Gearing Up for Today’s CPI Print

Breaking down yesterday’s late rally

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Every week, MrTopStep invites traders to an “Own the Close” contest where the closest guesstimate where the SPX will settle on Friday’s 4:00 cash close.

The winners get a free week’s access to the MrTopStep Chat and trading tools. Enter your guess now!

Our View

I think if you saw how I trade, over time you would get a feeling about how the words ‘tone and price action’ actually fit in. This was true early yesterday when I got short, but it was much more visible during the last selloff down to 5233.00. Here’s a snippet of my comments in the chatroom:

-

IMPRO : Dboy : (3:13:27 PM) : the slow walk down isn’t good for the sellers

-

IMPRO : Dboy : (3:18:23 PM) : weird time for a buy program

-

IMPRO : Dboy : (3:18:38 PM) : or front running 3:30?

-

IMPRO : Dboy : (3:20:04 PM) : this has acted like it wanted to rally all-day

I don’t have any special indicators, but you could feel how the ES and NQ didn’t want to break down. Then they squeezed higher late in the day.

The other thing I look at is how the ES makes its low and how quickly it rallies off it. When you add the lack of news, that only leaves the headlines BOTs to play with.

Our Lean

If I say it will be quiet today it will be busy and if I say it will be busy it will be dead…

More than likely today will be a mix of both. Everyone is expecting a hot CPI number and most of the hot numbers end up pushing the index markets up. That said, I don’t think this decline is over but I must say the rally was impressive. Either way, the 2:00 Fed Minutes should stir things up a bit also.

Our Lean: Yesterday was another good example of the term “don’t fight the FED.” Let’s face it, the government doesn’t want stocks to fall during an election year but that doesn’t mean there won’t be some declines. My lean, the ES went out with a 7-point premium over the S&P cash. If the ES gaps are higher, I want to sell the open or any 15 to 30-point rips and buy the 15 to 30-point drops. I also want to scale back my trading a bit as I expect a lot of whiplash today. My concern is people already sold and even if the CPI number comes in hot we could see a pop.

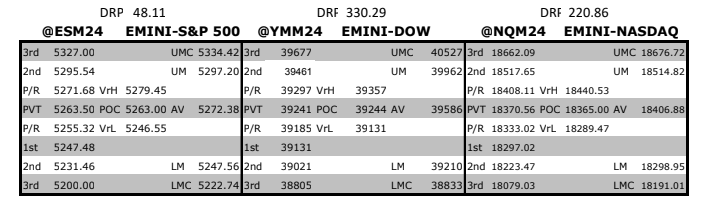

MrTopStep Levels:

