TODAY’S GAME PLAN: from

the trading desk, this is not research

DATA/HEADLINES ET : 8:30 a.m: US Sept.

Jobs Report, 12:00 p.m: Fed’s Waller speaks, 1:00 p.m: Baker Hughes US Rig Count, 3:00 p.m: US Aug. Consumer Credit

TODAY’S HIGHLIGHTS:

- Dick Butkus, a legendary Bears Hall of Fame middle linebacker, has passed away. This was announced 90 minutes

before the Bears 40-20 victory on Thursday. - Powerball at its 33rd straight drawing, now at $1.4 billion

Global equities were mostly higher, with US futures on the rise and European stocks

showing gains after a strong Asian session. Citi strategists have identified an appealing entry point for global equities following the recent selloff, with mid-2024 projections suggesting a 15% upside for the MSCI All Country World index. Currently, the focus

of the markets is on the forthcoming US payrolls report, which will provide insights into the labor market’s health after weaker private data earlier this week. While economists anticipate a slowdown in job growth to 170k in September, market participants

are keeping an eye on the possibility of a 190k gain, as reported by Bloomberg’s data. Yields have seen a slight increase across the curve, while both the dollar and oil have remained stable.

EQUITIES:

US equity futures edged higher as investors prepared for a US payrolls report forecast

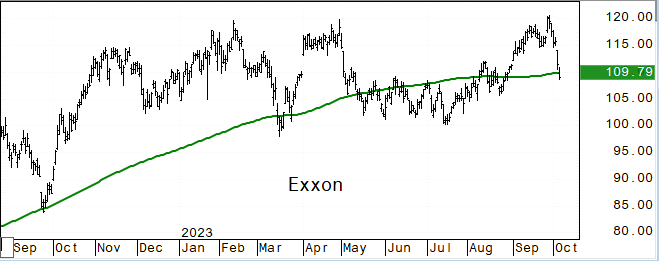

likely to show employers slowed hiring last month, potentially easing pressure on the Federal Reserve to raise interest rates again. The Labor Department’s closely watched employment report is also expected to show wage gains remaining elevated. Tesla fell

as much as 1.6% as the electric-vehicle maker cut prices on its most popular cars in the US. Exxon Mobil Corp. was poised for a 1.6% drop after a report that the oil giant is in talks to buy Pioneer Natural Resources Co. for as much as $60 billion. AMC Entertainment

rose 2.8% after it said it sold more than $100 million in advance tickets for the Taylor Swift/The Eras Tour Concert movie. Aehr Test Systems (AEHR US) fell as much as 14% after the supplier of semiconductor test and production burn-in equipment reported its

first-quarter results.

Futures ahead of the bell: E-Mini S&P +0.2%, Nasdaq +0.1%, Russell 2000 +0.3%, Dow

+0.2%.

European stocks rose, trimming their third straight weekly decline, as investors await the monthly US payrolls report. The Stoxx Europe 600 Index was 0.7% higher

with insurance and banking stocks outperforming. Food and beverage was the worst performing sector after US peers dropped on Thursday, with Nestle SA shares dropping to their lowest level since March 2021. Miners gained over 1% after news that a Chinese iron-ore

buying agency was in talks with global suppliers. Royal Philips NV plunged as much as 10% after agreeing to further testing on certain sleep and respiratory care devices. European gas jumped as union members at Chevron LNG facilities in Australia voted to

resume industrial action after criticizing the company’s efforts to finalize a deal on pay and conditions. Shell said it expects to see earnings from its natural gas business rebound in the third quarter following a disappointing set of results in the second

quarter. Stoxx 600 +0.6%, DAX +0.7%, CAC +0.6%, FTSE 100 +0.4%.

