Recap 📊

-

For Monday, May 12, 2025

-

NYSE Breadth: 78% Upside Volume

-

Nasdaq Breadth: 82% Upside Volume

-

Total Breadth: 81% Upside Volume

-

NYSE Advance/Decline: 76% Advance

-

Nasdaq Advance/Decline: 74% Advance

-

Total Advance/Decline: 75% Advance

-

NYSE New Highs/New Lows: 90 / 12

-

Nasdaq New Highs/New Lows: 160 / 65

-

NYSE TRIN: 0.89

-

Nasdaq TRIN: 0.59

-

Weekly Breadth Data 📈

-

Week ending Friday, May 9, 2025

-

NYSE Breadth: 54% Upside Volume

-

Nasdaq Breadth: 56% Upside Volume

-

Total Breadth: 55% Upside Volume

-

NYSE Advance/Decline: 58% Advance

-

Nasdaq Advance/Decline: 49% Advance

-

Total Advance/Decline: 53% Advance

-

NYSE New Highs/New Lows: 141 / 110

-

Nasdaq New Highs/New Lows: 256 / 303

-

NYSE TRIN: 0.89

-

Nasdaq TRIN: 0.63

-

Trading Room Summaries

Polaris Trading Group Summary – Monday, May 12, 2025

Overview:

Yesterday’s session in the PTG trading room, led by PTGDavid, was marked by strong bullish continuation on Cycle Day 3, choppy intraday action, and an ultimate rally into the close. The focus of the day was on staying flexible and trading with the rhythm of the market, rather than forcing positions.

Morning Session – Super Cycle Momentum and Early Shorts

-

The session opened with momentum continuing from the global “China Deal” rally. PTGDavid declared it a Super Cycle Day as price pushed beyond earlier targets.

-

The key resistance zone at 5850–5900 was tested early, aligning with prior pivot support areas.

-

An A4 short setup was identified and fulfilled its targets early, providing a profitable opening trade opportunity.

-

Initial bias was short leaning into the morning, but sentiment shifted as bulls held VWAP, prompting a switch to a long-side lean on dips.

Midday – Tricky Price Action and Crude Oil Success

-

PTGDavid emphasized the oscillating nature of the market with price action whipping around VWAP, leading to many “snaps and traps.”

-

Crude Oil’s Open Range Short was a standout trade, hitting all targets and validating the setup cleanly.

-

The midday theme was flexibility, with David cautioning traders to stay nimble amid quick reversals. The jellyfish analogy was used to encourage going with the flow.

-

A midday break included shared images of a beach walk, offering a refreshing reminder of the lifestyle trading can support when managed with discipline.

Afternoon – Grind Higher and Closing Strength

-

Into the afternoon, the market bias leaned bullish again, with a focus on pullback opportunities rather than chasing strength.

-

Bulls slowly ground price higher, and the Power Hour brought confirmation as a $3 billion MOC buy imbalance drove a last-minute rally.

-

PTGDavid noted that bulls often faded late in recent sessions, but this time they held and closed on the highs of the day.

-

Importantly, the Cycle Day 3 projected high of 5874.55 was fulfilled exactly, once again confirming the value of the cycle framework.

Key Trades and Lessons Learned

-

Crude Oil’s Open Range Short was a clear highlight, hitting all targets and offering a clean setup amid the choppier index action.

-

Early A4 short also paid out well before the shift in tone mid-morning.

-

The key lesson for the day was flexibility. PTGDavid reminded traders not to get locked into bias and to stay responsive to evolving conditions.

-

The Cycle Day 3 projection was a strong educational point, as it offered structure and accuracy in a day full of shifting intraday patterns.

Conclusion

Monday delivered another successful Super Cycle Day. The bulls took control early, gave way to some midday indecision, but returned with strength to close at the highs. Traders who stayed adaptable and disciplined were rewarded, especially on crude and late-session plays. The session underscored the power of the cycle methodology and the need to adjust quickly to what the market gives.

