This post goes out as an email to our subscribers every day and is posted for free here around 2 PM ET. To get your real-time copy, sign up for the free or premium version here: Opening Print Subscribe.

The Tale of Two Cities, S&P 500 U-Turn

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Our View

I do my very best not to change the “lean”. If I call it right, it sets the tone for my trading for the day. As we all know, I like trading the gaps, but Friday’s gap sharply lower gave the ES its high on the open, and yesterday’s big gap-up-and-go was not what I was looking for. I knew the risks going into it. I started writing about end-of-July weakness and warned about July month-end and early August weakness the week before the declines.

Most of last week’s weakness started on Monday when the ES closed down -0.04%, then fell -0.26% on Tuesday, -0.37% on Wednesday, -0.34% on Thursday, and down –1.69% Friday — or down -2.66% on the week. It was a pretty negative week and down hard on Friday, but ended with $2.6 billion to buy.

The last time the S&P closed down several days in a row was April 12–17, 2024, as part of the five-day losing streak ending April 18, 2024, which lost 2.8% and then rallied 3.85% over the next five sessions. The point being — after a five-day sell-off, the ES rallied 3.85% over the next five sessions.

After falling 1.8% on Friday, August, the S&P rallied 1.5% after losing 1.69% on August 1. The NQ closed down 2.06%, then gained 2%, and another $2.445 billion to buy on yesterday’s close.

It really looked like there was going to be more of a pullback, but a bleak economic background got energized by hopes the Fed will cut rates this year, as traders continue to deal with Trump’s ever-shifting headlines. Traders are also pressing through Q2 earnings season. So far, the S&P has reported about two-thirds of its 500 companies. According to FactSet, over 80% reported better-than-expected earnings per share, including some of the tech heavyweights: META, GOOG, and MSFT.

In the end, it’s been a tale of two cities — a big down day Friday and almost a full recovery yesterday. I wasn’t looking for it, but even the PitBull said the charts are “nuts.” In terms of the ES and NQ’s overall tone, the move back up with little to no pullbacks was stunning. In terms of the ES’s overall trade, volume was almost 700k contracts, low compared to Friday’s volume of 1.29 million contracts traded.

On Tap

This morning, we have two economic reports: the U.S. trade deficit at 8:30 ET and the S&P PMI at 9:45.

