Markets Try to Bounce as VIX Fades

Middle East conflict is front and center

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Every week, MrTopStep invites traders to an “Own the Close” contest where the closest guesstimate where the SPX will settle on Friday’s 4:00 cash close.

The winners get a free week’s access to the MrTopStep Chat and trading tools. Enter your guess now!

Our View

The ES and NQ performed well after dropping to a low of 5221.75 just after the open. Every dip was bought, whether it was a 20-point drop or a 70-point drop — at least until late in the day.

At that point, the market was hit hard by $7 billion in sell imbalances on the 3:50 imbalance. The buying pressure was heavy, and a total of $13.5 billion in selling occurred within 24 hours. I believe this selling is part of a risk-off trade related to the Iranian plan to attack Israel.

From the reports, it sounds like Iran and its proxies are planning to strike Israel, and Israel will likely respond in kind. If the conflict lasts only a few days, the markets might bounce back. However, if the fighting extends over days and weeks, the markets could decline sharply.

I’ve always said that the first significant war the US will become involved in will be in the Middle East. The situation is complicated: the US economic situation is unstable, Putin has been making progress in Ukraine, and there is news about a Pakistani national with ties to Iran being charged with a plot to potentially target Trump. The situation is highly volatile.

Our Lean

I started putting in the number of points and volume on some of the big rips and dips and it’s quite incredible. Yes, the VIX fell and it could fall further, but no matter how far the ES and NQ rally, the dark clouds hanging over the Middle East are not going anywhere. Does the conflict start tonight? Tomorrow? In a week? I’m not sure but it’s coming soon.

The ES sold off 106 points in the final two hours yesterday and went out at a 20 point discount to the S&P cash. Most of the time when this happens, the futures rally. After Monday’s $6.5 billion 3:50 cash imbalance sale, the sellers showed up in force again, selling $7 billion on yesterday’s close for a total of $13.5 billion sold over two days.

Someone said that’s too much, but I said that’s what they sold on the 3:50 imbalances and does not include what they sold throughout the last two sessions. This is all about the big pops and drops. While I still think higher prices and buying the big drops, I also know there is an overload of risk with crude oil and gold in play.

Ed Seykota from the Market Wizards book said that you are supposed to trade up to the event, not the event. Well guess what… that’s not how this goes anymore. You are either on board or you are out!

Our Lean: If the ES gaps sharply higher today, I am selling the open or the first rally above the gap. Then I’ll be looking to buy the initial drop and look for a place to be a buyer which should be done gingerly. If the ES gaps sharply lower, I am a hesitant buyer with tight stops. I think there could be another good short, but that could be at 5400. Bottom line, lots of risk out there.

