This post goes out as an email to our subscribers every day and is posted for free here around 2 PM ET. To get your real-time copy, sign up for the free or premium version here: Opening Print Subscribe.

From Rally to Drift: ES Faces First Pullback in 9 Days

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Our View

The ES was down about 0.65% when I got up at 6:30 a.m. yesterday. After the open, it was a small push up, then a selloff down to 5655.25 and then the ES slowly rallied up to 5706.25 around 2:40. You could see by the early price action it was going to be a grinder, and it was. I did try to buy the down open, but like I said about the down gaps: they rally a little, reverse to a new low, then go up. I’m not sure why it was so quiet, but maybe people decided on Cinco de Mayo over trading.

There was a late-day walk away — the ES just traded down to the 5671 area after the imbalance showed $600 million to buy, and then down to the 5666 area.

Let’s face it, the 9-day rally came to an end yesterday. There were some headlines: Treasury Secretary Scott Bessent said the administration was very close to some deals, there was stronger-than-expected service sector activity in April, Trump threatened foreign filmmakers and threatened to shut off the college loan spigot, Buffett retiring, and Sketchers going private in a deal worth $9.4 billion.

It was the slowest day in a long time. The ES only had a 51-point range and low volume, there were only 953k contracts traded, the lowest volume in over three months.

Gold is getting close to a technical correction, WTI settled down 2% at $57.13 a barrel (above the day’s low of $55.30), and Brent fell 1.7% to $60.23. U.S. natural gas fell 2.2% following last week’s 17% rally, the bond settled at 114.47, down 0.44%, the 10-year note closed up +0.62%, and Bitcoin was down 3%. The ES settled down 0.66%, the NQ closed down 0.76%, the YM closed down -0.24%, and the RTY closed down 0.77%. Everything is moving!

Our Lean

Aside from the lone economic report — the U.S. trade deficit — there’s a $42 billion 10-year note auction. The only reason I think the volume dropped so much yesterday is that, aside from the Fed’s upcoming two-day meeting and the refunding, there doesn’t seem to be much else driving the market. I still think we should see lower prices, but the stats and the low volume don’t read that way.

Our lean: I can’t rule out selling some early rips, but I still think you can buy the big drops. 5650 is today’s swing number.

