Global economic worries hits stocks overnight

Follow @MrTopStep on Twitter and please share if you find our work valuable.

Our View

I took last week off and I hate to say it, but I didn’t pay attention to the ES and NQ. I had a feeling the markets were setting up for a selloff and like I mentioned, the PitBull used to say every time I take time off — which isn’t often the — markets sell off.

But — and there’s always a but — when the ES closed weak on Friday two things happened.

The ES closed above the big figure at 4500 and even more importantly, everyone thought they closed weak after the index sold off 67 points from the high down to the session low (and then closed near the session low).

The PitBull asked me what I thought and I told him I couldn’t short a close like that. The main reason being that momentum-close trading doesn’t work enough and when it does, it’s like 10% to 20% of the time. The other 80% to 90% of the time, it’s a big fade and that’s what Monday’s action was about.

Of course, it helps that Monday’s tend to be the low-volume day of the week and it’s hard to short days like yesterday — AKA when “thin to win” is in play.

Our Lean

Can the ES go higher? I think it can, but traders really have to be careful on the long side right now.

First, remember the seasonalities. While the drop won’t (and shouldn’t) be straight down, we’ve declined in four out of five trading sessions in August. Second, stocks are being hit with a bunch of negative news this morning.

Moody’s lowered their credit rating on 10 small- and mid-sized lenders, warning about the risks of commercial real estate. That’s got the XLF and KRE back under pressure this morning. Further, worries out of China are now causing concern. From Bloomberg:

“Exports plunged by the most since early 2020, the beginning of the Covid pandemic, and imports contracted last month. The Hang Seng China Enterprises Index and a gauge of European mining shares fell about 2%. Commodities prices retreated, with oil and copper losing almost 2%.”

So can “thin to win” help drive the S&P higher? It can. But am I in love with the upside? Not really. The bond market has been struggling and crude has been marching higher, (with the exception of this morning’s action).

The ES is on very thin ice here as it hovers near the 4393-4503 zone. While that’s a big support zone, losing this measure opens the door to some of the lower prices we talked about yesterday.

Our Lean: Yesterday we talked about the possibility of ~4500 failing and opening the door to lower prices. Although, it seemed like it would take more time for that to happen. If it happens today, keep an eye on 4485, 4476 and 4450-60 as downside support. If ~4500 holds, 4520-22 and 4530 are areas to watch on the upside as potential resistance, followed by 4542.

