This post goes out as an email to our subscribers every day and is posted for free here around 2 PM ET. To get your real-time copy, sign up for the free or premium version here: Opening Print Subscribe.

The Downfall Of The Dollar

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Our View

Five Reasons the ES and NQ Sold Off

-

Dell (DELL) -8.0% and Marvell Technology (MRVL) -18%, Caterpillar (CAT) fell 3.6%.

-

August MNI Chicago PMI and the University of Michigan’s US August Consumer Sentiment Index fell.

-

@HandelStats “Up Thursday / Down Friday” Rule.

-

Week 5 Friday Options Expiration.

-

End-of-the-month rebalance.

The ES rallied up to 6518.00 on Globex, trading 6499.00 on the 9:30 regular session open. It traded up to 6602.75 and then sold off 43 points down to 6460.25 at 10:15. It rallied to 6475.50 at 10:35, sold off down to the low of the day at 6555.50, rallied up to 6472.00 at 11:06, and then traded in the 6458.50 to 6474.50 range for the next 4 hours.

The ES rallied up to 6476.00, traded 6479.25, fell a few points before the 3:50 imbalance showed $1.5 billion to sell, traded 6462.25 at 3:55, then rallied up to 6479.25 and traded 6475.25 on the 4:00 cash close. It traded 6472.75 on the 5:00 futures close, down 44.75 points or -0.69% on the day. The NQ settled at 23,461.75, down 307.25 points or -1.29%.

In the end, the ES and NQ were weighed down by weakness in technology stocks and economic reports. In terms of overall tone, it was all about the failed rallies. Volume was higher, with 1.275 million contracts traded.

On Sunday night, the ES opened at 6478.75, up 3.75 points, made a low at 6459.50, and settled at 6479.75, up 7 points or +0.11% on volume of 118k lots.

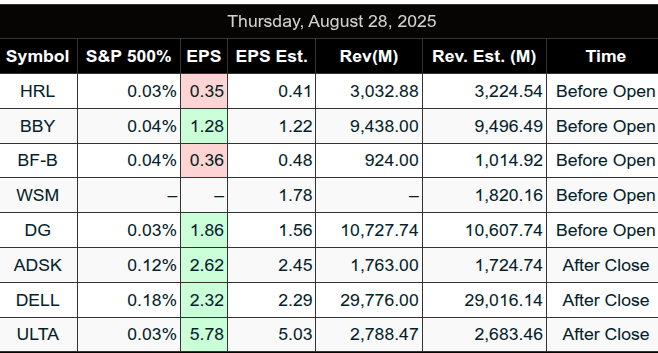

This week includes 15 economic reports, four Fed speakers, and the Senate Banking nomination hearing for Stephen Miran to be Fed Governor. The 2Q 2025 earnings season is 98% complete.

Dollar Demise

The most important currency in the world is under attack—the US dollar. I don’t think Trump helped its cause when he placed a 50% tariff on India. The U.S. and India have had an evolving, often strained relationship since India’s independence in 1947, following the end of British rule. Relations have moved from periods of estrangement during the Cold War to a strong strategic partnership in the 21st century, especially after India was named a major defense partner in 2016 and a civilian nuclear deal in 2008.

Additionally, India has been a major holdout in the expansion of BRICS, the new currency bloc designed to counter the U.S. dollar. Original BRICS members were Brazil, Russia, India, China, and South Africa. Nine additional countries were recently announced as partners: Belarus, Bolivia, Cuba, Kazakhstan, Malaysia, Thailand, Uganda, Uzbekistan, and Nigeria.

While China and Russia continue to push the initiative, India has advocated a more cautious and structured approach, primarily due to strategic competition with China. While India ultimately supported the expansion, it did so with specific motivations and concerns, including ongoing border disputes, strong opposition to the Belt and Road Initiative (BRI), and resistance to turning BRICS into an explicitly anti-Western currency.

