TODAY’S GAME PLAN: from the trading

desk, this is not research

DATA/HEADLINES 11:00ET Fed’s Cook speaks

TODAY’S HIGHLIGHTS:

- SOUTH AFRICA RECALLS DIPLOMATS FROM ISRAEL TO ASSESS ITS POSITION

World shares are heading for a sixth straight day of gains, helped by last week’s bond rally, as markets priced in earlier rate cuts in the United States and Europe.

Futures markets swung to imply a 90% chance the Fed was done raising rates and an 80% probability the European Central Bank will cut rates by April. In the Middle East, Israel on Sunday rejected growing calls for a ceasefire in Gaza, with military specialists

saying that forces are set to intensify their operations against Hamas. Iran said the war was likely to spread if “Israeli crimes” persisted, while the UK temporarily withdrew some of its embassy staff from Lebanon.

EQUITIES:

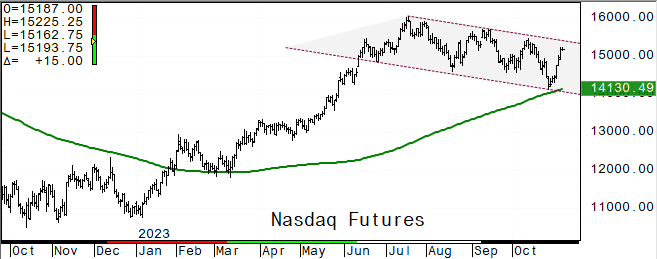

US equity futures edged higher after logging their best week this year, as hopes continued to prevail that the Federal Reserve is ready to call an end to tightening.

Investors will be listening out for confirmation when several Fed officials speak this week, including two appearances by Chair Jerome Powell. Some on Wall Street have cautioned that the optimism could be overdone. Morgan Stanley strategist Mike Wilson warned

that last week’s strong stock comeback “looks more like a bear market rally rather than the start of a sustained upswing,” citing a gloomy earnings outlook and weaker macro data. Another batch of earnings reports awaits investors this week, while the economic

calendar is quiet.

Futures ahead of the bell: E-Mini S&P +0.1%, Nasdaq +0.1%, Russell 2000 -0.02%, Dow +0.05%.

In pre-market trading, Tesla rose 2% after Reuters reported the company would produce a new, more affordable electric car model in Germany. Albemarle (ALB) fell 1% as UBS cut its recommendation

on the lithium producer’s stock to neutral from buy. BioNTech ADRs (BNTX) gain 3% after the vaccine maker reported a profit for the third quarter. Dish Network (DISH) is down 12% after reporting revenue for the third quarter that missed estimates. Paramount

Global (PARA) slides 4.9% after BofA double-downgrades its rating to underperform from buy. Bumble (BMBL) shares slump as much as 9% after the Wall Street Journal reported that CEO Whitney Wolfe Herd is stepping down.

European gauges erased early gains as bond yields pare some of Friday’s post-payrolls drop. The Stoxx 600 is flat after rising for five straight days. Travel and mining are the best performing

sectors while REITs underperform. Euro-Zone Investor Confidence came in at -18.6 versus -22.2 expected. German factory orders unexpectedly rose 0.2% in September. Among individual stock market movers, Ryanair Holdings jumped over 7% after announcing it will

pay out its first-ever dividend as Europe’s biggest discount airline benefits from growing traffic. Meanwhile, Telecom Italia SpA slipped after it agreed on Sunday to sell its land-line network to KKR in a blockbuster €22 billion ($23.6 billion) deal backed

by Italy’s government. DAX -0.1%, CAC -0.4%, FTSE 100 is flat. Travel & Leisure +1%, Basic Resources +0.7%. REITs -1.3%, Chemicals -1.1%.

Stocks in Asia extended their winning streak to a fourth day, led by a sharp rally in South Korea after authorities re-imposed a ban on short-selling to mid-2024. The MSCI Asia Pacific

Index rose 2%, with Toyota, Tencent and Samsung the top gainers. Shares in Japan climbed as trading resumed after Friday’s holiday. Gauges in Hong Kong and mainland China rallied after Premier Li Qiang promised further support for the economy including boosting

imports and protecting “rights and interest of foreign investors.” Kospi +5.7%, Hang Seng Tech +4.1%, Nikkei 225 +2.4%, Hang Seng Index +1.7%, Philippines +1.5%, CSI 300 +1.3%, Vietnam +1.2%, Sensex +0.9%, Taiwan +0.9%, ASX 200 +0.3%.