Discovery Trading Group Room Preview – Tuesday, May 13, 2025

-

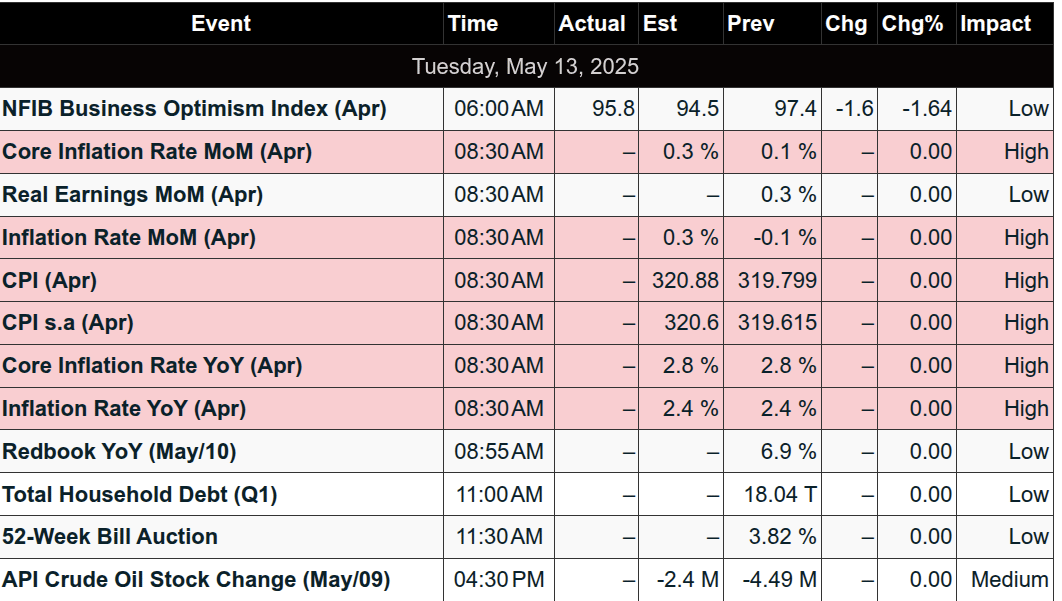

CPI Focus: April CPI data (8:30am ET) is key today, expected to show initial inflation impacts from Trump’s new tariffs.

-

Auto prices likely rose.

-

Broader inflation may be muted by a 90-day tariff delay on China.

-

-

US-China Trade Developments:

-

China declared US tariffs a “joke,” boosted domestic support, and cut interest rates.

-

US reduced tariffs from 145% to 30%, meeting most of Beijing’s demands.

-

China cut its US tariffs to 10% and pledged aggressive action on fentanyl exports, possibly leading to further reductions.

-

-

Corporate Highlights:

-

Honda: Projects a 59% drop in annual profits; delays EV supply chain plans in Canada due to tariff risks and weak EV demand.

-

Earnings Today:

-

Premarket: JD, NU, SE, SONY, TME.

-

After-Hours: ALC, EXEL.

-

-

-

Market Volatility & Technicals:

-

Volatility spiked post-US/China talks; ES 5-day average range is 103.50.

-

Expected to contract today after Monday’s rally.

-

No clear large trader bias overnight (light/mixed volume).

-

-

Key ES Levels:

-

Resistance: Short-term uptrend channel and 200-day MA at 5869–5874.

-

Support: 5620–5625, 5259–5264, 5107–5102, 4962–4967.

