TODAY’S GAME PLAN: from the trading

desk, this is not research

DATA/HEADLINES 8:30ET Weekly Jobless Claims; 10:00ET Wholesale Inventories; 12:00ET 3Q Household change in net

worth; 3:00ET Consumer Credit

Challenger Gray: US Job Market Loosening; Employers Not As Quick to Hire

TODAY’S HIGHLIGHTS:

- CBP sources, there were more than 12,000 migrant encounters at the southern border Tuesday, the highest single

day total ever recorded - Senate Republicans blocked $66 billion in emergency Ukraine aid

- US HAS ABOUT $1B LEFT OF $100B ALLOTTED FOR UKRAINE AID

Global bond and stock markets fell, fueled by comments from BOJ Governor Ueda and one of his deputies, jolting financial markets in Tokyo and shattering a period

of relative calm for Japan’s bonds. Ueda told lawmakers in parliament that his job was going to get more challenging from the year-end, helping fuel speculation of a near-term scrapping of the sub-zero rate. Deputy Governor Himino played down the adverse effects

of a rate hike on Wednesday which was probably the most significant of the apparent communication cues from the central bank.

EQUITIES:

US equity futures were muted as investors await a critical monthly payrolls report tomorrow. US tech stocks, meanwhile, were poised to outperform, helped by premarket

gains in Alphabet and Advanced Micro Devices. AbbVie will buy Cerevel Therapeutics in a deal valued at $8.7 billion, its second major acquisition in the past week. Futures ahead of the bell: E-Mini S&P +0.1%, Nasdaq +0.3%, Russell 2000 -0.3%, Dow -0.1%.

Futures ahead of the bell: E-Mini S&P +0.1%, Nasdaq +0.3%, Russell 2000 -0.3%, Dow -0.1%.

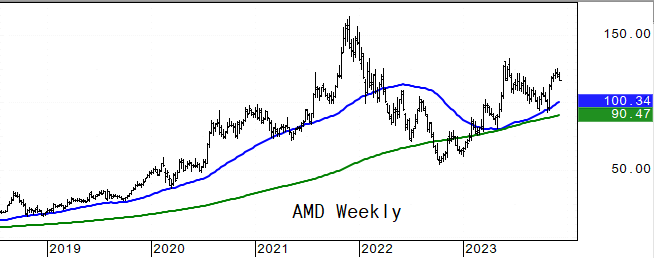

In pre-market trading, Alphabet (GOOGL) shares rise 2.6% a day after Google released Gemini, the “largest and most capable AI model” the company has ever built. AMD (AMD) gains 3.2% after

the chipmaker unveiled new so-called accelerator chips aimed at taking on the lucrative artificial intelligence market. Cerevel Therapeutics (CERE) shares rise 16% after AbbVie agreed to acquire the biotech company. C3.ai (AI) falls as much as 11% as the data

management and analysis software company reported revenue for the second quarter that missed estimates. Chewy (CHWY) shares drop 11% after the online pet supplies retailer cut its full-year net sales guidance. GameStop (GME) drop over 7% after the video-game

retailer reported third-quarter net sales that missed estimates. Sprinklr (CXM) shares slump 29%, set for their worst day on record, as analysts highlighted disappointing preliminary guidance for 2025. Braze (BRZE) climbs 8.6% after the software company boosted

its revenue guidance. MicroAlgo (MLGO) gains 48%, adding to Wednesday’s 296% rally that was driven by an announcement that its Chinese companies plan to sign a cooperation agreement over postgraduate training with two other bodies. Semtech (SMTC) shares are

up 9.5% after the semiconductor device company reported third-quarter results that beat expectations.

European stocks ticked lower, pausing after rallying to a four-month high as concerns over economic weakness outweighed recent hopes that interest rate cuts could be on the table for

next year. German industrial output fell 0.4% in October to its lowest since August 2020, adding to recent data pointing to a potential recession. Italian output contracted 0.2%, slightly less than expected. UK’s FTSE 100 opened lower in broad-based declines

as weak Chinese data took the wind out of China-exposed financials. Luxury retailer Burberry (BRBY.L) dipped 1.8% as Deutsche Bank reduced its price target on the stock, which dragged the personal goods sector. Stoxx 600 -0.25%, DAX -0.2%, CAC -0.2%, FTSE

100 is now flat. Banks -1.1%, Retail -1.1%, REITs -0.9%, Travel -0.8%. Basic Resources +0.5%, Utilities +0.4%.