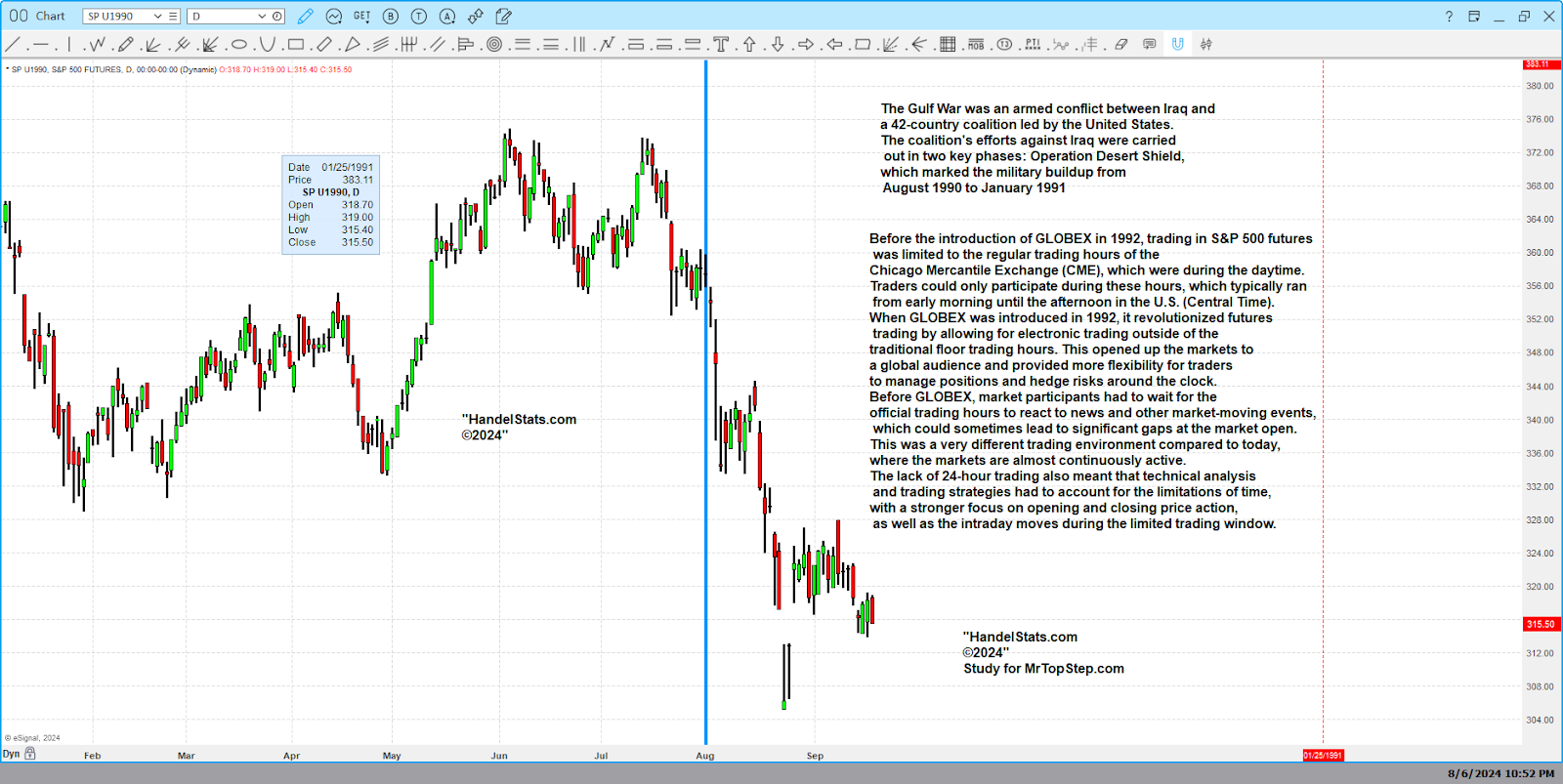

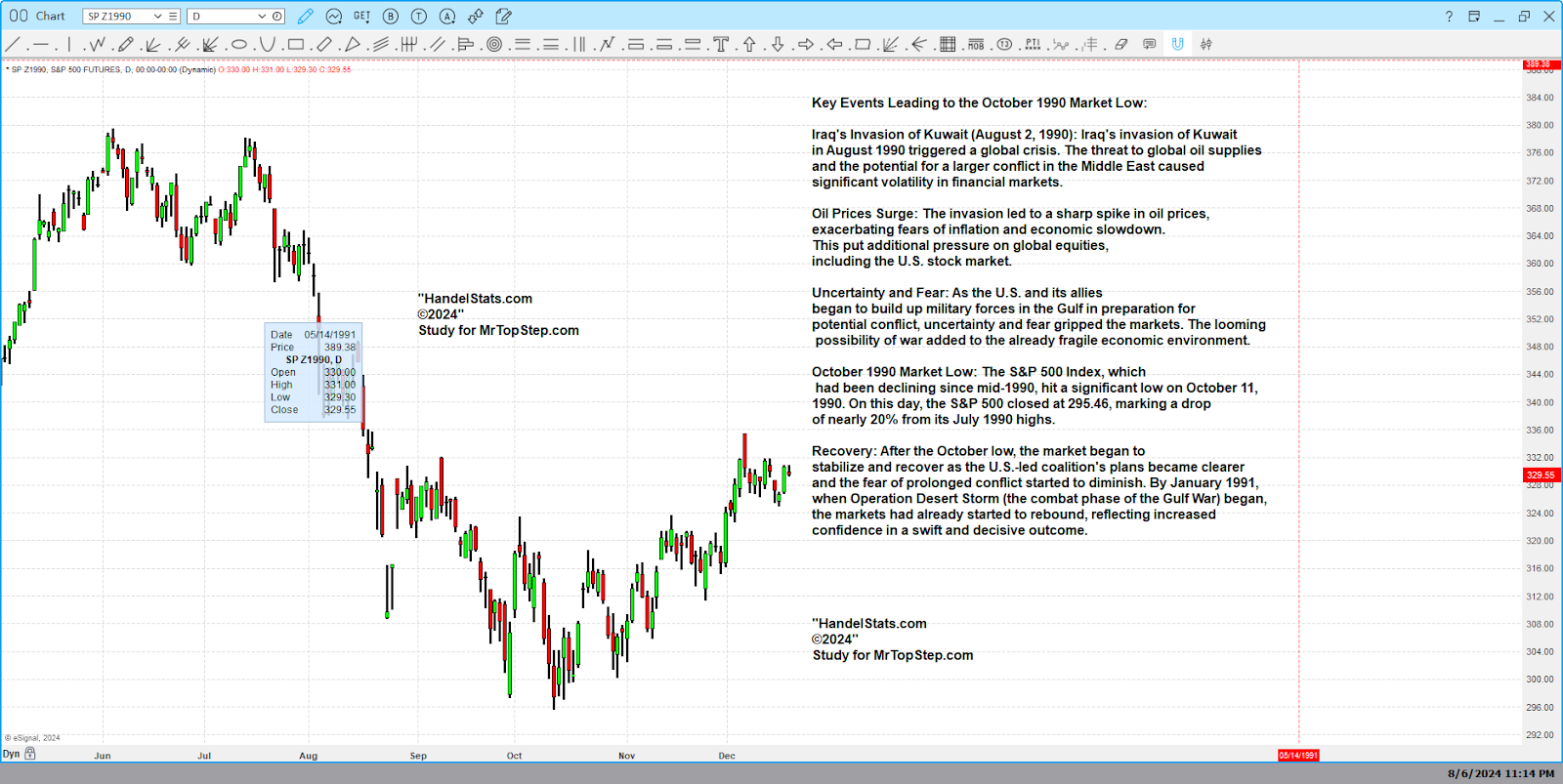

I asked Rich from HandelStats to make a comparison study of Gulf War 1 to the current Iranian/Israeli conflict and this is what he sent me.

I want to remind everyone this war may not be a swift and decisive victory. While I still think the market will rally, we are only five sessions into August, then in comes September and October — with the latter being the bear killer. Does that mean I think the markets are going down all the way into October? No, but that depends on when the conflict is over.

