TODAY’S GAME PLAN: from the trading

desk, this is not research

DATA/HEADLINES 9:00ET Fed’s Harker speaks; 12:15ET Fed’s Mester speaks

TODAY’S HIGHLIGHTS:

- Saudi Arabia and the UAE held rare talks in Riyadh

- SAG-AFTRA union warned that Hollywood actors dressing up as their favorite film or TV characters for Halloween

may break the walkout’s rules; CBS - Israel levelled a northern Gaza district on Friday after giving families a half-hour warning to escape

- SIRENS SOUND AT UN FORCES HQ IN LEBANON’S NAQOURA: NNA

World shares were broadly lower overnight, as volatility gripped global markets, as investors responded to the threat of a weekend escalation that could spread the

conflict between Israel and Hamas to the wider Middle East region. Adding to the anxiety about the broadening of the conflict, the Pentagon said the US had intercepted missiles fired from Yemen toward Israel. Israel’s military said it struck over 100 Hamas

targets in Gaza overnight and hit Hezbollah assets in response to fire from Lebanon. Meanwhile, Hamas has again called for a ‘Day of Rage’ on Friday. Egypt is expected to hold a “Summit for Peace” in Cairo on Saturday. Several leaders from the Middle East,

as well as the foreign ministers of Germany, France and the UK, are likely to attend.

EQUITIES:

US equity futures are modestly lower as treasuries gained, led by the 10 year, where yields have soared by 30 basis points this week to near 5%. Positioning in stocks has become so bearish

that it’s triggered a “contrarian buy signal” in a BofA indicator, setting up equities for a short-term rally, strategist Michael Hartnett said. In politics, Jim Jordan is weighing his next move in the campaign for House speaker ahead of a planned third vote

at 10am EST. He said the plan is to get a speaker elected this weekend.

Futures ahead of the bell: E-Mini S&P -0.15%, Nasdaq -0.2%, Russell 2000 -0.1%, Dow -0.2%. E-Mini S&P has key support again at its

200dma (4231 in SPX).

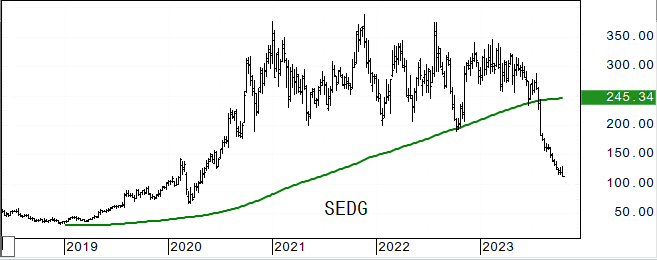

In pre-market trading, SolarEdge Technologies (SEDG) slumped 27% after cutting its sales forecast because of canceled orders. Other solar stocks also decline, with Enphase Energy (ENPH

-16%) and Sunrun (RUN -~10%) among the biggest fallers. Intuitive Surgical (ISRG) shares fall 7% after the maker of surgical tools reported third-quarter revenue that missed estimates. HP Enterprise (HPE) shares fell as much as 4.3% after the computing-services

provider forecast adjusted earnings per share for 2024 that missed estimates. Stocks exposed to cryptocurrencies rise, including CleanSpark (CLSK +7%) and Coinbase Global (COIN +4%), as Bitcoin moves closer toward the closely watched $30,000 level. Jazz Pharmaceuticals

(JAZZ) rose as much as 6.4% after reports the company is exploring strategic options including a potential sale. Regions Financial (RF) shares slide 6% after the firm’s third-quarter adjusted earnings per share missed estimates.

European gauges extended their drop to a seven-month low as investors remained on edge about the deepening crisis in the Middle East. The Stoxx Europe 600 fell to the lowest since March

20. Miners lagged, along with travel and leisure stocks. L’Oreal SA pared losses as traders weighed disappointing North Asia sales against better than expected performance in North America and Europe. The BOE’s Andrew Bailey hinted policy makers can’t let

up yet in their fight against inflation even as signs show that the UK economy is weakening. UK consumer confidence fell 9 points in October to minus 30, the biggest drop since the start of the pandemic, GfK said. And retail sales fell 0.9% last month, worse

than expected. Producer prices in Germany were down 14.7% year over year, the largest annual since records began in 1949. Stoxx 600 -1%, DAX -1.25%, CAC -1.2%, FTSE 100 -0.9%. Basic Resources -2.8%, Travel -1.9%, Retail -1.8%, Autos -1.6%, Healthcare outperforms

-0.2%.

