Jobs, Earnings and FRY-Day

Looks for some nice trading ranges today

Follow @MrTopStep on Twitter and please share if you find our work valuable.

Our View

On Wednesday the ES sold off 72 points from its high to its low. Yesterday the ES rallied over 90 points from its low to its high.

There was margin selling on Wednesday and a lot of option positions rolling down, then yesterday the put buyers and short call sellers were getting margin calls and rolling higher as the S&P stormed back.

While yesterday’s rally was a big turnaround, the largest move of the day started at 3:50 to 4:50 when the ES jumped 54 points. That’s after META and AMZN knocked it out of the park, adding to the buy spree we saw throughout the day.

Wednesday’s dip was tied to the Fed, end of the month, and the sluggish reactions out of MSFT, GOOGL and AMD. Just a day later and we had the exact opposite situation.

And while we’re at it, while bonds are under a little pressure this morning, let’s not forget they are up 4% to 5% so far this week.

Our Lean

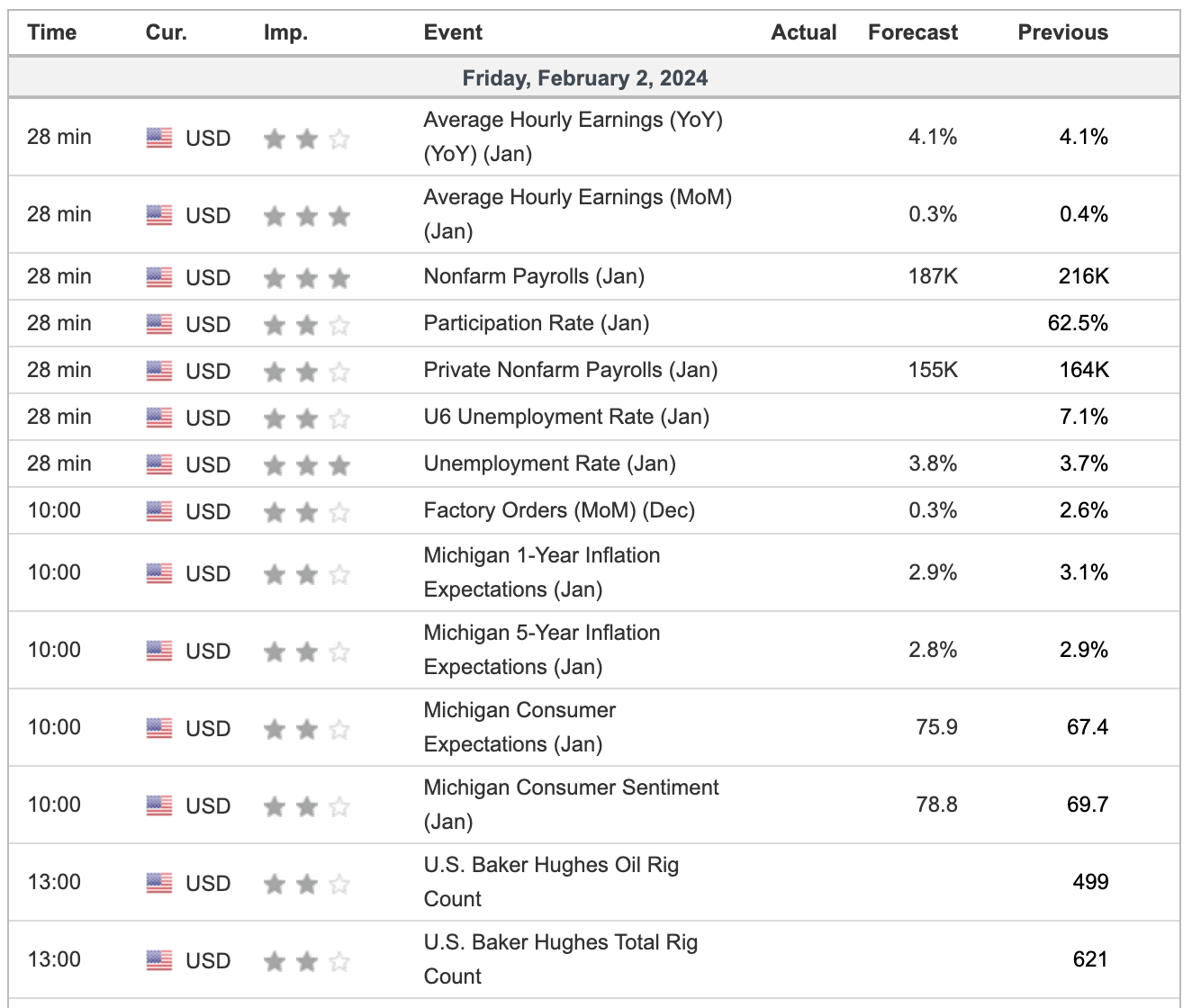

Today is the second trading day of February, the monthly jobs number, and the FRYday options expiration — so it should be another day of big swings.

Our Lean: My wishlist would be for a lower open and then look for some pullbacks to buy, but if the ES gaps higher, we could see some selling on the open. Sometimes highs and lows of the day are made on these gap opens. I don’t think we are going down. but I doubt the ES will go crazy on the upside like it did yesterday.

MiM and Daily Recap

ES Recap

The ES sold off down to 4873.75 at 2:30 am and rallied up to 4895.75 at 8:00 am and opened Thursday’s regular session at 4883.25. After the open, the ES traded 4899.25 at 10:33 and then sold off down to 4874.50 at 11:14. After the low, the ES stutter-stepped up to 4895.00 at 11:58, traded 4892.00 at 12:00 and in one bar rallied all the way up to 4909.75 at 12:12. After the high, the ES dropped down to 4900.50 at 12:38, rallied up to 4919.50 at 12:56 and then dropped down to 4899.00 at 1:08. From there it back-and-filled a bit and traded up to a lower high at 4913.00, sold back down to 4900.50 at 1:38 and rallied back up to 4916.75 at 2:11.