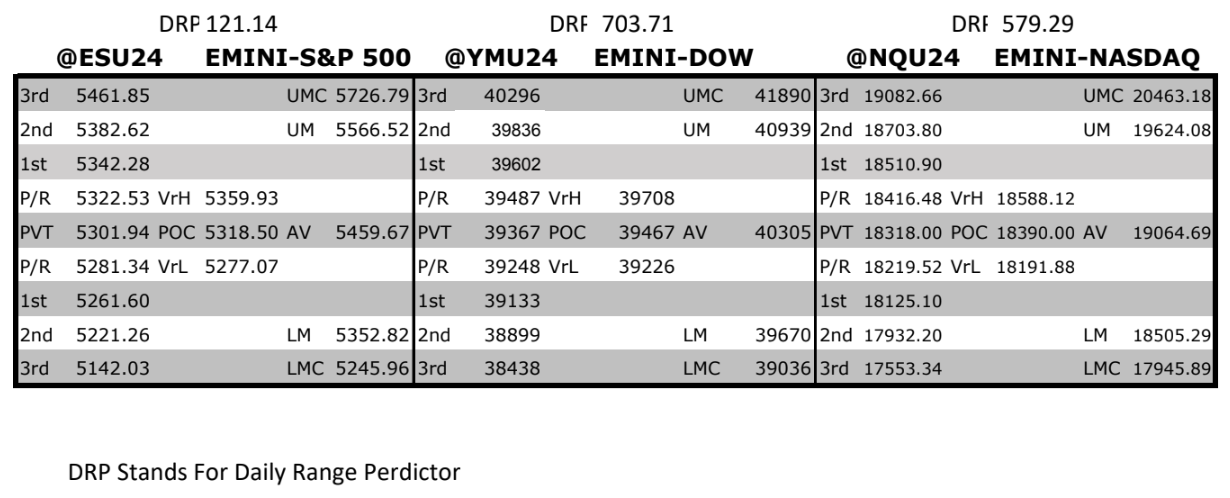

MrTopStep Levels:

MiM and Daily Recap

ES Recap

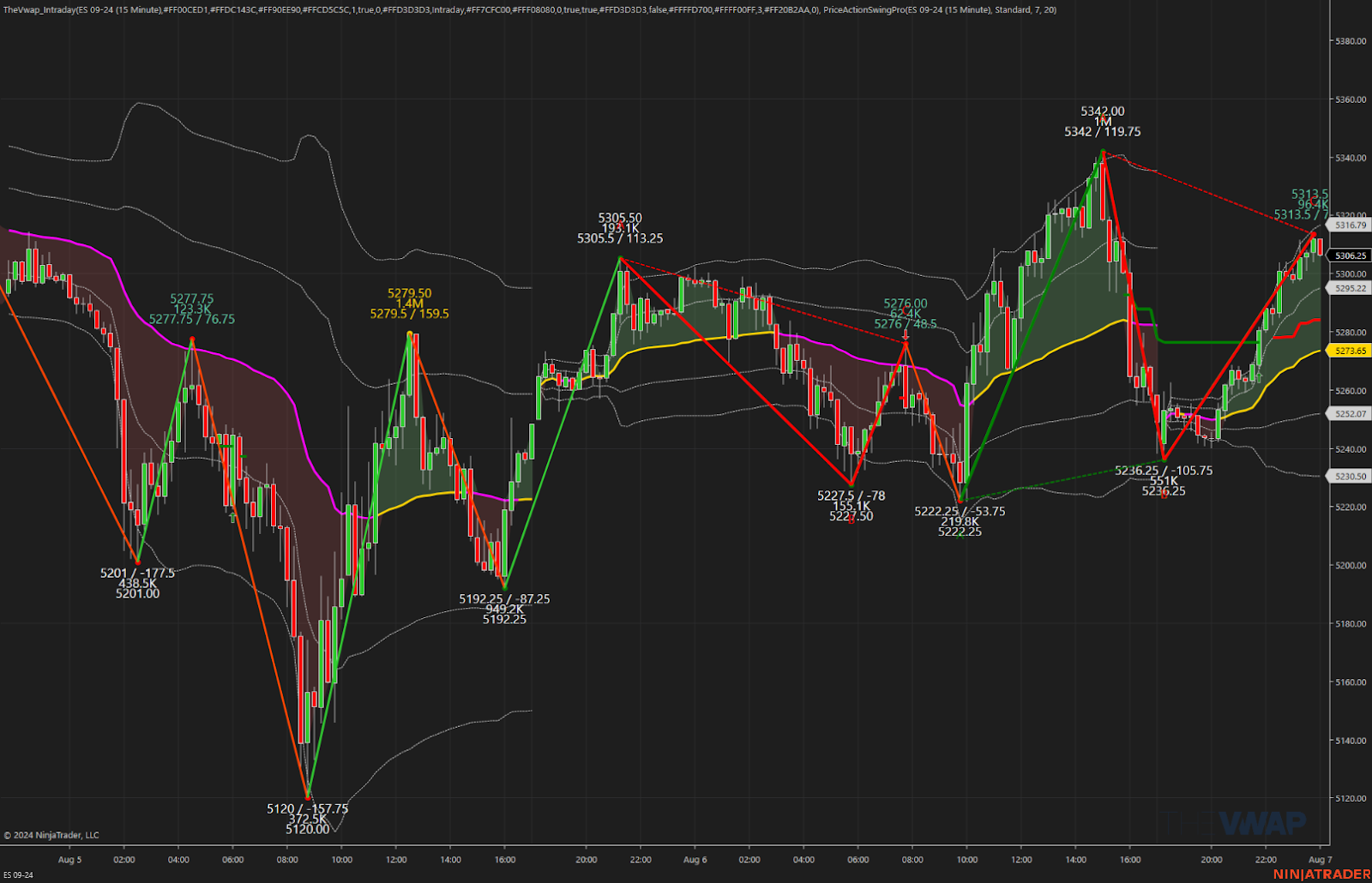

The ES traded up to 5305.50 and then sold off to 5227.50 on Globex before opening Tuesday’s session at 5235.00. After the open, the ES dropped to 5230.00, rallied to 5248.75, and then fell to the low of the day at 5221.75 at 9:50. It then rallied 87.25 points to 5319.00 at 10:50, with 339k ES traded. After this high, the ES sold off 42 points to 5267.00 at 11:30, rallied to 5313.50 at 12:20, pulled back to 5298.50, and then rallied to 5328.25. It pulled back again to 5312.50 and then rose to 5342.00, a 120.25-point rally at 2:50.

After the high, the ES sold off to 5239.50, with 137k ES traded from the high to the low. It then rallied back to 5320.25 at 3:30, pulled back to 5305.50 at 3:33, rallied to 5314.00, and then sold off to 5288.25 at 3:48. As the 3:50 imbalance showed $7 billion to sell, the ES dropped to 5259.50 and traded at 5254.75 at the 4:00 cash close. After 4:00, the ES rallied to 5279.75, sold off to 5238.25, and settled at 5249.00, up 31.50 points or +0.60%. The NQ settled at 18,099.00, up +0.48%, and the bonds (ZB) fell hard, down over 2 full points at one point, but settled at 123’20, down 1.25 points or -1.42% on the day.

In the end, the ES had an Iranian hangover. In terms of the ES’s overall tone, it was firm until the last hour when it dropped 104 points. In terms of the ES’s overall trade, volume was 1.2 million lower than Monday’s volume at 2.078 million contracts traded. The ES is now up 9.9% in 2024, after paring its advance from 19% at its July record high. The VIX dropped 28%, its biggest decline since 2010 and second-biggest one-day drop ever.

Technical Edge

-

NYSE Breadth: 76% Upside Volume

-

Nasdaq Breadth: 64% Upside Volume

-

Advance/Decline: 75% Advance

-

VIX: ~23

-

Now down slightly from Friday’s close

-

Guest Post — Polaris Trading

Topic: PTG Daily Trade Strategy

Author: David D Dube’ (a.k.a. PTGDavid)

Prior Session was Cycle Day 2: MATD rhythms quickly turned positive as a “classic” short-squeeze / dead-cat bounce drove price higher to fulfill our 5330 target as outlined in DTS Briefing 8/6/24. Late day “drill-down” reversed the session long squeeze and left shortie and trapped longs whimpering. Range was 120 handles on 1.682M contracts exchanged.