-

ES

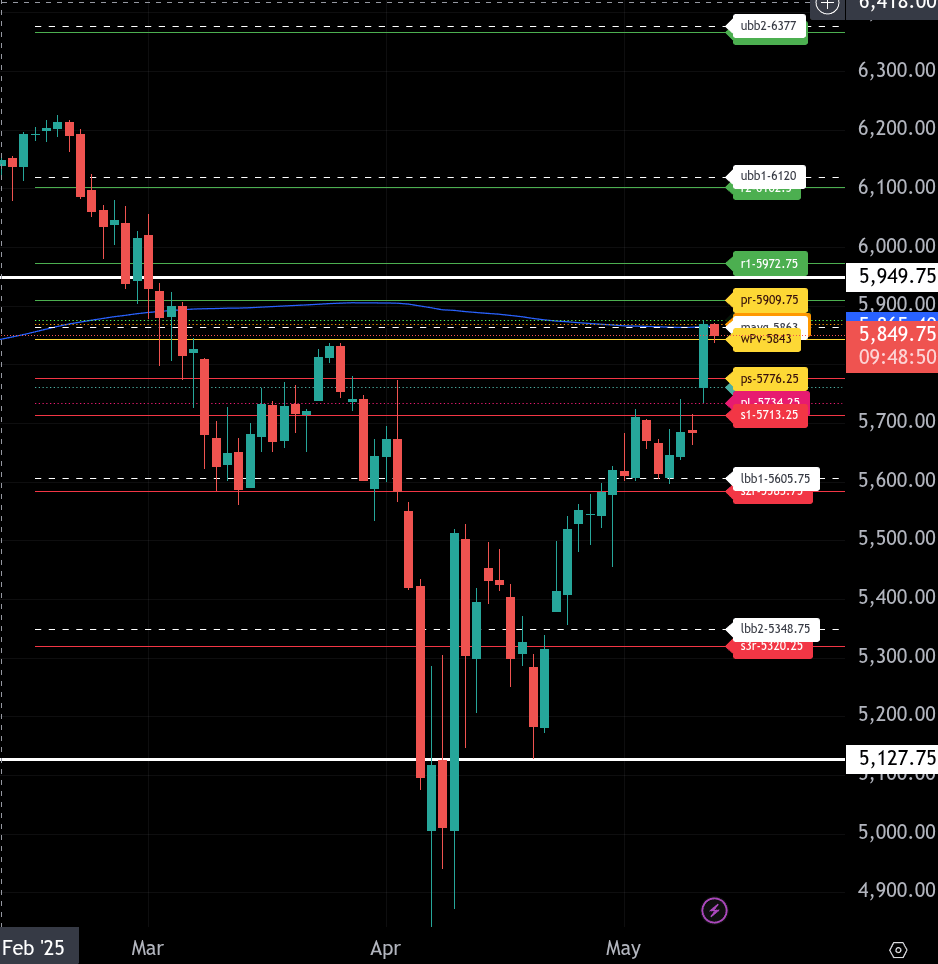

The bull/bear line for the ES is at 5843.00. This is the key pivot for today’s session. While the overnight session has seen a strong gap higher, this level still matters as a reference point if price were to fade the gap and test support zones below.

ES is currently trading around 5865.50, holding above the bull/bear line and suggesting continued bullish sentiment early in the session. If buyers can maintain control above 5843.00, we look to 5868.25 and 5876.25 as near-term resistance. A break above these levels would target 5909.75 as the upper range target for today. Beyond that, further resistance stands at 5949.75, with longer-term resistance up at 5972.75.

On the downside, if price breaks back below the bull/bear line at 5843.00, it would put the strength of this gap into question. A move under 5820.00 would likely open the door to test the lower range target at 5776.25. Below that, support comes in at 5761.00, with deeper levels down at 5734.25 and 5713.25.

The longer-term bull/bear line remains at 5949.75. A close above this level, followed by strength in tomorrow’s open, would confirm a larger shift in sentiment toward a bullish outlook for the rest of the week.

As it stands now, price action favors the bulls, but watching reactions around 5843.00 and 5820.00 will be critical to gauge whether this morning’s strength holds or fades into the regular session.

