This post goes out as an email to our subscribers every day and is posted for free here around 2 PM ET. To get your real-time copy, sign up for the free or premium version here: Opening Print Subscribe.

Dow’s Historic Decline Amid Mixed Market Signals: All Eyes on Powell [Updated with Lean]

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Our View

The Dow closed down for the ninth straight session, marking its longest downward streak since 1978—a 47-year record. I warned that the middle of December could get rough, but despite this, the ES is still up 0.40%, and the NQ has gained a whopping 5%. While I’ve read comments suggesting not to worry about the Dow’s weakness, any streak lasting 47 years is certainly significant.

Yesterday, retail sales rose by 0.7% in November, while industrial production declined again last month. But again, the Dow remained the weakest performer among the indices. Adding to the challenges, the yield on the 10-year note ended at 4.384%, down slightly from 4.397% on Monday.

Our Lean

It may seem like the rally is over, but the ES is still just 51 points off its contract high. I still believe the Fed wants to continue to paint a happy face on its rate cuts but Powell’s upcoming comments will be very telling.

Our Lean: Watching for a slow grind into the announcement and then the trading reaction to any fed comments and 2pm ET announcement.

MiM and Daily Recap

H25

Z24

The ES came into the morning session with an overnight high of 6152.75 at 11:15 PM, a level that was not revisited. A steady downward drift led to a pre-market low of 6125 at 8:07 AM. The regular trading session opened on the March contract at 6127.50, with a quick stop run after the open, printing an early low at 6121.50 just one minute in. By 9:41 AM, the market formed a higher low at 6123, which initiated some buying into a retest of part of the overnight range.

After trading 6134.75 at 9:56 AM, we reversed back down to print new lows on the day at 6117 by 10:28 AM. This led to another reversal and upside expansion of the range with some exhaustion short covering after the release of the 11:00 AM Housing Market Index numbers which were weaker than expected. This move peaked with a new session high at 6137.50 at 11:11 AM., making way for a pullback that led to a re-test and false breakout, printing 6138.25 at 11:50 AM which proved to be the high for the regular session.

From here, we reversed and started back down again towards the open but held and moved higher. A lunchtime lower high of 6136.25 at 12:45 PM yielded to the next three and a half hours of steady distribution as the ES couldn’t muster any buy-side interest, reaching the day’s low at 6114.25 at 2:24 PM and setting up a late-day short squeeze. This started with a higher low of 6115 at 2:28 PM, which was re-tested just three minutes later. Increased buying volume propelled the ES to 6128.75 by the 3:50 PM MiM release which showed 1.3 billion to sell. Considering the larger sell imbalances we’ve seen over the last week, this release was not enough to overcome the squeeze and additional short covering.

At 3:58 PM, just before the cash close, the ES reached 6133.25, followed by three minutes of position squaring that pushed prices back down through the open. A little more post-market movement brought us to our settle at 6125.75, down 28.25 points (-0.46%). The NQ settled at 22,304.75, down 103.25 points (-0.46%).

Volume for the session increased slightly, with the ES trading 1.83 million contracts and the NQ trading 561,000 contracts. There is lots of news to consider today with economic data releases in the morning, oil inventories, the Fed decision and press conference, and then the Bank of Japan’s rate announcement tonight. All this along with triple-witching on Friday sets up for a few days of higher volatility and wider ranges, but that could also just bring some wider, choppy trade ahead of the holidays.

In the end, this has been some of the weakest trading I’ve seen in a long time, and it has nothing to do with the lean. Regarding the overall tone of the indices, yesterday’s price action didn’t seem like a warm reception for the Fed’s rate cut.

Technical Edge

Fair Values for December 18, 2024:

-

SP: 77.97

-

NQ: 309.19

-

Dow: 522.29

Daily Market Recap 📊

-

NYSE Breadth: 33.4% Upside Volume

-

Nasdaq Breadth: 54.6% Upside Volume

-

Total Breadth: 52.3% Upside Volume

-

NYSE Advance/Decline: 27.3% Advance

-

Nasdaq Advance/Decline: 34.8% Advance

-

Total Advance/Decline: 31.9% Advance

-

NYSE New Highs/New Lows: 43 / 162

-

Nasdaq New Highs/New Lows: 126 / 236

-

NYSE TRIN: 0.57

-

Nasdaq TRIN: 0.46

Weekly Market 📈

-

NYSE Breadth: 39.7% Upside Volume

-

Nasdaq Breadth: 51.6% Upside Volume

-

Total Breadth: 47.2% Upside Volume

-

NYSE Advance/Decline: 26.4% Advance

-

Nasdaq Advance/Decline: 32.0% Advance

-

Total Advance/Decline: 29.9% Advance

-

NYSE New Highs/New Lows: 237 / 141

-

Nasdaq New Highs/New Lows: 497 / 359

Guest Posts

PTG David: Polaris Trading Group

Prior Session: Cycle Day 1 (CD1)

The prior session followed a Textbook Cycle Day 1 (CD1), with price declining to fulfill the projected lower target zone outlined in the prior DTS Briefing (12.17.24).

