TODAY’S GAME PLAN: from the trading

desk, this is not research

DATA/HEADLINES 2:00ET FOMC Rate Decision; 2:30ET Fed Chair Powell’s press conference* ; 5:30ET Brazil Rate Decision

TODAY’S HIGHLIGHTS:

- Hunter Biden will plead not guilty to federal gun charges

- China urges deeper trade ties with Russia despite disapproval from the West

- Brazilian Navy said it seized a record 3.6 metric tons of cocaine on a boat

- India advises citizens to avoid traveling to Canada because of “growing anti-India activities

Global equity markets edged higher as the Federal Reserve kicks off a series of monetary policy announcements by major central banks over the next three days. Data

from the UK showed a surprise drop in inflation in August, sparking expectations that the Bank of England could pause its historic run of interest rate hikes as soon as tomorrow. Britain’s Consumer Prices Index rose 6.7% from a year earlier in August, the

slowest pace in 18 months, and less than the 7% expected by economists. The probability of a quarter-point rate increase by the BOE at its meeting on Thursday — almost guaranteed earlier this week — fell to 50%, according to swap pricing. Later today, the

Fed is expected to pause its interest-rate hikes for the second time this year following a slowing in inflation while leaving the door open for another increase. Brazil’s central bank is expected to cut its benchmark rate another 50 bps to 12.75% this evening.

EQUITIES:

US equity futures edged higher as investors looked ahead to highly anticipated comments from the Federal Reserve. Aside from expectations of a hawkish hold, investors will focus on the

Fed’s updated quarterly rate projections to see if the committee seems determined to hike again. Treasury Secretary Janet Yellen said on Tuesday that US growth needed to slow to bring inflation back to target levels since the economy was operating at full

employment. Pimco warned markets may be underestimating the risks of both one more Fed hike and a US recession. Meanwhile, Bank of America analysts raised their forecast for the S&P 500 as indicators on the macro cycle, valuations and positioning are flashing

bullish signals.

Futures ahead of the bell: E-Mini S&P +0.2%, Nasdaq +0.2%, Russell 2000 +0.4%, Dow +0.25%.

In premarket trading, grocery delivery company Instacart (CART) slipped over 4%, a day after surging following one of the year’s biggest US initial public offerings. ARS Pharmaceuticals

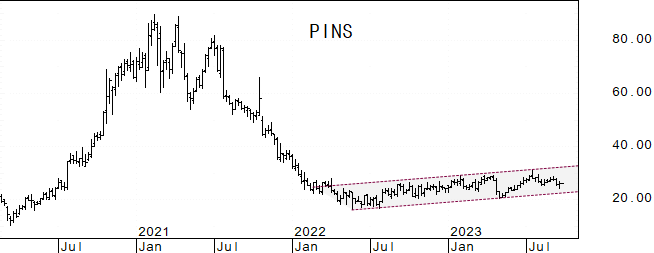

(SPRY) shares drop as much as 66% after the biotech said that the FDA has issued a letter requesting additional study for neffy — an epinephrine nasal spray to treat allergic reactions. Pinterest (PINS) gains over 3% as analysts were impressed by Tuesday’s

investor day. Coty (COTY) rose over 6% after boosting its like-for-like sales growth and adjusted Ebitda guidance for the full year, citing strong beauty demand. Dollar General (DG) falls 1.8% after JPMorgan cut its recommendation on the discount retailer

to underweight from neutral. Exscientia (EXAI) jumps 28% after the company said it entered into an AI-driven drug discovery collaboration with Merck KGaA. NCino Inc. (NCNO) shares are down 5.1% after Morgan Stanley downgraded the cloud-banking software company

to underweight.

European gauges are higher as traders bet that the Bank of England is nearing the end of its hiking cycle. UK’s FTSE 250 index jumped 1.5% after the inflation data, with homebuilders

sensitive to changes in interest rates leading the gains. Europe’s Stoxx 600 benchmark also benefited from the improved sentiment, climbing for the first time in three days as Real Estate sector outperforms. The auto sector was also near the top of the leaderboard

as European auto sales climbed for a 13th month. Stoxx 600 +0.7%, DAX +0.6%, CAC +0.5%, FTSE 100 +0.7%. REITS +2%, Banks +1.9%, Retail +1.5%, Autos +1.3%, Energy -0.8%.