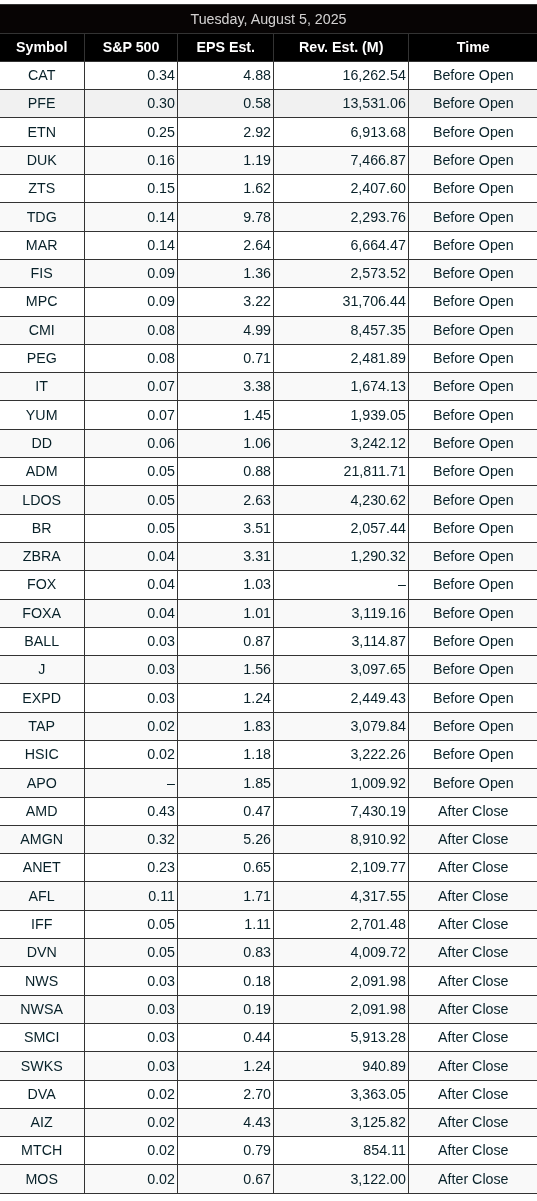

Pfizer (PFE) will release its Q2 2025 earnings before the market opens today. Caterpillar (CAT) is set to announce its Q2 2025 financial results at 6:30 a.m. EDT. Duke Energy (DUK) will post its Q2 2025 financial results at 7:00 a.m. EDT. Eaton Corporation (ETN) will announce its Q2 2025 earnings before the opening of the New York Stock Exchange. Finally, Advanced Micro Devices (AMD) will report its Q2 2025 earnings after the market closes today.

