TODAY’S GAME PLAN: from the trading

desk, this is not research

DATA/HEADLINES 11:00ET NY Fed 1-Yr Inflation Expectations; 1:00ET 3 year note auction

TODAY’S HIGHLIGHTS:

- US House returns from summer recess

- Biden said the sole threat to humanity’s existence is climate change — not even nuclear conflict poses a similar

danger - Kim Jong Un appears to have departed for Russia

Global equity markets rose as improved Chinese economic data aided sentiment. This week holds a number of major risk events, including US inflation data on Wednesday,

which may be pivotal before the Federal Reserve meets on Sept. 19. On Thursday, the European Central Bank is expected to announce its policy decision. Markets have all but priced out any chance of a hike in light of a sharp slowdown in business activity.

EQUITIES:

US equity futures are higher as upbeat Chinese data and comments from Treasury Secretary Janet Yellen fueled hopes for the health of the world’s two biggest economies. Yellen said she’s

increasingly confident that the US will be able to contain inflation without major damage to the job market. Investors will be monitoring a slew of economic data, including US consumer prices due later this week that will help traders assess the Fed’s path

on interest rates. On the corporate side, Apple (AAPL) is scheduled to host its marquee fall event on Tuesday, with new iPhones, Apple Watches, and a new charging port for most devices expected to be announced. A September 14 deadline also looms in a contract

dispute between the United Auto Workers and automakers, with workers threatening a strike when their current deal expires on Thursday. As competition in the AI space heats up, Meta Platforms is developing a new AI model aimed to be as powerful as OpenAI’s

latest ChatGPT version GPT-4, the Wall Street Journal reported.

Futures ahead of the bell: E-Mini S&P %, Nasdaq %, Russell 2000 %, Dow %.

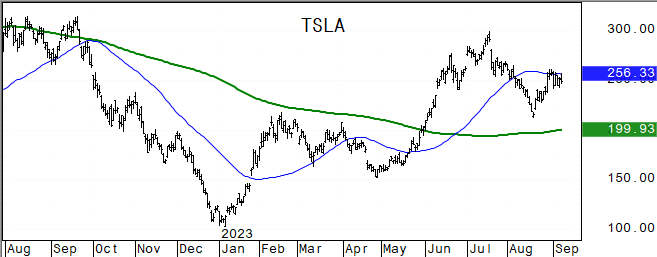

In pre-market trading, Tesla rallied 5% after Morgan Stanley said its Dojo supercomputer may add as much as $500 billion to its market value through faster adoption of robotaxis and network

services. Qualcomm shares jump ~8% after Apple extends an agreement to get modem semiconductors from the company for three more years, a sign that its efforts to design the chips in-house is taking longer than expected. Canopy Growth (CGC) surged 12%, putting

the marijuana company on track to extend advance for a second session. The stock soared on Friday amid a run of gains on renewed hopes that the SAFE Act on cannabis banking will move forward in Congress soon. Crinetics Pharma (CRNX) rose as much as 33% after

the pharmaceutical company said its investigational compound Paltusotine achieved positive results by meeting all secondary endpoints of the Phase 3 study. Microsoft (MSFT) is up 0.8% after Citi opened a positive catalyst watch on the stock. Arm Holdings is

reportedly gaining enough traction from investors to price its upcoming initial public offering at the top of the range for what would be the world’s largest listing this year. The SoftBank Group owned chip designer’s share sale is about six times subscribed.

J.M. Smucker is near a deal for Twinkie owner Hostess at a valuation of about $4 billion, the WSJ reported.

