Inflation Roulette vs. Cuts

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Our View

Everything went pretty much as expected—a pullback and higher prices. My own opinion is that this is exactly like the last few CPI reports, with a two-day rally before the number. I readily admit that I do not know the mechanics of how this works, but I feel confident that the Fed has access to the data—all data.

How is this going to play out today? I’ve got to question: if the number is good, do they sell the news? With the ES up 112 points and the NQ up 538.75 points off its September 8 low, that has to be a possibility.

The graph below gives the bank estimates for today’s CPI release:

Our Lean

I have a feeling the number is going to be market-moving. If the number is good and the ES rips higher, I think it will either get sold on the open or after the next leg up. If I’m right, it’s back to buying the 30 to 50-point sell-offs. If the ES gets hit hard, I’ll do the same thing. I’ll either buy the open or the first leg down after the gap down and buy the pullbacks.

I also want to pay attention to Globex volumes—300k to 400k ES traded before the open would be a good sign that most people have already placed their bets. Lastly, I’ll be paying attention to the ES overnight inventory. If it’s 100% sold or 100% bought on Globex, it’s a very effective tool. Here’s a link to it: https://www.tradingview.com/script/KyU8kIBI-Overnight-inventory/.

I’ll finish by saying there’s a good possibility that we see big two-way moves before and after the open.

Don’t forget the 3 parts to the trading day…

MrTopStep Levels:

MiM and Daily Recap

The ES continued its march higher, trading up to 5500.00 on Globex and opening Tuesday’s regular session at 5498.25. After the open, the ES traded down to 5496.75, rallied up to the high of the day at 5501.25 at 9:33, then sold off 8.75 points to 5492.50. It rallied again, reaching a lower high of 5500.50, sold off 9.25 points down to 5491.25 at 9:51, then rallied up to a 5500.50 double top. After that, it dropped 17 points down to 5483.50 and rallied up to another lower high of 5496.00 at 10:10.

After the low, the ES rallied up to 5487.50, sold off down to 5471.25, and then rallied back up to 5492.00 by 11:20 a.m. After the rally, the ES dropped 43.75 points down to 5448.25 at 12:04, then rallied 24.75 points to 5473.00, pulled back to 5464.75, and rallied 20 points to 5484.75. It sold off to 5477.00, rallied 9.25 points to 5486.25, pulled back to 5481.75, rallied up to 5486.50, dropped to 5482.75, and rallied again up to 5492.25 at 2:14 p.m.

After a small pullback down to 5488.25 at 2:16, the ES rallied 52.25 points up to 5503.00 at 3:33. After the high, the ES sold off down to 5495.75 and traded 5500.25 as the 3:50 cash imbalance showed $881 million to sell. It pulled back to 5497.00, traded up to 5506.00, and settled at 5502.25 on the 4:00 p.m. cash close. After 4:00, the ES pulled back to 5499.50, up 20 points or 0.36%.

The NQ settled at 18,864.00, up 142.75 points or +0.76%. The big story of the day was, in another sign of a global slowdown, crude oil fell 4.3% to its lowest price since December 2021. WTI futures closed at $65.75 a barrel.

In the end, it was another dip and rip. In terms of the ES’s overall tone, I thought it acted well, considering it was up 100 points on Monday. However, the ES wasn’t as firm as the NQ. In terms of the ES’s overall trade, volume was decent, with 1.48 million contracts traded.

Join us on the MiM and Spygate: Special Combined Rate

Technical Edge

-

NYSE Breadth: 40% Upside Volume

-

Nasdaq Breadth: 59% Upside Volume

-

Advance/Decline: 50% Advance

-

VIX: ~19.10

-

Fair Value: 7.96

Guest Post – PTG David @ Polaris Trading Group

Prior session was Cycle Day 3: Another outstanding three-day cycle as the statistic (90%) was satisfied and the cycle target (5486) fulfilled with today’s extended rally to the CD3 penetration level (5506). The range was 57 handles on 1.454M contracts exchanged.

This leads us into Cycle Day 1: The average decline for CD1 measures 5426. Price continues to be in “relief rally” mode from last week’s sell-off.

Today’s BIG event is the CPI release, which is key to the Fed’s decision on a rate cut for September. The expectation is for a high degree of volatility that could go either way, so we will play it “close to the vest” and let Mr. Market provide proper directional guidance.

…Transition from Cycle Day 3 to Cycle Day 1…

Our discipline of maintaining positions aligned with market forces continues to serve us well, so stay the course.