Our Lean

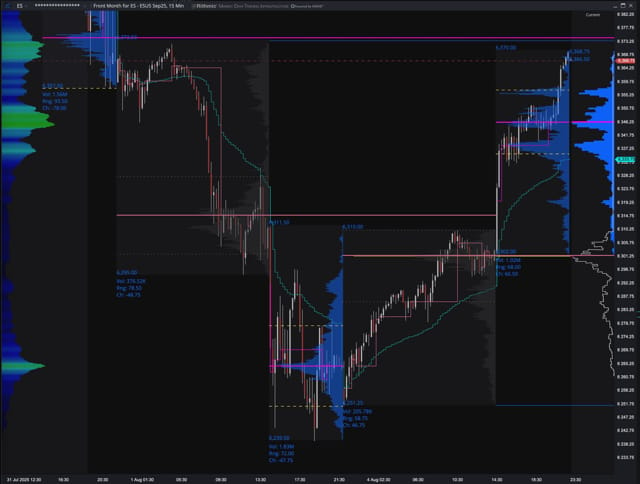

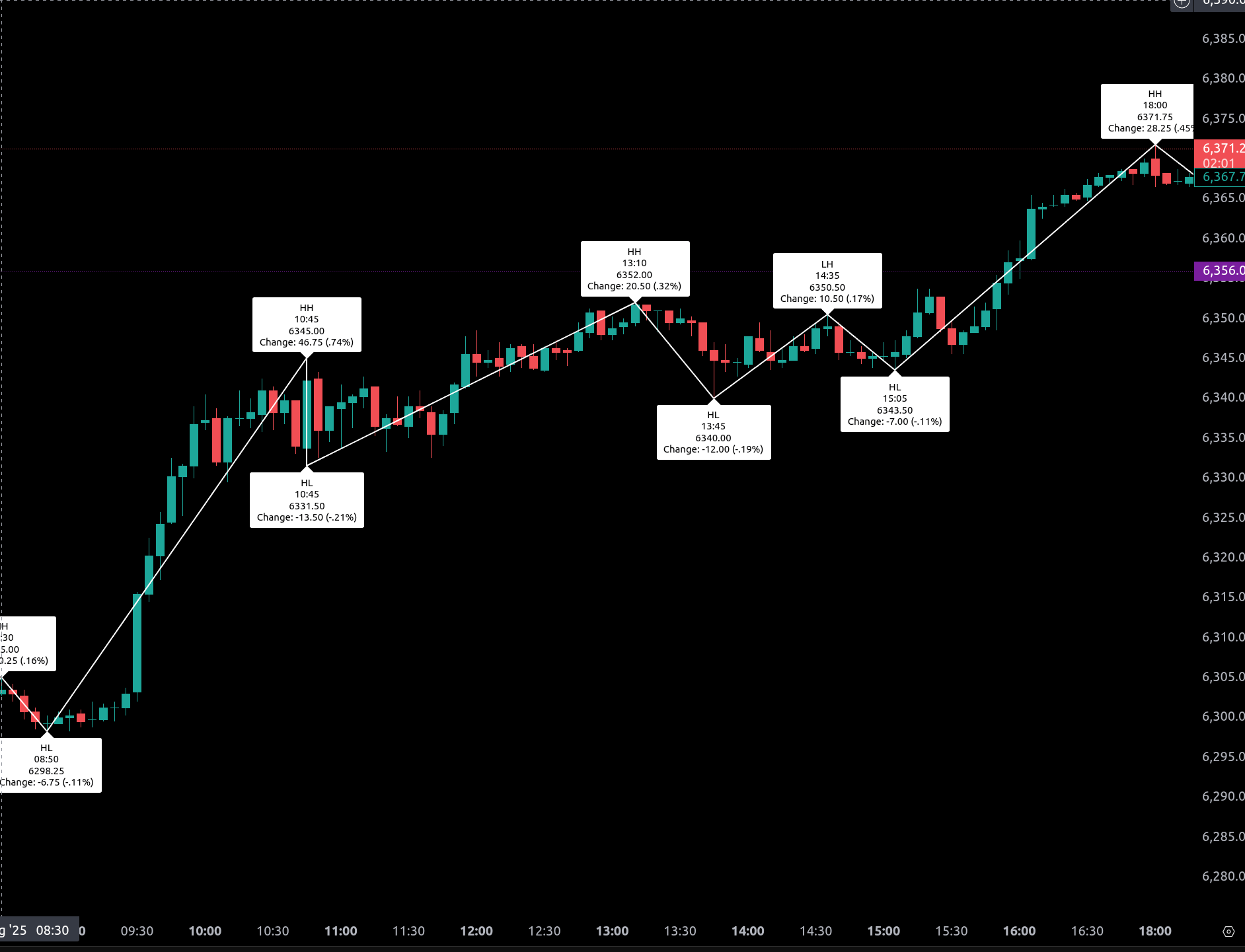

The charts I posted are of Thursday night’s Globex session into Friday’s close and Sunday night’s Globex session into Monday’s close. I make no excuses — I’ve had a hard time maneuvering. There are no shoulda, woulda, coulda’s in trading; you either make the right choices, or you end up on the wrong side, and no one likes that. And it’s not so much about the losses; it’s the missed opportunities we all look for once the markets go from 30-point ranges to 125 points.

Our lean: As of this morning’s 6377.00 Globex high, the ES is up 137.5 points off Friday’s 6239.50 low. The 50% retracement from the ES contract high at 6468.50 to Friday’s 6229.50 low is 229 points, putting the 50% level at 6349.00. The 38.2% retracement is 6377.202, which is also this morning’s early Globex high. The 23.6% retracement comes in at 6412.10.

On the downside, the 38.2% retracement is 6320.798, and the 23.6% retracement is 6285.904. I’m not going to mess with the gaps for a few days and will just trade the levels and buy the pullbacks.