FIXED INCOME:

Treasuries are slightly cheaper across the curve amid deeper losses in core European rates, partially unwinding Friday’s sharp bull-steepening rally. Euro zone yields

rise as investors took a breather after pricing in last week up to 100 basis points of ECB rate cuts by December 2024. US 10-year yields around 4.59%, 2 year ~4.87%. There is little economic data scheduled for this week, while auctions resume Tuesday with

$48b 3-year note sale, followed by 10- and 30-year offerings Wednesday and Thursday. Powell is slated to speak Wednesday and Thursday, among more than a dozen planned appearances by Fed officials this week.

METALS:

Gold declined after briefly rallying above $2,000 an ounce on Friday following US data that pointed to a cooling labor market. Gold is still up more than 8% in the wake of the Hamas attacks

on Israel a month ago. US Secretary of State Antony Blinken made an unscheduled stop in Baghdad at the weekend, expanding American diplomacy in the Middle East with the goal of preventing a spread of the Israel-Hamas war. Spot gold -0.4%, silver -0.4%.

ENERGY:

Oil prices rose, after falling 6% last week, as top exporters Saudi Arabia and Russia reaffirmed on Sunday that they will stick with their supply curbs of 1.3 million

barrels a day until the year end. China’s oil refinery utilization rates are easing from record third-quarter levels as thinning margins and a shortage of export quotas discourage plants from raising output for the rest of 2023. The drop in refining output

could reduce crude demand from the world’s top importer and cap global oil prices. WTI +1.2%, Brent +1.1%, US Nat Gas -4.8%, RBOB +1.3%.

CURRENCIES:

The dollar is slightly lower, headed for a fourth day of losses even as Treasuries came under modest pressure. The Chinese offshore yuan rose for a fourth day to

its strongest level in a month as traders repriced bets on Federal Reserve rate cuts. PBOC officials continued to support the yuan with another stronger-than-estimate fix. AUD/USD is lower after it closed 1.2% higher on Friday to extend a third weekly gain

to 2.8%, its best in about a year. RBA is forecast to raise interest rates on Tuesday, ending a four-meeting pause amid persistent inflation and broader economic resilience. US$ Index -0.03%, GBPUSD +0.15%, EURUSD +0.1%, USDJPY +0.3%, AUDUSD -0.2%, USDNOK

-0.7%, NZDUSD -0.5%.

Bitcoin +1.4%, Ethereum +1.6%.

TECHNICAL LEVELS:

|

ESZ23 |

10 Year Yield |

Dec Gold |

Dec WTI |

Spot $ Index |

|

|

Resistance |

4566.00 |

5.750% |

2100.0 |

92.13 |

110.000 |

|

|

4500/05 |

5.500% |

2081.0 |

89.85 |

108.970 |

|

|

4470.00 |

5.325% |

2056.0 |

88.13 |

107.990 |

|

|

4439.00* |

5.000% |

2029.4 |

86.46 |

107.350 |

|

|

4403.00 |

4.810% |

2019.7 |

85.88 |

106.785 |

|

Settlement |

4376.00 |

1999.2 |

80.51 |

||

|

|

4337.00 |

4.545% |

1983.5 |

80.20 |

105.660 |

|

|

4318.00 |

4.350% |

1964.0 |

78.27 |

104.380 |

|

|

4289.00 |

3.930% |

1947.1 |

76.70 |

103.800 |

|

|

4272.00 |

3.650% |

1921.5 |

75.60 |

103.420 |

|

Support |

4225.00 |

3.265% |

1898.4 |

74.25 |

102.550 |

Colors within the report:

Green is always the 200 period (day, week).

