Rally Is Long in the Tooth, but Bulls Have Control

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Every week, MrTopStep invites traders to an “Own the Close” contest where the closest guesstimate where the SPX will settle on Friday’s 4:00 cash close.

The winners get a free week’s access to the MrTopStep Chat and trading tools. Enter your guess now!

Our View

Up until 2:30, the ES had a 13.25 point trading range. That expanded to 23 points when the future sold off down to a new low at 5305.75 and rallied up to a new daily high at 5328.75 at 4:00.

If you have been bullish, the slower trade has been working in your favor. For the bears though, it’s been a slow death. The current slowdown is generally something we see going into June and July…but this started in April.

The old adage of “selling in May and walking away” has not worked so far, while rising inflation and slower GDP growth has thrown a monkey wrench into the Federal Reserve’s plans to start cutting interest rates. It wasn’t that long ago that the market was pricing in six rate cuts in 2024. I on the other hand was quick to say there was no way the Fed could cut rates because of the potential for sticky inflation and higher interest rates.

When you bundle this together I still think there are significant headwinds for equities even as they make new all-time contract highs…but right now, none of this matters.

Our Lean

I can’t rule out selling a gap-up open or the early rallies, but the ES has been up 10 out of the last 11 sessions. Today should be an up day, but Tuesday is not. I know the trend is your friend and buying weakness is still currently the path of least resistance, but the ES rally is long in the tooth.

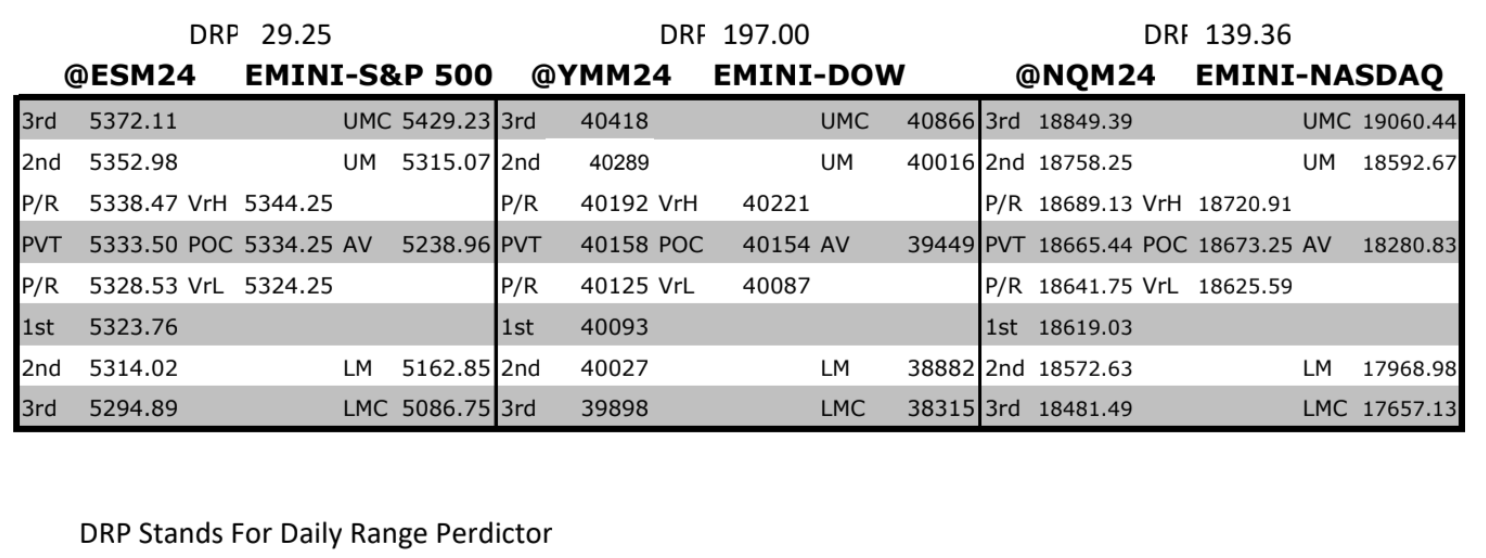

I still see ES 5350, 5375-5380 and 5400 as the next objectives, but the ES and NQ are in need of a pullback.

The trading floor of the CME was not a place for the faint of heart. It was a competitive place where if you were part of the ruling elite, you pretty much got to do anything you wanted without fear of being charged with a trading infraction in the CME’s compliance department.