MiM and Daily Recap

ES Futures Recap for August 4, 2025

Intraday Recap

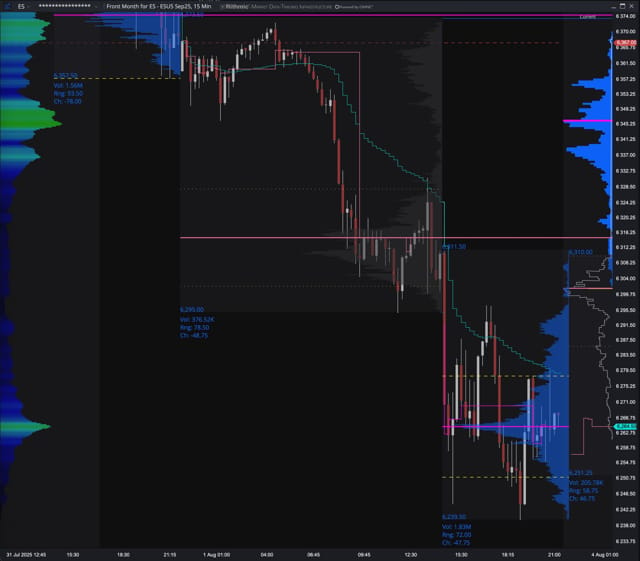

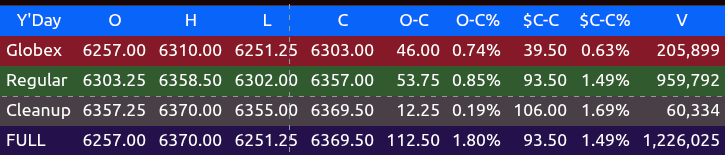

The overnight Globex session saw a steady climb into early Monday, beginning with an initial high of 6290.25 at 23:40 before dipping to a higher low of 6279.75 at 00:20. A modest bounce followed, pushing ES to 6293.00 at 02:00, but a selloff into 02:30 dropped the market to a lower low of 6279.25. From there, bulls regained control with a strong push to 6310.00 by 05:40, marking the Globex high. However, the session retraced into the 07:00 hour with a dip to 6294.50 ahead of the cash open.

The regular session opened at 6303.25 and immediately began a strong morning rally that lifted ES to 6345.00 by 10:45, a 46.75-point move off the low. A pullback to 6331.50 followed before bulls resumed control into the midday stretch, lifting the market to 6352.00 at 13:10. After a minor retracement to 6340.00 at 13:45, price advanced again to 6350.50 at 14:35 before briefly dipping to 6343.50 at 15:05.

The final afternoon leg saw a strong late-session push to 6357 by 16:00, the cash session high and close. The regular session ended at 6357.00, up 53.75 points or +0.85% from the open, while the full session gained 112.50 points (+1.80%) from the prior close, settling at 6369.50 by 17:00.

From the prior day’s close of 6257.00, ES gained 46.00 points during Globex, and another 53.75 during the regular session, with a final cleanup-session lift of 12.25 points into the 17:00 close. Volume was solid, with 1.23 million contracts traded across all sessions.

Market Tone & Notable Factors

Monday’s tone was bullish throughout, driven by early Globex strength, steady intraday higher lows, and a closing drive that extended gains into the end of the session. The cash market notably respected early support at 6298.25, which helped fuel a confidence-driven advance.

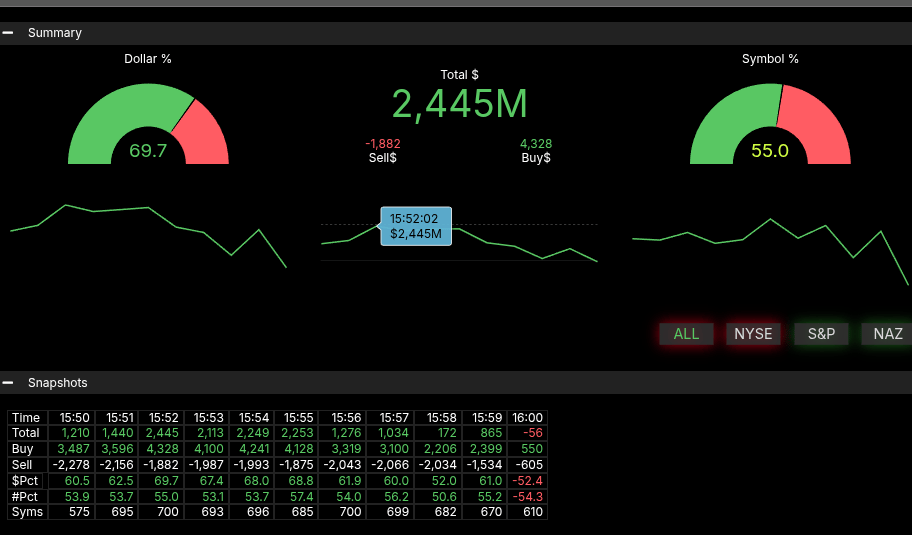

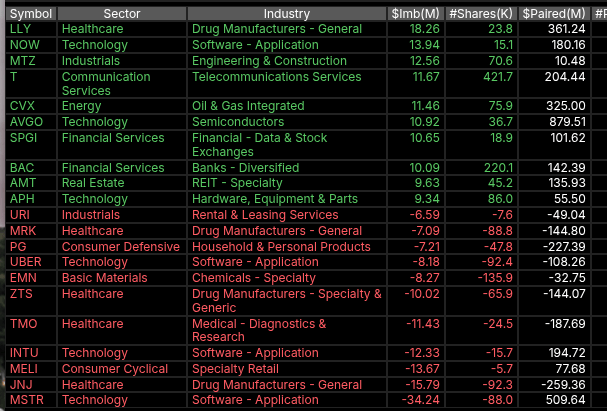

MOC (Market-On-Close) imbalance data showed a $2.445B net buy, with the dollar imbalance skewing 69.7% to the buy side. While the symbol imbalance finished at 55.0% and didn’t breach the 66% threshold, the $ value clearly indicated strong institutional interest into the bell. That supported the closing rally from 15:05 into 16:00.