European stocks rose, led higher by miners which got a lift from rising metals prices, while other cyclical sectors such as banks and insurers also rose. Italian banks led gains among

European lenders after a report that the government is weighing changes to a controversial tax on banks’ windfall profits. The EU cut its outlook for the euro-zone economy, predicting it will be dragged down this year by a contraction in Germany. Output in

the bloc will rise by 0.8% in 2023, compared with an earlier forecast for 1.1%. Elsewhere, Vistry Group was standout, soaring after saying that it plans to focus solely on building homes for affordable housing providers as private sales struggle. Covestro

AG rose after the German chemicals maker said its management board decided to enter talks over a potential takeover by Abu Dhabi National Oil Co. Stoxx 600 +0.3%, DAX +0.3%, CAC +0.3%, FTSE 100 +0.1%. Basic Resources +2.5%, Banks 11%, Autos +0.8%. Travel -0.3%.

Asian stocks advanced as a jump in China’s credit data boosted onshore equities. Chinese blue-chip stocks ended the day up 0.7% after data showed deflation pressures were easing, which

suggested the economy might be returning to a more stable footing. A separate report showed new lending almost quadrupled in August, a sign that recent steps to bolster the real estate market may be starting to lift household demand for mortgages, while corporate

loans also picked up. Regulators will make it easier for insurers to invest in domestic stocks by cutting their risk weighting. The MSCI Asia Pacific Index climbed 0.6%, its first gain in a week. Japanese financial stocks lent the biggest support as comments

from the Bank of Japan’s governor pushed up yields, which in turn boosted lenders. The country’s broader equity benchmarks remained under pressure as the yen strengthened. Stocks in Hong Kong slipped as the market reopened after Friday’s closure due to a heavy

rainstorm. Alibaba was a major drag after news of its former CEO’s departure. Shanghai Composite +0.8%, Sensex +0.8%, ASX 200 +0.5%, Kospi +0.4%, Topix +0.05%. Nikkei 225 -0.4%, Hang Seng Index -0.6%, Taiwan -0.9%, Vietnam -1.4%.

FIXED INCOME:

Treasuries fell as traders await key US inflation due later this week. The yield on the benchmark 10-year Treasury note rose 3 basis points to 4.29%, while that on

the two-year note was flat at 4.98%. Investors are pricing in a 93% probability the Fed will leave rates unchanged when it convenes next week, but the outcome of the November meeting is less clear. Focal points of US session include a 3-year note auction and

potential for another heavy corporate new-issue slate. Dollar IG issuance slate includes five names; syndicate desks are looking for around $30 billion in sales this week, with a bulk of the volume anticipated ahead of Wednesday’s inflation data.

METALS:

Gold rose by the most in almost two weeks, aided by a weaker dollar as moves by Asia’s biggest central banks hurt the US currency after a long rally. The metal fell

1.1% last week as gold-backed exchange-traded funds saw the biggest weekly outflow since June. Investors are looking ahead to a US consumer-price index report due midweek. Spot gold +0.4%, silver +0.6%.

ENERGY:

Oil slipped after rallying almost 10% over the past two weeks. Oil prices dipped on Monday after fresh Saudi and Russian crude output cuts had driven prices to 10-month

highs last week. The supply cuts overshadowed continuing concern over Chinese economic activity last week, but investors looked to be focusing on demand drivers on Monday. WTI -0.4, Brent -0.15%, US Nat Gas -0.2%, RBOB +0.6%.

CURRENCIES:

The dollar fell against all of its Group-of-10 peers after its recent rally drove the currency to a record streak of weekly gains. The greenback’s hot streak, which

saw it notch up its eighth consecutive weekly gain on Friday, came under threat as the People’s Bank of China escalated its defense of the yuan. The yen had the biggest move against the dollar, surging more than 1% after Bank of Japan Governor Kazuo Ueda

hinted at the possibility of ending the developed world’s last key negative interest rate. The yuan rebounded from a 16-year low after the People’s Bank of China delivered a strong verbal warning to speculators. Policymakers also set a daily fixing that was

stronger-than-expected. US $ Inde3x -0.4%, USDJPY +1%, GBPUSD +0.5%, EURUSD +0.2%.

Bitcoin -0.6%, Ethereum -1.8%.