As such, scenarios to consider for today’s trading:

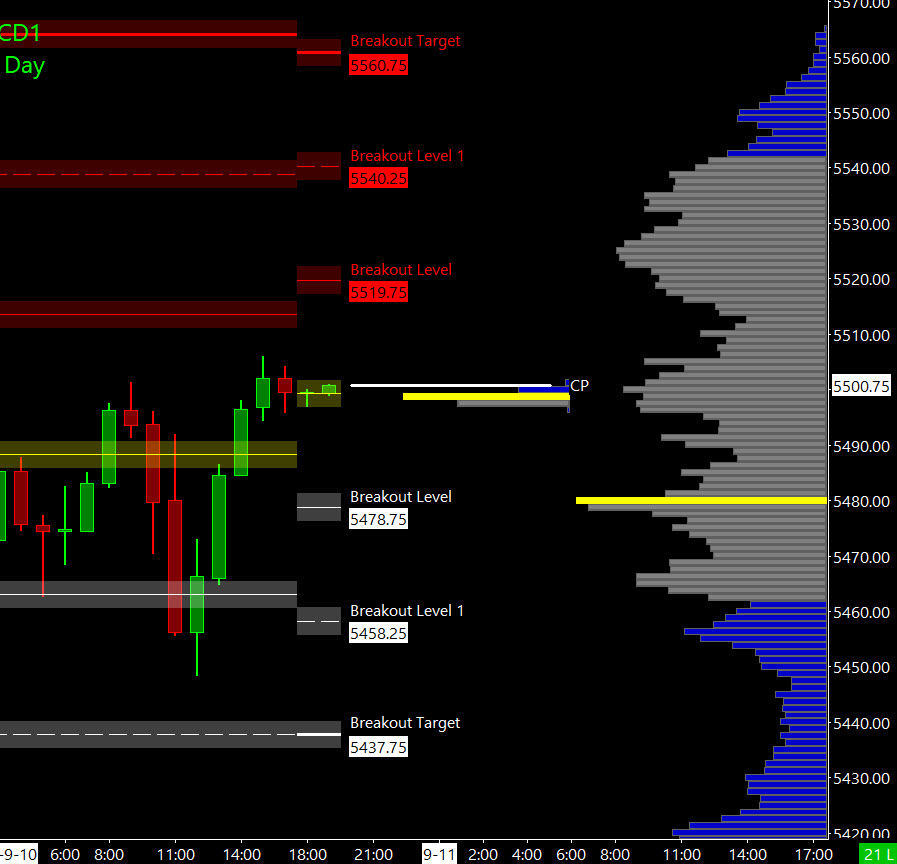

Bull Scenario: Price sustains a bid above 5505, initially targeting the 5520–5530 zone.

Bear Scenario: Price sustains an offer below 5505, initially targeting the 5480–5465 zone.

PVA High Edge = 5504

PVA Low Edge = 5478

Prior POC = 5496

Pricing note: All pricing appears consistent with market references, but verify the PVA high/low and the prior POC for any updates before trading.

ES Chart (Target Master)

Thanks for reading,

PTGDavid

Join the PTG Trading Community: https://mrtopstep.com/polaris-trading-group/

In The Rooms

PTG Trading Room Summary for Tuesday:

On Tuesday, September 10, 2024, PTGDavid guided traders through a strong bullish market, emphasizing that bulls were in control early, with price action fulfilling a 3-day cycle target and pushing into the 5500–5510 zone. PTGDavid advised patience, waiting for a directional breakout as price chopped between 5490 and 5500. A break lower eventually unfolded, providing a shorting opportunity aligned with Scenario #3, where traders could take advantage of VWAP levels for covers.

Throughout the midday session, PTGDavid highlighted the importance of holding above VWAP for bulls to maintain control, while bears attempted to press below prior highs. The market showed resilience, trapping bears with a dip-and-reclaim move around 5460, leading to a surge back to the highs. By the end of the session, the bulls remained dominant, with PTGDavid noting that the bulls “owned the close” as prices continued to rise, clearing highs and leading into the evening debate with strong upward momentum.

Notable successful trades included shorts from the Scenario #3 breakdown and long positions from VWAP levels during the afternoon rally. The bulls controlled most of the day, with consistent opportunities for traders following the bullish bias.

Join the PTG Trading Community: https://mrtopstep.com/polaris-trading-group/

Economic Calendar

For a more complete Economic Calendar see: https://mrtopstep.com/economic-calendar/

Comments are closed