The session ended on a strong note with price closing near the highs, suggesting bullish momentum may carry into Tuesday’s trade, barring any overnight macro surprises.

Technical Edge

Fair Values for August 5, 2025:

-

SP: 26.94

-

NQ: 116.38

-

Dow: 119.68

Daily Market Recap 📊

For Monday, August 4, 2025

-

NYSE Breadth: 80% Upside Volume

-

Nasdaq Breadth: 79% Upside Volume

-

Total Breadth: 79% Upside Volume

-

NYSE Advance/Decline: 81% Advance

-

Nasdaq Advance/Decline: 75% Advance

-

Total Advance/Decline: 78% Advance

-

NYSE New Highs/New Lows: 73 / 33

-

Nasdaq New Highs/New Lows: 115 / 95

-

NYSE TRIN: 1.04

-

Nasdaq TRIN: 0.80

Weekly Breadth Data 📈

For Week Ending Friday, August 1, 2025

-

NYSE Breadth: 32% Upside Volume

-

Nasdaq Breadth: 37% Upside Volume

-

Total Breadth: 35% Upside Volume

-

NYSE Advance/Decline: 31% Advance

-

Nasdaq Advance/Decline: 22% Advance

-

Total Advance/Decline: 25% Advance

-

NYSE New Highs/New Lows: 217 / 133

-

Nasdaq New Highs/New Lows: 438 / 322

-

NYSE TRIN: 0.95

-

Nasdaq TRIN: 0.46

I’ll keep the format consistent from here on. Let me know when you’re ready for tomorrow’s data.