MiM and Daily Recap

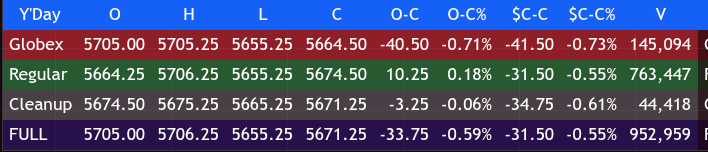

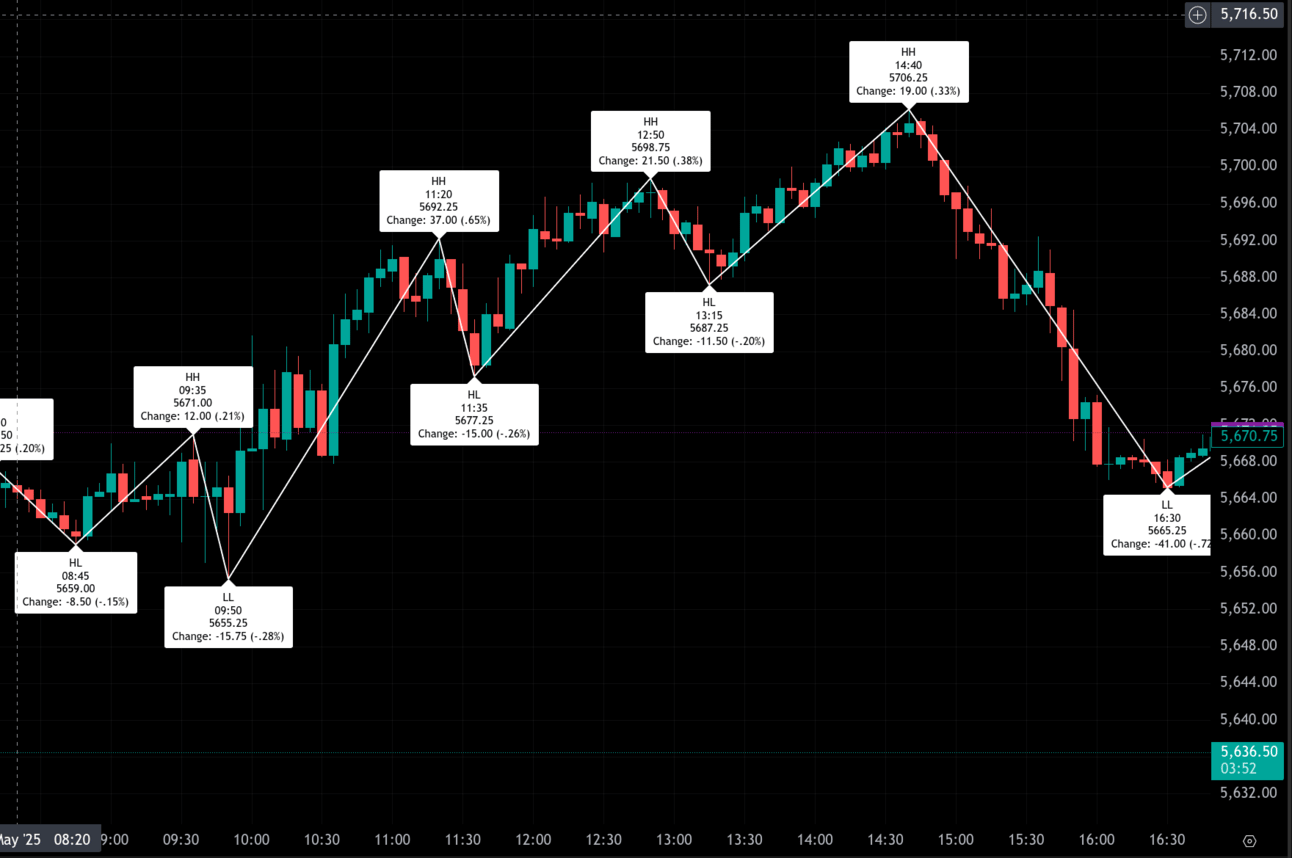

The ES began Monday’s Globex session at 5705.25 and dropped swiftly to a low of 5655.25 at 5:00 AM ET. This overnight drop of 41.50 points (-0.73%) set the stage for early weakness heading into the regular session.

The cash session opened at 5664.25, and buyers attempted to stabilize the tape. An early morning low was established at 5659.00 at 8:45 AM, followed by a rebound to 5671.00 at 9:35 AM, marking a modest 12.00-point rally. However, that push was quickly rejected, sending ES to the regular session low of 5655.25 by 9:50 AM. This formed a double-bottom against the Globex low.

From there, a stronger recovery emerged. The market climbed steadily through the late morning, tagging a higher high at 5692.25 at 11:20 AM—a 37.00-point rally off the prior low. After a brief pullback to 5677.25 at 11:35 AM (-15.00 points), the uptrend resumed. ES advanced to 5698.75 by 12:50 PM, then saw a modest retreat to 5687.25 at 1:15 PM before pushing higher once more into the afternoon.

The day’s peak came at 2:40 PM when ES hit 5706.25, up 51.00 points from the mid-morning low and briefly back above Friday’s settlement. However, this late push failed to hold. A sharp afternoon reversal began, eroding gains rapidly into the close. Sellers drove the market lower into the final hour, culminating in a late-session low of 5665.25 at 4:30 PM, down 41.00 points (-0.72%) from the day’s high.

The regular session closed at 5674.50, up 10.25 points from the open (+0.18%), but still down 31.50 points (-0.55%) from Friday’s 5706.00 cash close. Cleanup trade slightly trimmed gains, ending at 5671.25.

The overall tone was mixed with early downside follow-through from Globex weakness, followed by steady recovery during the morning and early afternoon. While bulls managed to regain some control intraday, the late-day reversal wiped out much of the progress.

Volume in the regular session reached 763,447 contracts, with the full session totaling 952,959, reflecting lighter participation throughout the day. The most notable move came late in the afternoon as the rally faded and sellers pressed into the close.