Asian shares declined as China’s lackluster economic recovery and a selloff in Japanese stocks weighed on investor sentiment. China’s imports unexpectedly shrank in November, while exports

grew for the first time in six months. Exports grew 0.5% from a year earlier, compared with a 6.4% fall in October. Imports fell 0.6% after a 3.0% jump last month. The MSCI Asia Pacific Index declined 0.2%, paring losses of as much as 1%. Most regional markets

closed in the red, with Japan the worst hit as a stronger yen weighs on returns of export-focused companies. Nikkei 225 -1.75%, Philippines -1.1%, Hang Seng Index -0.7%, Taiwan -0.5%, Vietnam -0.4%, CSI 300 -0.25%, ASX 200 -0.1%, Kospi -0.1%, Indonesia +0.7%.

The amount of money that institutional investors have in Chinese stocks and bonds has declined by more than $31 billion this year, through October, the biggest net outflow since China

joined the World Trade Organization in 2001: WSJ.

FIXED INCOME:

Treasuries remain cheaper on the day by as much as 5bp in belly of curve after paring losses incurred during the Asia session when a selloff in Japanese government

bonds on hawkish comments from BOJ leadership spilled over into core rates markets. JGB auction produced the largest tail on record. US 10-year yields at around 4.15% are higher by ~5bp after climbing as much as 8bp. Traders have nearly fully priced in the

likelihood of the Fed keeping interest rates unchanged at its meeting next week, with 61% betting on a rate cut as soon as March 2024, according to the CME Group’s FedWatch tool.

METALS:

Gold advanced as China added to its reserves for a 13th month in November. Investors are watching the inflation outlook carefully, with broad US labor-market data

due Friday likely to give more clues on future monetary policy. Spot gold +0.4%, silver +0.1%.

ENERGY:

Oil prices regained some ground after tumbling to a six-month low on Wednesday, but traders remained concerned about sluggish demand in the United States and China.

Chinese customs data showed that crude oil imports in November fell 9% from a year earlier. Oil’s recent selloff may boost the odds of an emergency OPEC+ meeting within the next few weeks, Citi said. Russia’s oil product exports rebounded from the lowest in

three months to 2.2 million barrels a day in November, Vortexa data showed. Plunging oil markets drove the price of Russia’s flagship Urals crude below a $60-a-barrel Group of Seven-imposed cap for the time since July. WTI and Brent +1%, US Nat Gas -2.1%,

RBOB +0.6%.

CURRENCIES:

In currency markets, the yen surged as Tokyo’s monetary policymakers gave their clearest hints yet that the exit from ultra-low interest rates was approaching. Traders

rapidly increased bets that the Bank of Japan will scrap the world’s last negative interest-rate regime as soon as this month. Elsewhere, the Swiss franc hit its highest level against the euro since 2015. The move reflects a shift in interest-rate expectations

as confidence grows that the European Central Bank will move to cut rates sooner than its Swiss counterpart. US$ Index -0.2%, GBPUSD is flat, USDJPY -1.5%, EURUSD +0.05%, AUDUSD +0.3%, USDNOK -0.6%.

Bitcoin -1%, Ethereum +0.2%.

TECHNICAL LEVELS:

|

ESZ23 |

10 Year Yield |

Feb Gold |

Jan WTI |

Spot $ Index |

|

|

Resistance |

4652.00 |

5.500% |

2180.0 |

81.00 |

107.350 |

|

|

4634.00 |

5.325% |

2150.0 |

79.00 |

106.300 |

|

|

4608.00 |

5.000% |

2135.0 |

78.02 |

105.500 |

|

|

4587.00 |

4.725% |

2100.5 |

76.75 |

104.350 |

|

|

4571.00 |

4.615% |

2075.0 |

72.15 |

103.580 |

|

Settlement |

4556.00 |

2047.9 |

69.38 |

||

|

|

4545.00 |

4.185% |

2026.7 |

69.11 |

102.540* |

|

|

4502.00 |

3.930% |

1991.5 |

66.80 |

101.240 |

|

|

4480.00 |

3.640% |

1958.7 |

63.64 |

100.000 |

|

|

4439.00 |

3.245% |

1949.0 |

62.00 |

99.580 |

|

Support |

4410.00 |

3.000% |

1927.5 |

60.00 |

99.000 |

Colors within the report:

Green is always the 200 period (day, week).