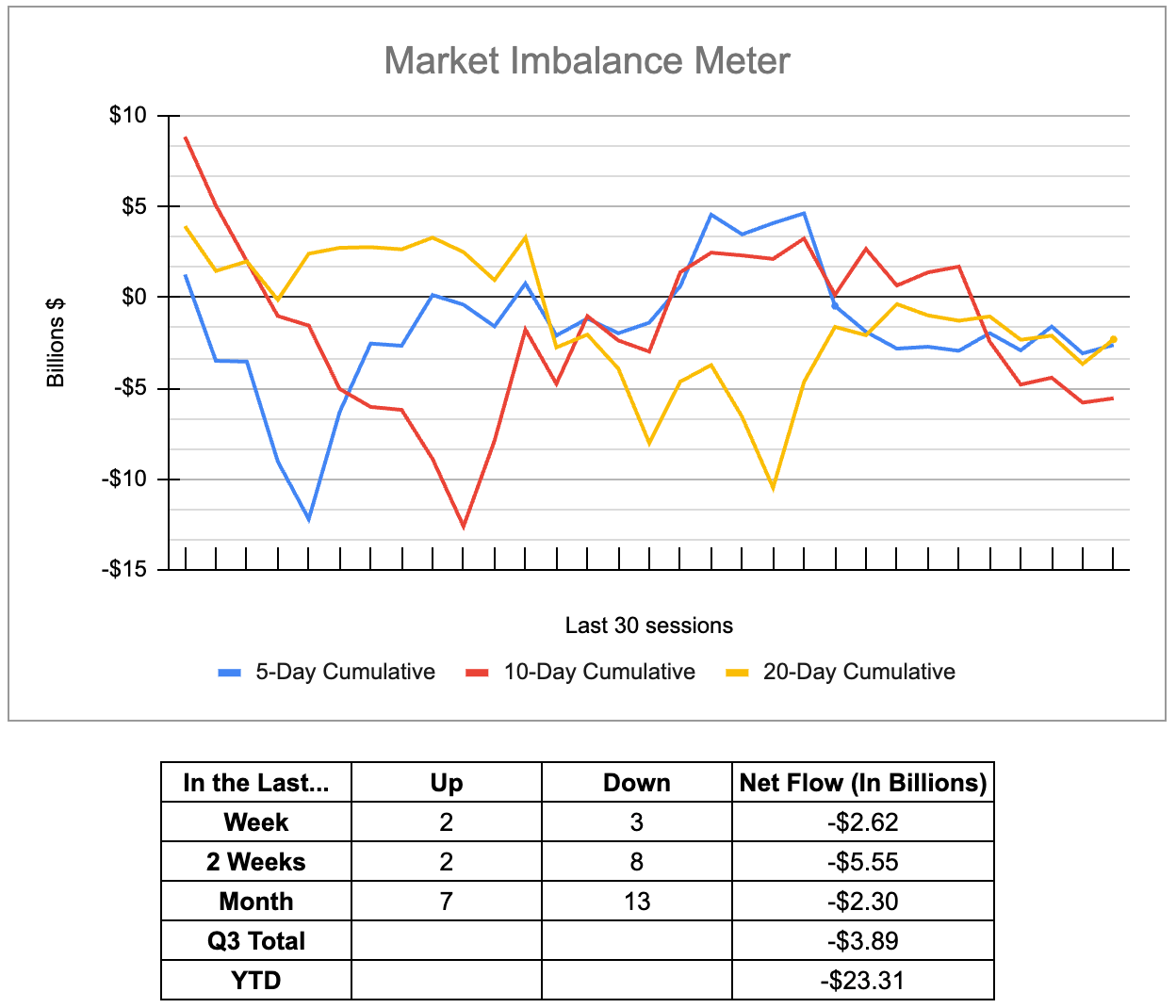

MiM and Daily Recap

The ES traded up to 4522 on Globex and opened Monday’s regular-hour session at 4518.25. After the open, the ES popped up to 4527.25, chopped down to 4510, then rallied to new highs at 4530 at 10:40. From there, the ES dipped down to the 4514 area from 11:15 to 11:30, rallied to a lower high near 4527.50, dipped back to 4520.50 at 12:40, then grinded up to a new session high at 4536.25 at 2:00.

After the high, the ES dipped back down to 4526.75 at 2:25, made a lower high at 4535.25 at 3:00, dipped down to a higher low of 4527 at 3:30. This gave the ES the energy to power up to new highs going into the close. The ES traded 4532.25 as the 3:50 cash imbalance showed about $250 million for sale and traded 4538.25 at 4:00. After 4:00, the ES climbed up to 4541.75, then settled at 4540 at the 5:00 futures close.

In the end, the buyers finally pushed back on the sellers and clawed back some of this month’s losses. In terms of the ES’s overall tone, it was firm. In terms of the ES’s overall trade, volume was okay, but on the lower side at 1.35 million.

Technical Edge

-

NYSE Breadth: 61% Upside Volume

-

Advance/Decline: 61% Advance

-

VIX: ~$17

SPY

Before we panic and freak out, the SPY is trading lower by about 0.75% in the pre-market, but is trading down to fill the gap from Friday. Admittedly, that leaves a gap back up to Monday’s close as well, but as long as last week’s low of ~$446.25 holds, then bulls could make a case for being long.

