TODAY’S GAME PLAN: from the trading

desk, this is not research

DATA/HEADLINES 9:00ET Fed’s Logan speaks; 9:15ET Fed’s Barr speaks; 12:50ET Fed’s Jefferson speaks

UST cash markets closed for US federal holiday

TODAY’S HIGHLIGHTS:

- Robert F. Kennedy Jr is expected to announce today that he will run as an independent

- UAW said about 4,000 members at Volvo’s Mack Trucks will strike

- Israel Military: Report Received of Infiltration From Lebanon

- World PANS/PANDAS Awareness Day today

Global shares are on the defensive after a surprise Hamas attack on Israel raised fears of a wider conflict, pushing investors into the safety of the dollar, gold

and bonds. The death toll from the conflict topped 1,100 as fighting continued for a third day. Investors avoided traditionally risky assets such as stocks and instead bought gold, bonds and the dollar. The Israeli military said it has retaken control of

towns from Hamas but added that fighters from the Islamic extremist group continued to trickle across the border from Gaza. Israel pointed the finger at Iran, which denied it was involved but congratulated Hamas on its “victory.” The US is sending a carrier

group and weapons to the region. Xi Jinping met in Beijing with Chuck Schumer and a delegation of US senators, hours after Schumer blasted Beijing’s stance on the Israel-Hamas conflict. As central bankers flock to Marrakech for IMF-World Bank meetings, European

Central Bank’s head Christine Lagarde said the IMF has cut its forecast for global growth, though not for the US.

EQUITIES:

US equity futures moved lower on the conflict in the Middle East, while higher oil prices boosted concerns about the economy. Airlines fell on the prospect for higher fuel costs, and

defense shares rallied. Meanwhile, House Republicans predicted they will have a new speaker in place by mid-week. Without a speaker, the House cannot conduct legislative business even with bipartisan support for Israel. Later this week, Fed minutes and key

inflation data might shed more light on the monetary-policy outlook, while the market will also digest earnings from some of the top banks.

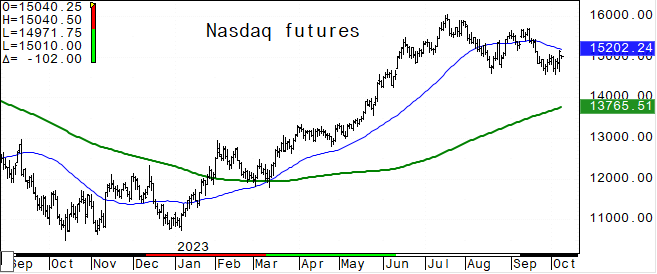

Futures ahead of the bell: E-Mini S&P -0.5%, Nasdaq -0.7%, Russell 2000 -0.8%, Dow -0.4%. E-Mini S&P held its key

200 day moving average last week.

In pre-market trading, defense stocks gained with Lockheed (LMT) +4.9%, RTX Corp (RTX) +4.6%, Northrop Grumman (NOC) +4.3%. Shares of US-listed Israeli companies fell; Inmode (INMD) -7.7%,

Gilat Satellite Networks (GILT) -5.5%, Elbit Systems (ESLT) -4.8%. Arm Holdings (ARM) shares edge higher as a majority of brokers initiate coverage on the chip designer with buy-equivalent recommendations. Lennox (LII) rises 1.4% as Goldman Sachs double-upgrade

Lennox International to buy from sell. Oracle (ORCL) rises 1% after Evercore ISI upgrades the infrastructure software company to outperform from in-line.

European gauges are mostly lower after paring early losses as the conflict in the Middle East boosted oil stocks. Defense stocks including Saab, BAE and Rheinmetall jumped ~5%, while

IAG led airline-stock declines as a growing number of carriers including Delta, United, American Airlines, Lufthansa and Air France-KLM suspended flights to Israel. Elsewhere, Metro Bank shares jumped 20% after the troubled UK lender clinched a £925 million

($1.1B) financing package. Travel and leisure shares lagged on concern higher oil prices will erode profits. The energy-heavy FTSE 100 Index outperformed regional peers. Germany’s DAX Index underperforms as German industrial output fell for a fourth month

in August. Stoxx 600 -0.3%, DAX -0.8%, CAC -0.6%, FTSE 100 +0.05%. Energy +3.6%, Food & Bev +0.6%, Utilities +0.3%. Retail -1.8%, Banks -1.8%, Travel & Leisure -1.4%.