-

Range: 38.50 handles

-

Volume: 1.146M contracts exchanged

Transition from Cycle Day 1 to Cycle Day 2

-

New Cycle Low: 6114.25 (established late in the session)

This level will serve as a key reference for the current cycle’s performance metrics.

Odds for Rally on Cycle Day 2 (CD2):

-

Rally > 10 handles: 89%

-

Rally > 20 handles: 63%

-

Average Range (CD2): 36.77

Key Economic Reports This Week

-

FOMC Meeting

-

Initial Jobless Claims

-

GDP

-

PCE

-

Rollover and OPEX

FOMC Interest Rate Expectations

-

Expectation: Reduction of interest rates by 25bps to the 4.25-4.50% range.

-

Fed Funds Futures Odds: 99% chance of a 25bps cut (via CME FedWatch).

PTG’s Primary Directive (PD)

Always stay in alignment with the dominant force.

Scenarios for Today’s Trading

Bull Scenario

-

Price sustains a bid above 6125

-

Targets: 6140 – 6145 zone

Bear Scenario

-

Price sustains an offer below 6125

-

Targets: 6115 – 6110 zone

Key Levels

-

PVA High Edge: 6135

-

PVA Low Edge: 6122

-

Prior POC: 6132

Thanks for reading, PTGDavid

Trading Room Summaries

Polaris Trading Group Summary – Tuesday, December 17, 2024

Overall Summary:

Today’s trading session in the Polaris Trading Group room revolved around the anticipated Cycle Day 1 (CD1) decline and its fulfillment. Key insights, strategies, and disciplined risk management were highlighted, with the trading room maintaining a collaborative and educational environment.

Highlights of the Day:

-

Cycle Day 1 Decline Accuracy:

-

PTGDavid pointed out early in the session that the spillover decline hit the projected 6135-6130 target zone, as noted in the Daily Trade Strategy (DTS).

-

The average decline range (22326) was fulfilled, reinforcing the reliability of the Taylor 3-Day Cycle framework.

-

David praised the “uncanny” accuracy of cycle analysis, calling it “voodoo.”

-

-

Morning Trade Action:

-

Focus on opening range mechanics for the NASDAQ (NQ). David explained that a 4-tick breach of either high or low triggers a trade, with stops placed on the opposite side of the range.

-

Lower target zones were successfully fulfilled, aligning with DTS projections.

-

-

PKB Long Setup Success:

-

A mid-morning shift occurred with a PKB (Peek-a-Boo) long setup, triggered when price moved back above the prior low.

-

The play was detailed with references to hurdles like VWAP (Volume Weighted Average Price) and prior levels at 6135, guiding participants through the trade.

-

-

Quiet Midday Period:

-

Lunch saw muted activity, with David emphasizing patience due to unclear directional edge in the price structure.

-

-

Afternoon Momentum and Imbalances:

-

The 2 PM “Shake and Bake” led to renewed opportunities, as PKB longs reclaimed additional structural levels (IB Low and VAL).

-

David noted a $1.1 Billion MOC sell imbalance, providing an end-of-day heads-up for participants.

-

Key Lessons and Takeaways:

-

Trust in Established Frameworks:

-

The Taylor 3-Day Cycle and DTS projections again proved their value, offering accurate directional guidance and target zones.

-

-

Risk Management:

-

Emphasis on stop placement (opposite side of the range) and consistent adherence to strategies was reiterated.

-

-

Educational Insights:

-

David provided explanations of PKB setups and opened discussions on session trends (trend vs. range days), reinforcing foundational knowledge.

-

Community Engagement:

-

The group was interactive, with members like lawr21, DanV, and Jimbo asking clarifying questions and sharing their trades and insights.

-

Participants expressed gratitude for David’s guidance, highlighting the room’s collaborative and supportive environment.

-

An evening class at 4:30 PM ET allowed further learning, with positive feedback from attendees.

Discovery Trading Group Room Preview – December 18, 2024

-

U.S. Markets Overview:

-

Dow Jones fell 0.6% on Tuesday, marking its ninth consecutive loss—the longest streak since 1978. Nvidia (NVDA), a new Dow component, has dropped over 10% since its recent all-time high.