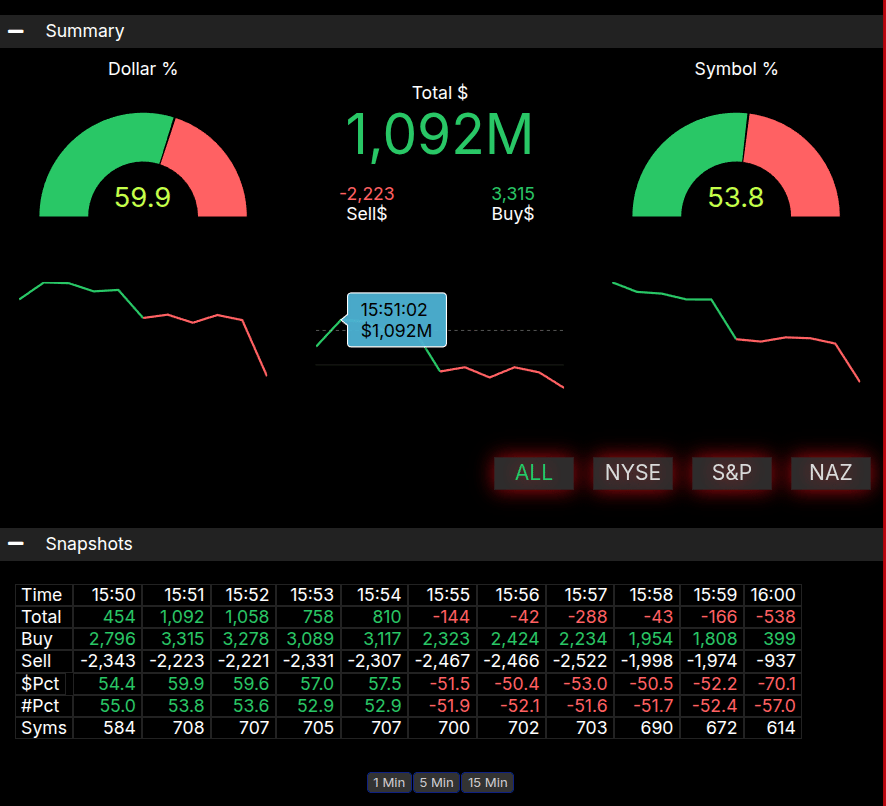

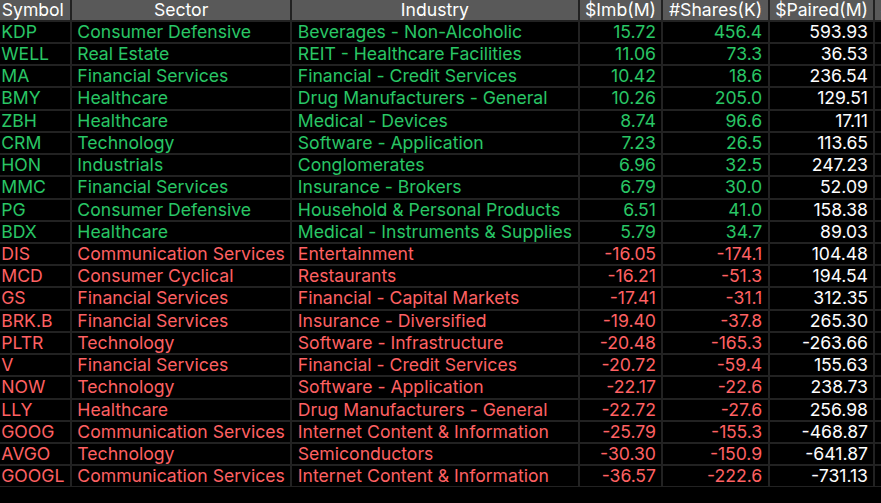

The MiM (Market-on-Close) imbalance was not a significant directional driver. At 3:51 PM, the total imbalance was $1.092B to buy, representing 59.9% of dollar flow, below the 66% threshold for strong conviction. Symbol imbalance ended at 53.8% buy, showing moderate skew but not enough to sustain the rally. Despite this, the closing trade action was notably heavy on the sell side in the final minutes.