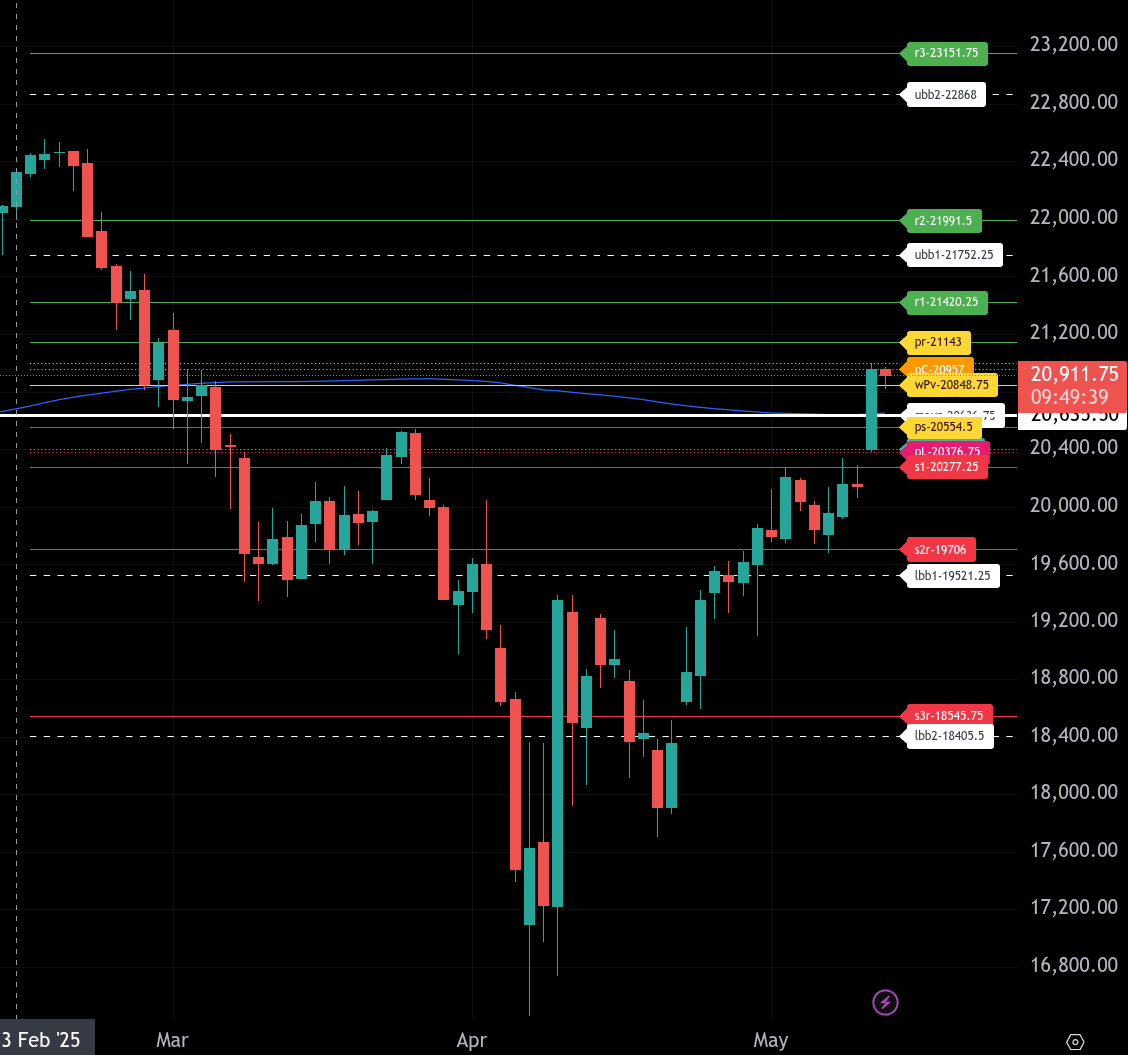

NQ – Week to Week

The bull/bear line for the NQ is at 20,848.80. With NQ currently trading around 20,912.30 in the premarket, price action is slightly above this critical pivot level. If buyers can maintain strength above this line, bullish momentum could extend higher into the session.

