TODAY’S GAME PLAN: from

the trading desk, this is not research

DATA/HEADLINES ET : 8:00a.m

MBA Mortgage Applications, 8:30 am GDP, Retail Inventories MoM, Core PCE Price Index, Advanced U.S. trade balance in goods, 1:45 pm Cleveland Fed President Mester speaks, 2:00 pm Fed Beige Book

TODAY’S HIGHLIGHTS:

- Miriam Adelson to sell $2 billion in Las Vegas Sands stock as she looks to buy sports team.

- Influential value investor Charlie Munger, longtime vice chairman Berkshire Hathaway, has died.

One month before his 100th birthday. - Apple will end its credit-card partnership with Goldman Sachs, the WSJ reported.

Global stocks edged higher and Treasuries extended their November rally, driven by growing anticipation that the Federal Reserve

has completed policy tightening and might consider interest rate cuts in the coming year. The MSCI All Country World Index recorded an 8.7% increase this month, the most since November 2020. Fed Governor Christopher Waller’s comments supporting the central

bank’s ability to reach a 2% inflation target contributed to the positive market sentiment. Bill Ackman is also betting on a rate cut as soon as the first quarter, he said there’s a “real risk of a hard landing if the Fed doesn’t start cutting rates pretty

soon.” Meanwhile, the dollar steadied, oil advanced and gold ticked lower.

EQUITIES:

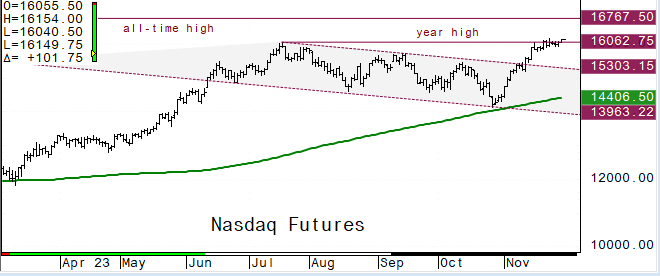

US equity futures climbed higher, with Nasdaq futures leading +0.6%. Notable stock movements include Airbnb slipping 0.8% after a Jefferies downgrade, while CrowdStrike Holdings

rises 3.0% on strong Q3 results. Fluence Energy surges 19% following positive earnings and optimistic analyst views. GameStop sees a 12% jump ahead of its third-quarter results. Las Vegas Sands falls 5.6% as Miriam Adelson sells stock for a Dallas Mavericks

stake. NetApp climbs 12% after raising its full-year outlook, Okta drops 6.2% due to a network breach, and Workday rises 8.92% on robust Q3 results and an increased full-year subscription revenue forecast. Other notable premarket movers include: Stellantis

(STLA US) +3.0%, Pinterest (PINS US) +2.6%, Mobileye (MBLY US) +2.6%,Colgate-Palmolive (CL US) -1.0%,Newmont Corp (NEM US) -1.3%, NetApp Inc (NTAP US) +12.4%,Klaviyo (KVYO US) +3.6%.

Futures ahead of the bell: E-Mini S&P +0.5%, Nasdaq +0.6%, Russell 2000 +0.8%, Dow +0.3%.

European stocks rose as the latest inflation data indicated a decline across the region. The Stoxx Europe 600 increased by 0.5%, with autos leading the gains, and real estate

and technology stocks benefiting from falling bond yields. Koninklijke Philips NV faced a decline due to safety issues with its sleep apnea machines. Kindred Group Plc dropped after Q3 profit missed estimates, while Vestas Wind Systems A/S climbed following

a rating upgrade. Germany and Spain reported lower inflation, and traders anticipate upcoming reports to assess the impact of European Central Bank tightening on consumer prices. Despite concerns about economic growth, European stocks are set for their best

month since November. Bank stocks underperformed, influenced by a selloff in Asian equities, with Standard Chartered Plc and HSBC Holdings Plc weighing on the sector. Stoxx 600 +0.6%, DAX +1%, CAC +0.5%, FTSE 100 -0.08%.