Asian equities fell as investors worried over escalation in the Middle East crisis in addition to Federal Reserve policy and China’s uneven recovery. Chinese indexes pared some earlier

losses as the PBOC pumped a record amount of short-term cash into its financial system to keep funding costs low. Morgan Stanley advises against buying the dip in Chinese equities as market sentiment is likely to stay fragile while foreign fund outflow could

persist near-term. Meanwhile, concerns around property sector lingered on, with Country Garden Holdings missing a dollar bond interest payment, default is all but official. Japanese core inflation slowed to 2.8% in September, lending credence to the BOJ’s

view that upward pressure on prices is peaking. The MSCI Asia Pacific Index ended 0.5% lower on the day after paring a loss of nearly 1%. Kospi -1.7%, Thailand –1.6%, Philippines -1.2%, ASX 200 -1.2%, Hang Seng Index -0.7%, CSI 300 -0.65%, Topix -0.4%, Sensex

-0.3%, Taiwan -0.1%. Vietnam bucked the trend, +1.9%.

FIXED INCOME:

Treasuries are richer across the curve in a bull-flattening move, unwinding a portion of Thursday’s aggressive steepening that pushed 2s10s spread to least inverted

level in more than a year. US yields richer by 1bp to 5bp across the curve with long-end-led gains flattening 2s10s by as much as 4.2bp on the day. 10-year yield eased five basis points to 4.93%, trimming weekly advance to 32 basis points: 2-year yield ~5.13%.

Fed blackout period begins after the close

METALS:

Gold extended gains following a report US bases in Iraq and Syria were targeted in drone attacks. Gold prices rose to their highest levels in three months today and are heading for the

second consecutive weekly gain with increasing demand boosted by the conflict in the Middle East. Risk-off sentiment has bolstered demand for the precious metal, as the US said it’s seeing stepped-up drone attacks in Iraq and Syria while an American destroyer

in the Red Sea intercepted cruise missiles fired toward Israel by Houthi rebels in Yemen. There are concerns that the conflict will spread to other states including Iran, and could even potentially draw in the US, which has beefed up its military presence

substantially. Spot gold +0.2%, silver +0.2%.

ENERGY:

Oil prices extended gains and are on track for a second weekly rise on heightened fears that the Israel-Gaza crisis may spread in the Middle East and disrupt supply.

There is rising tension that the Israel Defense Forces will enter Gaza this weekend. Washington is seeking to buy 6 million barrels of crude for delivery to the Strategic Petroleum Reserve in December and January, as it continues its plan to replenish the

emergency stockpile, the US Department of Energy said on Thursday. Separately, a temporary lifting of US oil sanctions on Venezuela is unlikely to require any policy changes by OPEC+ for the time being as a recovery in production is likely to be gradual, OPEC+

sources said. WTI +1.5%, Brent +1.1%, US Nat Gas -0.4%, RBOB +1.3%.

CURRENCIES:

In currency markets, the dollar erased earlier gains as US yields lost traction, putting the greenback on course to end the week little changed, after a run of four

weekly gains. The pound weakened after UK retail sales tumbled more than expected as unusually warm September weather discouraged shoppers from spending on winter clothes. NZD/USD slipped for a fourth day, leading G-10 losses and set for its third weekly loss.

US$ Index -0.05%, GBPUSD -0.05%, EURUSD +0.1%, USDJPY +0.1%, AUDUSD -0.2%, NZDUSD -0.35%.

Bitcoin +4.3%%, Ethereum +3.3%. Cryptocurrency-exposed names rose as Bitcoin inched closer toward the closely watched $30,000 level. Riot Platforms advanced as much

as 6.8% and Coinbase Global gained more than 3%.

TECHNICAL LEVELS:

|

ESZ23 |

10 Year Yield |

Dec Gold |

Dec WTI |

Spot $ Index |

|

|

Resistance |

4415.00 |

|

2056.0 |

96.50 |

110.000 |

|

|

4400.00 |

5.750% |

2029.9 |

95.03 |

108.970 |

|

|

4374.00 |

5.500% |

2010.9 |

93.10 |

107.990 |

|

|

4340.00 |

5.325% |

2000.0 |

92.13 |

107.350 |

|

|

4315.00 |

5.000% |

1982/85 |

89.85 |

106.785 |

|

Settlement |

4303.00 |

1980.5 |

88.37 |

||

|

|

4277.00 |

4.800% |

1942.2 |

86.66 |

105.535 |

|

|

4258.50 |

4.430% |

1921.2 |

84.70 |

105.100 |

|

|

4235.50 |

3.925% |

1881.7 |

81.50 |

104.380* |

|

|

4216.00 |

3.865% |

1856.0 |

79.35 |

103.800 |

|

Support |

4202.00* |

3.500% |

1821/23 |

78.02 |

103.180 |

Colors within the report:

Green is always the 200 period (day, week).