In summary, the ES posted a session of two halves: an orderly midday climb and a sharp late-day retreat, closing lower versus the prior session and leaving a neutral-to-bearish tone heading into today.

Technical Edge

MrTopStep Levels:

Fair Values for May 6, 2025:

-

SP: 20.55

-

NQ: 87.27

-

Dow: 98.59

Daily Market Recap 📊

-

For Monday, May 5, 2025

-

NYSE Breadth: 35% Upside Volume

-

Nasdaq Breadth: 43% Upside Volume

-

Total Breadth: 41% Upside Volume

-

NYSE Advance/Decline: 33% Advance

-

Nasdaq Advance/Decline: 36% Advance

-

Total Advance/Decline: 35% Advance

-

NYSE New Highs/New Lows: 55 / 29

-

Nasdaq New Highs/New Lows: 107 / 66

-

NYSE TRIN: 0.81

-

Nasdaq TRIN: 0.75

-

Weekly Breadth Data 📈

-

Week ending Friday, May 2, 2025

-

NYSE Breadth: 59% Upside Volume

-

Nasdaq Breadth: 69% Upside Volume

-

Total Breadth: 65% Upside Volume

-

NYSE Advance/Decline: 72% Advance

-

Nasdaq Advance/Decline: 67% Advance

-

Total Advance/Decline: 69% Advance

-

NYSE New Highs/New Lows: 96 / 72

-

Nasdaq New Highs/New Lows: 215 / 216

-

NYSE TRIN: 0.71

-

Nasdaq TRIN: 0.54

-

Trading Room Summaries

Polaris Trading Group Summary – Monday, May 5, 2025

Overview:

Monday marked the start of a new Cycle Day (Cycle Day 1), and PTGDavid guided the room through a textbook decline rhythm, consistent with expectations outlined in the Daily Trade Strategy (DTS). The session featured disciplined execution around key levels, successful target zone fulfillment, and valuable intraday commentary, making it a productive and instructive day for PTG traders.

Key Highlights:

-

Pre-Market Setup:

PTGDavid shared the daily strategy links and tools early, highlighting that both ES and NQ had already fulfilled their initial downside targets in the overnight session—a strong early confirmation of the DTS framework. -

Cycle Day 1 Dynamics:

As expected for CD1, a decline was anticipated, and the market respected that rhythm throughout the day. Early action saw price oscillating within the Open Range (60–70), later confirming bearish control. -

Trade Execution and Setups:

-

Slatitude39 reported following an ATR 10 short at 5680, aligning with the DTS bearish bias.

-

PTGDavid called a “Dip n Rip” move late morning, warning traders of manipulation designed to trap weak longs.

-

A VWAP resistance rejection at the Open Range High and inability to hold above 580–585 led to a shift in sentiment, setting up for a Gap Fill play.

-

By mid-afternoon, David confirmed the gap was filled, and later the Globex Open Price was tagged, which became a key pivot point for liquidity targeting.

-

-

Late Day Action & Lessons:

-

With the Globex Open filled, David noted buyers vanished and sellers pressed toward 5685 liquidity, which was accurately predicted and confirmed in real-time (“Boom…There’s your liquidity grab @ 5685”).

-

His commentary emphasized liquidity-driven moves, manipulation awareness, and cycle pattern recognition—crucial takeaways for traders.

-

Lessons Learned:

-

Respect the DTS Framework: Both NQ and ES fulfilling initial downside targets gave confidence to the DTS projections.

-

Cycle Rhythm Recognition: Textbook CD1 price action reaffirmed the importance of aligning with expected cycle behavior.

-

Liquidity Awareness: Watching key levels like Globex Open and gap zones helped time entries and exits effectively.

-

Avoiding FOMO/Chase: David’s note that “all the FVG players on screwtube got shut out” was a caution against overhyped strategies not aligned with the day’s structure.

Overall:

A solid session for PTG traders, with clear setups, fulfilled technical targets, and precise market reads. PTGDavid’s real-time guidance helped the room stay on the right side of the trade and highlighted the value of structure-based trading.

Discovery Trading Group Room Preview – Tuesday, May 6, 2025

-

Market Pullback & Trade Optimism Cools

-

S&P 500 dropped 0.6% Monday, ending its longest winning streak in over 20 years.

