TODAY’S GAME PLAN: from the trading

desk, this is not research

DATA/HEADLINES 8:15 ECB Rate Decision; 8:30ET Retail Sales, Weekly Jobless Claims, PPI; 8:45ET ECB President

Lagarde news conference; 10:00ET Business Inventories

US RETAIL SALES INCREASED 0.6% IN AUG.; EST. 0.1%. US AUG. PRODUCER PRICES RISE 1.6% Y/Y; EST. 1.3%, US AUG. PRODUCER PRICES RISE 0.7% M/M; EST. 0.4%

TODAY’S HIGHLIGHTS:

- August CBP encounters will be approx. 230,000 when released, highest of 2023

- China Cuts Reserve Requirement Ratio For Second Time This Year

- NASA’s exclusive UFO study findings will be revealed today

- Schumer told tech leaders they won’t like some things we’ll do

Global shares rose as focus today will be the latest interest rate decision from the European Central Bank. Higher borrowing costs across much of the world and China’s

economic malaise are taking a toll on economic growth, with a recession in the euro zone now a distinct possibility. Meanwhile, soaring global oil prices are exacerbating persistent cost pressures in Europe even as economic growth flounders. Earlier data showed

Sweden’s core inflation slowed to 7.2% year-on-year, weaker than expected. Britain’s housing market slowed further in August in the face of high mortgage rates. Sentiment improved after China’s central bank said it will cut the reserve requirement ratio for

financial institutions by 0.25 percentage points from Sep 15. Meanwhile, a European Commission investigation into Chinese electric vehicles believed to have benefited from state subsidies will have a “negative” impact on economic and trade ties, China’s commerce

ministry warned.

EQUITIES:

US equity futures are edging higher as investors looked ahead to a busy day for US economic data. UAW strikes at America’s Big Three automakers may go ahead as unions and employers remain

far apart before tonight’s deadline. Arm Holdings shares start trading today, marking the biggest initial public offering of the year. There are also a few key earnings results after the close including Adobe (ADBE) and Lennar (LEB).

Futures ahead of the data: E-Mini S&P +0.5%, Nasdaq +0.5%, Russell 2000 +0.7%, Dow +0.3%.

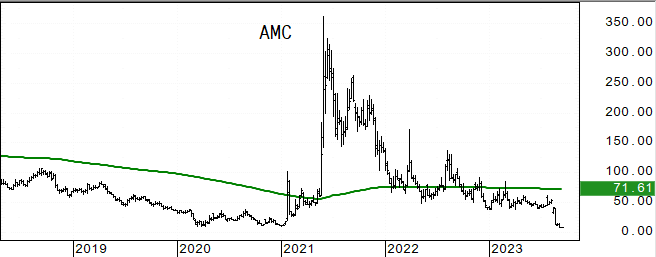

In pre-market trading, AMC Entertainment (AMC) rose 8% as the cinema chain disclosed that it raised about $325.5 million through the sale of 40 million shares. Carnival Corp. (CCL) gains

1.9% and Norwegian Cruise Line (NCLH) is up 2% after Redburn Atlantic lifts both stocks to buy from neutral. First Solar (FSLR) rose ~3% as BMO Capital Markets raised the stock to outperform. Semtech (SMTC) fell as much as 5.3% as the chipmaker issued a current

quarter sales forecast that missed estimates. Visa (V) fell over 2% as the company takes the first step to let the biggest US banks sell their shares in the world’s largest payments network. Vital Energy (VTLE) shares fall around 8% after the company said

it signed three agreements for Permian Basin assets. HP Inc. (HPQ) fell 2.5% after Warren Buffett’s Berkshire Hathaway disclosed that it sold shares. PureCycle Technologies (PCT) shares are down 10% after the plastics recycling company said its facility in

Ironton, Ohio, is in the process of restarting following a series of problems.