Ask ChatGPT

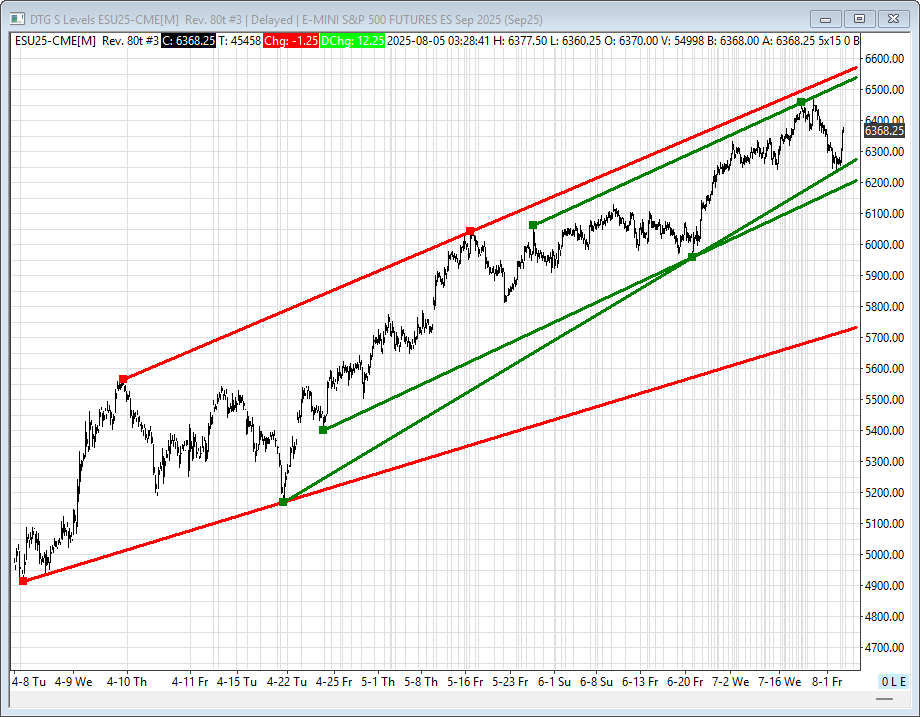

ES – Levels

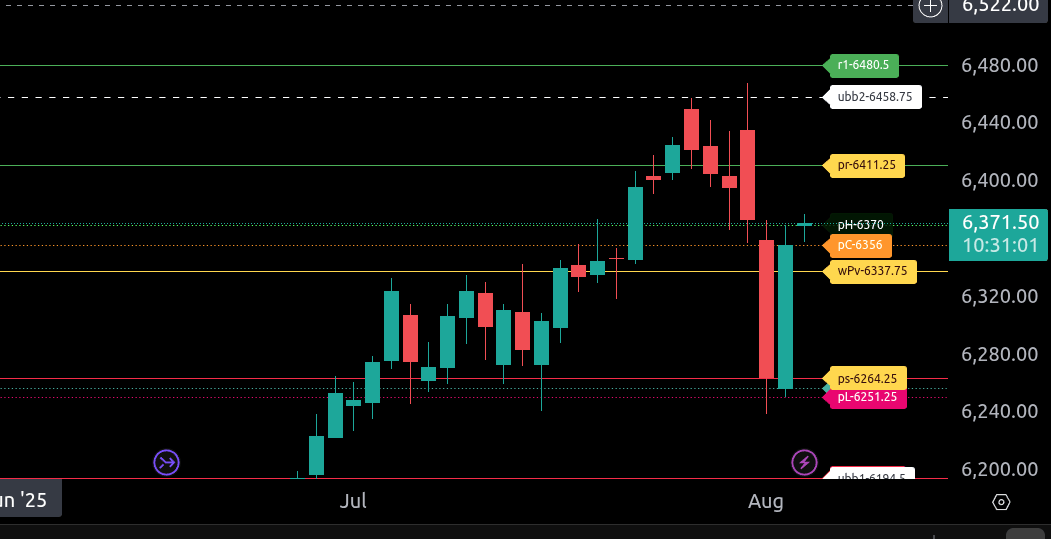

The bull/bear line for the ES is at 6337.75. This is the critical pivot that defines directional bias for today. Holding above this level favors bullish continuation, while trading below it opens the door for further downside.

Currently, ES is trading at 6371.75, showing a reclaim of the bull/bear line and printing back above yesterday’s close of 6356. The first upside magnet is the prior high at 6370, followed by the upper range target at 6411.25. Beyond that, resistance sits at 6458.75 and 6480.50, where sellers may step in.

On the downside, if ES loses 6337.75 again, we look for support at 6264.25 and 6251.25, today’s lower range targets. A failure there could open the door to deeper downside toward 6194.50.

Reminder, we are still in a long-term bullish trend.

NQ – Levels

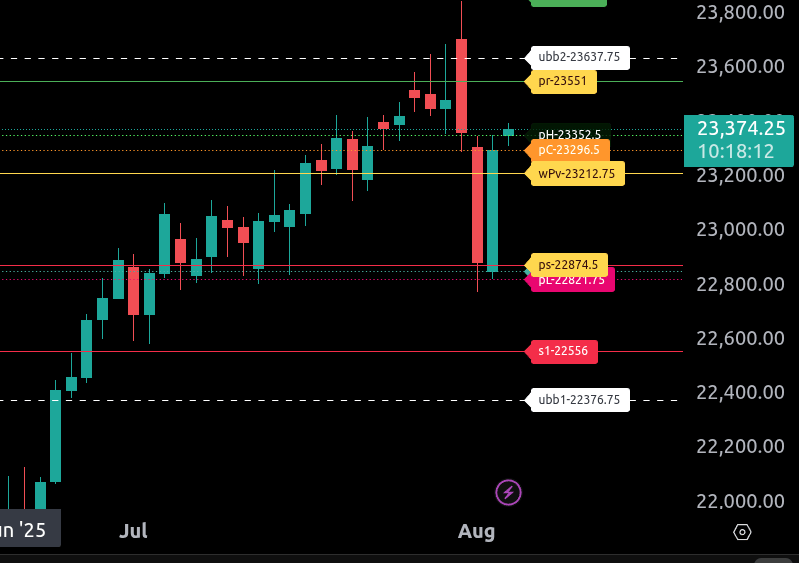

The bull/bear line for NQ is at 23,212.75. This is the key pivot level for today. As long as price remains above this level, the market retains a bullish intraday tone. If NQ trades below it, downside momentum may resume.