Red is always 21,

Blue = 50,

Brown =

100 *Stars have added importance

- Upgrades

- (ALVO) Alvotech Raised to Neutral at Citi; PT $10

- (AMXB MM) America Movil ADRs Raised to Buy at HSBC; PT $21.50

- (CTSH) Cognizant Raised to Buy at Citi; PT $80

- (CTVA) Corteva Raised to Outperform at Oppenheimer

- (EXFY) Expensify Raised to Outperform at BMO; PT $4

- (KNX) Knight-Swift Raised to Neutral at JPMorgan; PT $57

- (MRK) Merck & Co Raised to Buy at UBS

- (MS) Morgan Stanley Raised to Peerperform at Wolfe

- (NFLX) Netflix Raised to Accumulate at Phillip Secs; PT $455

- (T) AT&T Raised to Sector Outperform at Scotiabank; PT $18.50

- (UNP) Union Pacific Raised to Buy at Deutsche Bank; PT $235

- Downgrades

- (AA) Alcoa Cut to Strong Sell at CFRA

- (BEAM) Beam Therapeutics Cut to Market Perform at Leerink; PT $20

- (CNE CN) Canacol Energy Cut to Hold at Jefferies; PT C$11

- (CNHI) CNH Industrial Cut to Perform at Oppenheimer

- (COLM) Columbia Sports Cut to Neutral at Seaport Global Securities

- (HP) Helmerich & Payne Cut to Hold at Benchmark; PT $50

- (NOVA) Sunnova Energy Cut to Hold at Deutsche Bank; PT $12.50

- (PRST) Presto Automation Cut to Neutral at Chardan Capital Markets

- (RUN) Sunrun Cut to Hold at Deutsche Bank; PT $15

- (SEDG) SolarEdge Cut to Market Perform at Oppenheimer

- (SEDG) Cut to Neutral at Goldman; PT $131

- (SEDG) Cut to Neutral at Roth MKM; PT $100

- (SEDG) Cut to Hold at Deutsche Bank; PT $150

- (TIGO) Millicom Cut to Hold at HSBC; PT $17

- Initiations

- (AAV CN) Advantage Energy Ltd Rated New Outperform at ATB Capital

- (AGL) Agilon Health Rated New Buy at Benchmark; PT $28

- (AMRC) Ameresco Rated New Neutral at BNPP Exane; PT $43

- (ARRY) Array Rated New Neutral at BNPP Exane; PT $21

- (AVDX) AvidXchange Rated New Buy at UBS; PT $11.50

- (BEPC CN) Brookfield Renewable Rated New Outperform at BNPP Exane

- (CRM) Salesforce Inc Rated New Buy at Fubon; PT $251

- (ENPH) Enphase Energy Rated New Neutral at BNPP Exane; PT $131

- (FLNC) Fluence Energy Rated New Underperform at BNPP Exane; PT $18

- (FLT) FleetCor Rated New Neutral at UBS; PT $280

- (FSLR) First Solar Rated New Outperform at BNPP Exane; PT $237

- (GFL CN) GFL Environmental Rated New Buy at Truist Secs; PT $46

- (GMED) Globus Medical Rated New Buy at Roth MKM; PT $75

- (GNRC) Generac Rated New Underperform at BNPP Exane; PT $78

- (HAL) Halliburton Rated New Hold at Baptista Research; PT $49

- (HASI) Hannon Armstrong Rated New Outperform at BNPP Exane; PT $29

- (HCA) HCA Healthcare Rated New Outperform at Baptista Research

- (IMXI) International Money Rated New Neutral at UBS; PT $18

- (IVR) Invesco Mortgage Rated New Neutral at BTIG

- (JKHY) Jack Henry Rated New Neutral at UBS; PT $165

- (LNG) Cheniere Energy Rated New Hold at Baptista Research; PT $198

- (LSPD CN) Lightspeed Commerce Inc Rated New Neutral at UBS; PT $16

- (MLNK) MeridianLink Rated New Sell at UBS; PT $17

- (MPLX) MPLX Rated New Hold at Baptista Research; PT $38.60

- (NOVA) Sunnova Energy Rated New Neutral at BNPP Exane; PT $14

- (NVEI CN) Nuvei Rated New Buy at UBS; PT $20

- (PSFE) Paysafe Rated New Sell at UBS; PT $10

- (RPAY) Repay Holdings Corp Rated New Neutral at UBS; PT $7.50

- (RSKD) Riskified Rated New Buy at UBS; PT $5.75

- (RUN) Sunrun Rated New Outperform at BNPP Exane; PT $20

- (SEDG) SolarEdge Rated New Outperform at BNPP Exane; PT $140

- (SHLS) Shoals Technologies Rated New Outperform at BNPP Exane; PT $33

- (SOFI) SoFi Technologies Rated New Neutral at UBS; PT $7

- (SPWR) SunPower Rated New Underperform at BNPP Exane; PT $4

- (STEM) Stem Inc Rated New Neutral at BNPP Exane; PT $5

- (SXTP) 60 Degrees Pharmaceuticals Rated New Neutral at HC Wainwright

- (VRRM) Verra Mobility Rated New Buy at UBS; PT $25

- (WEX) WEX Rated New Neutral at UBS; PT $210

Data sources: Bloomberg, Reuters, CQG

No responses yet