This post goes out as an email to our subscribers every day and is posted for free here around 2 PM ET. To get your real-time copy, sign up for the free or premium version here: Opening Print Subscribe.

Who’s At Fault For The Decline, Epstein Or AI?

Follow @MrTopStep on Twitter and please share if you find our work valuable!

FREE Two-Week Offer for the Opening Print Premium. Open up the Lean and other premium features for the next Two Weeks!

Our View

Today, there are going to be four distinct parts to the trading session:

-

What happens on Globex

-

What happens after the 9:30 open

-

What happens in the final hour

-

What happens after $NVDA reports earnings

It’s all eyes on Nvidia… Both Goldman Sachs and JPMorgan expect Nvidia to post another strong beat-and-raise quarter when it reports fiscal Q3 2026 results after the close today.

The banks are aligned with Nvidia’s $54B revenue guidance (range $52.9B–$55B) and consensus EPS of approximately $1.25–$1.26, with both firms anticipating upside driven by continued AI data-center demand, Blackwell GPU ramps, and a massive order backlog.

Goldman (Buy, $250 PT) and JPMorgan (Overweight, $250 PT) each value the stock at roughly 42× 2026 earnings and see any near-term weakness around the print as a buying opportunity, maintaining that the multi-year AI infrastructure cycle remains firmly intact.

Options markets are pricing in a massive ±7% post-earnings move for Nvidia—one of the largest ever. The at-the-money straddle is implying a ±$12.68 swing from Tuesday’s $181.13 close (trading range: $168–$194). This translates to a potential $320 billion single-day change in market cap, the biggest dollar move ever tied to a corporate earnings event.

This 7% implied move is well above Nvidia’s recent average actual move of 4%, but it reflects heightened uncertainty around AI demand, Blackwell ramps, China restrictions, and hyperscale CapEx sustainability.

With billions in gamma exposure at stake, volatility across semis and the Nasdaq is likely to spike—regardless of direction.

Our Lean

It’s not that hard to see the markets are struggling, but they are getting stretched out. Can the NQ fall 7 or 8 days in a row? Will they sell the NVDA earnings? I don’t really know.

What I do know is that while I was “trying to be bullish,” every big dead cat rally failed. And last night, the Senate unanimously approved a bill to force the release of the Epstein files. It’s a big mess.

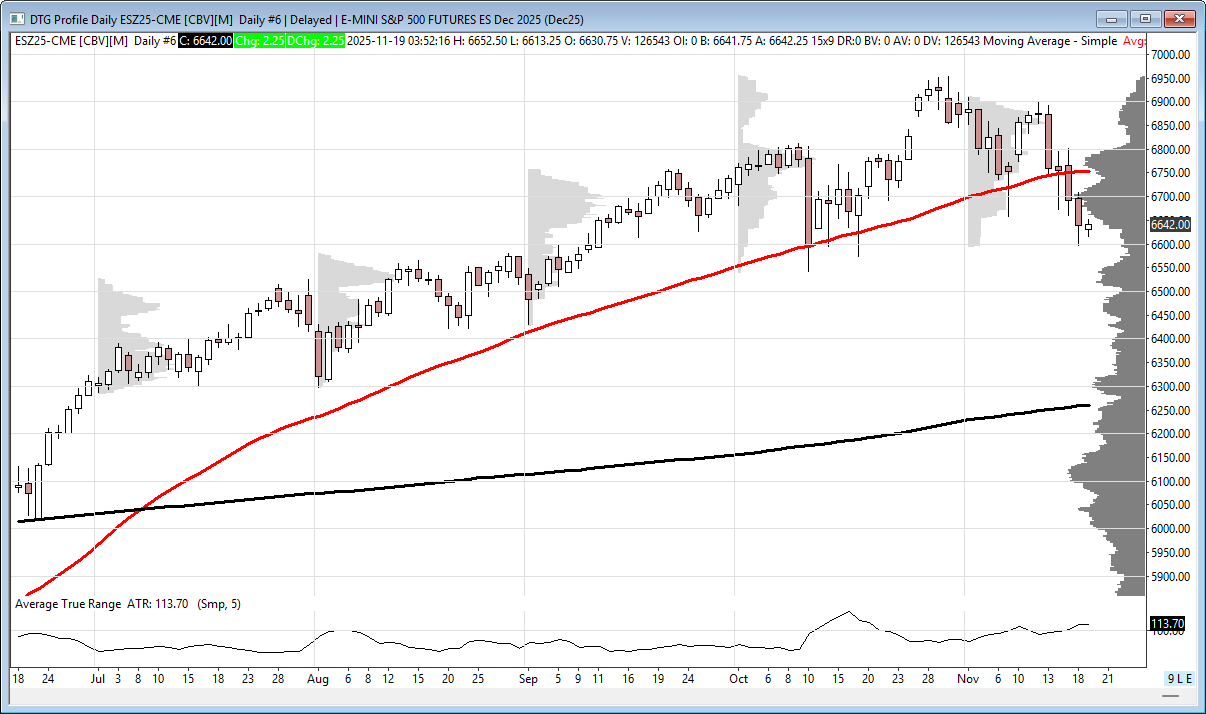

As for downside levels, I think if the ES starts taking out the 6600 level, the next big spots are 6550 and 6480.

Below is an email from Joe S., and I have to admit that, despite his email and knowing the Epstein headlines were bad, I never put this together like Joe did. I want to thank you for the email, Joe.

Danny –

I hope you’re doing well! As always, you know I love the opening print!

This will be quick, but I wanted to point out something with the Market that I brought up a few months ago, although, unfortunately, I can’t find the email chain between us.

