TODAY’S GAME PLAN: from the trading

desk, this is not research

DATA/HEADLINES 8:50ET Fed’s Cook speaks; 11:00ET NY Fed 1-Yr Inflation Expectations

TODAY’S HIGHLIGHTS:

- Goldman estimates over 170bln of buybacks are in play into year end

- Tim Scott drops out of presidential race

- Biden has wiped out $127 billion in student loan debt by tweaking existing programs

- Aaron Rodgers is targeting a return to NFL action by mid-December

- Jimbo Fisher fired from Texas A&M but gets $75M buyout

Global shares nudged higher with focus turning to US inflation data tomorrow for more clues on whether interest rates have peaked. More signs of thawing US-China

ties are emerging, with Biden and Xi Jinping due to meet on Wednesday. The White House has cited a resumption of US-China military communications as a priority. The SCMP reported that the leaders will agree to a ban on the use of AI in autonomous weapons.

The US conducted airstrikes in eastern Syria on weapon storage facilities linked to Iran. CNN reported that over 800 foreign nationals crossed into Egypt yesterday. The US still faces a risk of a government shutdown at the end of this week despite a new compromise

plan by Speaker Mike Johnson that leaves out hardline conservative priorities like cutting spending and curtailing migration.

EQUITIES:

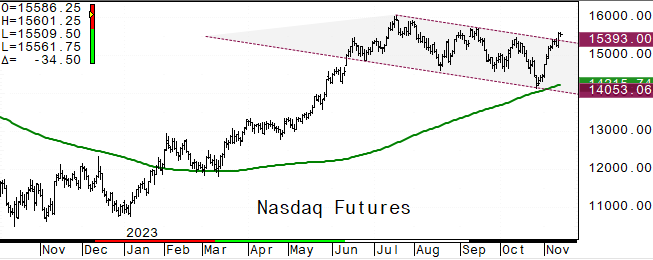

US equity futures are slightly weaker, following two weeks of robust gains, as investors waited for inflation data that could show if the Federal Reserve is done

hiking interest rates. Morgan Stanley economists forecast deep Fed rate cuts from June as the economy weakens, while Goldman expects fewer reductions and predicted the first cut in the fourth quarter of 2024. Investor focus will be on Tuesday’s consumer price

data, which is expected to show inflation easing to a year-on-year rate of 3.3% in October, down from 3.7% in the prior month. In a survey from the American Association of Individual Investors, the percentage of respondents who say they’re optimistic on the

stock market jumped by three-quarters, while the ranks of pessimists has plunged. From one weak to the next, the bull-bear spread rose by 41 points, an advance last seen in early 2009. Historically, such a rapid increase in enthusiasm has preceded weakness

for stocks.

Futures ahead of the bell: E-Mini S&P -0.2%, Nasdaq -0.25%, Russell 2000 -0.2%, Dow -0.1%.

In pre-market trading, Boeing shares advanced almost 4%, lifted by a $52 billion deal with Emirates, as well as news that China is weighing an end to a freeze on purchases of Boeing aircraft.

StoneCo (STNE) shares gain 4.9% after the financial technology provider reported results late Friday that beat expectations. Monday.com (MNDY) rises 8% after providing a 4Q revenue forecast that beat. Plug Power (PLUG) falls 4% as Morgan Stanley cuts its

price target on the hydrogen fuel cell maker after the company’s going-concern warning last week. Aclaris Therapeutics (ACRS) tumbles 81% after the company said it will discontinue further development of the zunsemetinib program. Health Catalyst (HCAT) gains

about 3% after the health care software provider is upgraded at Piper following recent results. Verve Therapeutics (VERV) slumps 39% after the biotech company said two patients experienced serious heart-related adverse events during a trial of its gene-editing

therapy.

European gauges gained but are well off their earlier highs. Europe’s Stoxx 600 index is up 0.5%, boosted by a rally in travel and healthcare stocks. Denmark’s Novo Nordisk A/S jumped

more than 4% after a study backed the use of Wegovy, its blockbuster weight-loss drug, to cut heart attacks and deaths in obesity patients. AstraZeneca (AZN.L +1.5%) is planning to launch a new affordable weight loss drug to compete with more expensive obesity

medicines such as Novo Nordisk’s Wegovy and Eli Lilly’s Zepbound. DAX +0.15%, CAC +0.2%, FTSE 100 +0.5%. Travel & Leisure +1.7%, Banks +1%, Healthcare +1%, Telecom +0.8%. Financial Services lag, down 0.3%.