And if you did get charged? You got off because everything was utterly crooked. Like Jimmy Kaulentis, the head of ABS Broker Group who punched me in the face three times while I was putting orders into the S&P pit for UBS. This kind of shit did not happen at the Chicago Board of Trade CBOT) or the Chicago Board of Options (CBOE). I don’t pretend to be an angel, but I never took kickbacks and I fought with everything I had to protect customer orders and if you asked the PitBull or any of the banks or hedge funds that used my desk, they would say the same thing, that’s why they used me.

Take this piece for example, where I was quoted in Bloomberg:

He even persuaded some to let him manage their money, despite never registering with any financial authority as a broker or adviser. ‘I remember people telling me to stay away from this guy,’ says CME trader Daniel Riley, who encountered Terry two decades ago on the Chicago trading floor and who took their advice.

MrTopStep Levels:

MiM and Daily Recap

ES recap

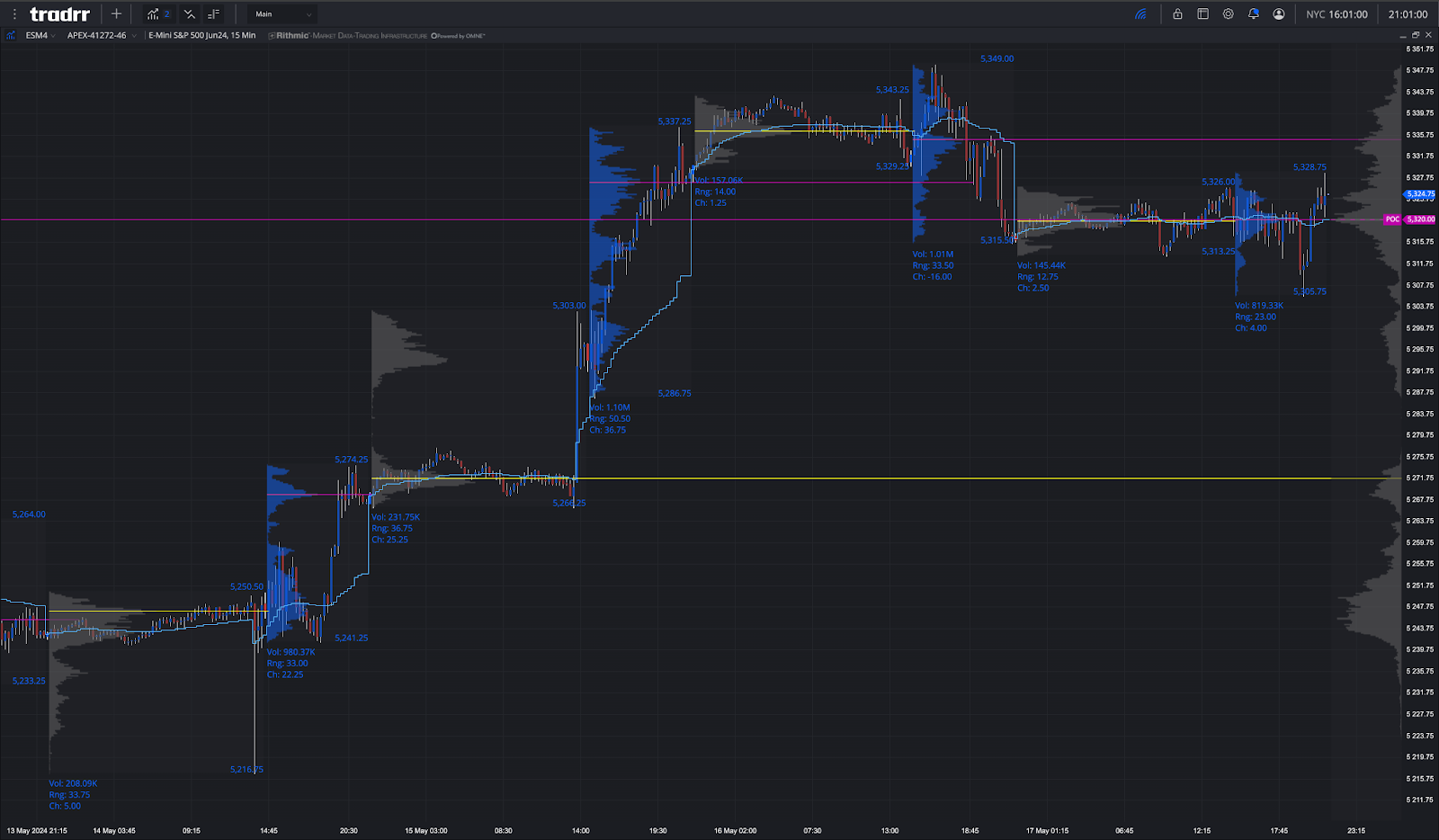

The ES traded up to 5326.00 on Globex and opened Friday’s regular session at 5320.75. After the open, the ES traded up to 5324.25, sold off down to 5315.75, and pulled back to 5316.25 at 11:15. From there, it rallied up to 5325.50 at 11:00 and sold back off down to the 5312.75 level at 1:00.

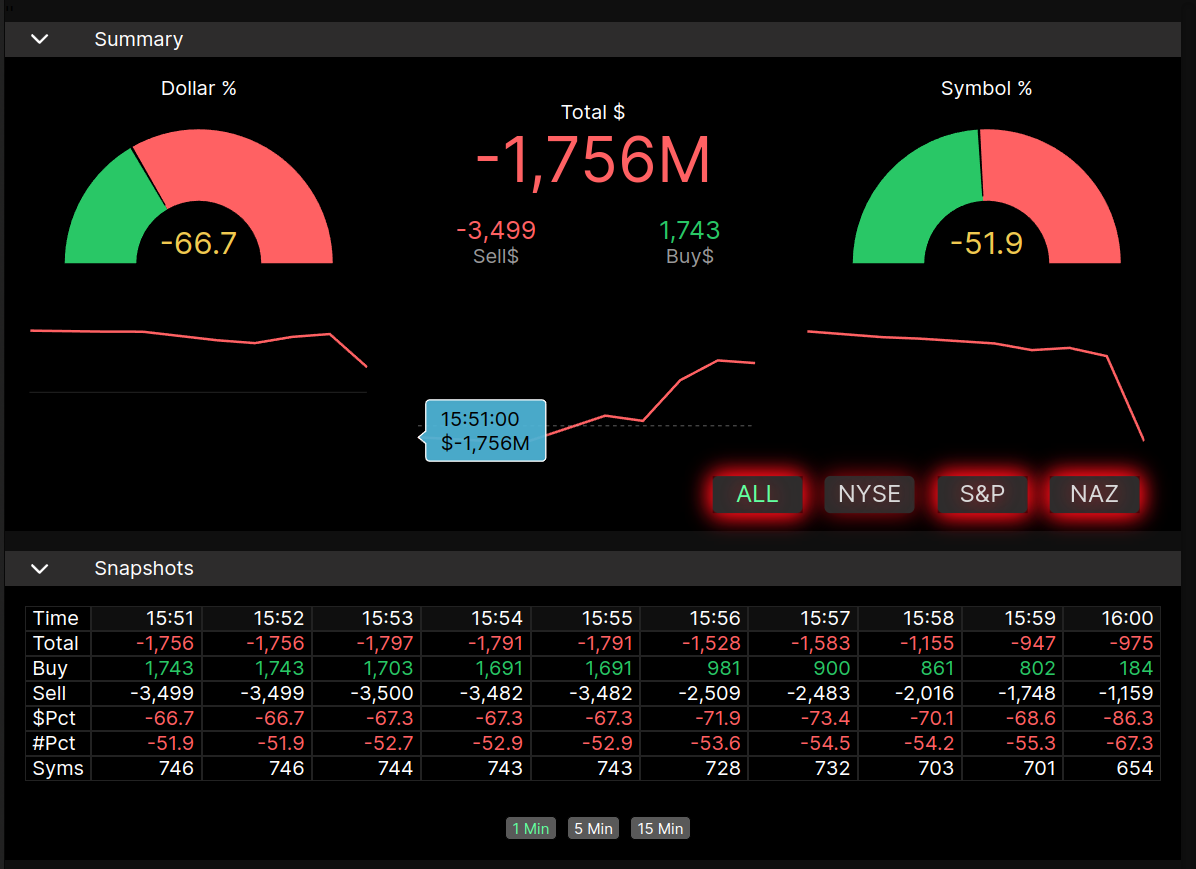

After the low, the ES rallied up to a lower high at 5312.75 at 1:30 and then a sell program hit that pushed the ES down 16 points to 5305.75 at 2:30 and then rallied 16.25 points up to 5322.25 at 3:00. After the drop and pop, the ES traded 5318.75, traded 5322 as the 3:50 cash imbalance showed $1.8 million to sell and traded 5327.75 on the 4:00 cash close and settled at 5372.25 on the 5:00 futures close, up 7 points or +0.30% on the day.