Asian stocks fell for a third day as caution prevailed ahead of the Federal Reserve’s policy decision. The MSCI Asia Pacific Index dropped 0.8%, led by health-care and energy shares.

Chinese equities dipped after the nation’s lenders kept their benchmark lending rates unchanged, as officials assess the economic impact of existing stimulus. The PBOC said it has sufficient policy space to support the Chinese economy, adding to expectations

there may be more easing to come, including rate cuts. Shares in India fell on rising concerns about diplomatic tensions between the two nations over the murder of a Sikh leader. Sensex -1.2%, Topix -1%, Hang Seng Index -0.6%, Taiwan -0.6%, ASX 200 -0.5%,

CSI 300 -0.4%. Vietnam +1.2%, Kospi was flat.

FIXED INCOME:

US Treasury yields dipped after yields on five and 10 year notes hit the highest levels since 2007 yesterday. US yields lower by as much as 3bp in belly of the curve

with 5s30s and 2s10s steeper by 1.5bps. 10 year yield ~ 4.35%, 2 year yield at 5.07%. UK bonds outperform in an aggressive bull-steepening move after an unexpected drop in UK inflation opened the door for Bank of England to pause rate hikes in Thursday’s decision.

BOE rate hike probability has fallen to 42% from 79% yesterday.

METALS:

Gold held steady ahead of the Fed decision amid expectations that US interest rates will stay higher for longer. While Chair Jerome Powell and his colleagues are

expected to hold borrowing costs steady later Wednesday in a bid to curb inflation, traders are focusing on the steer provided by officials on the future rate direction. Swaps markets see policy remaining tight for the rest of the year, with a 40% chance of

another hike in 2023. Spot gold +0.1%, silver +0.5%.

ENERGY:

Oil prices fell as investors await the Fed’s interest rate decision to assess the outlook for economic growth and fuel demand. Prices fell despite US crude oil stockpiles

falling last week by about 5.25 million barrels, according to API. That would bring holdings to the lowest in more than nine months if confirmed by the EIA today. Goldman Sachs analysts raised their forecast for brent crude back to $100 as worldwide demand

hits unprecedented levels and OPEC+ supply curbs continue to tighten the market. Goldman said it assumed that Saudi Arabia would gradually unwind its voluntary output cut of 1 million bpd starting in the second quarter of 2024. WTI -0.8%, Brent -0.7%, US Nat

Gas -1.8%, RBOB -0.7%.

CURRENCIES:

The dollar is mixed versus G-10 peers ahead of FOMC. Sterling weakened to its lowest level since May after British inflation slowed unexpectedly, as traders bet that

the Bank of England is nearing the end of its hiking cycle, with only one more rate increase now fully priced. The yen steadied after rebounding from its near 10-month low after US Treasury Secretary Janet Yellen said any intervention by Japan to support its

currency would be understandable if it were aimed to smooth out volatility. Japan’s top currency official said he’s keeping in close contact with his counterparts in the US, and both sides agree that excessive currency moves are unwelcome. China kept benchmark

lending rates unchanged, in line with expectations, as fresh signs of economic stabilization and a weakening yuan reduced the need for immediate monetary easing. US$ Index -0.1%, GBPUSD -0.25%, USDJPY is flat, EURUSD +0.2%, AUDUSD +0.5%, USDNOK -0.5%, USDCAD

-0.15%

Bitcoin -0.3%, Ethereum -0.8%.

TECHNICAL LEVELS:

|

ESZ23 |

10 Year Yield |

Dec Gold |

Nov WTI |

Spot $ Index |

|

|

Resistance |

4597.50 |

5.325% |

2040.0 |

98.00 |

108.500 |

|

|

4575.00 |

5.000% |

2029.0 |

97.07 |

107.990 |

|

|

4550.00 |

4.710% |

2004.0 |

95.00 |

107.195 |

|

|

4527.50 |

4.500% |

1996.0 |

93.74 |

105.883 |

|

|

4504.00 |

4.369% |

1981.0 |

92.00 |

105.380 |

|

Settlement |

4490.00 |

1953.7 |

90.48 |

||

|

|

4483.00 |

4.100% |

1932.3* |

87.50 |

103.100 |

|

|

4465.00 |

3.940% |

1907.0* |

83.50 |

102.370 |

|

|

4452.00 |

3.725% |

1866.0 |

82.25 |

101.700 |

|

|

4434.00 |

3.680% |

1842.0 |

80.65 |

100.710 |

|

Support |

4400.00 |

3.500% |

1821.0 |

77.50 |

100.000 |

Colors within the report:

Green is always the 200 period (day, week).