TECHNICAL LEVELS:

|

ESU23 |

10 Year Yield |

Dec Gold |

Oct WTI |

Spot $ Index |

|

|

Resistance |

4600.00 |

5.325% |

|

93.74 |

108.500 |

|

|

4547.50 |

4.710% |

2029.0 |

91.50 |

107.990 |

|

|

4523.00 |

4.500% |

2004.0 |

90.00 |

107.195 |

|

|

4501/05 |

4.375% |

1996.0 |

89.18 |

105.883 |

|

|

4491.00 |

4.360% |

1977.4 |

88.08 |

105.380 |

|

Settlement |

4461.75 |

1942.7 |

87.51 |

||

|

|

4448.50 |

4.050% |

1940.5 |

84.08 |

103.100 |

|

|

4425.00 |

3.940% |

1925.0* |

81.62 |

102.370 |

|

|

4386.00 |

3.725% |

1907.0* |

79.10 |

101.700 |

|

|

4350.00 |

3.680% |

1866.0 |

76.31 |

100.710 |

|

Support |

4330.00* |

3.500% |

1842.0 |

73.56 |

100.000 |

Colors within the report:

Green is always the 200 period (day, week).

Red is always 21,

Blue = 50,

Brown =

100 *Stars have added importance

UPGRADES:

- Brown-Forman (BF/B) raised to outperform at Bernstein; PT $76.40

- DoorDash (DASH) raised to hold at Jefferies; PT $90

- Kenvue (KVUE) raised to buy at Deutsche Bank; PT $27

- Nubank (NU) raised to overweight at JPMorgan; PT $9

- Tenable (TENB) raised to overweight at JPMorgan; PT $56

- Tesla (TSLA) raised to overweight at Morgan Stanley; PT $400

DOWNGRADES:

- Brunswick (BC) cut to neutral at JPMorgan; PT $79

- Evergy (EVRG) cut to peerperform at Wolfe

- RTX Corp (RTX) cut to hold at Melius; PT $92

- Rent the Runway (RENT) cut to market perform at Telsey; PT $1

INITIATIONS:

- Blue Bird (BLBD) rated new overweight at Barclays; PT $25

- Ecovyst Inc (ECVT) reinstated buy at Citi; PT $12

- Forza X1 (FRZA) rated new buy at ThinkEquity; PT $5

- HB Fuller (FUL) reinstated neutral at Citi; PT $78

- L3Harris (LHX) reinstated buy at Citi; PT $193

- Red Rock Resorts (RRR) rated new positive at Susquehanna; PT $52

- SharkNinja (SN) rated new buy at Jefferies; PT $67

Upside:

-TSLA +6% upgraded at Morgan Stanley VOL 5.2M

-TWNK +14% J.M. Smucker said to near deal to acquire the co., the transaction could be worth ~$4.0B VOL 6.2M

-META +1% US press reports that Meta Platforms is building AI model to rival OpenAI’s VOL 179K

-IMTX +5% Moderna to pay Immatics as much as $1.8B in cancer-drug deal VOL 26K

-QCOM +8$% extends agreement with Apple Inc. to supply Snapdragon 5G Modem-RF Systems for smartphone launches in 2024, 2025 and 2026 VOL 773K

-TSAT +3% signs 14-Launch agreement with SpaceX VOL 3K

-BA +1% confirms $7.8B deal from Vietnam Airlines for 50 B737 VOL 31K

-K +1% Board of Directors formally approves the previously announced separation into two independent, publicly traded companies VOL 2K

-AQST +5% receives FDA acceptance of New Drug Application (NDA) for Libervant (diazepam) Buccal Film in pediatric patients VOL 3K

Downside:

-RTX -4% to recognize ~$3B charge in Q3 due to Pratt & Whitney powder metal manufacturing matter; Affirms FY23 adj Rev VOL 137K

-REKR -1% secondary VOL 1K

-BOWL -3% earnings VOL 63K

-SJM -10% Hostess deal VOL 41K

Data sources: Bloomberg, Reuters, CQG

No responses yet