Asian stocks were mixed as mainland Chinese shares fell on their return from the Golden Week holidays, while energy-related shares advanced after Hamas’ surprise attack on Israel sparked

a rally in oil prices. Shares of Chinese developers declined as tepid data on home sales during the Golden Week holidays underscores the ongoing woes in the country’s property sector. Chinese travel stocks were mostly lower after tourism revenue from China’s

holiday edged only slightly above its pre-Covid level. Shares of some Huawei suppliers surged by their daily limit of 10% on expectation of Huawei’s strong cellphone orders growth. The morning session in Hong Kong was scrapped due to a typhoon. Many major

markets, including Japan, South Korea and Taiwan, were closed for holidays. Vietnam +0.8%, ASX 200 +0.2%, Hang Seng Index +0.2%, China’s CSI 300 -0.1%, Shanghai Composite -0.4%, Sensex -0.7%.

FIXED INCOME:

Treasury futures gapped higher and have broadly held gains into early US session, following increased geopolitical tensions in the Middle East. Treasury 10-year futures

are higher by around 13 ticks on the day. Cash Treasuries are closed Monday for a US holiday. The rally in Treasury futures is equivalent to approximately 7bps drop in the corresponding yield, would put 10-year ~4.73% vs. Friday’s ~4.80% close. Treasury auctions

resume Tuesday with $46b 3-year note sale, followed by 10- and 30-year sales Wednesday and Thursday.

METALS:

Gold rose on increased haven demand after tensions ramped up in the wake of the Hamas attack on Israel. The precious metal gained as much as 1.2% on Monday as financial markets braced

for headwinds and volatility from the shock attack by Gaza militants. While the sudden crisis in Israel has added a small premium to gold, bigger gains will only come if there is a much more substantial escalation across the region. Spot gold +0.9%, silver

+0.1%.

ENERGY:

Oil jumped on fears of renewed instability in the Middle East, home to almost a third of global supply. While the latest events aren’t an immediate threat to oil

flows, traders are concerned the conflict may become a proxy war. The US said it was dispatching warships and the Wall Street Journal reported that Iranian security officials helped plan the strike. Any retaliation against Tehran may endanger the passage of

vessels through the Strait of Hormuz. Oil demand will climb 16% over the next two decades, OPEC said in its World Oil Outlook. OPEC+ ministers reiterated a willingness to take additional measures to support market stability. Europe’s natural gas futures jumped

above €40 after a leak was discovered on a pipeline in the Baltic region. WTI +4%, Brent +4%, US Nat Gas +0.7%, RBOB +3.2%.

CURRENCIES:

In currency markets, the dollar, the yen and long-volatility trades are the havens in demand after Israel declared war on Hamas. The Euro fell as Industrial Production

in Germany surprised to the downside. Production declined 0.2% from July, more than expected, led by construction and energy. The Bank of Israel said it will sell as much as $30 billion in foreign exchange and extend up to $15 billion through swap mechanisms

to support markets. The shekel slipped to the weakest in seven years as fighting entered a third day. The offshore yuan edged higher after the People’s Bank of China once again set the daily fixing at a stronger level than traders’ estimates. AUD/JPY, a barometer

of risk sentiment, drops 0.6%. US$ Index +0.5%, GBPUSD -0.55%, EURUSD -0.6%, AUDUSD -0.4%, NZDUSD -0.2%, USDSEK +0.7%.

Bitcoin %, Ethereum %.