Currently, NQ is trading around 23,372.75, which is above the bull/bear line, signaling a modestly bullish bias in the Globex session. If this strength holds, the immediate upside target is 23,551, today’s upper range target. A breakout above this level could open the door to further resistance at 23,637.75 and 23,869.50.

On the downside, first support sits at 23,296.50. A failure to hold above that could shift the bias back to neutral. Below the bull/bear line, look for sellers to press toward 22,874.50 and 22,821.75, our lower range targets. Breaching these levels could trigger additional liquidation.

Reminder, we are still in a long-term bullish trend, but short-term control hinges on holding above 23,212.75.

.

Calendars

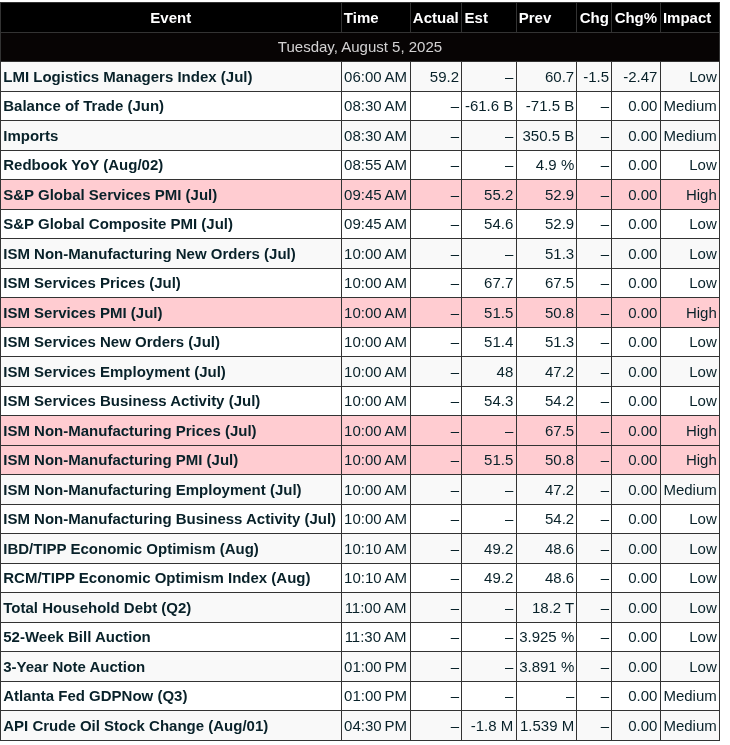

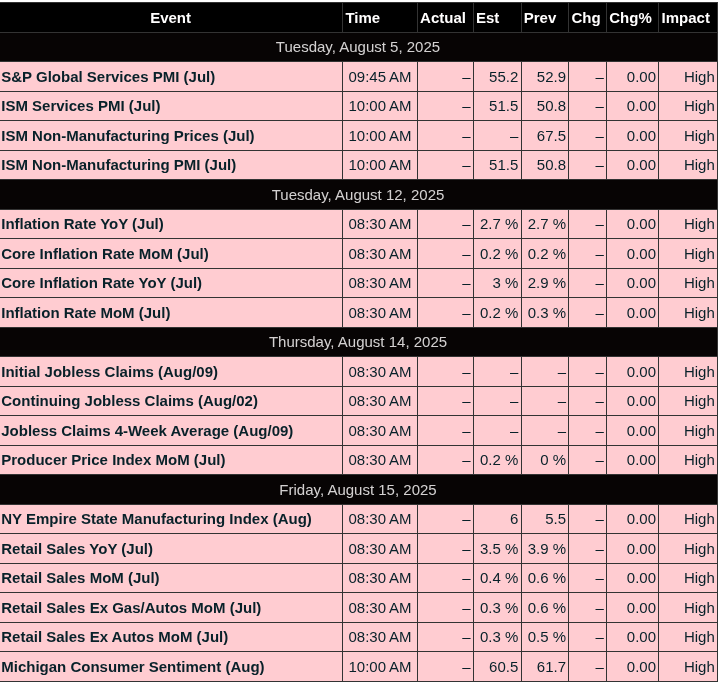

Economic Calendar

Today

Important Upcoming

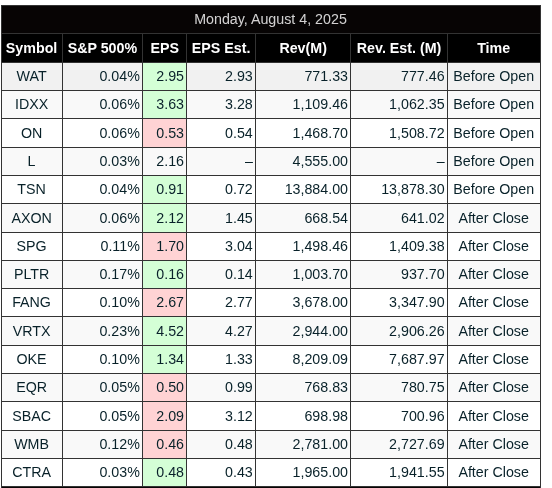

Earnings

Trading Room Summaries

Polaris Trading Group Summary – Monday, August 4, 2025

General Theme:

Strong bullish bias from the open, driven by overnight buying and confirmed by price action throughout the day. The session provided clear setups early, and the market fulfilled key statistical targets into the close, aligning well with the PTG playbook.

Market Structure and Strategy

-

Early lean favored long setups, with Globex buyers holding strong.

-

PTGDavid called out an Open Range Breakout Long in ES and NQ, which played out effectively.

-

Buyers consistently bought dips, supporting the trend throughout the session.

-

Price action was in alignment with bullish expectations and 3-Day Cycle behavior.

Key Trade Setups and Executions

-

The Open Range Breakout strategy was the primary structured opportunity and executed well.

-

Later in the day, PTGDavid identified the 30-handle area as a potential dip-buy zone, reinforcing the continuation bias.