The upper intraday range target is at 21,143.00. Between the pivot and the upper range, upside resistance comes in at 20,957.00 and 20,996.00. Above 21,143.00, watch for resistance at 21,420.30 and 21,752.30, which mark more extended upside targets if a strong rally develops.

If NQ falls back below the bull/bear line, support is seen at 20,635.50, then at 20,554.50. The lower intraday range target is 20,277.30. A sustained break below this zone would open the door for deeper retracements, with minor support near 20,376.80 along the way. On the downside, major resistance sits at 20,636.00. We need a close above this level to shift our longer-term sentiment to bullish.

Premarket structure suggests an early upside bias, but the ability to hold above 20,848.80 on any backtest will be key to confirming continued strength into the regular session.

Calendars

Economic Calendar

Today

Important Upcoming

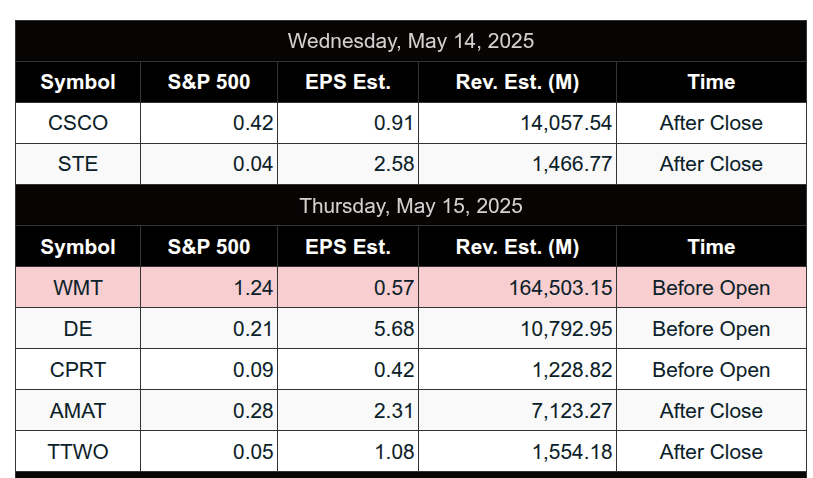

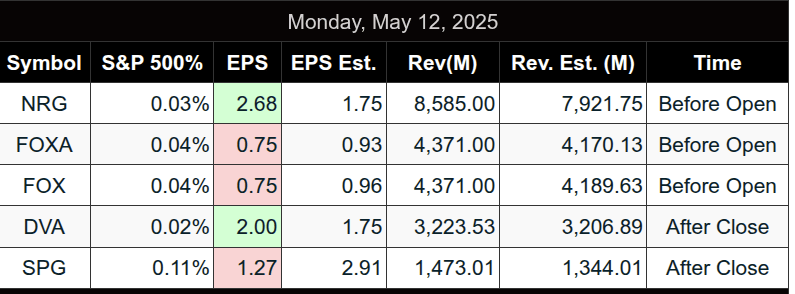

Earnings

Affiliate Disclosure: This newsletter may contain affiliate links, which means we may earn a commission if you click through and make a purchase. This comes at no additional cost to you and helps us continue providing valuable content. We only recommend products or services we genuinely believe in. Thank you for your support!

Disclaimer: Charts and analysis are for discussion and education purposes only. I am not a financial advisor, do not give financial advice and am not recommending the buying or selling of any security.

Remember: Not all setups will trigger. Not all setups will be profitable. Not all setups should be taken. These are simply the setups that I have put together for years on my own and what I watch as part of my own “game plan” coming into each day. Good luck!

This post goes out as an email to our subscribers every day and is posted for free here around 2 PM ET. To get your real-time copy, sign up for the free or premium version here: Opening Print Subscribe.

Comments are closed