Market Review

GLOBEX

| (ESH20:CME) GLOBEX Session | (ESH20:CME) Day Session |

| High 3751.25 | Opening Print: 3740.75 |

| Low: 3656.50 | High 3777.00 |

| Volume: 210,000 | Low: 3717.25 |

| ES Settlement 3756.75 | |

| Total Volume 1.62 M |

S&P 500 Futures Recap – Trade Date February 1, 202

February Opens With a Buy – Indices Now In Positive for 2021

After trading in an 84.75-handle overnight range, the S&P 500 futures opened Monday’s cash session at 3740.75, traded an early high of 3747.25 and then sold down to a daily low of 3717.25 just before 9:00 CT. From there, buyers would lift the S&Ps through the rest of the morning and into the mid-afternoon printing a high of day of 3777.00 just after 1:30. From there, the ES would show some weakness for the rest of the afternoon trading down to a late session low of 3756.75 before settling at 3757.00, up 50.75 handles on solid volume of 1.6 million contracts. In terms of price action, it was all about buying the early low and holding into the mid-afternoon.

Economic Calendar

Closing Prices

In the Tradechat Room

MiM

The early MIM was all about the buy and that was taken hook, line, and sinker into the 15:00 candle where the market became undecided. The 15:50 reveal of -620M sell was taken as positive (the NQ was positive) but the 15:54 trades were unleashed and sold the market down about 15 points. That 15:55 reversal is a very oft occurring move and bears some study.

Questions? Please email me: Marlin@mrtopstep.com

Get the skinny when we get it: Join the MiM.

Covid Corner:

Overall the US continues to improve, there are some worries about WA and TX which are still near their highs.

The US leads the world in total number of vaccines distributed. We are watching for the curve to flatten out indicating that we are exhausting one of three things, the vaccine, people to administer the vaccine, or arms to put the vaccine in.

This is the same graph as the one above except in a per capita basis, this case per 100 people. Israel enjoys the honor of leading per capita with an injection rate of about 1.7% of its population per day. That has come off from their 2+% they were doing last week. That would suggest that the vaccine amount is constrained at this point. The US continues to improve and we are currently vaccinating about 0.47% of the population per day. China has fallen off over the last few days.

Wear your masks!

Stay at least 10 feet behind someone wearing a mask! (Particularly in a checkout line)

Stay home!

Take your Vitamin D!

Chart of the Day

Our View

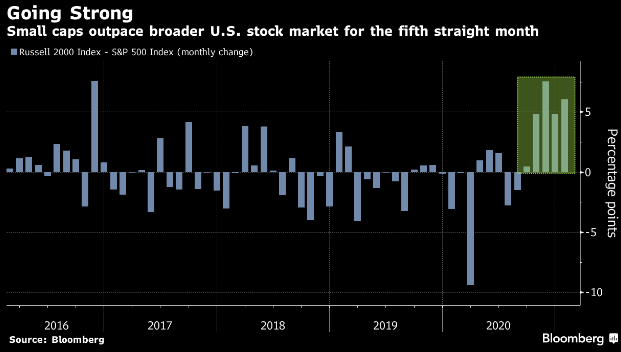

#ES: Largest Rally Since November 24th

The markets had their worst week since October and what happens? The ES has its largest rally since November 24th.

I have a very basic ‘trading rule’ that goes like this; it takes days and weeks to knock the markets down and only one to bring it back! As I write this, the ES just traded up to 3787.75 on Globex, up 24 points and up 131.75 points from Sunday night’s 3656 low. That’s an average gain of 4.87 points per hour. The old saying is that the markets go down faster than they go up, not this time. This is clearly a game of ‘shuffle your feet’ or lose your seat!

Our view, yesterday’s rally in the S&P was the largest since November 24th. Maybe after the rest of the tech earnings, the S&P goes back down but it’s the first trading days of the new month and will likely see more money going in. Our lean is to sell a gap up open or the first rally above and buy the mid-morning pullback. 3820 on TAP!

Danny Riley is a 39-year veteran of the CME trading floor. He ran one of the largest S&P desks on the floor of the CME Group since 1985.

As always, please use protective buy and sell stops when trading futures and options.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Decisions to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

No responses yet