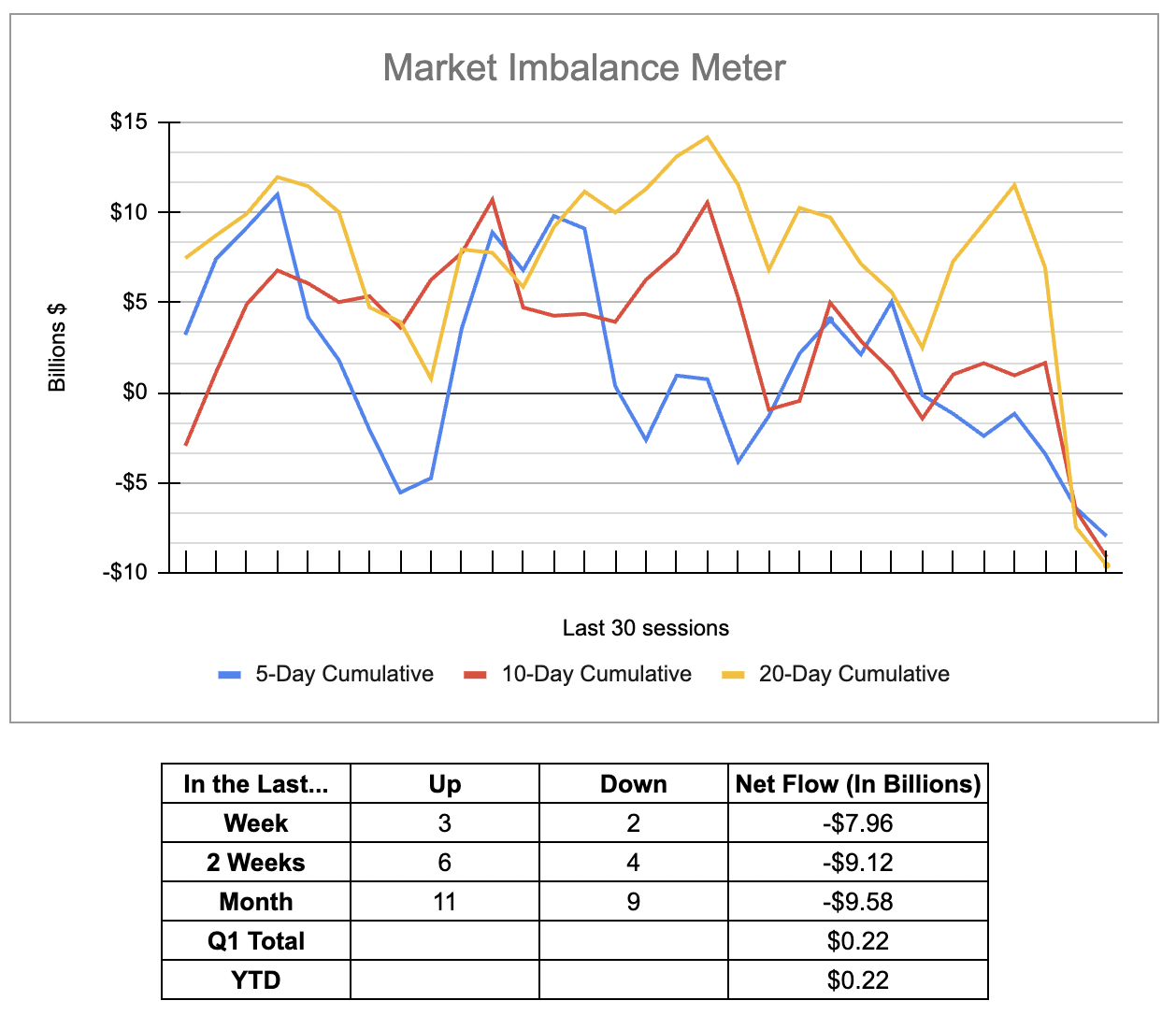

The ES sold back off down to a higher low at 4908.00, rallied back up to 4927.00 and pulled back to 4919.00 at 3:11 as the early MIM showed $289 million to buy. After that, the ES traded back up to 4928.00 at 3:40 and traded 4921.50 as the 3:50 cash imbalance showed $288 million to buy. It traded down to 4919.25, rallied up to 4929.75 and traded 4926.75 on the 4:00 cash close. After 4:00, the ES popped up again after AMZN and META reported better than expected results and traded up to 4954.50 at 4:30, dipped down to 4945.00 and settled at 4959.00, up 87.25 points or + 1.79%.

The NQ settled at 17,628.00, up 367.75 points or +2.13%, the YM (Dow futures) closed at 38,626.00 points, up +0.90, and the RTY settled at 1,980.80 up 24.90 points or up 1.37% on the day. The yield on the 10-year note dropped to 3.862%, from 3.965% on Wednesday. That was the lowest closing level of this year.

In the end, Wednesday was all tech sell programs and weak tech earnings and yesterday was all buy programs and buy stops and positive tech earnings. The ES and NQ were already on the highs or just off, but when the earnings hit it blew out the upside buy stops.

In terms of the ES’s overall tone, it was firm all day, even on the pullbacks. In terms of the ES’s overall trade, volume was steady with 267k traded on Globex and 1.402 million traded on the day session for a total of 1.669 million contracts traded.

Technical Edge

-

NYSE Breadth: 68% Upside Volume

-

Nasdaq Breadth: 67% Upside Volume

-

Advance/Decline: 77% Advance

-

VIX: ~14

ES

Levels from HandelStats.com

-

Upside: Trade above 4961.25 targets 1sd at 4973.21, then 1sd weekly at 4975.41. Trade and hourly close above there targets 4983.49, then 4997.85, then 2 sd at 5002.17. Trade and hourly close above there targets 3 sd at 5031.13.

-

Downside: Trade and hourly close below 4954.75 targets settlement at 4944.25. Trade and hourly close below there targets 4919.50, then -1sd at 4915.29. Hourly close below there targets 4893.50, then -2sd at 4886.33 and 4884.25. Hourly close below there targets 4870.80, then -3 sd at 4857.37.

Guest Post

SpotGamma is one the the shining stars of the options markets. If you have never heard of them or already know of them and have never signed up for their options flow products or the SG Academy, I fully suggest you check them out and add them to your trader’s toolbox.