Asian equities declined, driven by a selloff in Chinese tech stocks and profit-taking ahead of potential month-end portfolio rebalancing. The MSCI Asia

Pacific Index erased a 0.5% gain, with Hong Kong stocks closing at their lowest level in a month. Meituan’s warning on slowing growth in its meal delivery business weighed on the regional gauge, particularly impacting Hong Kong’s technology index. Despite

the dip, Asian equities are set for their best month since January. Australian stocks climbed on lower-than-expected inflation, supporting the case for the Reserve Bank to maintain interest rates. Indian stocks rallied, outperforming the region. Adani Group

and PDD suppliers in China saw notable movements, while Chinese high-voltage fast-charging stocks rose. Evergrande Property Services advanced, and Asian gold miners gained as bullion reached its highest level since May. Singapore +0.6%, Topix -0.5%, Vietnam

+0.6%, Sensex +1.1%, Kospi -0.1%, ASX 200 +0.3%, Taiwan +0.1%, Thailand -1.2%, Indonesia +0.04%, CSI 300 -0.8%.

FIXED INCOME:

Treasuries are on track for their most significant monthly gain since August 2019, as investors increasingly believe that both the Federal Reserve’s cash

rate and the benchmark 10-year yield have reached their peak. Federal Reserve Governor Christopher Waller on Tuesday said that monetary policy was “well positioned” to achieve the Fed’s goals of slowing the economy and lowering inflation. US 2- and 10-year

yields both slid as much as seven basis points to 4.66% and 4.25% respectively.

METALS:

Gold steadied and was near its highest point since May, influenced by Federal Reserve officials’ remarks suggesting potential interest rate cuts next year. Governor Christopher Waller’s statement

on inflation targets eased pressure on the dollar and Treasury yields. Gold +0.08%, Silver -0.2%.

ENERGY:

Oil prices extended their largest weekly gain as traders anticipated the high-stakes OPEC+ meeting and assessed signals of the Federal Reserve

halting interest rate hikes. Despite the rally, oil is poised for a second consecutive monthly decline due to increased non-OPEC supply. The American Petroleum Institute reported a decrease in US inventories, potentially marking the first weekly drop in six

weeks. WTI +1.7%, Brent +1.5%

CURRENCIES:

In currency markets, the US dollar rebounded from a decline as Treasury yields eased. EUR/USD fluctuated, trading 0.2% lower, impacted by easing Spanish inflation. The New Zealand

dollar outperformed as the RBNZ held rates at 5.5% but suggested potential hikes in the future. USD/JPY recovered from a drop to its lowest since Sept. 12. GBP/USD reversed gains, with BOE Governor Bailey emphasizing no discussions on interest rate cuts. Fed

Chair Powell’s upcoming speech and month-end flows are influencing market dynamics.US$ Index +0.1%, GBPUSD flat, USDJPY -0.1%, EURUSD -0.1%, AUDUSD -0.4%, USDNOK -0.2%, NZDUSD +0.3%.

Bitcoin +0.6%, Ethereum +0.1%.

TECHNICAL LEVELS:

|

ESZ23 |

10 Year Yield |

Dec Gold |

Jan WTI |

Spot $ Index |

|

|

Resistance |

4652.00 |

5.500% |

86.29 |

107.990 |

|

|

|

4624.00 |

5.325% |

84.57 |

107.350 |

|

|

|

4611.00 |

5.000% |

2100.0 |

80.90 |

106.450 |

|

|

4597.50 |

4.775% |

2085.4 |

80.10 |

105.800 |

|

|

4571.00 |

4.620% |

2056.0 |

78.18 |

104.750 |

|

Settlement |

4563.00 |

2040.0 |

76.41 |

||

|

|

4540/41 |

4.350% |

2019.7 |

72.16 |

103.620 |

|

|

4518.00 |

3.990% |

2012.4 |

70.16w |

102.550 |

|

|

4500.00 |

3.640% |

1981.5 |

66.80 |

101.240 |

|

|

4470.00 |

3.245% |

1963.9 |

65.00 |

100.000 |

|

Support |

4439.00 |

3.000% |

1950.6 |

62.55 |

99.580 |

Colors within the report:

Green is always the

200 period (day, week). Red is always 21,

Blue = 50,

Brown =

100 *Stars have added importance

- Upgrades

- AvalonBay (AVB)

Raised to Neutral at JPMorgan; PT $194 - Equifax (EFX)

Raised to Buy at CFRA; PT $245 - RBC

Bearings (RBC) Raised to Buy at BofA; PT $280 - Torex

Gold Resources (TXG CN) Raised to Outperform at RBC;

PT C$22 - Tuya (TUYA)

ADRs Raised to Overweight at Morgan Stanley; PT $2.70 - Downgrades

- Airbnb (ABNB)

Cut to Hold at Jefferies; PT $140 - CAE (CAE

CN) Cut to Underperform at BofA; PT $19 - Carlyle

Group (CG) Cut to Inline at Evercore ISI; PT $32 - Constellation

Energy (CEG) Cut to Neutral at Seaport Global Securities - Gol (GOLL4

BZ) ADRs Cut to Sell at Citi; PT $3 - Hershey (HSY)

Cut to Neutral at Piper Sandler - Splunk (SPLK)

Cut to Hold at Truist Secs; PT $157 - Initiations

- Akebia

Therapeutics (AKBA) Reinstated Buy at BTIG; PT $4 - Alexander

& Baldwin (ALEX) Rated New Market Perform at JMP - Alphabet (GOOGL)

Rated New Positive at Vertical Group - Amazon (AMZN)

Rated New Positive at Vertical Group - Cabaletta

Bio (CABA) Rated New Outperform at William Blair - Comcast (CMCSA)

Rated New Neutral at Vertical Group - Criteo (CRTO)

ADRs Rated New Cautious at Vertical Group - Disney (DIS)

Rated New Neutral at Vertical Group - Fox

Corp (FOXA) Rated New Neutral at Vertical Group - Gaotu

Techedu (GOTU) ADRs Rated New Buy at BOCOM Intl; PT

$3.10 - Gitlab (GTLB)

Rated New Market Perform at Raymond James - Green

Thumb Industries Inc (GTII CN) Rated New Outperform

at ATB Capital - Korro

Bio, Inc. (KRRO) Rated New Outperform at RBC; PT $70 - Magnite

Inc (MGNI) Rated New Cautious at Vertical Group - Marti

Technologies (MRT) Rated New Overweight at Cantor;

PT 90 cents - Meta

Platforms (META) Rated New Positive at Vertical Group - Microvast (MVST)

Rated New Overweight at Cantor; PT $8 - Moderna (MRNA)

Rated New Hold at Canaccord; PT $82 - OmniAb (OABI)

Rated New Outperform at RBC; PT $6 - Paramount

Global (PARA) Rated New Neutral at Vertical Group - Pinterest (PINS)

Rated New Positive at Vertical Group - PubMatic (PUBM)

Rated New Cautious at Vertical Group - Roku (ROKU)

Rated New Positive at Vertical Group - Sitka

Gold (SIG CN) Rated New Speculative Buy at Paradigm

Capital - Snap (SNAP)

Rated New Neutral at Vertical Group - Snowline

Gold (SGD CN) Rated New Speculative Buy at Paradigm

Capital - Sophia

Genetics (SOPH) Rated New Outperform at RBC; PT $8 - Spyre

Therapeutics Inc (SYRE) Rated New Outperform at Cowen - Talen

Energy Corp (TLNE) Rated New Buy at Seaport Global

Securities - Trade

Desk (TTD) Rated New Positive at Vertical Group - Youdao (DAO)

ADRs Rated New Buy at BOCOM Intl; PT $6.30

Data sources: Bloomberg, Reuters, CQG

No responses yet