TODAY’S GAME PLAN: from the trading

desk, this is not research

DATA/HEADLINES 8:30ET Weekly Jobless Claims, Personal Income, Personal Spending, PCE Deflator; 9:15ET Fed’s Williams

speaks; 9:45ET MNI Chicago PMI; 10:00ET Pending Home Sales

Oct PCE Core Price Index +0.2% Rate On Mo; +3.5% On Yr. Oct PCE Price Index Unchanged Rate On Mo; +3% On Yr. Fed Chair Jerome Powell speaks on Friday

TODAY’S HIGHLIGHTS:

- Global stocks head for best month since Nov 2020

- Treasury yields set for biggest monthly fall since 2008

- Henry Kissinger died on Wednesday at age 100

- ABBVIE TO BUY IMMUNOGEN

World stocks edged higher, with MSCI’s world stock index heading for their best monthly jump (~9%) since the first COVID-19 vaccine breakthroughs of 2020, as the

continuing downtrend for global bond yields lifted confidence. November’s equity rally has been broad based, with global growth stocks up 11% while value stocks have gained nearly 7%. Total returns for the month on global sovereign and corporate bonds were

flirting with their best four weeks since the crash of 2008. Data today showed China’s manufacturing activity fell deeper into contraction in November, suggesting more stimulus will be needed. Japan’s Retail Sales came in weak at -1.6%. Money markets now expect

the ECB to cut interest rates as soon as April as November euro zone inflation figures came in much lower than forecast. All eyes will now be on the US October PCE inflation readings ahead of the US open.

EQUITIES:

US equity futures are higher, heading for their best month in more than a year, as investors waited for a key US inflation metric for further evidence that price

pressure are cooling. Data due this morning is forecast to show the Fed’s preferred inflation metric — the personal consumption expenditures price index — decelerated in October to the slowest annual rate since early 2021. Today’s MSCI rebalance event will

generally result in high volatility, higher volume, and a much larger percentage of the day’s volume trading in the last ten minutes of the session and the close.

Futures ahead of the bell: E-Mini S&P +0.35%, Nasdaq +0.35%, Russell 2000 +0.5%, Dow +0.6%.

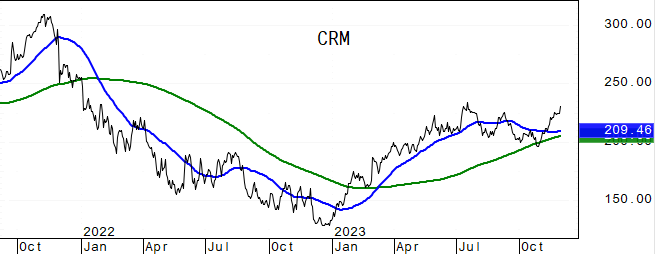

In pre-market trading, Salesforce (CRM) shares jumped as much as 9% after the application software firm’s results and profit forecasts beat estimates. HP Enterprise (HPE) shares are up

about 3% and are set to extend gains for a second session as Morgan Stanley raised its recommendation following results. ImmunoGen (IMGN) shares are halted after AbbVie (ABBV) agreed to buy the company. Nutanix (NTNX) gains about 9% as strong demand fueled

a quarterly sales beat. Pure Storage (PSTG) slumps 17% after the technology company’s outlook disappointed. Snowflake (SNOW) climbs about 7% after the US cloud-software company posted 3Q results that beat expectations. Synopsys (SNPS) is up 2% after the maker

of electronic design automation software reported fourth-quarter results that beat expectations.

European stocks rose, and are poised for their best monthly gain since January as cooling inflation data across the region gave fresh impetus for a risk on rally from real estate to tech.

A flurry of weak economic data out of Germany, France and Italy bolstered bets that interest rates are heading toward cuts next year. Euro-Zone CPI came in weaker with a 2.4% y-o-y print versus 2.7% expected. France’s economy unexpectedly shrank in the third

quarter while November inflation sank more than anticipated. Europe’s Stoxx 600 index added 0.5%, set for its best month since January. Financial services and energy sectors outperformed Thursday, while autos and travel and leisure dropped. Stoxx 600 +0.5%,

DAX +0.5%, CAC +0.6%, FTSE 100 +0.7%. Energy +2%, Financial Services +1.1%, Insurance +0.8%. Autos -0.1%, Travel -0.5%.