Over the weekend, Chinese President Xi Jinping reiterated his vision for a new global economic and security order that prioritizes the “Global South.” In a direct challenge to the United States during a summit that included Russia and India, Xi said:

“We must continue to take a clear stand against hegemonism and power politics, and practice true multilateralism.”

This was a thinly veiled swipe at the United States and Trump’s tariff policies. Xi also called for the creation of a new SCO development bank, which would mark a major step in the bloc’s long-held aspiration of developing an alternative payment system to circumvent the U.S. dollar and its global sanction power.

At a point when US and India relations were at their highest levels, Trump decided to pull India into the fray, pushing them back toward Russia and China. The jury is still out on BRICS, but clearly, U.S. policy may have moved the bar higher.

Our View

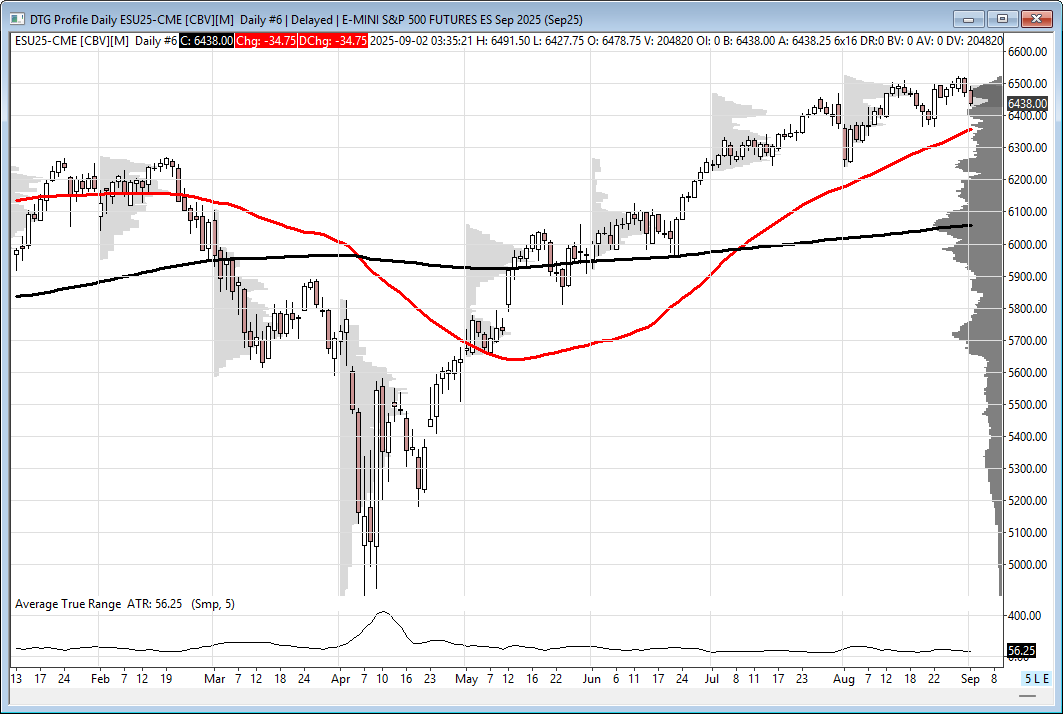

The ES has rallied 30.48% from its April 7 low and is now up over 10% on the year. It got through August with flying colors, but September has historically been the worst-performing month for the S&P 500, with an average decline of about 1.2% since 1928 and negative returns in 56% of those years.

The worst September was during the 2008 credit crisis, when Lehman Brothers collapsed—ES dropped 9.3% for the month. Their desk was right above mine on the floor. In 2024, the ES snapped a three-week winning streak and dropped a record 4.25% in the first week, marking its worst September start since 1953. Over the last 5 years, it has averaged a -4.2% return; over the last 10 years, -2%, and over 25 years, -1.5%. No matter how you do the math, September is a tough month.