Let me Preface by stating

-

Chaotic November is expected annually

-

We rallied hard, so pullback was to be expected

-

I’m long currently

-

Below is my crockpot of shit – Epstein – that I believe is having an impact on the market that no one is talking about – but i don’t know how to quantify it. I know it sounds crazy, but I can’t shake this thought.

Do you remember that email chain I sent some months back relating to the Epstein Files? The timing of all this is nothing short of coincidental, but it’s worth pointing out to you. Maybe your experience / connections can help highlight something I’m unable to see. Or, maybe, you can put some actual #s to this. Regardless, I think the Epstein Files are related to the market weakness

-

Epstein Files have gained traction in recent weeks. Go back to end of October – that’s when the conversation really started heating up

-

Last Wednesday, 11/12 – Trump has a dinner for the Financial Institutions

-

Last Thursday, 11/13 – The market bottom fell out (Sell off coordinated – Trump Plans Dinner With Jamie Dimon, Wall Street Executives)

-

Today (Just normal market activity but) The house did agree to release and fell apart as soon as that news came out

-

Harvard President steps down this week after being in the emails

My question is, and what I can’t figure out, how many of these financial institutions are tied to epstein?

-

There’s too many what if’s, and I’m not going to make assumptions. But something, at least to me, is going on here that is impacting the markets one way or another

From the 30,000 Foot View – Please tell me I’m wrong, but isn’t this odd?

2008 – Epstein Pleads Guilty | 2009 – Financial Crash

2019 – Epstein Arrested / Killed | 2020 – Covid Hits

2025 – Epstein Files released | ? – Financial Meltdown

Not expecting a response on this, just wanted to get some information over to you, that maybe you can make more sense of it all.

Have a great night and look forward to the opening print tomorrow!

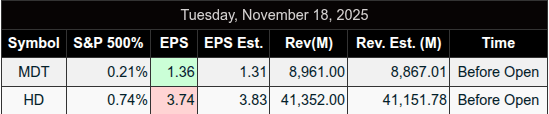

Market Recap

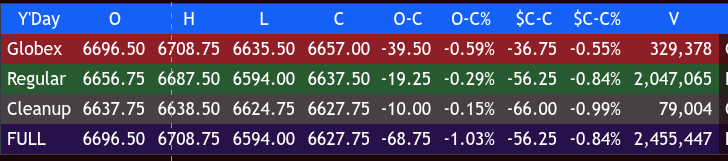

After a solid finish to Monday’s close, the ES picked up where it left off, going down to 6635.50 on Globex and opening Tuesday’s regular session at 6656.75. After the open, the ES traded 6675.50 and dropped 29 points down to 6646.50 in the first minute, rallied up to 6679.00, and then dropped 75.75 points down to 6603.25 at 10:00. It then rallied up to 6639.00, sold off to a higher low 0.75 points at 11:00, rallied 20.5 points up to 6659.50 at 11:35, sold off 44.75 points down to another higher low at 6614.75 at 12:30, and just smoked 6680.50 at 1:10.

The ES made a series of higher highs up to 6659.75 at 1:40, and then traded up to a double top just below the previous high at 6685.50 at 3:00. After the push up, the ES reversed down to 6650.75 at 3:25.

The ES traded 6644.50 as the 3:50 cash imbalance showed $2.9 billion to sell, which increased to almost $4 billion to sell, and traded 6637.50 on the 4:00 cash close. The ES traded down to 6624.75 and settled at 6639.75, down 52.25 points, or -0.78%, down 4 sessions in a row, totalling -236 points, a loss of -3.47%.

The NQ settled at 24,595.75, down 283.25 points or -1.14%, down 7 of the last 8 sessions, totalling 1,154.50 points or 4.55%, and down 1,507.50 points or 5.77% since the first trading day of October.

In the end, it was another rough day of big rips and dips. In terms of the ES’s overall tone, it acted better than the NQ — but that’s not saying much. In terms of the ES’s overall trade, volume was higher at 2.459 million contracts traded, the highest volume since October 10th (2.57 million).

AI Recap: U.S. stocks fell for a fourth straight session, with the Dow dropping 498 points (−1.07%) to 46,091, the S&P 500 sliding 0.83% to 6,617, and the Nasdaq declining 1.21% to 22,433, as both mega-cap tech (Nvidia, AMD, Marvell, Micron) and old-economy names like Home Depot (−6% after slashing guidance) came under heavy pressure.

The PHLX Semiconductor Index officially entered correction territory, the VIX spiked 10.3% to 24.69, and investor anxiety over an AI bubble reached new heights, with 45% of fund managers now citing it as the top tail risk amid sky-high valuations and massive data-center debt buildup.

This sharp selloff stands in stark contrast to the past 16 years of quick, shallow bear markets that trained an entire generation to “buy the dip” aggressively, even in the junkiest names. Few participants today personally remember the deep, multi-year pain of 2007–09 or earlier recessions.

The rapid 4.3-month recovery from this year’s earlier swoon, led by AI and unprofitable speculative stocks, has only reinforced dangerous complacency. History shows that only long, recession-accompanied bear markets truly cleanse the system, destroy the previous mania’s excesses, and re-teach the market what capital is actually for. Until that painful but necessary lesson arrives, the stage remains set for an even bigger reckoning.

As I have always said, the Bull’s gotta eat too. Is the decline over? I don’t know. But the Nasdaq has been down 6 sessions in a row three times in two years, and there were no 7-day declines over the same period.

On Tap:

The only major economic report of the day will be the delayed U.S. International Trade in Goods and Services for August 2025 at 8:30 a.m. ET.

