Following the Path of Least Resistance…Higher

There’s still no fear in the markets

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Every week, MrTopStep invites traders to an “Own the Close” contest where the closest guesstimate where the SPX will settle on Friday’s 4:00 cash close.

The winners get a free week’s access to the MrTopStep Chat and trading tools. Enter your guess now!

Our View

I totally underestimated the Fed Minutes that showed concerns over inflation and cast doubt over further rate cuts and I paid the price.

As soon as the Fed headlines hit the tape, the headline algos took over. I got beat up trying to be long a few times, but the ES kept falling. Eventually though, I got out and got long off the lows and ended up on the day.

Early on I said in the MTS chat that the early quick drops were not a good sign, but I had no idea we would see such a big drop. I did mention the VIX yesterday, which settled at 11.86 on Tuesday, and while it did trade up to the 12.80 level it ended up settling at 12.29.

In other words? There’s still no fear.

Our Lean

Unlike yesterday, there is less noise today.

The ES has been up 11 of the first 16 sessions so far in May, and is up in 9 of the last 13 sessions. The stats are good today and all yesterday’s selloff did was add more shorts.

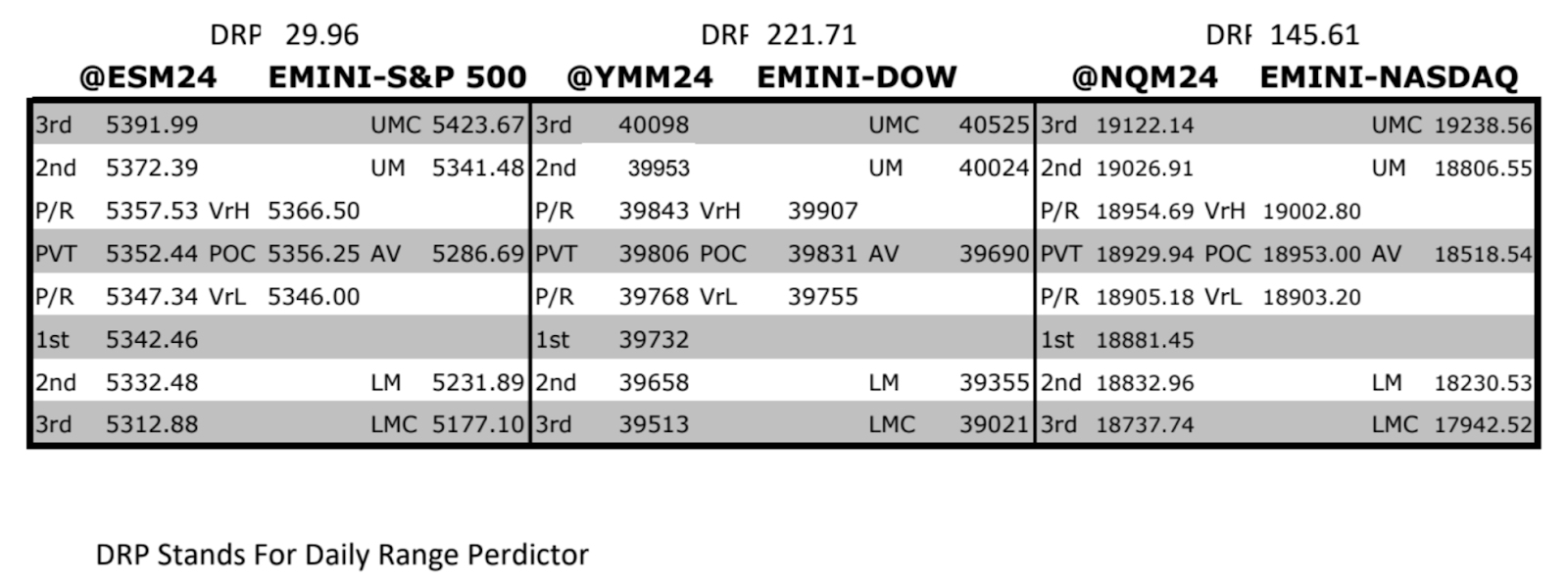

Our lean is for higher prices and buying pullbacks is the path of least resistance. Buy-stops start around 5348.50 and go all the way up to 5385. But that’s not all. If today closes higher, the odds favor Friday being up also and the end of the month looks higher also. Remember, we’re going into a holiday weekend.

MrTopStep Levels:

MiM and Daily Recap

ES recap

The ES traded up to 5349.25 on Globex and opened Wednesday’s regular session at 5338.00. After the open, the ES traded 5337.25, popped to 5340.75, dropped to 5337.75, then rallied to a new high at 5344.00 at 10:03. From there, the ES sold off back to 5339.00 and then rallied up to the early high of the day at 5345.00 at 11:16. Then out of nowhere it dropped 12.25 points down to 5332.50 at 11:50 and then slowly made its way back up to 5343.50 at 1:27 and then in came another 14.25 point drop down to 5329.25. The ES rallied back up to 5338.75 and then sold off down to 5325.25 at 1:45 and rallied up to 5331.00 at 2:00 when the Fed Minutes were released.

The ES slid down to 5313.75 at 2:04, rallied back up to 5326.75 at 2:06 and then dropped down to 5308.25 at 2:30, back-and-filled for a bit, then traded down to 5306.75 at 2:42. After the low, the ES traded up to a 5319.50 double top at 3:18 and then did another dive bomb down to 5308.75 and then ripped up to 5329.25 at 3:30 and then pulled back to the 5316.50 at 3:48 and traded 5315.50 as the 3:50 imbalance showed $1.06 billion to sell, traded down to 5310.75 and traded 5324.75 at 3:58 and traded 5329.25 on the 4:00 cash close.