-

Optimism over potential US-China trade talks has stalled — no formal negotiations yet.

New Trade Front: Movie Tariffs

-

Trump announced plans for 100% tariffs on foreign-produced films to protect Hollywood.

-

Media stocks including Netflix (NFLX), Warner Bros. Discovery (WBD), and Paramount (PARA) fell ~2%.

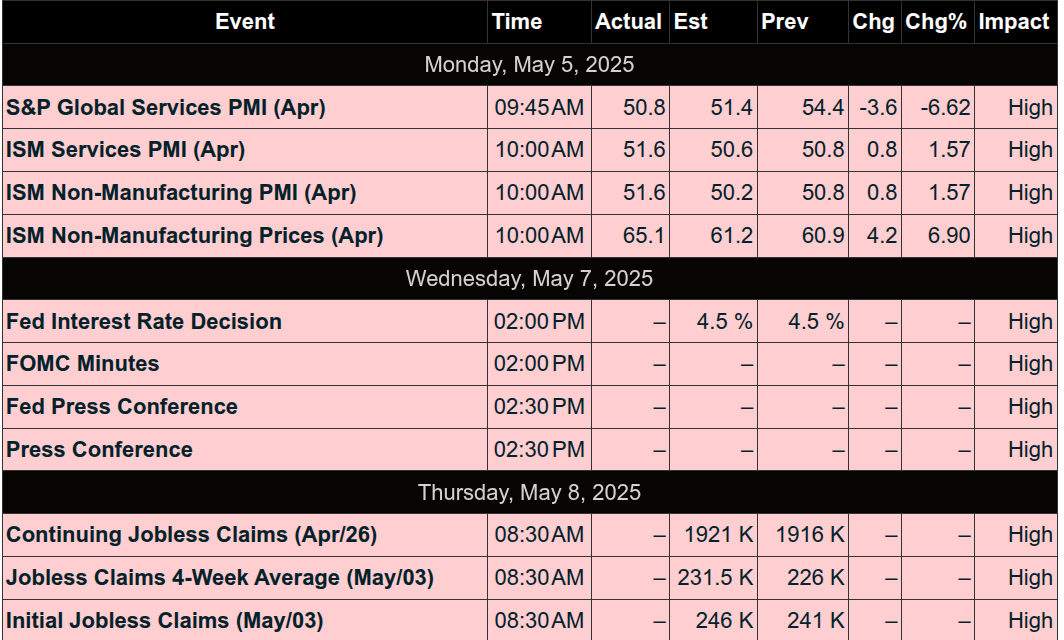

Fed in Focus

-

The Fed begins its May policy meeting today, with a decision expected Wednesday.

-

Rates are expected to remain steady despite Trump’s pressure to cut.

Corporate Impact of Trade Tensions

-

Ford: Beat Q1 earnings but pulled guidance due to a projected $1.5B tariff hit and rare earth material concerns.

-

GM: Warned of a possible $5B tariff-related cost by 2025.

-

Mattel: Moving production out of China, raising prices to offset tariffs; still sources ~60% of its US imports from China.