TECHNICAL LEVELS:

|

ESZ23 |

10 Year Yield |

Dec Gold |

Nov WTI |

Spot $ Index |

|

|

Resistance |

4500.00 |

|

1981/85 |

92.13 |

111.525 |

|

|

4466.00 |

5.500% |

1937.5 |

89.86 |

110.000 |

|

|

4445.00 |

5.325% |

1923.5 |

88.30 |

108.970 |

|

|

4400/07* |

5.000% |

1900.0 |

86.67 |

107.990 |

|

|

4371/74 |

4.885% |

1870.0 |

84.56 |

107.350 |

|

Settlement |

4341.50 |

1845.2 |

82.79 |

||

|

|

4322.00 |

4.700% |

1823.5 |

81.50 |

105.960 |

|

|

4286.00 |

4.500% |

1821.0 |

80.00 |

104.420 |

|

|

4261.50 |

4.250% |

1800.0 |

77.62 |

103.800 |

|

|

4235.00 |

4.000% |

1796.7* |

76.03 |

103.180 |

|

Support |

4200/01* |

3.800% |

1776.5 |

73.40 |

102.920 |

Colors within the report:

Green is always the 200 period (day, week).

Red is always 21,

Blue = 50,

Brown =

100 *Stars have added importance

- Upgrades

- (ARMK) Aramark Raised to Buy at Jefferies; PT $29

- (CBUS) Cibus Inc Raised to Buy at HC Wainwright; PT $25

- (LII) Lennox Raised to Buy at Goldman; PT $455

- (MRTX) Mirati Therapeutics Raised to Sector Perform at Scotiabank

- (MSM) MSC Industrial Raised to Buy at Loop Capital; PT $124

- (ONON) On Holding Raised to Outperform at Baird; PT $33

- (ONON) Raised to Hold at Williams Trading; PT $26

- (ORCL) Oracle Raised to Outperform at Evercore ISI

- (PTEN) Patterson-UTI Raised to Buy at Citi

- (ZS) Zscaler Raised to Overweight at Barclays

- Downgrades

- (APO) Apollo Global Cut to Market Perform at Oppenheimer

- (DDOG) Datadog Cut to Neutral at BofA; PT $105

- (MRTX) Mirati Therapeutics Cut to Neutral at B Riley; PT $60

- (MRTX) Cut to Hold at JonesTrading; PT $58

- (MRTX) Cut to Market Perform at JMP

- (MRTX) Cut to Hold at Jefferies; PT $58

- (OWL) Blue Owl Capital Cut to Market Perform at Oppenheimer

- (SPLK) Splunk Cut to Inline at Evercore ISI; PT $157

- (SPOT) Spotify Cut to Neutral at Redburn; PT $160

- (TENB) Tenable Cut to Equal-Weight at Barclays; PT $47

- (ZWS) Zurn Elkay Water Cut to Neutral at Goldman

- Initiations

- (ARM) ARM Holdings PLC ADRs Rated New Buy at Rosenblatt Securities Inc

- (ARM) ADRs Rated New Peerperform at Wolfe

- (ARM) ADRs Rated New Hold at HSBC; PT $57

- (ARM) ADRs Rated New Buy at Guggenheim; PT $64

- (ARM) ADRs Rated New Buy at Mizuho Securities; PT $62

- (ARM) ADRs Rated New Market Perform at BMO; PT $60

- (ARM) ADRs Rated New Buy at Jefferies; PT $64

- (ARM) ADRs Rated New Overweight at Barclays; PT $65

- (ARM) ADRs Rated New Outperform at BNPP Exane; PT $65

- (ARM) ADRs Rated New Buy at Deutsche Bank; PT $60

- (ARM) ADRs Rated New Overweight at JPMorgan; PT $70

- (ARM) ADRs Rated New Outperform at Cowen; PT $63

- (ARM) ADRs Rated New Buy at Citi; PT $65

- (CFLT) Confluent Rated New Equal-Weight at Capital One; PT $35

- (CLDI) Calidi Biotherapeutics Rated New Outperform at Baird; PT $9

- (KE) Kimball Electronics Rated New Buy at B Riley; PT $39

- (PRME) Prime Medicine Rated New Outperform at BMO; PT $19

- (SCLX) Scilex Holding Rated New Buy at HC Wainwright; PT $12

- (TFIN) Triumph Financial Inc Reinstated Neutral at Piper Sandler

Data sources: Bloomberg, Reuters, CQG

No responses yet