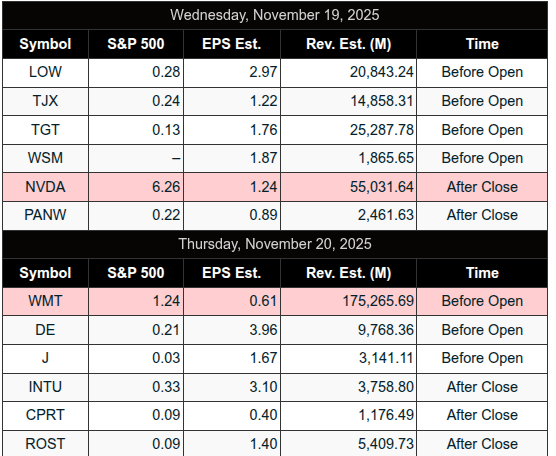

Earnings Before the Bell:

-

TJX Companies ($TJX)

-

Target ($TGT)

-

Lowe’s ($LOW)

-

Williams-Sonoma ($WSM)

-

Viking Holdings ($VIK)

Earnings After the Close:

-

Palo Alto Networks ($PANW)

-

Nvidia ($NVDA)

Guest Posts

S&P 500 (ES)

Prior Session was Cycle Day 1: “The Blitzkrieg Assault” Director’s Cut

🎯 Session Synopsis

Cycle Day 1 didn’t just arrive — it parachuted in at dawn, kicked down the door, and shouted “Surprise inspection!” What began as your garden-variety CD1 softness detonated into a full-scale Blitzkrieg Assault: Director’s Cut, complete with bonus scenes the Bulls definitely didn’t ask for.

The opening bell rang and the tape charged forward like it had binge-watched Rocky I–IV on double speed. What should’ve been routine CD1 probing quickly devolved into a full-contact Rugby Match inside the 6665–6685 warzone — elbows up, helmets optional, egos absolutely bruised. Entry signals were sacrificed, stop orders died with honor, and at least three traders filed emotional damage claims against NinjaTrader.

Market Tape: Fast, Snappy, and Completely Unforgiving

Volatility was firing off 10-point uppercuts faster than a caffeinated kangaroo. You had two choices:

-

Get green and stay green,

or -

Stare at the chart like it was your first exposure to ancient Sanskrit.

Bulls tried to reclaim ground multiple times, but every rally attempt slammed face-first into a grizzled Bearish defensive line camped at 40–45. Their discipline was absolute: “You shall not pass.”

Price never convincingly held above ONL, never sniffed its way back into value, and never mounted anything resembling coordinated offense. The tape told the story plainly:

This CD1 belonged to the Bears, full custody, no visitation rights.

For greater detail of how this day unfolded, click on the Trading Room RECAP 11.18.25 link.

…Transition from Cycle Day 1 to Cycle Day 2

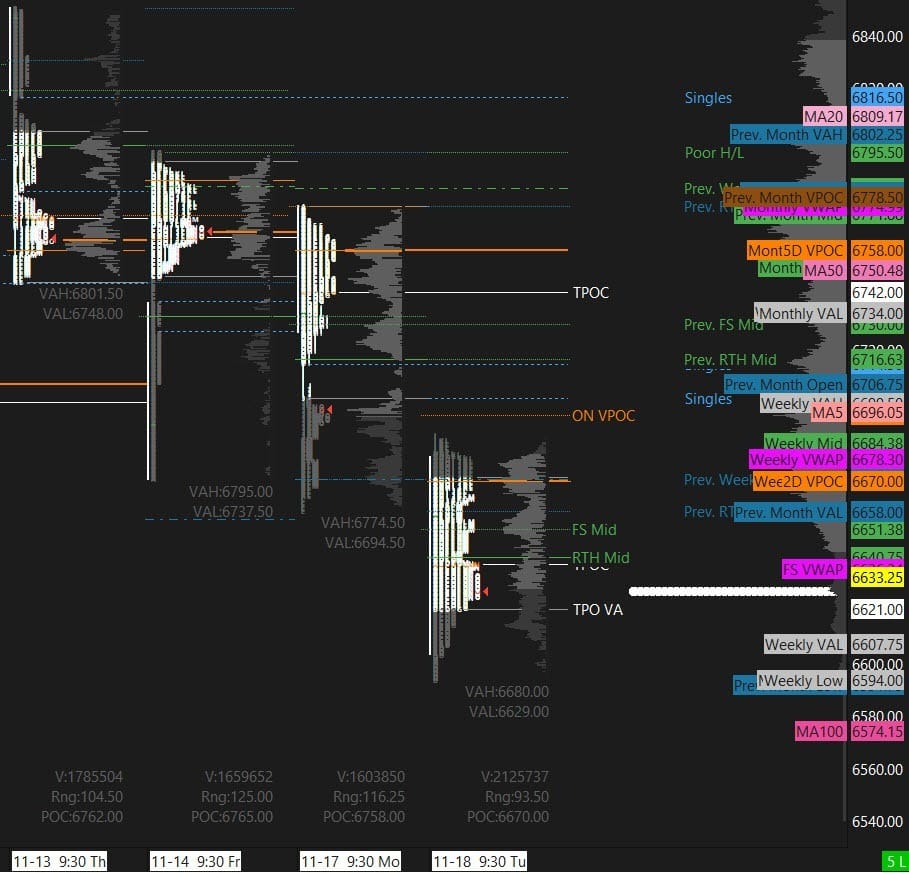

Transition into Cycle Day 2: With CD1’s carnage dutifully archived in the war log and volatility now fully front-loaded, we rotate into Cycle Day 2 — the market’s traditional “clean up your room or you’re grounded” session. It’s the balancing day where both sides ice their bruises, recalibrate their ambitions, and pretend they didn’t just make questionable life choices at yesterday’s extremes.