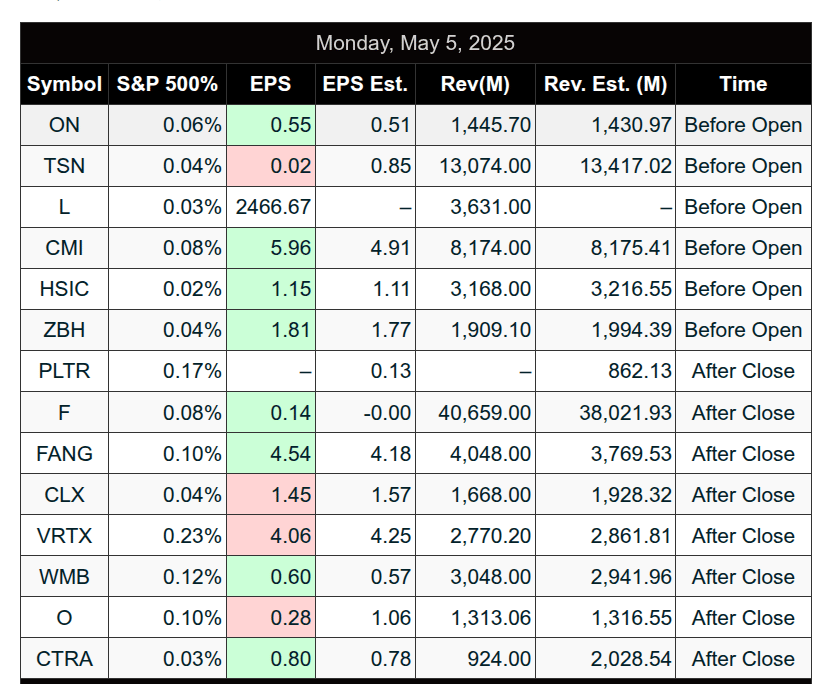

Earnings Lineup

-

Premarket: Marriott (MAR), AEP, ADM, BALL, BAM, CEG, DDOG, and others.

-

After Hours: AMD, Super Micro (SMCI), Rivian (RIVN), EA, SU, and more.

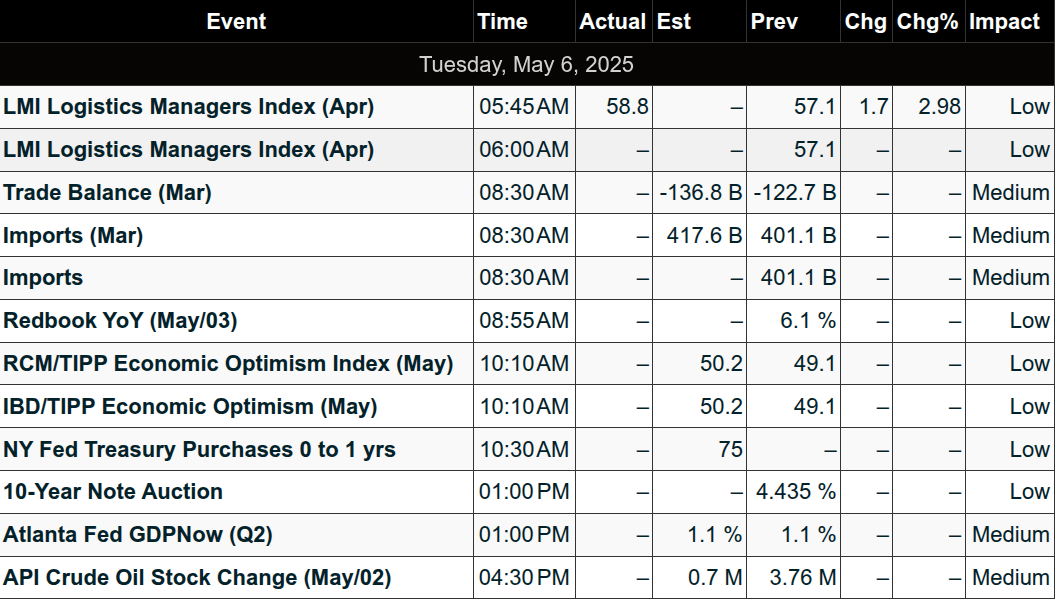

Economic Calendar

-

Trade Balance report due at 8:30am ET.

-

Otherwise, light on macro data.

Volatility & Technicals

-

ES 5-day average daily range: 104 points — high volatility persists.

-

No clear whale bias in overnight volume (light and mixed).

-

ES continues to grind within short-term uptrend channels.

-

50-day MA: 5610.75 as potential support.