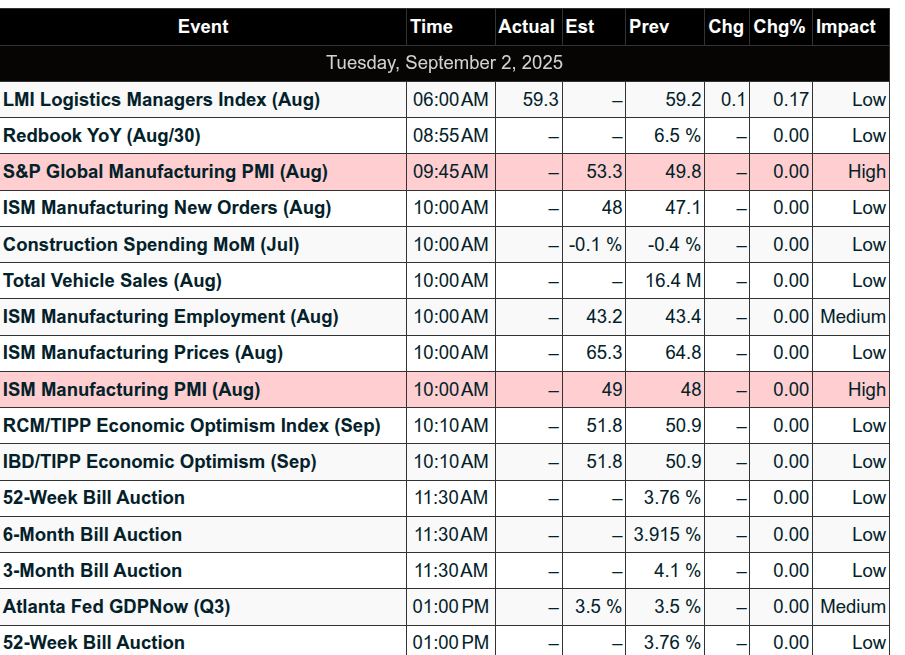

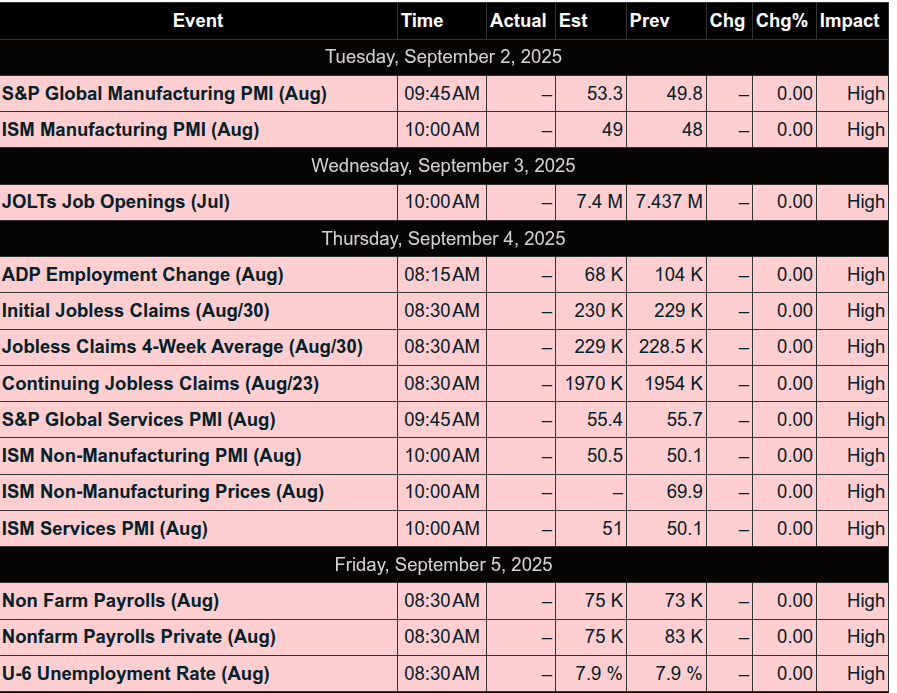

September and October were always rough, and I expect we’ll see this part of this possibly starting this week with today’s ISM and S&P PMI, Thursday’s CPI, and Friday’s jobs number.