European gauges inch higher as investors awaited the interest rate decision from the ECB. Markets are now pricing in a 65% chance of a 25-basis-point hike that could take Europe’s key

interest rate to a record peak. The FTSE 100 is outperforming led by a strong move in miners following some positive broker commentary on the sector. UBS expects the central bank to deliver a final 25 basis point hike but acknowledged that in light of weak

economic data in recent weeks, the central bank may pause in order to leave the door open for a hike in October. The ECB raised it deposit rate by 25bps and say inflation is still seen as too high for too long. ECB also cut their growth forecasts in every

year through 2025 and sees inflation slowing to 2.1% in 2025. Stoxx 600 +0.3%, DAX -0.1%, CAC +0.1%, FTSE 100 +0.9%. Basic Resources +3.5%, Energy +1.7%. Retail -0.6%, Food & Bev -0.4%. Lagarde is on deck…

Asian stocks advanced on the back of a rally in tech shares, as US inflation data overnight affirmed bets that the Federal Reserve would likely pause rate hikes. The MSCI Asia Pacific

Index rose 0.9%, ending a two day losing streak. Hong Kong and mainland China shares fluctuated as concerns remained in the property sector. Country Garden Holdings fell as the deadline approaches for holders of a yuan bond to vote on the company’s repayment

extension request. China electric vehicle shares dropped after European officials launched a probe into Beijing’s EV subsidies. Traders will now be watching the latest readings on China’s industrial production and retail sales, due Friday. Kospi +1.5%, Nikkei

225 +1.4%, Taiwan +1.3%, Philippines and Singapore +1%, ASX 200 +0.5%, Hang Seng Index +0.2%, Sensex +0.1%, CSI 300 -0.1%.

FIXED INCOME:

Treasuries are little changed across the curve, lagging gains across core European rates ahead of the ECB policy decision at 8:15ET. Traders now see a 97% chance

policymakers will hold rates steady at their September 19-20 meeting, according to data from the CME group. More inflation data due today could sway those bets, with the August update on producer prices and retail sales scheduled before the bell.

METALS:

Gold steadied after falling in the wake of hotter-than-expected inflation data ahead of the release of statistics on US retail sales. Bullion has trended lower this

month due to a relentless rally by the greenback on bets that the US central bank’s monetary policy will be tighter than its Asian peers. Traders are now gearing up for the release of data on US retail sales this morning, to gauge whether a key driver of the

economy is fading. Spot gold is flat, silver -1.1%.

ENERGY:

Oil rebounded as expectations of a tighter global crude supply outlook for the rest of 2023 overshadowed concerns over weaker economic growth and rising US inventories.

Both benchmarks touched 10-month highs on Wednesday before release of the US supply report showing rising crude and refined product stocks sent prices lower. WTI is nearing $90 a barrel for the first time since November. WTI +1.5%, Brent +1.4%, US Nat Gas

+5%, RBOB +1.1%.

CURRENCIES:

In currency markets, the euro fluctuated with money markets pricing in a two-thirds chance of another increase at the European Central Bank’s meeting. An increase

of 25 basis points would take the rate the ECB pays on bank deposits to 4.0%, the highest level since the euro was launched in 1999. The euro jumped toward intraday highs yet the move quickly reversed as soon as inflation projections hit the wires. AUD/USD

gained 0.5% before halving gains. The initial boost was due to a headline beat in employment change for August, with traders selling into the gains on the realization that it was largely driven by part-time positions. US$ Index is flat, EURUSD -0.25%, GBPUSD

-0.2%, AUDUSD +0.3%, USDJPY -0.1%.

Bitcoin +1%, Ethereum +1.4%.