Asian stocks gained, with investors shrugging off a weak set of economic data from China. The MSCI Asia Pacific Index rose 0.4% for its best month since January. Shares in Hong Kong reversed

an early dip to finish higher, while China’s benchmark rose despite disappointing Chinese manufacturing data. China’s manufacturing activity shrank for a second straight month in November and at a quicker pace. The official purchasing managers’ index fell

to 49.4 in November from 49.5 in October, missing forecasts of 49.7. The new export orders component extended its decline for a ninth month, while the services sector contracted for the first time in 12 months. Japanese shares snapped a three-day losing

streak, while Korean stocks advanced after the Bank of Korea held its key interest rate. ASX 200 +0.7%, Indonesia +0.6%, Kospi +0.6%, Nikkei 225 +0.5%, Taiwan +0.4%, Hang Seng Index +0.3%, CSI 300 +0.2%, Sensex +0.1%. Singapore -0.4%, Philippines -0.7%, Vietnam

-0.8%.

FIXED INCOME:

Treasuries are slightly cheaper across the curve with losses led by long-end, extending Wednesday’s steepening move. US 10-year yields around 4.285%, +2bps; 2 year

yield ~4.63%, -4bps. continued long-end underperformance steepens 2s10s spread by 3.7bps from the 5pm EST close. Futures markets are now pricing in more than 100 basis points of rate cuts next year starting in May. With new data showing euro zone-wide inflation

had slowed again this month, the yield on Germany’s 10-year bond fell in early trading to its lowest since late July. Markets now show a quarter-point reduction in ECB rates is fully priced by April.

METALS:

Gold dipped slightly, pausing after a sustained rally, as markets await US inflation data. Despite this pause, gold’s value hovers near the seven-month high achieved

earlier in the week, buoyed by the prospect of a dovish pivot from the Federal Reserve, a softening dollar, and a modest uptick in demand for safe-haven assets, which collectively propelled gold’s impressive performance throughout November. Spot gold -0.1%,

silver +0.2%.

ENERGY:

Oil prices ticked higher again after rising more than $1 on Wednesday ahead of a key meeting that will see OPEC+ set output policy into the new year. OPEC+ nears

agreement, after earlier dispute over quotas. Focus is on additional collective cut of at least 1 million barrels/day. OPEC+ hasn’t confirmed yet whether it will hold a press conference at the conclusion of its meeting. This gathering is online, and the group’s

track record over the past couple of years has been erratic. WTI +1.4%, Brent +1.4%, US Nat Gas +1.2%, RBOB +0.7%.

CURRENCIES:

Currency markets reacted to the European data, that included news of a withering French economy. The dollar trimmed monthly losses as the euro fell sharply following

data that showed inflation in France eased more than expected. EURUSD drops 0.3%, still up by the most in a year on a monthly basis. The Swedish krona leads losses in the Group-of-10 currencies, yet it’s still set for its best monthly performance since 2010;

USDSEK is down 6.7% in November. US$ Index +0.45%, EURUSD -0.3%, GBPUSD -0.3%, USDJPY +0.1%, AUDUSD -0.1%, USDSEK +0.9%, USDNOK +0.6%.

Bitcoin +0.1%, Ethereum +0.6%.

TECHNICAL LEVELS:

|

ESZ23 |

10 Year Yield |

Dec Gold |

Jan WTI |

Spot $ Index |

|

|

Resistance |

4652.00 |

5.500% |

|

86.29 |

107.350 |

|

|

4624.00 |

5.325% |

2056.0 |

83.60 |

106.500 |

|

|

4600.00 |

5.000% |

2029.4 |

82.93 |

105.800 |

|

|

4581.00 |

4.725% |

2019.7 |

80.90 |

104.950 |

|

|

4571.50 |

4.625% |

1998.0 |

78.13 |

103.600 |

|

Settlement |

4559.25 |

2067.1 |

77.86 |

||

|

|

4547.00 |

4.185% |

2020.0 |

76.76 |

102.540* |

|

|

4524.50 |

3.930% |

1977.5 |

75.00 |

101.240 |

|

|

4502.00 |

3.640% |

1954.6 |

73.75 |

100.000 |

|

|

4480.00 |

3.245% |

1918.7 |

70.04w |

99.580 |

|

Support |

4447.00 |

3.000% |

1900.0 |

66.80 |

99.000 |

Colors within the report:

Green is always the 200 period (day, week).