Asian equities rose, helped by a rally in regional technology shares after a positive sales update by heavyweight TSMC. Chinese internet firms also gained amid sales growth during the

Singles’ Day shopping festival. China’s consumption rebound slowed and private business confidence lost momentum in October, according to independent surveys. Goldman Sachs downgraded offshore Chinese stocks due to modest earnings growth, while Morgan Stanley

said debt and deflation challenges will persist for the nation’s shares. The pace of gains in Japan’s producer prices decelerated more than expected in October to the weakest in over two years. The MSCI Asia Pacific Index rose 0.3%, with TSMC, Tencent and

Alibaba providing the biggest boost. Singapore and Malaysia were closed for a holiday. Hang Seng Index +1.3%, Taiwan +0.9%, Indonesia +0.4%, Shanghai Composite +0.25%, Nikkei 225 +0.05%. Vietnam -0.15%, CSI 300 -0.2%, Kospi -0.2%, ASX 200 -0.4%, Sensex -0.5%,

Philippines -0.7%.

FIXED INCOME:

Treasuries are richer by 1bp-2bp across the curve, recouping some of the late-Friday losses spurred by Moody’s shift to negative outlook on US credit rating. US session

is light on economic data and Fed speakers, and coupon auction slate is blank until Nov. 20. 10-year around 4.63%; 5s30s spread slightly steeper on the day at ~8bp after dropping below 6bp Friday.

METALS:

Gold held last week’s loss and copper advanced as investors looked ahead to Tuesday’s crucial US inflation figures. The consumer price index excluding food and fuel

is seen increasing 0.3% for a third month, which could support a hawkish stance from Federal Reserve officials. Fed Chair Jerome Powell said last week that the central bank won’t hesitate to hike further if needed. Spot gold -0.2%, silver -0.8%, Copper +1.2%.

ENERGY:

Oil prices edge higher, attempting to build on a Friday rebound that wasn’t enough to avert a third straight weekly decline blamed on worries about the demand outlook.

Brent crude oil futures held near $81 after losing about 12% in the past three weeks. OPEC published its monthly market report today which will be followed by the International Energy Agency later in the week. OPEC nudged its forecast for 2023 growth in oil

demand higher to 2.5 million barrels a day. Oil demand in 2024 is forecast to grow by 2.2 mbd, unchanged from OPEC’s previous assessment. WTI +0.2%, Brent +0.2%, US Nat Gas +4%, RBOB -0.1%.

CURRENCIES:

In currency markets, the yen fell to a fresh 2023 low against the dollar, raising concerns that authorities will intervene to support the currency. The dollar steadied

amid a tight range as traders focus on Tuesday’s US CPI data. A downgrade in US credit rating outlook by Moody’s Investor Service limited dollar dips while risk-on flows ahead of US President’s meeting with his Chinese counterpart Xi Jinping later this week

capped intraday strength. US$ Index is flat, GBPUSD +0.1%, EURUSD -0.05%, USDJPY +0.15%, AUDUSD +0.2%, NZDUSD -0.2%, USDCHF +0.2%.

Bitcoin -1%, Ethereum -0.5%.

TECHNICAL LEVELS:

|

ESZ23 |

10 Year Yield |

Dec Gold |

Dec WTI |

Spot $ Index |

|

|

Resistance |

4566.00 |

5.500% |

2056.0 |

86.00 |

108.970 |

|

|

4515.00 |

5.325% |

2029.4 |

85.77 |

107.990 |

|

|

4500.00 |

5.000% |

2019.7 |

82.60 |

107.350 |

|

|

4470.00 |

4.810% |

1998.0 |

80.00 |

106.785 |

|

|

4439.00* |

4.680% |

1982.2 |

78.17 |

105.870 |

|

Settlement |

4430.50 |

1937.7 |

77.17 |

||

|

|

4413.00 |

4.580% |

1921.5 |

74.25 |

104.850 |

|

|

4385.00 |

4.350% |

1898.4 |

72.88 |

104.380 |

|

|

4354.00 |

3.930% |

1865.5 |

70.00 |

103.800 |

|

|

4315.00 |

3.650% |

1849.0 |

66.80 |

103.420 |

|

Support |

4282.00 |

3.245% |

|

63.64 |

102.550 |

Colors within the report:

Green is always the 200 period (day, week).