Bulls must demonstrate actual vertebrae by reclaiming 6685–6690+ and finishing the day on the highs. After four straight red candles, a green close isn’t a luxury — it’s a reputational requirement. Fail to defend 6620 Value Low, and they’ll be handing Bears a morale boost wrapped in a gift bow.

Bears, for their part, maintain the tactical edge so long as price lives below 6665–6655. That’s their elevated firing position, and they’ll be more than happy to smack down any early-morning “reversal rally” the Bulls try to stealth-deploy before lunch.

Balance day? Absolutely.

Boring? You wish.

Opportunity? Always — if you stay sharp.

Discipline Mode: Flexible. Focused. Zero hero trades.

Of course, nothing changes for PTG…Simply follow your plan. Take only Triple A setups and manage the $risk. ALWAYS HAVE HARD STOP-LOSSES in-place on the exchange.

PTG’s Primary Directive (PD) is to ALWAYS STAY IN ALIGNMENT with the DOMINANT FORCE.

As such, scenarios to consider for today’s trading.

Bull Scenario: Price sustains a bid above 6640+-, initially targets 6655 – 6665 zone.

Bear Scenario: Price sustains an offer below 6640+-, initially targets 6625 – 6620 zone.

PVA High Edge = 6679 PVA Low Edge = 6631 Prior POC = 6667

ESZ

Thanks for reading, PTGDavid

MiM

MOC Recap

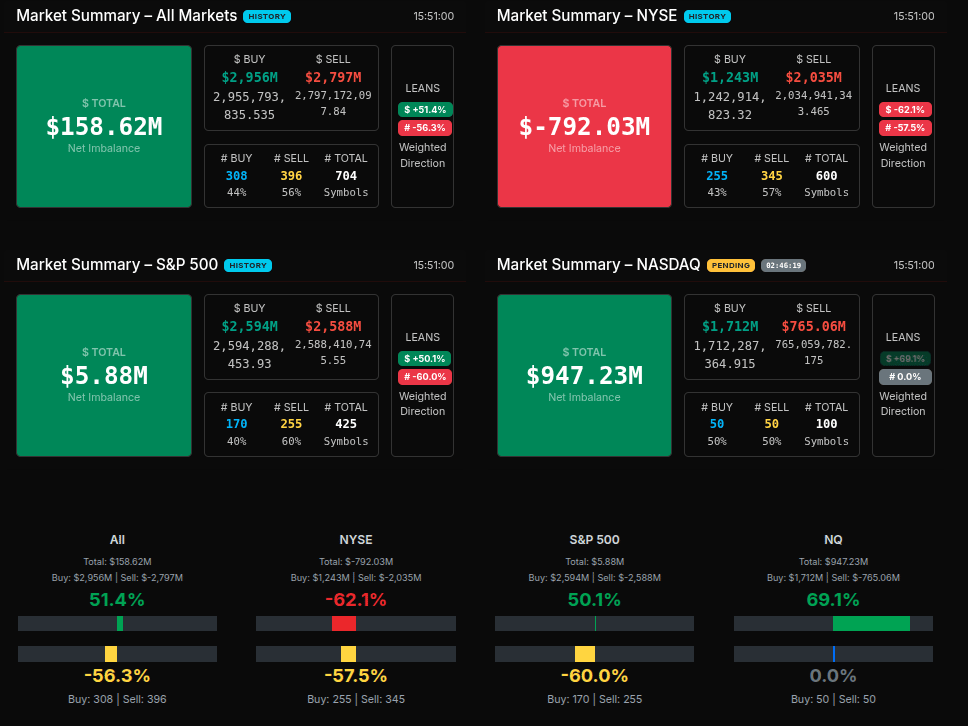

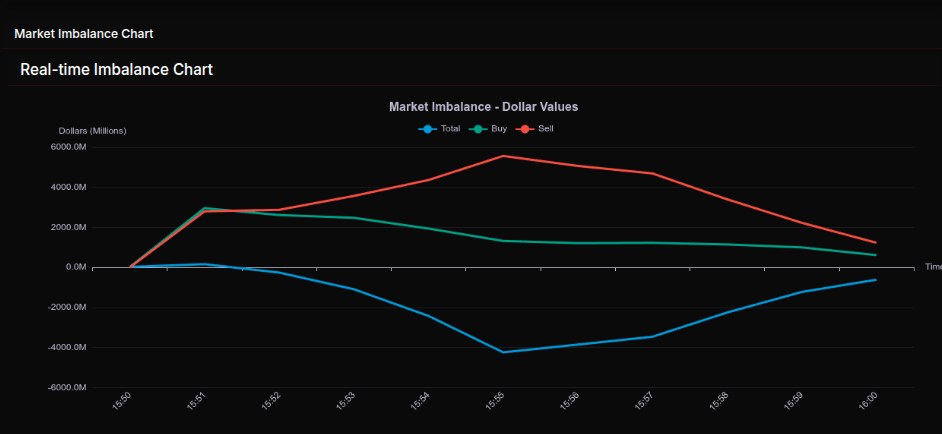

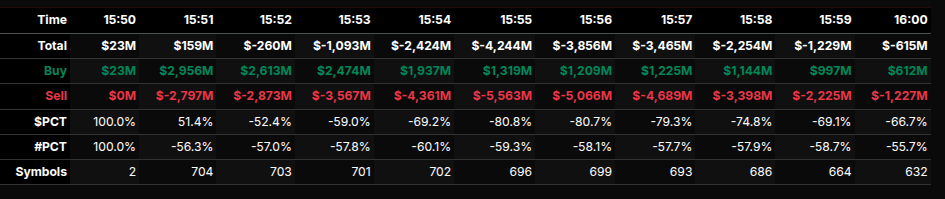

The MOC opened with a small positive imbalance but immediately flipped into a heavy sell program as NYSE flows dominated the tape. At 15:50 the market showed a modest +$23M buy imbalance, but by 15:51 the number declined to +$159M — the last positive imbalance on the MiM for the rest of the close. By 15:52 the auction reversed sharply to –$260M, and over the next three minutes the sell side accelerated to a session low of –$4.24B at 15:54. From there, the imbalance recovered but remained negative, settling near –$615M into the bell.