-

Trendline resistance: 5836/41

-

Trendline supports: 5542/47, 5226/31, 5110/05, 4950/60

-

-

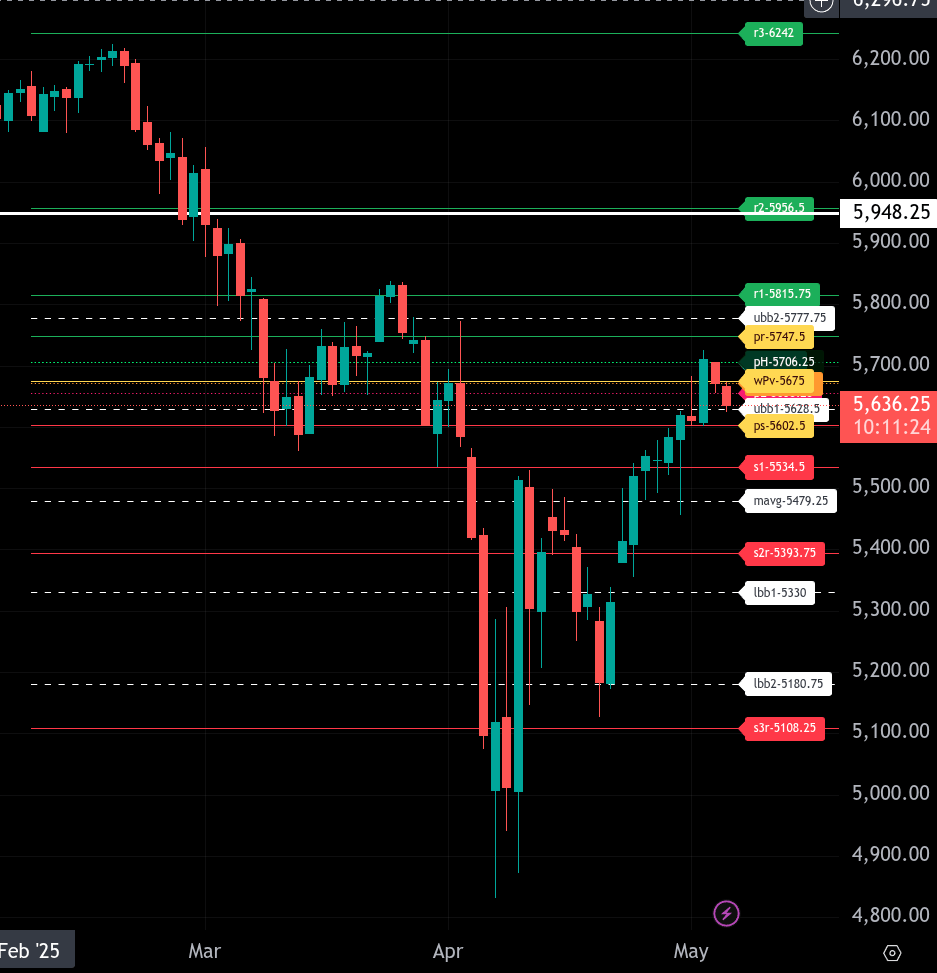

ES

The bull/bear line for ES is at 5675.00. This is the critical level that must be reclaimed for the market to regain bullish footing. Until price can trade and hold above this level, sellers remain in control.

Currently, ES is trading around 5636.25, showing weakness below the bull/bear line. If this pressure persists, we look for downside continuation toward the lower intraday target at 5602.50. Below that, further support comes in at 5534.50 and 5479.25. A break of these areas could open the door to a deeper test near 5393.75.

To the upside, resistance sits first at 5675.00, then at 5706.25, with the upper intraday range target at 5747.50. Sustained price above 5747.50 could shift sentiment more bullish, potentially targeting the next resistance zone around 5777.75 and 5815.75.

The market remains technically bearish below 5675.00, and sellers are likely to press until that level is reclaimed with strength..