Red is always 21,

Blue = 50,

Brown =

100 *Stars have added importance

- Upgrades

- Ally Financial (ALLY) Raised to Outperform at Wolfe; PT $39

- Duke Energy (DUK) Raised to Overweight at Wells Fargo; PT $103

- EverQuote (EVER) Raised to Buy at B Riley; PT $14

- HP Enterprise (HPE) Raised to Equal-Weight at Morgan Stanley; PT $16

- Hudson Pacific (HPP) Raised to Neutral at Goldman; PT $6.25

- Pinterest (PINS) Raised to Buy at Jefferies; PT $41

- QuinStreet (QNST) Raised to Buy at B Riley; PT $19

- Regency Centers (REG) Raised to Buy at Compass Point; PT $72

- Snap (SNAP) Raised to Buy at Jefferies; PT $16

- Spirit Aero (SPR) Raised to Outperform at Baird; PT $36

- TPG (TPG) Raised to Buy at Goldman; PT $43

- Workday (WDAY) Raised to Buy at CFRA; PT $290

- Downgrades

- Acadia Realty (AKR) Cut to Neutral at Compass Point; PT $16

- Bilibili (BILI) ADRs Cut to Underweight at Barclays; PT $10

- Ericsson (ERICB SS) ADRs Cut to Neutral at JPMorgan; PT $5.88

- Farfetch (FTCH) Cut to Neutral at BTIG

- Nokia (NOKIA FH) ADRs Cut to Neutral at JPMorgan; PT $4.39

- Nutrien (NTR CN) Cut to Neutral at BNPP Exane; PT C$76.13

- Okta (OKTA) Cut to Sector Perform at Scotiabank; PT $70

- Cut to Market Perform at Cowen; PT $74

- Cut to Sector Weight at KeyBanc

- Cut to Equal-Weight at Wells Fargo; PT $70

- Petco (WOOF) Cut to Neutral at Baird; PT $3

- Quisitive Technology Sol (QUIS CN) Cut to Market Perform at Raymond James

- Initiations

- Aveanna Healthcare (AVAH) Rated New Sell at UBS; PT $1.50

- Centerra Gold (CG CN) Rated New Buy at Desjardins; PT C$12

- Choice Properties REIT (CHP-U CN) Reinstated Outperform at BMO; PT C$15

- Crombie REIT (CRR-U CN) Reinstated Outperform at BMO; PT C$14.50

- CT REIT (CRT-U CN) Reinstated Market Perform at BMO; PT C$14.50

- First Capital REIT (FCR-U CN) Reinstated Outperform at BMO; PT C$16

- GE Healthcare (GEHC) Rated New Hold at Jefferies; PT $80

- Hyperfine (HYPR) Rated New Hold at Jefferies; PT $1.25

- Kulr Technology Group (KULR) Rated New Speculative Buy at Benchmark

- Lantheus (LNTH) Rated New Buy at Brookline Capital; PT $100

- Lattice Semi (LSCC) Rated New Buy at Deutsche Bank; PT $70

- Molson Coors (TAP) Reinstated Hold at HSBC; PT $68

- Nuvei (NVEI CN) Rated New Buy at Seaport Global Securities; PT $25

- Olympia Financial (OLY CN) Rated New Buy at Fundamental Research

- Paysafe (PSFE) Rated New Hold at Jefferies; PT $11

- Pyxis Oncology (PYXS) Rated New Buy at HC Wainwright; PT $4

- Service Corp (SCI) Rated New Buy at UBS; PT $72

- Stantec (STN CN) Resumed Buy at Desjardins; PT C$104

- Tenaya (TNYA) Rated New Outperform at Leerink; PT $7

- Trane Technologies (TT) Rated New Outperform at CICC; PT $252.96

- Veralto (VLTO) Rated New Buy at Stifel; PT $82

Data sources: Bloomberg, Reuters, CQG

No responses yet