Our Lean

Despite the constant news flow, the ES is only 20 points away from 6600 and 43 points off its all-time high at 6523, which is the key to the next move up. While price action has been weak, the Stock Trader’s Almanac shows the day after Labor Day is historically mixed:

-

Dow up 16 of the last 30, but down 11 of the last 14

-

S&P up 18 of the last 29, but down 9 of the last 16

-

S&P has opened the month strong in 18 of the last 29 years, but tends to close weak due to end-of-quarter mutual fund restructuring

-

The last trading day of September has been down 20 of the last 31 years

-

September Quadruple Witching can be a dangerous week

To summarize, we could see more sideways chop until after the middle of the month.

Our lean: As we roll into an unseasonably soft September off the heel of the BRICS meeting, the court ruling that says most of Trump’s global tariffs are illegal, the CAC and FTSE are weak, and the DAX is down 1.5%, with NVDA also down 1.5%. I think we could be in for some weakness.

6418 is critical, and 6408 is the level to watch — that’s the 38.2% Fibonacci retracement from the August 1 low. Below that, 6390–6388 and 6365.00 are key support levels.

I’ll be looking to buy the early weakness using stops and to sell any 30 to 50-point rallies.

MiM and Daily Recap

ES Futures Recap – Friday

Intraday Recap

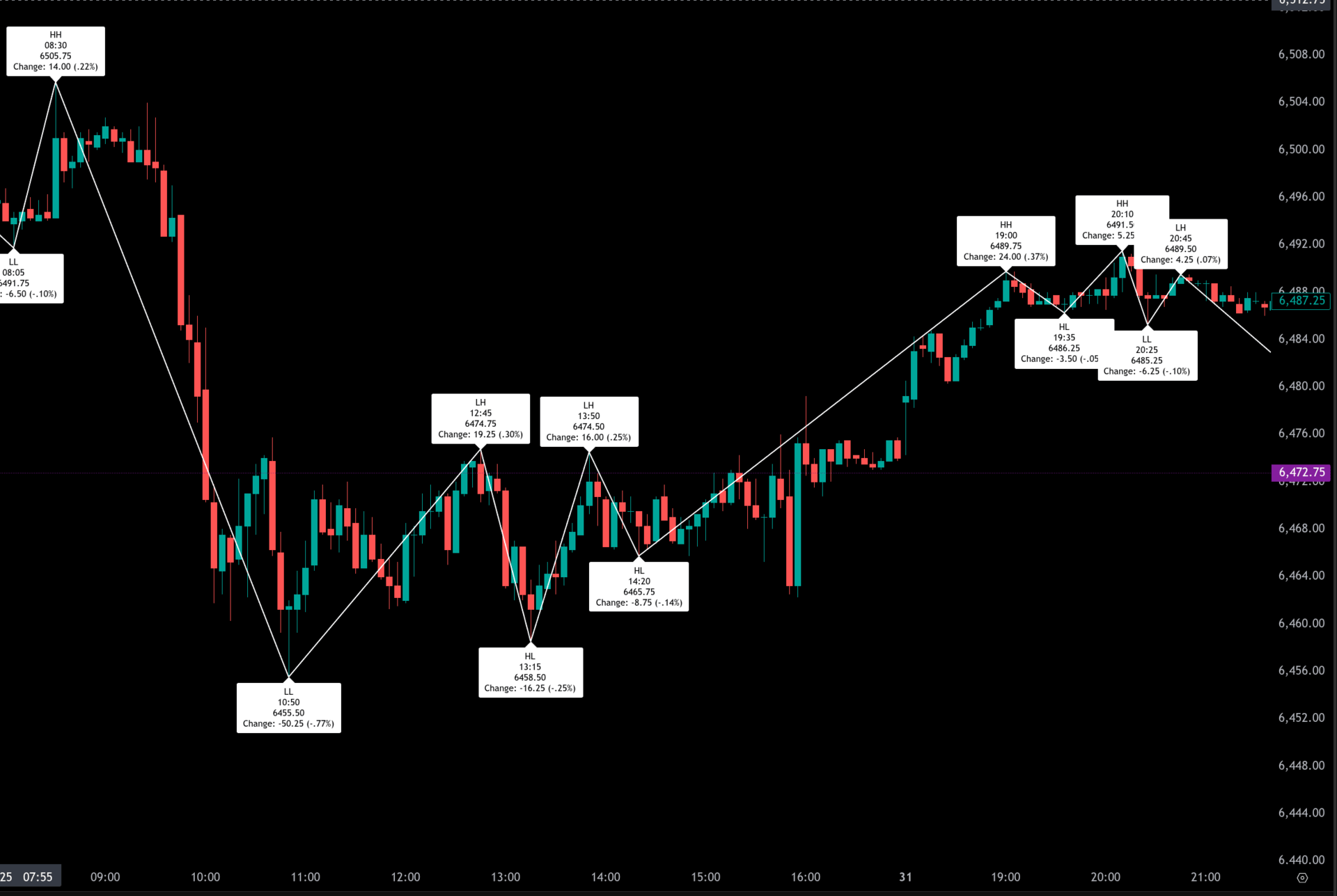

The ES market action heading into and through Friday showed signs of hesitation after recent strength. Overnight Globex trade began Thursday evening at 6516.75, traded pretty much into a tight range until sellers came in at 3:10 and pushed the contract down 23 points to 6488.75. There was a slight push from there into the cash open of 6499. Overall, the market lost 17 points from its open.

The regular session opened at 6499.00 and immediately fell into pressure, posting a sharp low of 6455.50 at 10:50. That represented a 45-point slide from the open. Buyers stepped in around midday, producing a rebound toward 6474.75 by 12:45. Another test of 6465.75 at 14:20 gave way to steadier upside into the late afternoon. The market ended up closing at 6474, a 25-point slide from the open.

Market Tone & Notable Factors

Overall sentiment leaned cautious. The overnight Globex trade showed clear selling pressure with successive lower highs and lows, culminating in the early morning flush. Cash session action offered stabilization, with buyers preventing a deeper breakdown after the 6455.50 low, but recovery lacked real momentum. The ability to finish above the prior day’s settlement was a small positive, though ranges were compressed and buyers were hesitant.