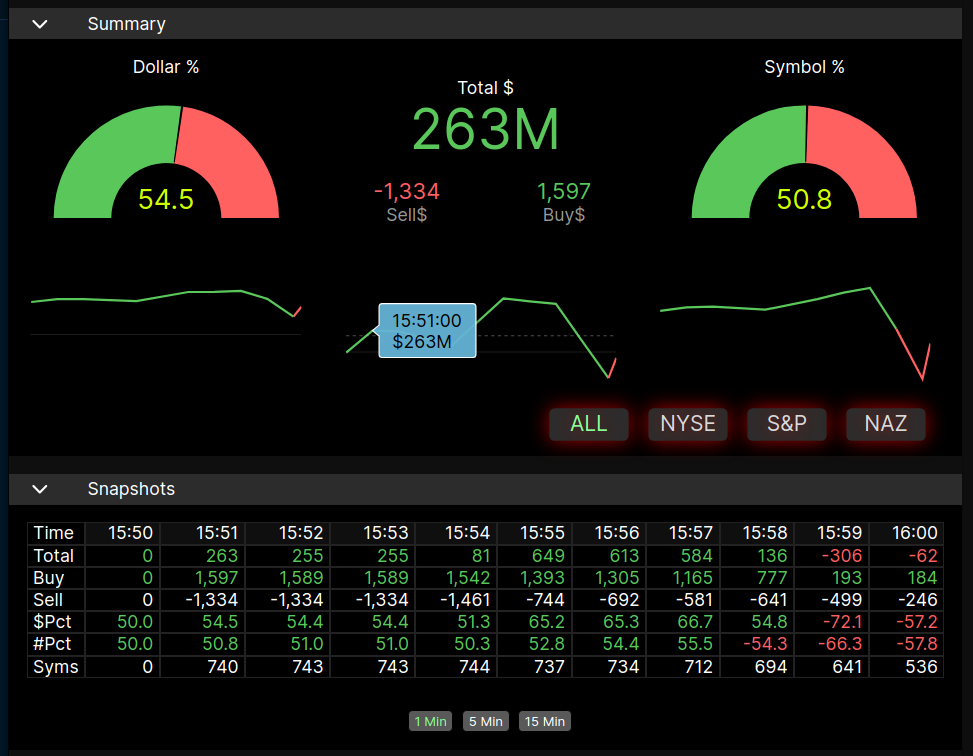

MiM and Daily Recap

ES Recap

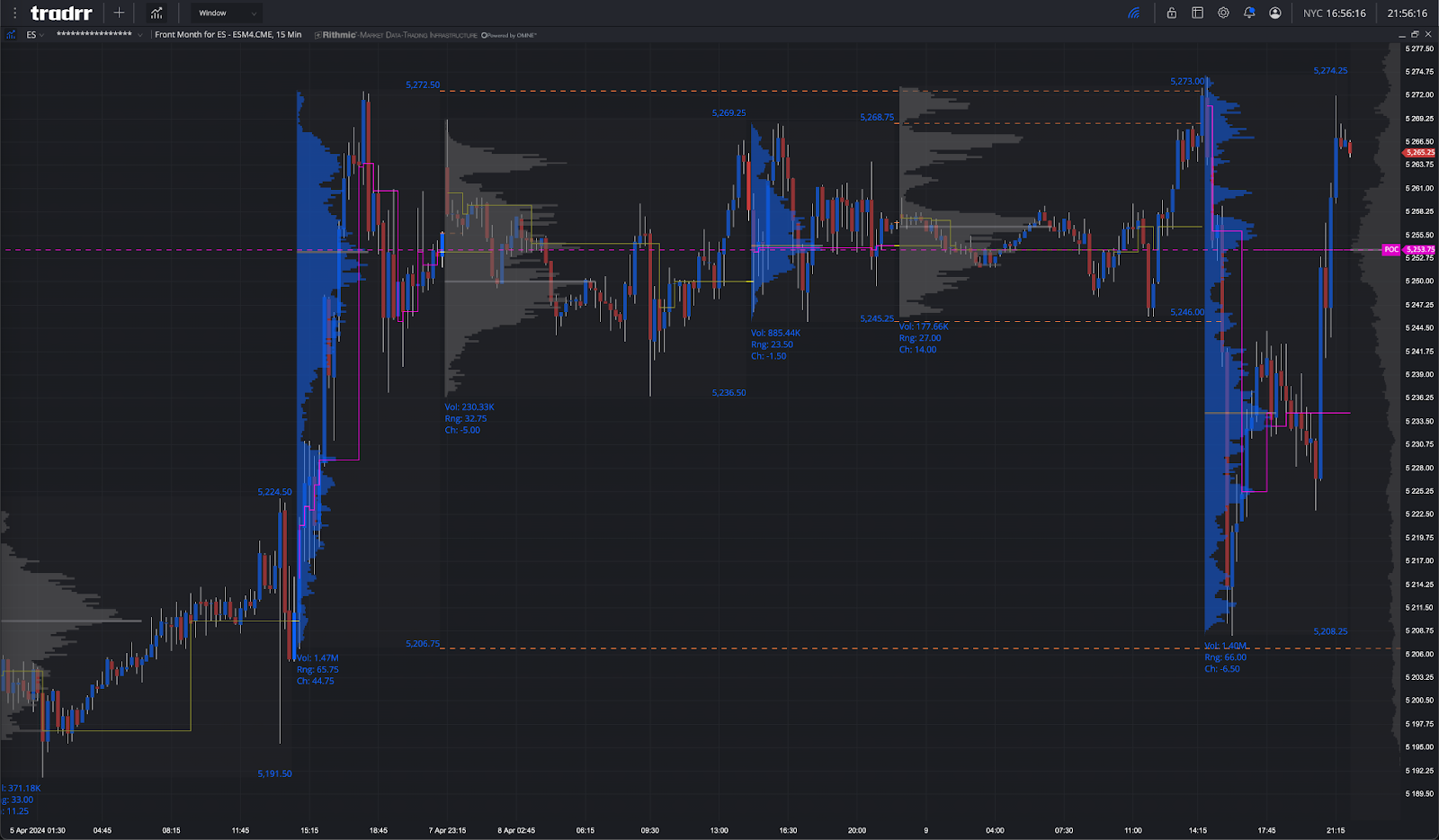

Initially, the ES sold off down to 5246.00, rallied up to 5273.00 at 9:19 am on Globex and opened Tuesday’s regular session at 5271.75. As I said in the View both Monday and Tuesday, the ES is not acting right. After the open, the ES rallied up to 5273.25, made a few lower highs at 5272.25 and 5266.75 and then broke through the VWAP at 5262.00, then broke down to 5255.50. After the low, the ES up-ticked to a 5258.50 double top at 9:51 and then stutter-stepped down to a 5252.50 double bottom at 10:13, rallied up to 1 tick below the VWAP at 5259.00 and then dropped 19 points down to 5240.00. From there, it bounced a few points up to 5243.40 and then chunked its way down to the 5208.25 level at 10:55.