Here’s a snippet from them:

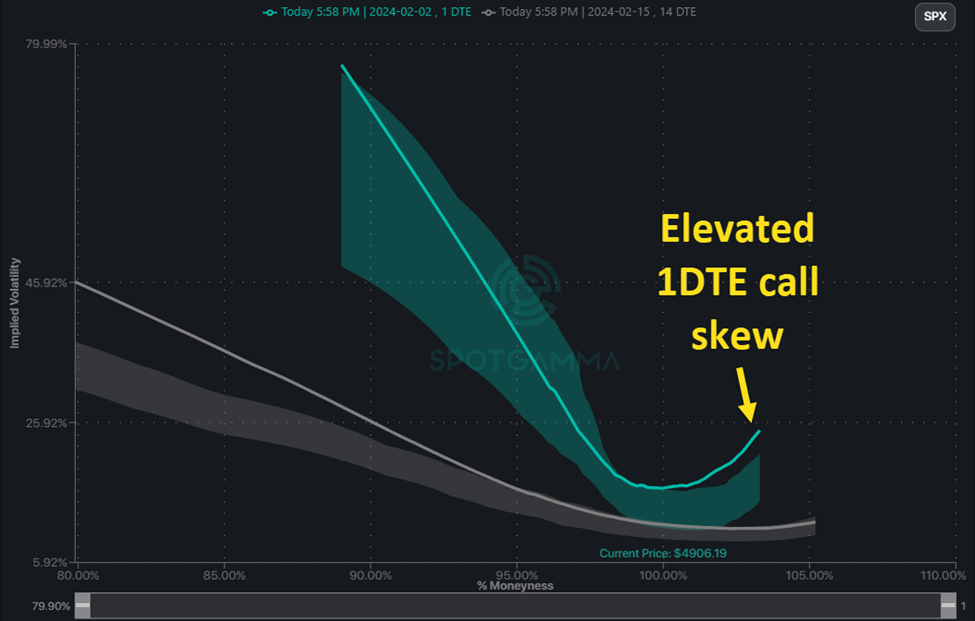

Regarding volatility, the big move up we had today was largely driven by dominant call buying on the S&P 500. This can be seen in how relatively high 1DTE call skew has curved up (compared to its 10-90th percentile range):

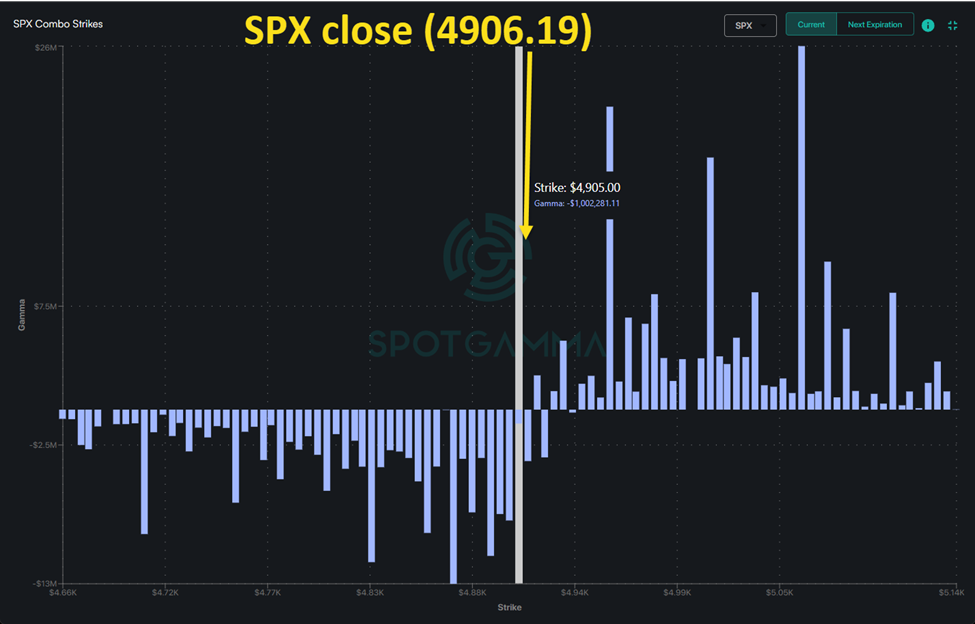

This bounce moved the market back into positive gamma territory with a surge up, and then pulled back to the Volatility Trigger (as well as intraday VWAP for extra confluence). In other words, the equity market really needed that, as well as these powerful earnings. To illustrate how important this surge up was to get back to safety, we are now only barely at the top of the “skittish” range. Per our Combo chart on SPX, we need to be above 4900 for decisive safety.

Economic Calendar

Comments are closed