-

The S&P 500 declined 0.4%, while the Nasdaq 100 slid 0.3%.

-

-

Federal Reserve Meeting:

-

The Fed’s final 2024 meeting concludes today, with a rate announcement at 2:00 PM ET.

-

A 25-basis point rate cut is expected, but further cuts may slow to address inflation concerns. Fed Chair Powell’s press conference at 2:30 PM ET could trigger significant market reactions.

-

-

Economic Indicators:

-

Retail sales exceeded expectations, underscoring a resilient economy.

-

Additional data releases today include Building Permits, Housing Starts, and Crude Oil Inventories.

-

-

Japanese Automaker Merger Talks:

-

Honda and Nissan are exploring a potential merger, with speculation about Foxconn’s involvement.

-

Nissan shares jumped 24%, while Honda declined 3%, as companies aim to stay competitive in the EV-focused auto market.

-

-

Brazil’s Fiscal Crisis:

-

Brazil’s currency has fallen 21% against the USD in 2024. The government is grappling with a 10% budget deficit.

-

The central bank implemented a 1-point rate hike, targeting a 14.25% rate by March. Despite challenges, the economy continues to grow, with unemployment near record lows.

-

-

Market Volatility and Technical Levels:

-

December has seen sideways trading in the ES futures. Today’s Fed reaction may set the tone for the remainder of the year.

-

Key technical levels for ES:

-

Support: 6130/33, 5987/92

-

Resistance: 6281/86

-

-

-

Corporate Earnings:

-

No notable earnings reports scheduled for today.

-

Summary: Markets are awaiting today’s Federal Reserve announcements and subsequent Powell commentary, which could significantly shift December’s steady volatility. Global headlines, including the Honda-Nissan merger talks and Brazil’s fiscal struggles, add to the mixed sentiment. Keep an eye on key technical levels and data releases for potential directional cues.

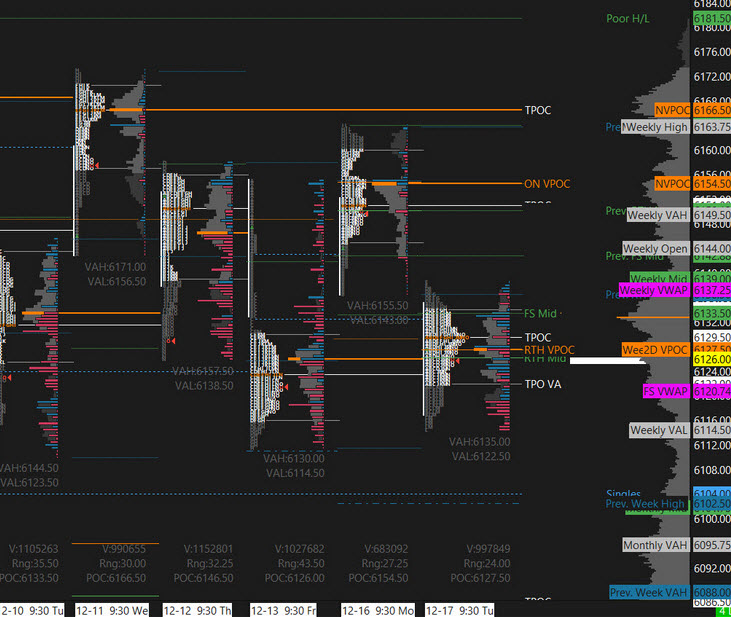

ES -Week to Week

ES is in a flat spin unable to break either way. Fed today at 2 pm ET. Usual behavior is a slow grind higher for the day with an impulse of volatility. The upper end of the trading range is 6171.50 and the downside is 6106.25. We would not consider a trend change until 5991 is touched.

NQ – Week to Week

If we do break higher today we like 22,426 as a touch for the high side. If NQ gives up the ghost we expect 22,052 to be a target.

Calendars

Today

Important Upcoming

Earnings

Affiliate Disclosure: This newsletter may contain affiliate links, which means we may earn a commission if you click through and make a purchase. This comes at no additional cost to you and helps us continue providing valuable content. We only recommend products or services we genuinely believe in. Thank you for your support!

Disclaimer: Charts and analysis are for discussion and education purposes only. I am not a financial advisor, do not give financial advice and am not recommending the buying or selling of any security.

Remember: Not all setups will trigger. Not all setups will be profitable. Not all setups should be taken. These are simply the setups that I have put together for years on my own and what I watch as part of my own “game plan” coming into each day. Good luck!

This post goes out as an email to our subscribers every day and is posted for free here around 2 PM ET. To get your real-time copy, sign up for the free or premium version here: Opening Print Subscribe.

Comments are closed