Red is always 21,

Blue = 50,

Brown =

100 *Stars have added importance

- Upgrades

- Axis Capital (AXS) Raised to Outperform at KBW; PT $66

- Booking (BKNG) Raised to Market Perform at Bernstein

- Brookfield Renewable Partners (BEP-U CN) Raised to Outperform at RBC

- CrowdStrike (CRWD) Raised to Buy at Stifel; PT $225

- Guardant Health (GH) Raised to Outperform at Raymond James; PT $27

- Health Catalyst (HCAT) Raised to Overweight at Piper Sandler; PT $11

- HP Inc (HPQ) Raised to Buy at Citi; PT $33

- Montauk Renewables (MNTK) Raised to Sector Outperform at Scotiabank

- Natera (NTRA) Raised to Strong Buy at Raymond James

- Oracle (ORCL) Raised to Buy at Edward Jones

- Parkit Enterprise (PKT CN) Raised to Outperform at Raymond James

- Teck Resources (TECK/B CN) Raised to Buy at Paradigm Capital; PT C$60

- TripAdvisor (TRIP) Raised to Outperform at Bernstein

- Downgrades

- 2U (TWOU) Cut to Neutral at Citi

- Barings BDC (BBDC) Cut to Equal-Weight at Wells Fargo; PT $8.50

- Beyond Meat (BYND) Cut to Underweight at Consumer Edge Research; PT $5

- Crescent Capital BDC (CCAP) Cut to Equal-Weight at Wells Fargo; PT $16

- Greenbrook TMS (GBNH) Cut to Hold at Bloom Burton & Co; PT 30 cents

- Highwoods (HIW) Cut to Neutral at BofA; PT $20

- Hudson Pacific (HPP) Cut to Underperform at BofA

- Paramount Group (PGRE) Cut to Underperform at BofA

- Pivotree (PVT CN) Cut to Speculative Buy at Canaccord; PT C$3.25

- Plug Power (PLUG) Cut to Peerperform at Wolfe

- Regions Financial (RF) Cut to Hold at Odeon Capital; PT $17.10

- Southwest Air (LUV) Cut to Sell at Melius

- Unity Software (U) Cut to Peerperform at Wolfe

- Ventyx Bio (VTYX) Cut to Inline at Evercore ISI; PT $5

- Waters (WAT) Cut to Underweight at Barclays; PT $230

- WP Carey (WPC) Cut to Market Perform at JMP

- Initiations

- ABM Industries (ABM) Rated New Hold at Truist Secs; PT $43

- Cintas (CTAS) Rated New Buy at Truist Secs; PT $625

- Colgate-Palmolive (CL) Reinstated Buy at Jefferies; PT $87

- Genasys Inc (GNSS) Rated New Buy at Roth MKM; PT $3.50

- Gitlab (GTLB) Rated New Buy at BTIG; PT $56

- Mirum Pharma (MIRM) Rated New Overweight at Morgan Stanley; PT $60

- Olin (OLN) Rated New Buy at Citi

- Singing Machine (MICS) Rated New Buy at Ascendiant Capital Markets

- Tesla (TSLA) Rated New Overweight at Guotai Junan Sec; PT $248.20

- TMC the metals (TMC) Rated New Speculative Buy at Cantor; PT $4.20

- V2X Inc (VVX) Rated New Market Outperform at JMP; PT $65

- Vita Coco (COCO) Rated New Buy at Jefferies; PT $33

- WK Kellogg (KLG) Rated New Inline at Evercore ISI; PT $13

Data sources: Bloomberg, Reuters, CQG

No responses yet