Red is always 21,

Blue = 50,

Brown =

100 *Stars have added importance

- Upgrades

- Acadia Pharma (ACAD) Raised to Buy at Mizuho Securities; PT $35

- Andlauer Healthcare Group (AND CN) Raised to Outperform at CIBC

- Apple (AAPL) Raised to Accumulate at Phillip Secs; PT $194

- Bank of America (BAC) Raised to Market Perform at KBW; PT $30

- Block (SQ) Raised to Accumulate at CLSA; PT $57

- Centerspace (CSR) Raised to Buy at Compass Point; PT $65

- Corcept (CORT) Raised to Buy at Truist Secs; PT $38

- CRH (CRH) Raised to Neutral at Goldman; PT $58

- Dominion Energy (D) Raised to Overweight at Barclays; PT $47

- Ferrari (RACE) Raised to Overweight at Barclays; PT $375.83

- KeyCorp (KEY) Raised to Outperform at KBW; PT $15

- Kontoor Brands (KTB) Raised to Overweight at Barclays; PT $59

- Park Hotels (PK) Raised to Overweight at Barclays; PT $19

- Sovos (SOVO) Raised to Outperform at Telsey; PT $23

- TVA Group (TVA/B CN) Raised to Sector Perform at National Bank; PT C$1.60

- Vermilion Energy (VET CN) Raised to Buy at Desjardins; PT C$24.50

- Visteon (VC) Raised to Buy at Citi; PT $149

- VYNE Therapeutics Inc (VYNE) Raised to Outperform at LifeSci Capital

- Downgrades

- Albemarle (ALB) Cut to Neutral at UBS; PT $140

- Avient Corp (AVNT) Cut to Hold at Deutsche Bank; PT $37

- BJ’s Wholesale (BJ) Cut to Hold at Deutsche Bank; PT $71

- Bloomin’ Brands (BLMN) Cut to Outperform at Raymond James

- Cathay General (CATY) Cut to Underweight at Piper Sandler; PT $31

- EnerSys (ENS) Cut to Market Perform at William Blair

- EngageSmart (ESMT) Cut to Market Perform at William Blair

- Fortinet (FTNT) Cut to Hold at HSBC; PT $49

- Nutrien (NTR CN) Cut to Neutral at JPMorgan; PT C$79.18

- Omega Healthcare (OHI) Cut to Underperform at BNPP Exane; PT $32

- Paramount Global (PARA) Cut to Underperform at BofA; PT $9

- Pioneer Natural (PXD) Cut to Neutral at Susquehanna; PT $250

- Sangamo (SGMO) Cut to Equal-Weight at Wells Fargo; PT $1

- Sixth Street Specialty Lending (TSLX) Cut to Neutral at B Riley; PT $22

- SolarEdge (SEDG) Cut to Equal-Weight at Wells Fargo; PT $82

- Cut to Hold at HSBC; PT $80

- TechnipFMC (FTI) Cut to Neutral at BNPP Exane; PT $23.50

- Initiations

- Beamr Imaging (BMR) Rated New Buy at ThinkEquity; PT $5

- Bilibili (BILI) ADRs Rated New Buy at Mizuho Securities; PT $18

- Birkenstock Holding (BIRK) Rated New Hold at Deutsche Bank; PT $43

- Rated New Outperform at William Blair

- Rated New Outperform at Telsey; PT $47

- Rated New Overweight at Piper Sandler

- Rated New Neutral at BNPP Exane; PT $44

- Rated New Outperform at Baird; PT $48

- Rated New Buy at Goldman; PT $48.50

- Rated New Buy at Stifel; PT $47

- Rated New Overweight at JPMorgan; PT $48

- Rated New Outperform at BMO; PT $50

- Rated New Equal-Weight at Morgan Stanley

- Rated New Buy at Williams Trading; PT $55

- Rated New Buy at Citi; PT $52

- Rated New Hold at HSBC; PT $42

- Rated New Buy at Jefferies; PT $50

- Bitcoin Depot (BTM) Rated New Buy at HC Wainwright; PT $6

- Confluent (CFLT) Rated New Outperform at RBC; PT $22

- Cytokinetics (CYTK) Rated New Outperform at Baptista Research

- Legend Biotech (LEGN) ADRs Rated New Buy at Goldman; PT $90.09

- MRC Global (MRC) Rated New Buy at Baptista Research; PT $14.50

- Oxford Industries (OXM) Reinstated Neutral at B Riley; PT $90

- Prothena (PRTA) Rated New Buy at Baptista Research; PT $60

- Unitil (UTL) Rated New Neutral at Guggenheim

- WK Kellogg (KLG) Rated New Underweight at Barclays; PT $11

- World Kinect Corp (WKC) Rated New Equal-Weight at Morgan Stanley

Data sources: Bloomberg, Reuters, CQG

No responses yet