TECHNICAL LEVELS:

|

ESZ23 |

10 Year Yield |

Dec Gold |

Oct WTI |

Spot $ Index |

|

|

Resistance |

4610.00 |

5.325% |

2040.0 |

97.07 |

108.500 |

|

|

4597.50 |

5.000% |

2029.0 |

93.74 |

107.990 |

|

|

4573.00 |

4.710% |

2004.0 |

91.30/50 |

107.195 |

|

|

4551/53 |

4.500% |

1996.0 |

90.00 |

105.883 |

|

|

4538.50 |

4.360% |

1978.4 |

89.18 |

105.380 |

|

Settlement |

4517.50 |

1932.5 |

88.42 |

||

|

|

4495.00 |

4.080% |

1927.9* |

84.08 |

103.100 |

|

|

4474/82 |

3.940% |

1907.0* |

81.62 |

102.370 |

|

|

4440.00 |

3.725% |

1866.0 |

79.10 |

101.700 |

|

|

4425.00 |

3.680% |

1842.0 |

76.31 |

100.710 |

|

Support |

4350.00 |

3.500% |

|

73.56 |

100.000 |

Colors within the report:

Green is always the 200 period (day, week).

Red is always 21,

Blue = 50,

Brown =

100 *Stars have added importance

UPGRADES:

- Canadian National (CNR CN) raised to outperform at Raymond James

- Carnival (CCL) raised to buy at Redburn

- Etsy (ETSY) raised to outperform at Wolfe; PT $100

- First Bancorp NC (FBNC) raised to buy at DA Davidson; PT $34

- First Solar (FSLR) raised to outperform at BMO; PT $237

- JFrog (FROG) raised to outperform at William Blair

- Lennar (LEN) raised to buy at CFRA; PT $142

- MetLife (MET) raised to buy at Jefferies; PT $72

- Norwegian Cruise (NCLH) raised to buy at Redburn

- Oracle (ORCL) raised to buy at DZ Bank; PT $125

- Prudential Financial (PRU) raised to hold at Jefferies; PT $93

- Semtech (SMTC) raised to buy at Summit Insights

- Semtech (SMTC) raised to positive at Susquehanna; PT $30

- Virtu Financial (VIRT) raised to buy at Citi; PT $20

DOWNGRADES:

- Arco Platform (ARCE) cut to neutral at JPMorgan; PT $14

- CS Disco (LAW) cut to market perform at MoffettNathanson LLC; PT $9

- Carrier Global (CARR) cut to neutral at Mizuho Securities; PT $61

- Digital Turbine (APPS) cut to neutral at BofA; PT $8

- Frontier Airlines (ULCC) cut to market perform at Cowen; PT $8

- Hostess Brands (TWNK) cut to hold at Jefferies; PT $34

- IBEX (IBEX) cut to sector perform at RBC; PT $18

- J M Smucker (SJM) cut to neutral at BofA; PT $145

- MoonLake Immunotherapeutics (MLTX) cut to neutral at Bryan Garnier

- RTX Corp (RTX) cut to hold at DZ Bank; PT $79

- RTX Corp (RTX) cut to underperform at BofA; PT $75

- Semtech (SMTC) cut to hold at Benchmark

INITIATIONS:

- Allied Gold (AAUC CN) rated new buy at Canaccord; PT C$8

- Allied Gold (AAUC CN) rated new buy at Stifel Canada; PT C$8

- BJ’s Wholesale (BJ) rated new outperform at Cowen; PT $80

- Delivra Health Brands In (DHB CN) rated new buy at Fundamental Research

- Dragonfly Energy (DFLI) rated new buy at Roth MKM; PT $4

- First Advantage (FA) rated new outperform at Wolfe; PT $17

- First Majestic (FR CN) reinstated market perform at BMO; PT C$8.25

- Fortrea (FTRE) rated new inline at Evercore ISI; PT $31

- Hecla Mining (HL) reinstated outperform at BMO; PT $5.50

- Herbalife Ltd (HLF) rated new neutral at DA Davidson; PT $13.50

- HireRight Holdings (HRT) rated new peer perform at Wolfe

- MAG Silver (MAG CN) reinstated outperform at BMO; PT C$23.50

- Moody’s (MCO) rated new outperform at Wolfe; PT $390

- PRO REIT (PRV-U CN) rated new buy at Echelon Wealth; PT C$6.50

- RAPT Therapeutics (RAPT) rated new buy at Berenberg; PT $34

- S&P Global (SPGI) rated new outperform at Wolfe; PT $453

Data sources: Bloomberg, Reuters, CQG

No responses yet