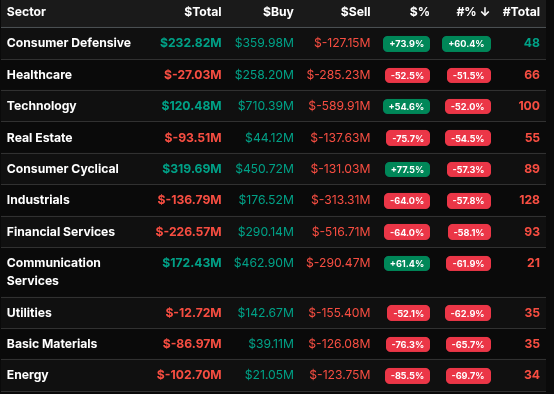

The sector profile confirms the rotation: Consumer Defensive (+74%), Consumer Cyclical (+78%), Technology (+55%), and Communication Services (+61%) showed clear buy lean, while Energy (–86%), Basic Materials (–76%), Real Estate (–76%), and Industrials (–64%) were aggressively sold. These extreme readings — many beyond ±66% — indicate wholesale repositioning rather than rotation.

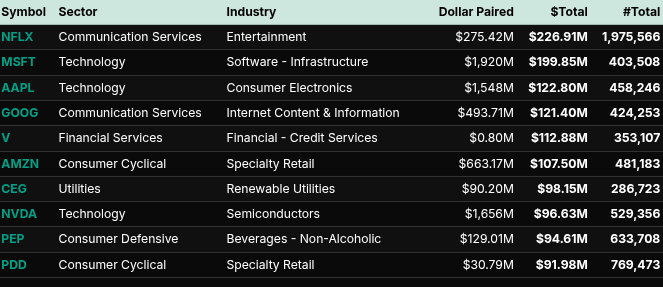

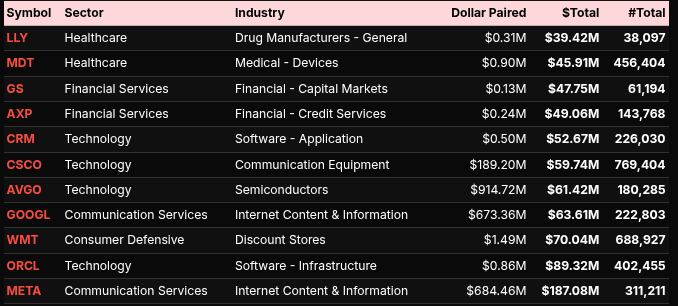

Symbol-level flows reflect this divide. Heavy buyers included NFLX, MSFT, AAPL, GOOG, AMZN, and NVDA. On the sell side, large outflows hit LLY, MDT, GS, AXP, CRM, CSCO, AVGO, and META. The strongest buying clustered in Communication Services, Technology, and Consumer groups, while Financials and Energy were hit with broad liquidation.

Price aligned with the imbalance path. ES traded 6650–6647 through the build, then slipped into the 6630s as the –$4B imbalance peaked. A mild bounce followed as sell pressure eased into the close, but not enough to offset the earlier downside.

In all, the MOC showed aggressive institution-driven selling concentrated in NYSE and cyclical sectors, offset by targeted NASDAQ accumulation in large-cap tech and communication names.

Technical Edge

Fair Values for November 19, 2025:

-

SP: 18.83

-

NQ: 78.11

-

Dow: 70.84

Daily Market Recap 📊

For Tuesday, November 18, 2025

-

NYSE Breadth: 61% Upside Volume

-

Nasdaq Breadth: 56% Upside Volume

-

Total Breadth: 57% Upside Volume

-

NYSE Advance/Decline: 54% Advance

-

Nasdaq Advance/Decline: 50% Advance

-

Total Advance/Decline: 52% Advance

-

NYSE New Highs/New Lows: 38 / 170

-

Nasdaq New Highs/New Lows: 60 / 393

-

NYSE TRIN: 0.73

-

Nasdaq TRIN: 0.77

Weekly Market 📈

For the week ending Friday, November 14, 2025

-

NYSE Breadth: 48% Upside Volume

-

Nasdaq Breadth: 49% Upside Volume

-

Total Breadth: 49% Upside Volume

-

NYSE Advance/Decline: 45% Advance

-

Nasdaq Advance/Decline: 41% Advance

-

Total Advance/Decline: 43% Advance

-

NYSE New Highs/New Lows: 286 / 170

-

Nasdaq New Highs/New Lows: 401 / 522

-

NYSE TRIN: 0.85

-

Nasdaq TRIN: 0.71

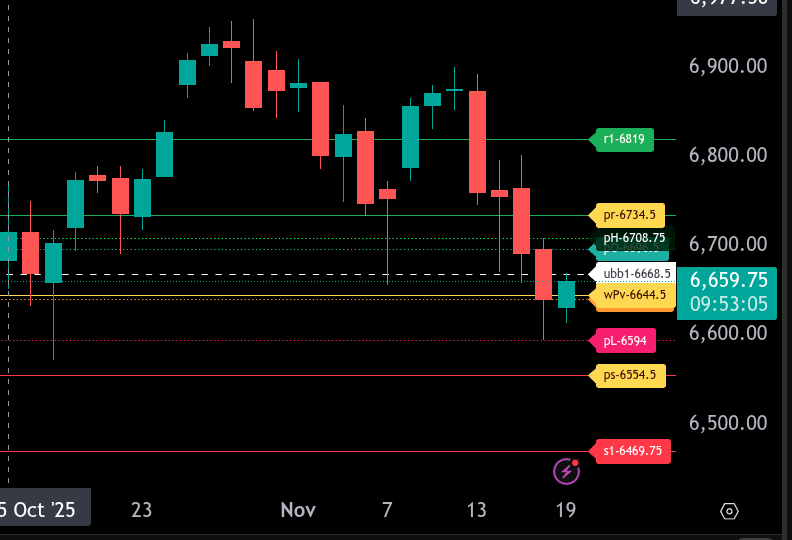

ES Levels

The bull/bear line for the ES is at 6644.50. Price is currently trading near 6659.50, showing early strength above this level. Holding above keeps the tone bullish for attempts back into higher resistance zones.

First upside resistance is 6708.75, with a further push targeting 6734.50 as the upper range target. A sustained move above 6734.50 opens the door toward 6819.

If ES slips back below 6644.50, sellers can press into 6639.75 and then 6594. A break under 6594 exposes the lower range target at 6554.50. Continued weakness below that level shifts focus toward 6469.75.

Overall, holding above 6644.50 favors rotations back toward 6708.75 and 6734.50. Losing 6644.50 shifts control back to sellers with targets down to 6594 and 6554.50.

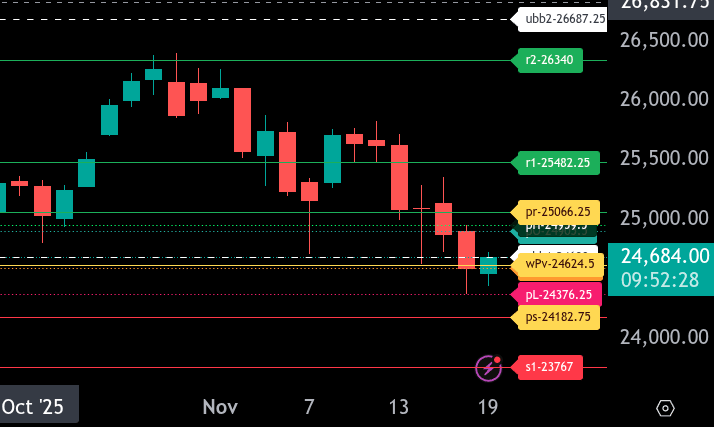

NQ Levels

The bull/bear line for the NQ is at 24,624.50. Trading above this level shifts momentum toward the upside; below it keeps sellers in control.

NQ is currently near 24,688.50 in the Globex session, holding slightly above the bull/bear line. If buyers can maintain this strength, upside continuation targets 24,959.50 first and then the upper range target at 25,066.25.

If price slips back below 24,624.50, downside pressure opens a path toward 24,376.25 and then the lower range target at 24,182.75.

Overall, holding above 24,624.50 keeps buyers in control for now, but dipping back under it quickly flips the bias back to sellers.