Asian stocks gained, led by a rally in Hong Kong shares, while other markets were more muted, with all eyes on the US payroll data for cues on the Federal Reserve’s

policy path. The MSCI Asia Pacific Index rose as much as 0.7%, paring its slide for the week to 1.6%. Chinese tech giants Tencent, Alibaba, and Meituan were among the biggest contributors to the gauge’s advance. Hong Kong stocks were the biggest gainers in

the region, with analysts citing positive Golden Week holiday spending data and positioning ahead of the reopening of mainland markets as drivers. Japan equities were little changed, while benchmarks in India, Australia, and South Korea edged higher. Japan’s

labor cash earnings grew 1.1% year on year in August, missing estimates, while July’s growth was revised lower. That may reinforce the BOJ’s need to wait before normalizing policy. Meanwhile, the RBI kept rates unchanged at 6.5% for a fourth straight meeting,

as expected. Kospi +0.2%, ASX 200 +0.4%, Vietnam +1.3%, Nikkei 225 -0.2%, Sensex +0.5%, Philippines +1.3%, Taiwan +0.5%.

FIXED INCOME:

Treasuries were slightly cheaper across the curve ahead of the September jobs report, with futures trading just off Thursday session highs, as stock futures held

gains. The 10-year was around 4.74%, in the middle of Thursday’s range, with gilts lagging by 1.5bp in the sector. Beaten-down bonds will make a comeback in 2024 when higher interest rates send the economy into a recession, according to Bank of America’s Michael

Hartnett. “Bonds should be the best performing asset class in the first half of 2024,” Hartnett wrote in a note. Scheduled Fed speakers include Waller at 12 pm.

METALS:

Gold remained stable, hovering close to its lowest point since March. The precious metal is poised to record a second consecutive week of losses, primarily influenced

by the rise in US bond yields, with the Federal Reserve emphasizing its commitment to maintaining a tight monetary policy for an extended period. Meanwhile, copper prices saw an increase as investors analyzed recent mixed data, although growing inventories

continue to suppress prices. Gold +0.1%, Silver +0.6%.

ENERGY:

Oil prices were stable after a brutal week that saw a relentless bond market selloff trigger global growth worries. Demand fears driven by macroeconomic

headwinds were compounded by another partial lifting of Russia’s fuel export ban on Friday. Russia announced that it had lifted its ban on diesel exports for supplies delivered to ports by pipeline, under the proviso that companies sell at least 50% of their

diesel production to the domestic market. The ban on all gasoline exports remains in place. Brent and WTI futures are on course for approximately 12% and 9% week-on-week declines, respectively, driven principally by concerns that higher-for-longer interest

rates will slow global growth and hammer fuel demand. WTI +0.2%, Brent +0.2%.

CURRENCIES:

The Dollar Index was little changed during the day within the generally narrow trading ranges of the G-10 currencies. USD/JPY strengthened as wage growth for Japanese

workers proved to be slower than anticipated in August, reinforcing the Bank of Japan’s cautious approach towards normalizing policy, as they await additional labor market strength signs. Sterling edged upward, with traders carefully considering the possibility

that the Bank of England may have completed its most extensive rate-hiking cycle in decades. US$ Index was flat, GBPUSD +0.1%, USDJPY -0.3%, EURUSD +0.03%, AUDUSD -0.2%, NZDUSD -0.1%, USDCAD -0.06%.

Bitcoin +0.8%, Ethereum +1%.

TECHNICAL LEVELS:

|

ESZ23 |

10 Year Yield |

Dec Gold |

Nov WTI |

Spot $ Index |

|

|

Resistance |

4399.00 |

|

1982.5 |

93.71 |

111.525 |

|

|

4371/74 |

5.500% |

1936.5 |

92.25 |

110.000 |

|

|

4342.00 |

5.325% |

1913.5 |

90.90 |

108.970 |

|

|

4319.50 |

5.000% |

1900.0 |

88.30 |

107.990 |

|

|

4304.00 |

4.810% |

1865.0 |

84.90 |

107.350 |

|

Settlement |

4290.75 |

1831.8 |

82.31 |

||

|

|

4274.00 |

4.700% |

1826.2 |

82.15 |

105.380 |

|

|

4261.50 |

4.500% |

1821.0 |

81.50 |

104.420 |

|

|

4231.00 |

4.250% |

1800.0 |

80.00 |

103.800 |

|

|

4200/01* |

4.000% |

1796.7* |

77.54 |

103.100 |

|

Support |

4165/75 |

3.800% |

1776.5 |

75.92 |

102.920 |

Colors within the report:

Green is always the 200 period (day, week).

Red is always 21,

Blue = 50,

Brown =

100 *Stars have added importance

Data sources: Bloomberg, Reuters, CQG

No responses yet