-

Upside Levels: $448, $450, $451.50

-

Downside Levels: $447.25, $446.25, $444 to $445

Daily chart with note:

S&P 500 — ES Futures

SPX

-

Upside Levels: 4495-4500, 4526-30, 4540

-

Downside Levels: 4475-78, 4555-60, 4540, 4532

S&P 500 — ES Futures

ES 30-min

On the daily chart, you can see where the 4460 area brings up a couple of key measures in the 50-day moving average and the 78.6% retracement.

ES Daily

-

Key support: 4493-4503

-

Upside Levels: 4220-22, 4530, 4546-50

-

Downside levels: 4493-4503, 4485, 4476, 4450-60

NQ

Somehow, 15,340 continues to hold as support, although a break of this area opens the door down to the 15,275 area. Ideally, bulls will want to see the NQ regain the 200-sma (on the 4-hour chart, below).

NQ 4-hour

-

Upside Levels: 15,500, 15,525-545, 15,610-625

-

Downside levels: 15,320-340, 15,275-300, ~15,100

QQQ

QQQ Daily

The $371.75 area continues to hold quite well, although that may be put to the test today. If it breaks — significantly — it could put the $368.50 to $369 area in play (the gap-fill and 61.8% retracement).

Just below that is the 10-week and 50-day moving averages.

On the upside, the $376-77 area has been resistance.

Open Positions

Bold are the trades with recent updates.

Italics show means the trade is closed.

Any positions that get down to ¼ or less (AKA runners) are removed from the list below and left up to you to manage. My only suggestion would be break-even (B/E) or better stops.

** = previously mentioned trade setup we are stalking.

Down to Runners in GE, CAH, LLY, ABBV, AAPL, MCD & BRK.B. Now Add META, AVGO, UBER, CRM, AMZN, CVS, AMD, TLT and YM.

-

JPM — Many are long from $143-145. This is a longer term swing. Trimmed $153s, then $157.50+ on 7/24.

-

Down to ½ position vs. Break-even stop. Can make small, ~10% position trim if we see $160+

-

-

ARKK — Long from ~$46 — trimmed near/at $50. Still carrying ⅔ to ¾ of position. Trim at ~$52

-

Added back about ⅓ of our position around $45.50. Keep in mind, there could be room down to the 50-day moving average.

-

-

WMT — went weekly-up from this week’s play — Trimmed above $157.55 and then $158. Down to ½ position with trim at $160+, Trimmed the add portion above $159 (a high of $161.19 on 8/7)

-

Break-even stop, down to ¼ position or less at $162.50

-

-

** XOM — watch for the monthly-up over $108.50.

-

TLT — Long from $95.63 (daily-up) — Trim down to ½ or less on this morning’s gap-up as we traded ~$97+ | Trim more if we see $97.75+ and the 10-day ema.

-

Break-even stop

-

Go-To Watchlist

Feel free to build your own trades off these relative strength leaders

Relative strength leaders →

(Lack of updates here but these names remain my top focus list!)

-

Growth stocks ARKK — DKNG, DOCN, UPST, SHOP

-

LLY, CAH

-

Energy stocks — VLO, SLB, EOG

-

AI stocks — NVDA, AMD, AVGO, ADBE, SMCI

-

Mega cap tech — MSFT, AAPL, META, CRM

-

Select retail — CMG, ELF, LULU, COST

-

Homebuilders ITB — TOL, KBH, DHI

-

BRK.B

-

ABEV, DXCM

-

Cruise stocks — RCL, CCL, NCLH

-

DAL, DT, AMAT

Relative weakness leaders →

-

DIS → new 52-week lows

-

CF, MOS

-

PFE (all vaccine gains now gone)

-

EL, FL, DG

Economic Calendar

Disclaimer: Charts and analysis are for discussion and education purposes only. I am not a financial advisor, do not give financial advice and am not recommending the buying or selling of any security.

Remember: Not all setups will trigger. Not all setups will be profitable. Not all setups should be taken. These are simply the setups that I have put together for years on my own and what I watch as part of my own “game plan” coming into each day. Good luck!

Update your email preferences or unsubscribe here

© The Opening Print

228 Park Ave S, #29976, New York, New York 10003, United States

No responses yet