After the low, the ES rallied up to 5222.00, traded down a few points to 5217.00, dipped a few times and traded up to 5231.00 at 11:13, sold back off down to 5222.25 and then rallied up to the 5239.25 level at 12:01, pulled back to 5233.25, then pulled back a few points and railed up to 5244.25 at 12:37, dropped down to 5231.75, back-and-filled for a few minutes and then traded back above the VWAP at 5242.75 at 1:41 and then sold off down to 5228.25 at 2:04.

After the drop, the ES rallied back up to 5239.25 and then slow-walked down to 5223.00 at 3:12 and then rallied 30 points up to 5253.00 in 8 minutes after this Fed headline hit the tape: Fed’s Bostic: I can’t eliminate the possibility that rate cuts move even further out.

After the rip the ES pulled back the ES pulled the ES traded up to a new high for the day at 5257.00 at 3:31:50, up 34 points off the low, and then dropped down to 5241.00. The ES traded 5246.00 as the 3:50 cash imbalance showed $290 million to buy, rallied up to 5260.00, and traded at 5260.75 on the 4:00 cash close. After 4:00 the ES rallied up to another new high at 5272.00 at 4:03 and settled at 5265.50 on the 5:00 futures close, up 12.25 points or 0.23%. The NQ closed up 89.75 points or +0.49% on the day.

In the end, I guess the best thing I can say is there was something for everyone. In terms of the ES’s overall tone, I said several things about how I didn’t think the ES acted badly during the late selloff and I pointed out that the decline was ‘slow walking’ and that it wasn’t bearish. In terms of the ES’s overall trade, volume was steady: 188k traded on Globex, and up until the late rally, the ES volume was OK but not large, but then the late rally pushed it up to 1.39 million on the day session for a total of 1.578 million contracts traded.

Technical Edge

-

NYSE Breadth: 67% Upside Volume

-

Nasdaq Breadth: 69% Upside Volume

-

Advance/Decline: 58% Advance

-

VIX: ~15

ES Daily (Levels in Lean)

Guest Post

Topic: PTG / Taylor 3 Day Cycle

Author: David D Dube’ (a.k.a. PTGDavid)

Website: https://polaristradinggroup.com/

S&P 500 (ES)

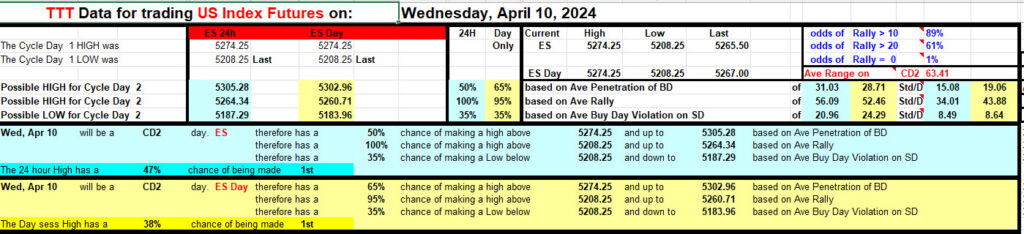

Prior Session was Cycle Day 1: Normal CD1 as price declined fulfilling 5220 Average Decline Target and established a new Cycle Low at 5208.25. Range was 66 handles on 1.591M contracts exchanged.

NOTE: Primary Objective for Cycle Day 1 is to establish a LOW from which to stage the next rally. This session was a “textbook” Cycle Day 1

…Transition from Cycle Day 1 to Cycle Day 2

This leads us into Cycle Day 2: Cycle Day 2 Average Rally (52 – 56 pts) measured from the Cycle Day 1 Low (5208.25) targets 5264.25, which was fulfilled during prior session’s late day squeeze rally. The BIG Event for this session is the all-important CPI inflation gauge. Since today’s average rally is in-place, we’ll defer to greater market forces to determine the next directional lean.