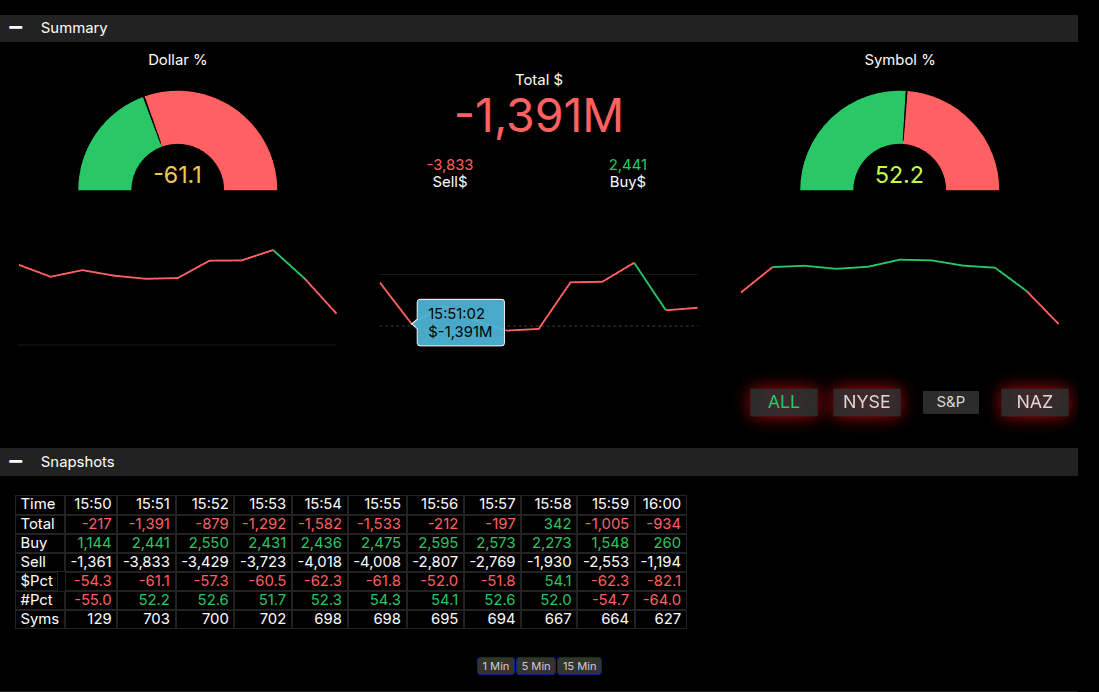

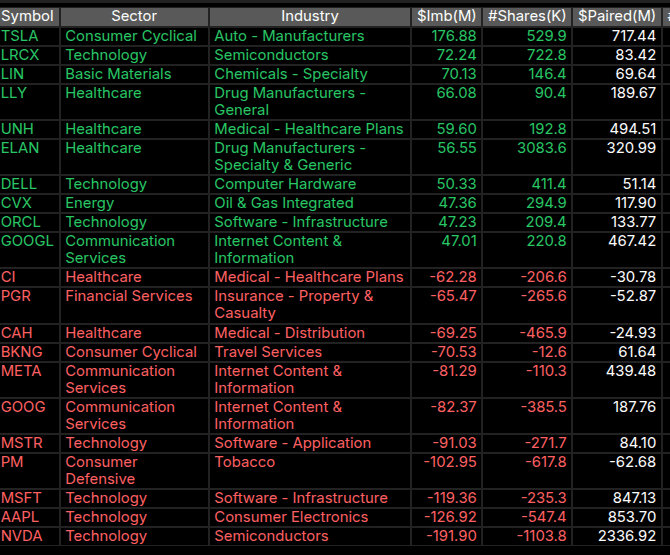

The Market-on-Close imbalance data confirmed a defensive tone. At 15:51 ET, imbalance levels reached -$1.39B to sell, with sell programs outweighing buy flow by a wide margin. While the symbol imbalance held at 52.2%—not an extreme reading—the dollar imbalance reflected notable institutional selling. This helped limit late-session upside and kept ES capped just below 6492 into the close.

In sum, the day carried a neutral-to-slightly bearish tone. While the regular session held its ground with a modest positive cash-to-cash gain, the backdrop of heavy MOC selling and weak overnight structure suggested traders remain cautious heading into the holiday-shortened week. Focus now shifts to whether buyers can defend 6450 on future retests or if sellers use the holiday gap to press the market lower.

Technical Edge

Fair Values for September 2, 2025:

-

SP: 10.22

-

NQ: 43.63

-

Dow: 60.1

Daily Market Recap 📊

For Friday, August 29, 2025

• NYSE Breadth: 51.9% Upside Volume

• Nasdaq Breadth: 47.7% Upside Volume

• Total Breadth: 48.2% Upside Volume

• NYSE Advance/Decline: 49% Advance

• Nasdaq Advance/Decline: 38.9% Advance

• Total Advance/Decline: 42.7% Advance

• NYSE New Highs/New Lows: 108 / 7

• Nasdaq New Highs/New Lows: 133 / 69

• NYSE TRIN: 0.81

• Nasdaq TRIN: 0.69

Weekly Breadth Data 📈

For Week Ending Friday, August 29, 2025

• NYSE Breadth: 52.7% Upside Volume

• Nasdaq Breadth: 56.5% Upside Volume

• Total Breadth: 55.2% Upside Volume

• NYSE Advance/Decline: 48.3% Advance

• Nasdaq Advance/Decline: 44.3% Advance

• Total Advance/Decline: 45.8% Advance

• NYSE New Highs/New Lows: 281 / 25

• Nasdaq New Highs/New Lows: 478 / 166

• NYSE TRIN: 0.80

• Nasdaq TRIN: 0.60

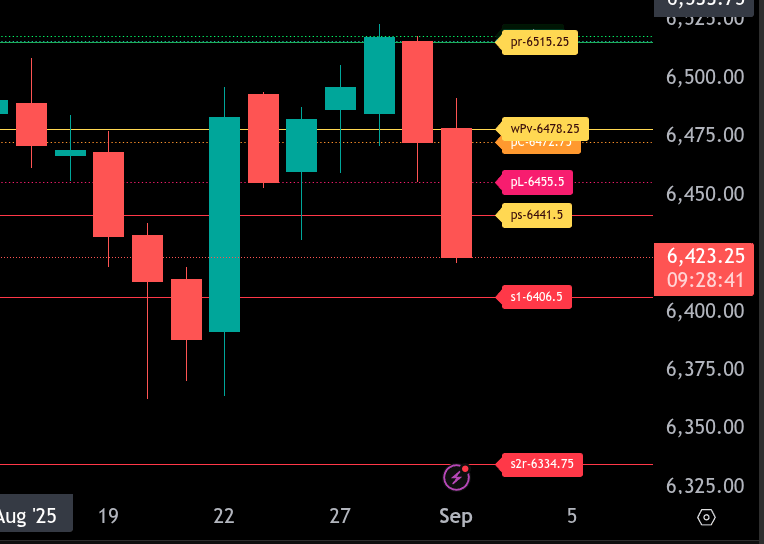

ES – Levels

The bull/bear line for the ES is at 6478.25. This is the key pivot level that must be regained for bullish sentiment to re-establish. Staying below this level keeps the pressure to the downside.

Currently, ES is trading at 6423.75, showing weakness below the bull/bear line. If selling continues, the first goal for the bulls is to recover our downside target of 6441.50. If that fails, then the next target below is 6406.50. A break below 6406.50 could extend losses further and put the 6370.00 region in play.

On the upside, resistance above the lower range target comes in at 6455.50, then stronger resistance at 6472.75 just beneath the bull/bear line. If ES can reclaim and hold above 6478.25, the next objective would be 6515.25, our upper range target. A sustained push above that level could reopen the path towards 6540.00.

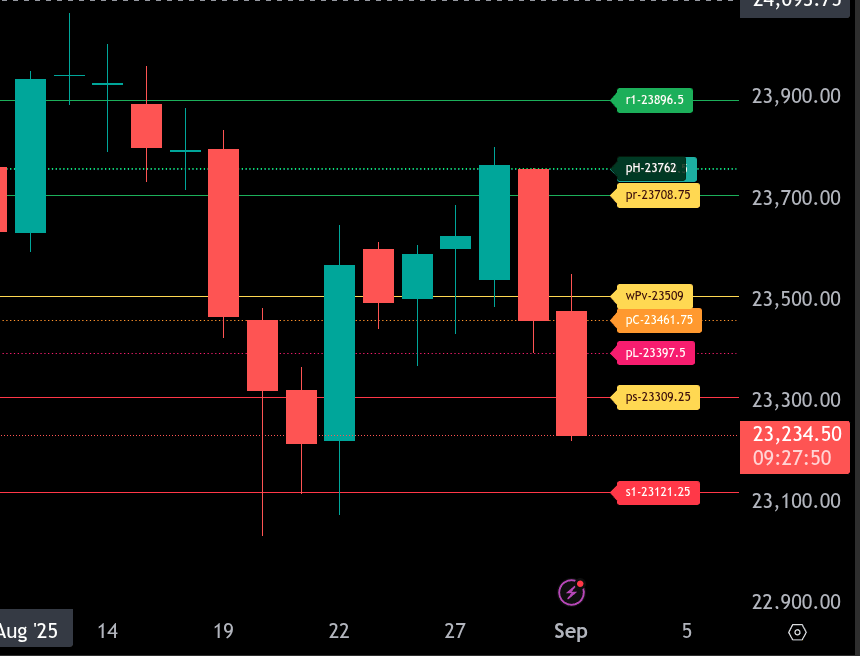

NQ – Levels

The bull/bear line for the ES is at 23,509. This level is the key pivot that determines sentiment. Remaining below this level keeps the market under pressure, while reclaiming it could shift momentum back to the upside.