Red is always 21,

Blue = 50,

Brown =

100 *Stars have added importance

- Upgrades

- (AZUL4 BZ) Azul ADRs Raised to Buy at Goldman; PT $18.30

- (BHC CN) Bausch Health Raised to Buy at Jefferies; PT C$21.54

- (GSHD) Goosehead Insurance Raised to Outperform at BMO; PT $90

- (HPP) Hudson Pacific Raised to Outperform at BMO; PT $10

- (KIM) Kimco Realty Raised to Equal-Weight at Wells Fargo; PT $20

- (LPX) Louisiana-Pacific Raised to Buy at TD; PT $78

- (PINS) Pinterest Raised to Buy at DA Davidson; PT $35

- (PINS) Raised to Buy at Citi; PT $36

- (SBRA) Sabra Health Raised to Buy at Jefferies; PT $15

- (SITC) SITE Centers Raised to Overweight at Wells Fargo; PT $15

- (WDC) Western Digital Raised to Outperform at BNPP Exane; PT $58

- (WING) Wingstop Raised to Outperform at Wedbush; PT $200

- Downgrades

- (CHWY) Chewy Cut to Market Perform at Oppenheimer

- (DAVA) Endava ADRs Cut to Hold at CFRA(Earlier)

- (DG) Dollar General Cut to Underweight at JPMorgan; PT $116

- (MTA CN) Metalla Royalty & Streaming Cut to Sell at Cantor; PT C$3.75

- (NCNO) nCino Cut to Underweight at Morgan Stanley; PT $24

- (NOVR CN) Nova Royalty Cut to Hold at Cantor; PT C$1.75

- (PECO) Phillips Edison Cut to Underweight at Wells Fargo; PT $35

- (ROIC) Retail Opportunity Cut to Equal-Weight at Wells Fargo; PT $15

- (SPRY) ARS Pharmaceuticals Inc Cut to Market Perform at William Blair

- (SWKS) Skyworks Cut to Neutral at BNPP Exane; PT $110

- (ZBRA) Zebra Tech Cut to Underweight at Morgan Stanley; PT $220

- Initiations

- (ATSG) Air Transport Rated New Outperform at Oppenheimer; PT $27

- (BBW) Build-A-Bear Rated New Buy at DA Davidson; PT $42

- (BRKL) Brookline Bancorp Rated New Outperform at Hovde Group; PT $10.75

- (CART) Maplebear Rated New Hold at Needham

- (CSGP) CoStar Reinstated Market Outperform at JMP; PT $100

- (CTRE) CareTrust REIT Rated New Buy at Jefferies; PT $23

- (FCNCA) First Citizens Rated New Overweight at JPMorgan; PT $1,850

- (IBM) IBM Reinstated Outperform at RBC; PT $188

- (LTC) LTC Properties Rated New Hold at Jefferies; PT $29

- (LULU) Lululemon Reinstated Buy at Needham; PT $470

- (MIRM) Mirum Pharma Rated New Market Outperform at JMP; PT $70

- (NHI) National Health Investors Rated New Hold at Jefferies; PT $52

- (NYCB) New York Community Bancorp Rated New Neutral at Autonomous

- (ONON) On Holding Rated New Buy at Needham; PT $40

- (RVPH) Reviva Pharmaceuticals Rated New Buy at Roth MKM; PT $12

- (SKIN) Beauty Health Rated New Outperform at Imperial; PT $14

- (SONO) Sonos Rated New Buy at Rosenblatt Securities Inc; PT $20

- (SOVO) Sovos Reinstated Outperform at Cowen; PT $22

Data sources: Bloomberg, Reuters, CQG

No responses yet