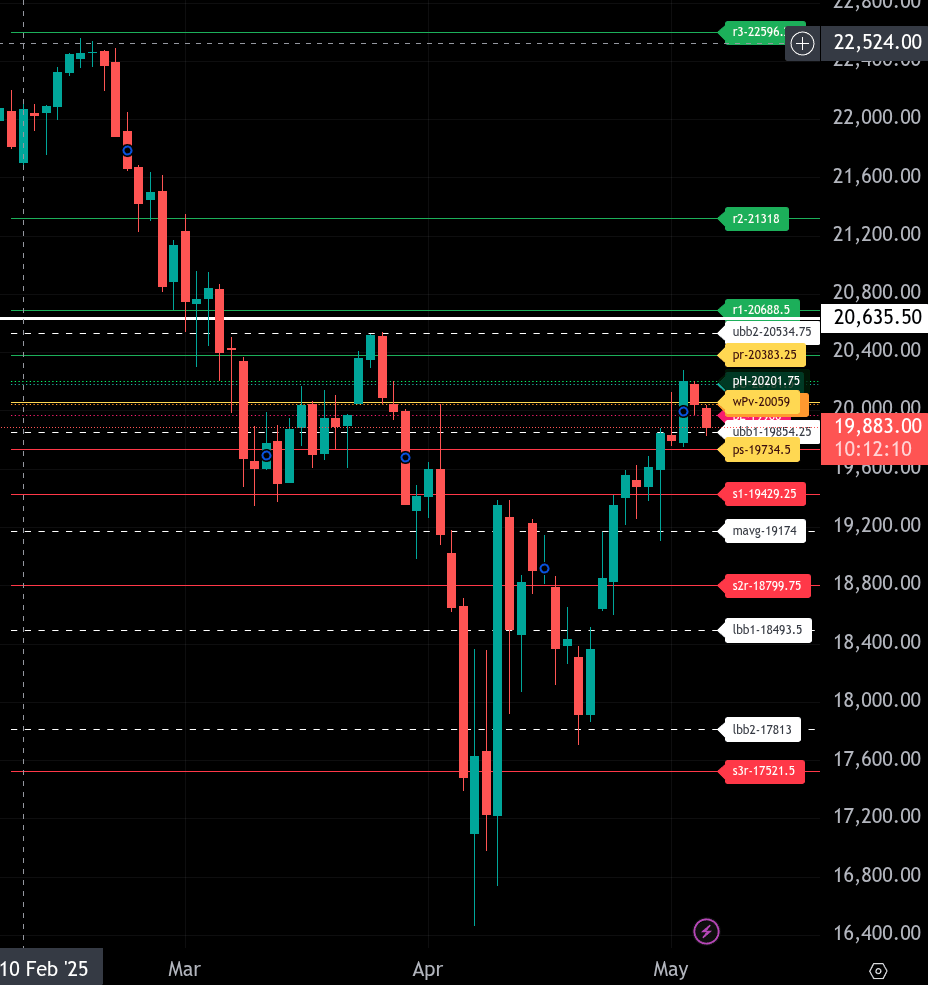

NQ – Week to Week

The bull/bear line for NQ is at 20,059.00. Holding above this level is essential for buyers to maintain short-term control. Below it, the tone shifts to bearish, and sellers are likely to dominate.

NQ is currently trading near 19,894.00, below the bull/bear line. This opens the door for further downside probing toward 19,734.50, our lower intraday range target. A decisive breakdown below that exposes support at 19,429.25 (s1), followed by the 19,174.00 area (mavg) and deeper at 18,799.75 (szr). The lowest structural level for today is 18,493.50 (lbb1), which would only come into play in a major liquidation scenario.

To the upside, resistance begins at 19,966.00 (pL), which coincides with the Globex session’s high. Regaining this level would challenge the bull/bear line at 20,059.00. A sustained move above it targets 20,281.75 (pH), then 20,383.25 (pr), and 20,534.75 (ubb2). If momentum continues, the upper extreme sits at 20,688.50 (r1), with 20,635.50 as the overnight high.

The market remains in a vulnerable state under the 20,059.00 bull/bear pivot. Price action below 19,966.00 favors further downside probing. Bulls need a clear reclaim of 20,059.00 and hold to shift momentum back upward, with 20,383.25 and 20,534.75 as key resistance checkpoints on that path.

Calendars

Economic Calendar

Today

Important Upcoming

Earnings

Affiliate Disclosure: This newsletter may contain affiliate links, which means we may earn a commission if you click through and make a purchase. This comes at no additional cost to you and helps us continue providing valuable content. We only recommend products or services we genuinely believe in. Thank you for your support!

Disclaimer: Charts and analysis are for discussion and education purposes only. I am not a financial advisor, do not give financial advice and am not recommending the buying or selling of any security.

Remember: Not all setups will trigger. Not all setups will be profitable. Not all setups should be taken. These are simply the setups that I have put together for years on my own and what I watch as part of my own “game plan” coming into each day. Good luck!

This post goes out as an email to our subscribers every day and is posted for free here around 2 PM ET. To get your real-time copy, sign up for the free or premium version here: Opening Print Subscribe.

Comments are closed