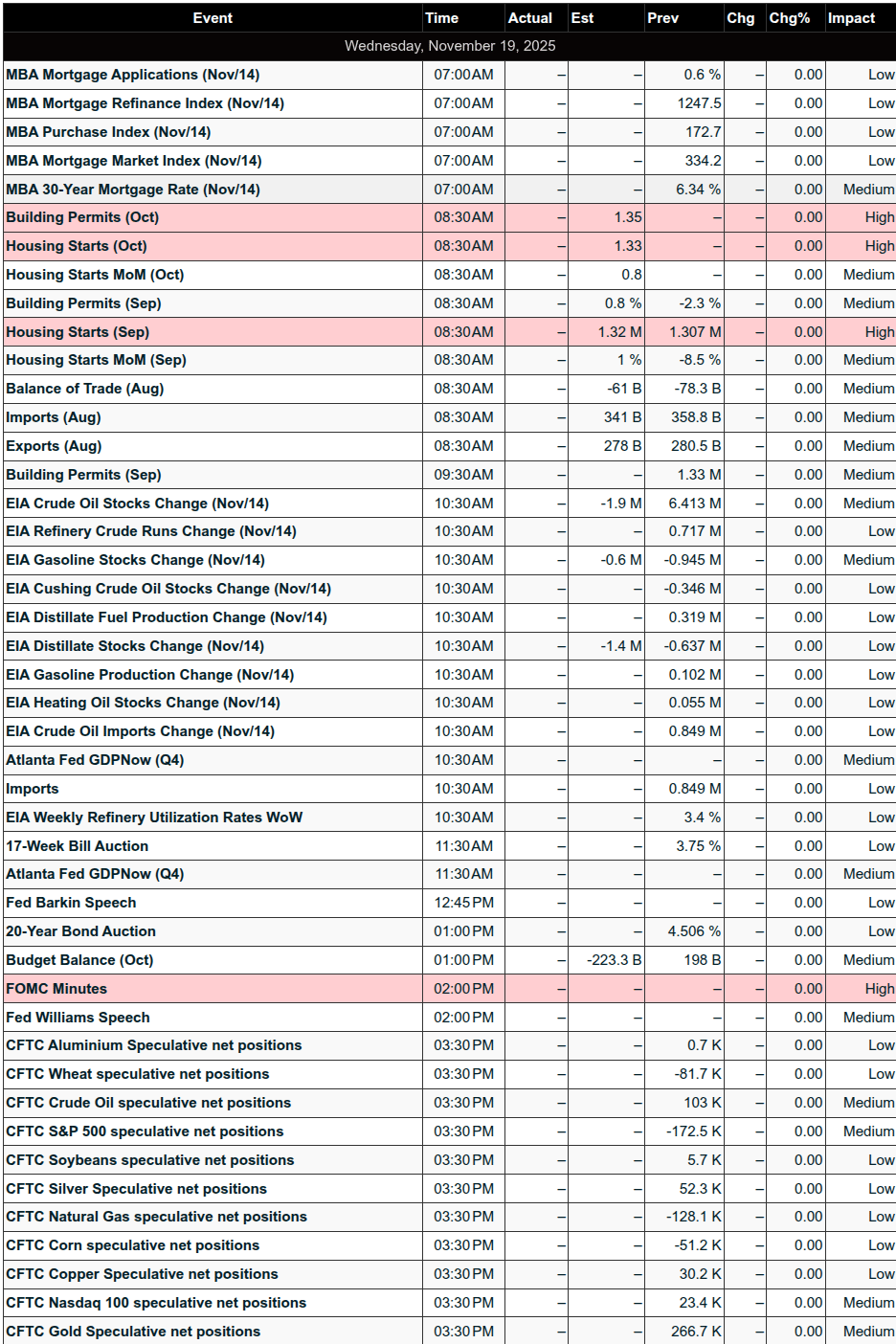

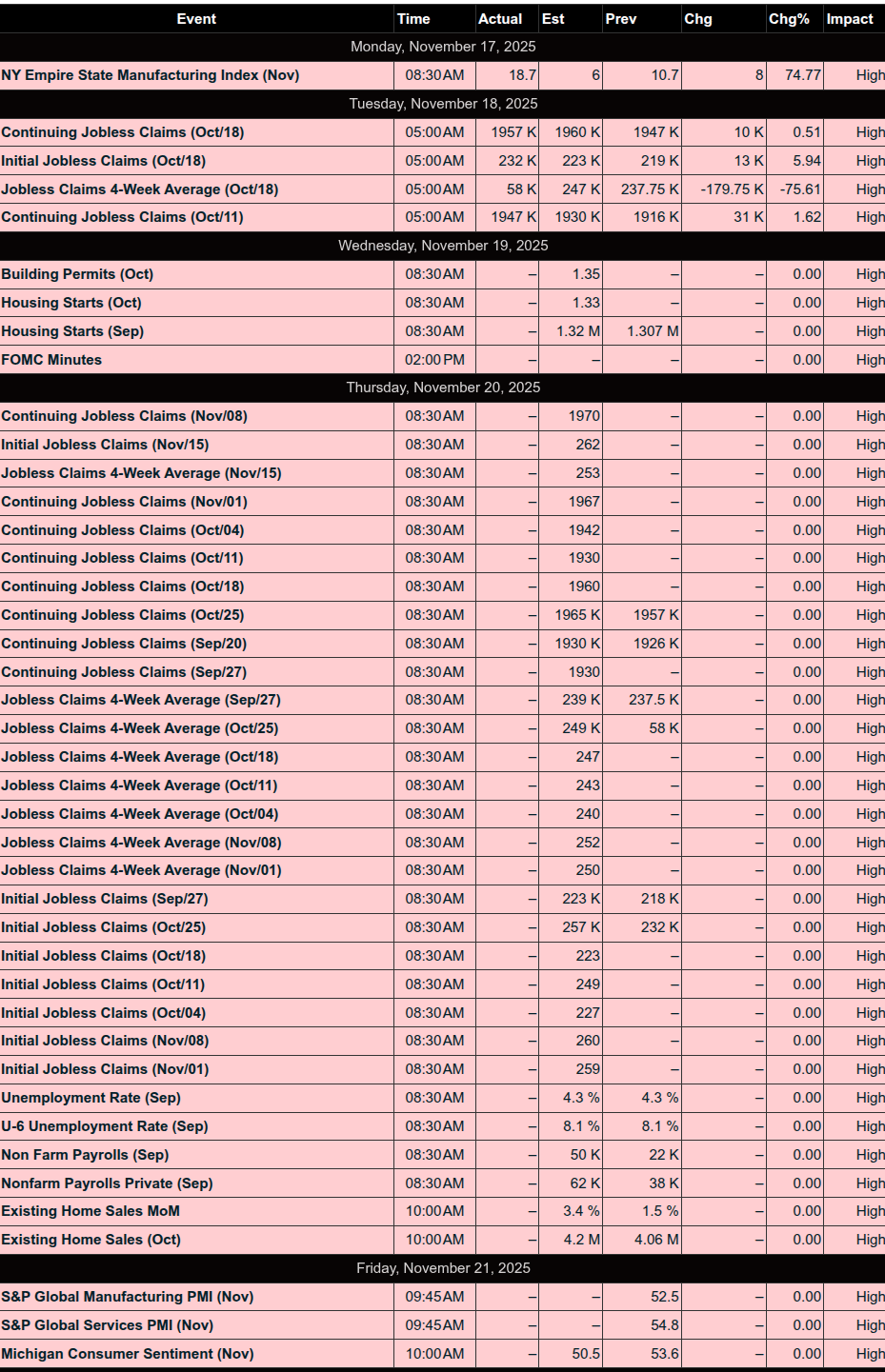

Calendars

Economic

Today

Important Upcoming / Recent

Earnings

Upcoming

Recent

Trading Room Summaries

Polaris Trading Group Summary – Tuesday, November 18, 2025

Tuesday’s session was marked by early opportunities on the long side, platform disruptions mid-morning, and increasingly volatile, whippy price action that demanded precision and adaptability. The day ultimately trended weaker, with bears dominating into the close as a large MOC sell imbalance sealed the session’s tone.