Red is always 21,

Blue = 50,

Brown =

100 *Stars have added importance

- Upgrades

- Athabasca Oil (ATH CN) Raised to Buy at TD; PT C$4.50

- Raised to Buy at Desjardins; PT C$4.75

- Raised to Outperform at RBC; PT C$5

- Biogen (BIIB) Raised to Outperform at Raymond James; PT $283

- Bioventus (BVS) Raised to Buy at Canaccord; PT $7

- Datadog (DDOG) Raised to Buy at Stifel; PT $140

- JB Hunt (JBHT) Raised to Neutral at UBS; PT $205

- Qiagen (QIA GR) Raised to Buy at Goldman

- Schneider National (SNDR) Raised to Equal-Weight at Wells Fargo; PT $25

- SentinelOne (S) Raised to Buy at WestPark Capital; PT $31

- Sphere Entertainment (SPHR) Raised to Buy at Seaport Global Securities

- Vistagen Therapeutics Inc (VTGN) Raised to Buy at Jefferies; PT $15

- Downgrades

- 5e Advanced Materials (FEAM) Cut to Neutral at B Riley; PT $2.50

- Cerevel Therapeutics (CERE) Cut to Neutral at Cantor; PT $45

- Cut to Neutral at Piper Sandler; PT $45

- Danaher (DHR) Cut to Neutral at Goldman

- FMC Corp (FMC) Cut to Neutral at Mizuho Securities; PT $59

- Gildan Activewear (GIL CN) Cut to Hold at Edward Jones

- Masco (MAS) Cut to Hold at CFRA; PT $63

- Sprinklr (CXM) Cut to Neutral at BTIG

- Take-Two (TTWO) Cut to Neutral at BofA; PT $170

- Tim Brasil (TIMS3 BZ) ADRs Cut to Sector Perform at Scotiabank; PT $18

- Initiations

- Airbus (AIR FP) ADRs Rated New Sell at Berenberg; PT $27

- Bumble (BMBL) Rated New Overweight at Wells Fargo; PT $19

- Coca-Cola Femsa (KOFUBL MM) ADRs Rated New Neutral at Citi; PT $90

- Elanco Animal Health (ELAN) Rated New Outperform at BNPP Exane; PT $18

- Femsa (FEMSAUBD MM) ADRs Reinstated Neutral at Citi; PT $134

- First Industrial Realty (FR) Rated New Equal-Weight at Wells Fargo

- Idexx Labs (IDXX) Rated New Outperform at BNPP Exane; PT $602

- Intercorp Finl (IFS) Reinstated Hold at Credicorp Capital; PT $30

- LCI Industries (LCII) Rated New Market Perform at BMO; PT $105

- Lucid (LCID) Rated New Hold at Stifel; PT $5

- Match Group (MTCH) Rated New Equal-Weight at Wells Fargo; PT $32

- New Oriental Education (EDU) ADRs Rated New Buy at Huatai Research

- Olin (OLN) Rated New Hold at Deutsche Bank; PT $52

- Patrick Industries (PATK) Rated New Outperform at BMO; PT $105

- Phibro Animal (PAHC) Rated New Underperform at BNPP Exane; PT $9

- Pure Storage (PSTG) Rated New Buy at Guggenheim; PT $48

- Rivian (RIVN) Rated New Buy at Stifel; PT $23

- Terreno Realty (TRNO) Rated New Overweight at Wells Fargo; PT $71

- Vaxcyte (PCVX) Rated New Buy at Mizuho Securities; PT $69

- Zoetis (ZTS) Rated New Outperform at BNPP Exane; PT $237

Data sources: Bloomberg, Reuters, CQG

No responses yet