After 4:00, the ES rallied up to 5336.75, pulled back to 5325.00 at 3:16 and we waited on NVDA earnings at 4:20 when it also announced a 10-for-1 stock split. After the earnings announcement, the ES dropped down to 5310.25 at 4:20:18 and shot up to 5346.50 at 4:20:37 pulled back to the 5336.50 level at 4:20:52, double topped at 5347.00 at 4:21:17 and then sold off under the VWAP down to a 5325.75 double bottom at 4:29:47, rallied back up to 5332.25 at 4:16:32 and then dropped down to 5321.25 at 4:34, rallied back up to 5331.25 at 3:41 and settled at 5328.50, down, 17.25 points or 0.32% on the day. The yield on the 10-year note, a benchmark for mortgages and other borrowing costs, rose to 4.433%, from 4.414% on Tuesday and copper futures pulled back to around $4.87 per pound in their biggest one-day percentage decline since July 2022, having settled Tuesday at an all-time high. Gold futures also edged lower, as did oil prices.

In the end, the early 10 and 12 point drops was the early tell. In terms of the ES’s overall tone, it was all about washing out the weak longs and jamming them back up just before and after the earnings. In terms of the ES’s overall trade, volume was low: 121k traded contracts traded on Globex and despite the oversized movement, only 1.020 million traded on the day session for a total of 1.141 million contracts traded.

Technical Edge

-

NYSE Breadth: 36% Upside Volume

-

Nasdaq Breadth: 65% Upside Volume

-

Advance/Decline: 28% Advance

-

VIX: ~11.50

ES

ES daily (levels in Our Lean)

NQ

NQ Daily

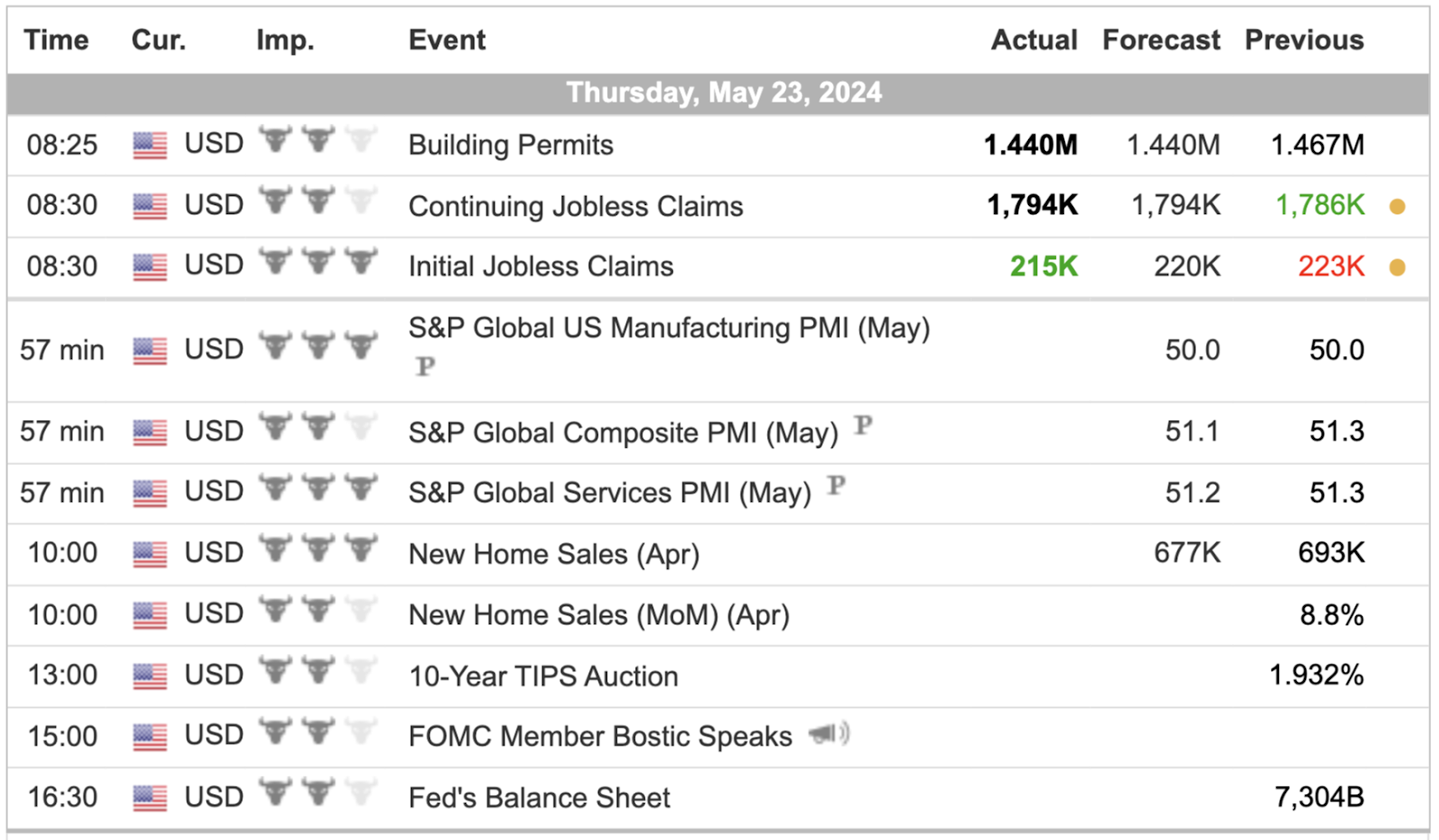

Economic Calendar

For a more complete Economic Calendar see: https://mrtopstep.com/economic-calendar/

Comments are closed