As always, our tactical trade plan remains unchanged…Stay in alignment with dominant intra-day forces. As such, scenarios to consider for today’s trading.

Bull Scenario: Price sustains a bid above 5260, initially targets 5275 – 5280 zone.

Bear Scenario: Price sustains an offer below 5260, initially targets 5245 – 5240 zone.

PVA High Edge = 5256 PVA Low Edge = 5217 Prior POC = 5234

*****The 3 Day Cycle has a 90% probability of fulfilling Positive Cycle Statistics covering 12 years of recorded tracking history.

Thanks for viewing,

PTGDavid

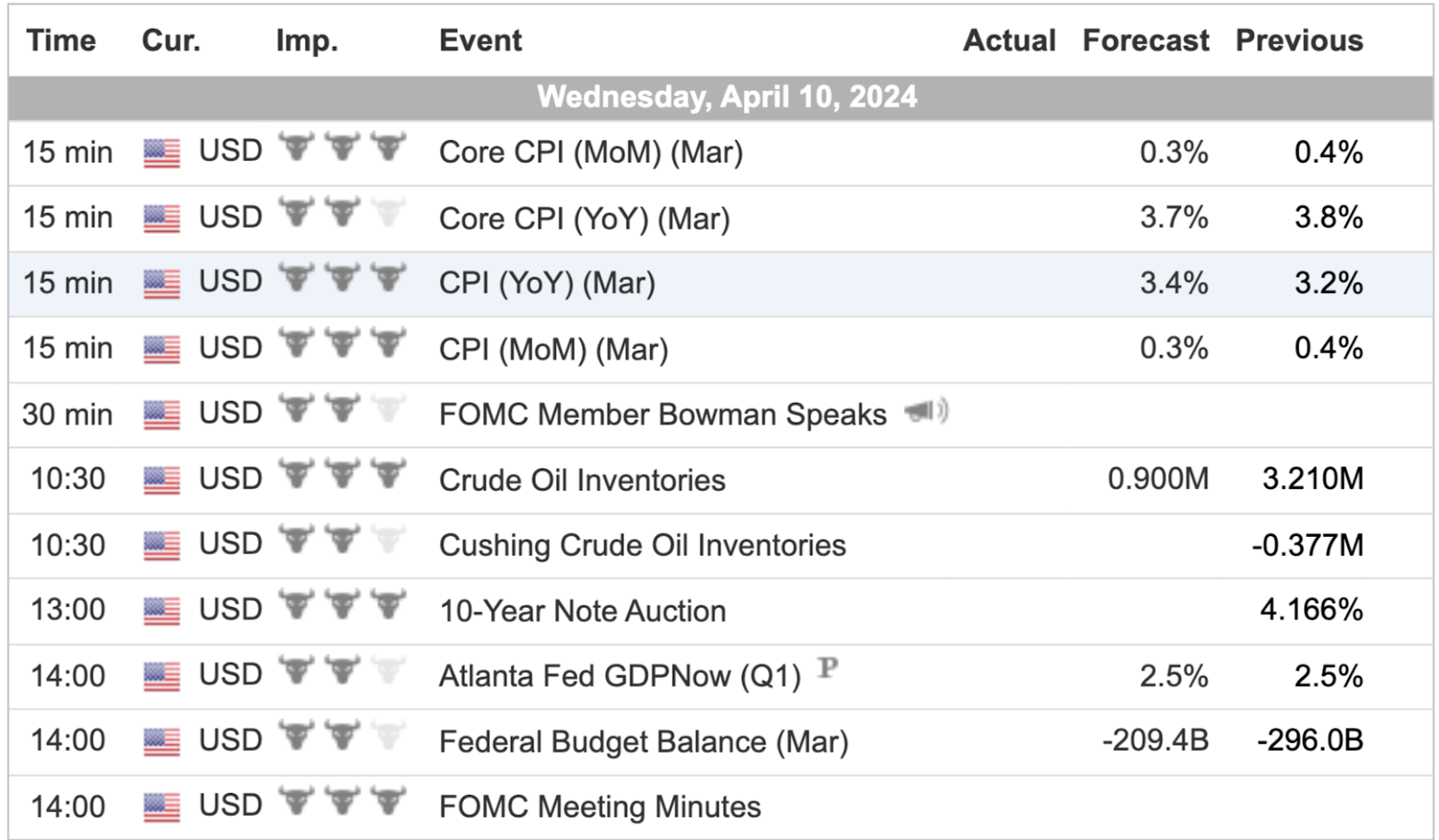

Economic Calendar

Comments are closed