Positive Trades & Wins:

-

Early Long off Support Buy Zone (6648–6652 ES):

This zone triggered nicely around 8:30 AM, producing a solid +5 pt move. Manny called it out live, referencing a strong bid and buyer defense—excellent confirmation of the morning’s trade plan. -

PeterN Passed an Evaluation Account:

A standout achievement. He capitalized on early ORB setups and chose to step away after success—model discipline. -

Manny and Others Booked Early Gains:

Manny reported a small win early and stayed green despite technical issues. Later in the morning, he emphasized the principle: “Take what you can, get green, stay green.”

Challenges & Lessons Learned:

-

Platform Disruptions (NinjaTrader & Data Feeds):

Several members, including Manny and PTGDavid, lost connection mid-morning, with NinjaTrader particularly affected. Cloudflare outages seemed to be the root cause. A key takeaway: having backup platforms and understanding the fragility of trading tech is critical. -

Missed Fills & Volatile Tape:

A few traders narrowly missed fills (3 ticks off before a “gnarly” bounce).

Lesson: “These occurrences rarely work in one’s favor”—highlighting the importance of managing slippage and using well-placed orders. -

Fast Markets Required Fast Decisions:

David repeatedly reminded the room of the whippy volatility: 10+ point swings in seconds. Many traders opted to preserve gains rather than overtrade in such conditions—a wise choice. -

Mixed Signals into the Close:

Bears retained control through most of the day. A tug-of-war around the 6665–6685 range was described by David as a “Rugby Match” with heavy volume and broken momentum.

The close brought a massive $4B MOC Sell Imbalance, confirming sellers’ dominance and sealing the day as a Cycle Day 1 Weakness.

Key Lessons:

-

Mastery over Quantity:

David reinforced: “Master one setup and practice it 10,000 times.” Focus on repetition and consistency over chasing multiple trade ideas. -

Tech Preparedness Matters:

Platform failure is a real risk. Multiple traders highlighted the importance of not disconnecting once connected, and some leaned on backup platforms like Sierra or DeltaTrader. -

Mental Composure is Part of the Edge:

Manny wisely said, “Getting upset won’t help you trade better.” Staying emotionally stable helped several members stay out of poor trades.

Summary:

Despite tech issues and a very fast tape, the room extracted value from early setups, especially the Support Buy at 6648–6652. Adaptability and emotional control were the day’s real edge. The afternoon favored bears, with large sell imbalances confirming downside pressure. The PTG team navigated the session with professionalism, discipline, and an emphasis on protecting capital.

Discovery Trading Group Room Preview – Wednesday, November 19, 2025

Market Focus: Nvidia Earnings

-

Nvidia (NVDA) reports Q3 earnings after the bell — critical AI bellwether.

-

Stock is down ~12% from all-time highs; market cap previously topped $5T.

-

Options imply a 7% move (~$320B in market cap swing).

-

SoftBank and Peter Thiel’s fund have exited major NVDA positions.

-

Hyperscalers (AMZN, GOOGL, MSFT) make up ~50% of NVDA’s data center revenue.

-

Data center now contributes 89% of NVDA’s total revenue.

-

China remains excluded from NVDA’s revenue model due to chip restrictions.

Corporate Earnings

-

Premarket: Lowe’s (LOW), Target (TGT), TJX (TJX), VIK, Williams-Sonoma (WSM)

-

After Hours: Nvidia (NVDA), Palo Alto Networks (PANW), ZTO Express (ZTO)

-

Thursday Premarket: NetEase (NTES), Walmart (WMT)

Economic Data & Fed Watch

-

FOMC Minutes at 2:00pm ET — expected to have limited market impact.

-

September jobs report set for release Thursday morning.

-

Interest rate swaps show ~50% odds of a December cut.

-

Leaked jobs data suggests rising unemployment due to the government shutdown period.

-

Upcoming data:

-

Trade Balance: 8:30am ET

-

Crude Oil Inventories: 10:30am ET

-

-

Fed Speakers:

-

Stephen Miran – 10:00am ET

-

Thomas Barkin – 12:45pm ET

-

John Williams – 2:00pm ET

-

Market Technicals & Sentiment

-

Volatility increasing: ES 5-day ADR at 115.50.

-

Whale bias: Leaning bearish on lighter overnight large-trader volume.

-

Key ES Support: 6586/83s — if broken, could lead to deeper selling.

-

Key ES Resistance:

-

6719/24s – holding as short-term top

-

6854/49s, 7129/34s, 7230/35s – higher resistance levels

-

-

ES below 50-day MA (6753) — now flattening and may turn lower, a bearish sign.

Affiliate Disclosure: This newsletter may contain affiliate links, which means we may earn a commission if you click through and make a purchase. This comes at no additional cost to you and helps us continue providing valuable content. We only recommend products or services we genuinely believe in. Thank you for your support!

Disclaimer: Charts and analysis are for discussion and education purposes only. I am not a financial advisor, do not give financial advice and am not recommending the buying or selling of any security.

Remember: Not all setups will trigger. Not all setups will be profitable. Not all setups should be taken. These are simply the setups that I have put together for years on my own and what I watch as part of my own “game plan” coming into each day. Good luck!

This post goes out as an email to our subscribers every day and is posted for free here around 2 PM ET. To get your real-time copy, sign up for the free or premium version here: Opening Print Subscribe.

Comments are closed