Currently, ES is trading around 23,234.75, which is well below the bull/bear line and signals bearish conditions in the early session. The lower range target is 23,309.25, which has already been breached. If weakness continues, the next downside objective sits at 23,121.25. A break below there could open the door toward the 23,000 round number zone.

On the upside, initial resistance comes at 23,397.50, then 23,461.75, with stronger resistance at the bull/bear line of 23,509. Above this, further resistance is seen at 23,708.75, the upper range target, and then at 23,762.

.

Calendars

Economic Calendar

Today

Important Upcoming

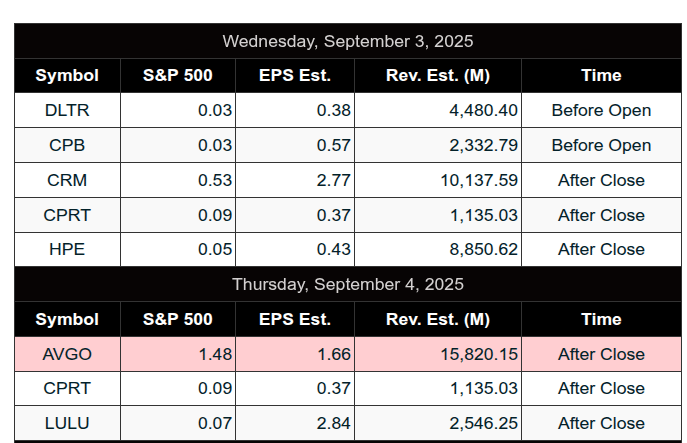

Earnings

Trading Room Summaries

Discovery Trading Group Room Preview – Tuesday, September 2, 2025

-

Tariff Ruling: The US Court of Appeals upheld a decision limiting President Trump’s authority on global tariffs but left them in place pending potential Supreme Court review. Trump maintains, “ALL TARIFFS ARE STILL IN EFFECT!”

-

Housing Emergency & Midterms: Treasury Secretary Bessent suggests Trump may declare a national housing emergency, making affordability a central theme for Republicans heading into 2026.

-

Fed Policy & Market Moves: A 90% chance of a September Fed rate cut is now priced in by swaps. Gold surged past $3,500 (+30% YTD) on rate cut hopes. Job data remains a critical driver.

-

Geopolitics: Russia and China inked a legally binding deal to construct the long-anticipated Power of Siberia 2 gas pipeline.

-

Today’s Earnings & Data: Watch for results from Zscaler (ZS), Macy’s (M), DocuSign (DOCU), Nebius Group (NBIS), and NIO. Key economic releases include S&P Global Manufacturing PMI (9:45am ET), ISM Manufacturing/Prices, and Construction Spending (10:00am ET).

-

Market Technicals & Volatility:

-

Volatility is contracting ahead of major catalysts: Friday’s jobs report, next week’s CPI, and the Fed the following week.

-

ES 5-day ADR has dropped to 51.75 points.

-

No significant overnight whale activity.

-

ES retesting bottom of inside uptrend channel (6423/28) in overnight trade.

-

Affiliate Disclosure: This newsletter may contain affiliate links, which means we may earn a commission if you click through and make a purchase. This comes at no additional cost to you and helps us continue providing valuable content. We only recommend products or services we genuinely believe in. Thank you for your support!

Disclaimer: Charts and analysis are for discussion and education purposes only. I am not a financial advisor, do not give financial advice and am not recommending the buying or selling of any security.

Remember: Not all setups will trigger. Not all setups will be profitable. Not all setups should be taken. These are simply the setups that I have put together for years on my own and what I watch as part of my own “game plan” coming into each day. Good luck!

This post goes out as an email to our subscribers every day and is posted for free here around 2 PM ET. To get your real-time copy, sign up for the free or premium version here: Opening Print Subscribe.

Comments are closed