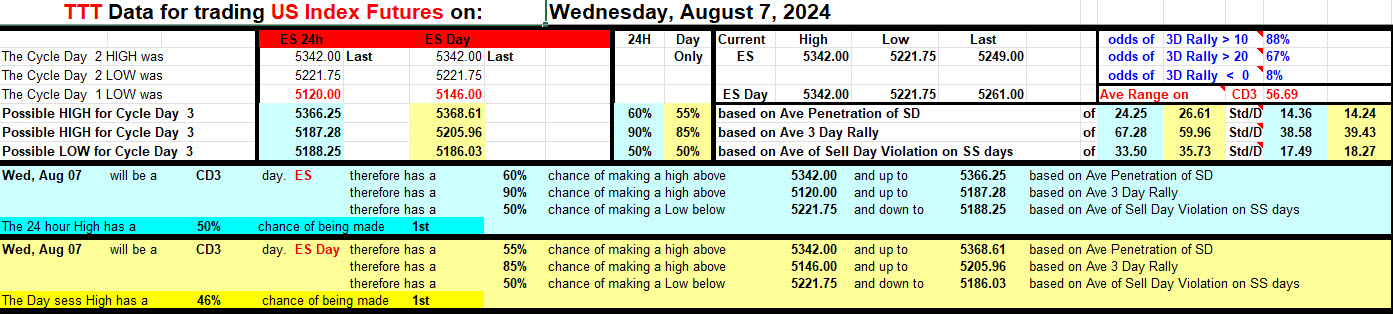

…Transition from Cycle Day 2 to Cycle Day 3

This leads us into Cycle Day 3: Price has surpassed cycle targets and is currently above CD1 Low (5120), so we’ll mark this session as a “wild-card.” If the prior session was a DCB (dead-cat bounce), expectation would be for further downside to retest CD1 Low. Momentum clearly favors sellers as it is the current “risk-off” sentiment. Any bounce at this stage should be viewed as a selling opportunity.

You Know The Plan! Our discipline of maintaining positioning that is aligned with market forces continues to serve us well, so stay the course.

As such, scenarios to consider for today’s trading.

Bull Scenario: Price sustains a bid above 5240, initially targets 5275 – 5290 zone.

Bear Scenario: Price sustains an offer below 5230, initially targets 5205 – 5195 zone.

PVA High Edge = 5312 PVA Low Edge = 5255 Prior POC = 5270

Thanks for reading,

PTGDavid

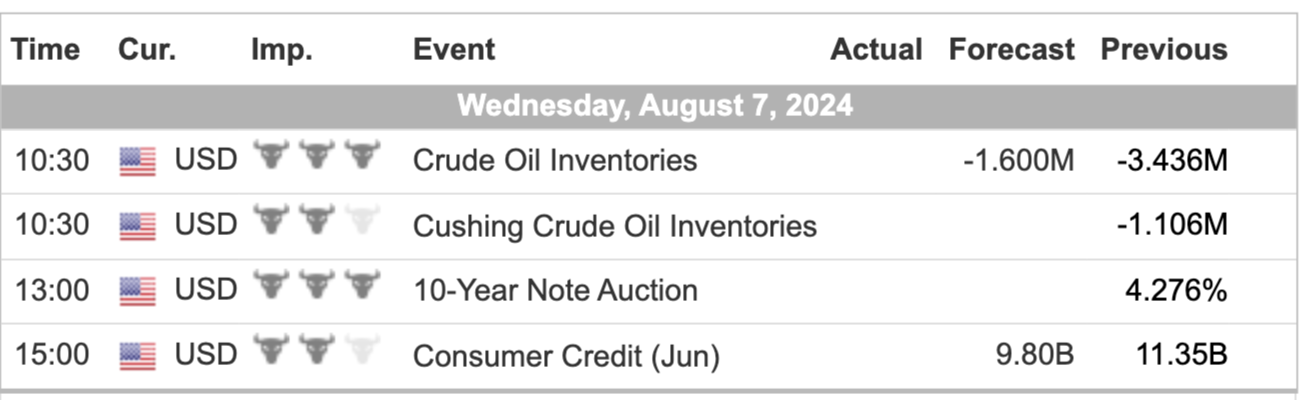

Economic Calendar

For a more complete Economic Calendar see: https://mrtopstep.com/economic-calendar/

Comments are closed