In the end, there have been some slow Friday option expirations recently and this was one of them. In terms of the ES’s overall tone, it was firm. In terms of the ES’s overall trade, volume was low: 156k traded on Globex and 836k traded on the day session for a total of 992k contracts traded.

Treasury yields edged up too. The yield on the 10-year note settled at 4.376%, snapping a three-day streak of declines. Gold settled above $2,400 at 2419.80, up $34.30 or 1.44%, silver also settled on a new high at $31.775, up $1.889 or +6.36%.

Technical Edge

-

NYSE Breadth: 59% Upside Volume

-

Nasdaq Breadth: 37% Upside Volume

-

Advance/Decline: 54% Advance

-

VIX: ~12.25

ES

ES Daily — levels in “Our Lean”

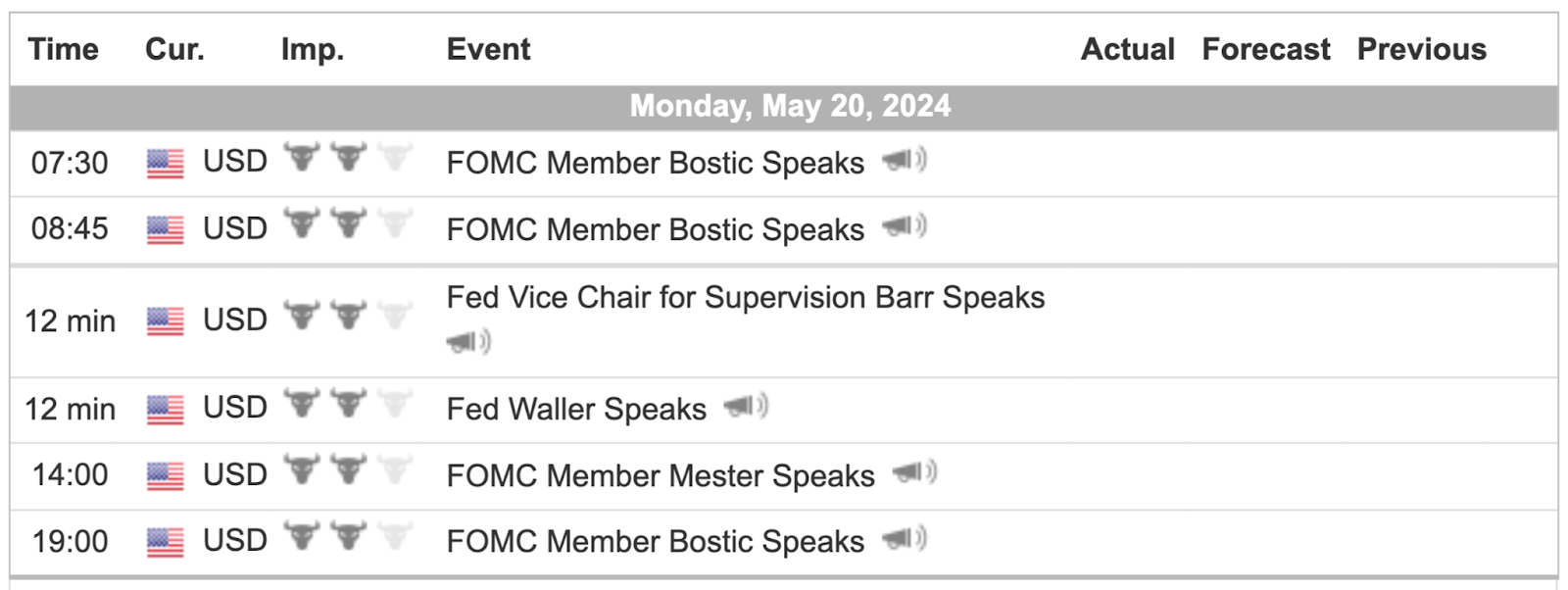

Economic Calendar

For a more complete Economic Calendar see: https://mrtopstep.com/economic-calendar/

Comments are closed