-

Afternoon focus shifted to reclaiming the CD1 low, a statistical setup with over 91% historical fulfillment.

-

Both NQ and ES fulfilled the CD1 reclaim targets, with ES achieving it just before the close.

-

A strong Market-On-Close (MOC) Buy Imbalance ($2.3B) supported the final push.

Lessons and Discussions

-

Emphasis on “Staying Aligned” with market direction to avoid unnecessary losses.

-

Manny highlighted the importance of mental discipline—specifically, resisting the urge to countertrade after missing a move.

-

Room members discussed automation and how programmed trades often exhibit cleaner, more disciplined behavior than discretionary ones.

-

PTGDavid and others stressed the principle of “less is more” and the value of one good trade over frequent participation.

Statistical Context and Closing Action

-

PTGDavid tracked the 3-Day Cycle reclaim closely, using historical stats to guide decision-making.

-

NQ completed its reclaim in the afternoon; ES followed with a strong late-session rally.

-

The CD1 reclaim confirmed the statistical edge and validated the bullish game plan.

-

Market closed strong, aligned with expectations and closing imbalances.

Takeaway

-

The session rewarded alignment with the trend, patience, and execution of well-defined setups.

-

Mental discipline and statistical awareness were key factors in navigating the day successfully.

Discovery Trading Group Room Preview – Tuesday, August 5, 2025

-

Morning Market Summary – August 5, 2025

-

Market Focus: Corporate earnings remain the key driver.

-

Earnings Highlight: Palantir (PLTR) jumped after hours, topping $1B in quarterly revenue and beating expectations.

-

Monday Recap: Stocks rebounded from Friday’s drop, which was triggered by:

-

Weak jobs report

-

New tariffs

-

Inflation signals

-

Firing of the BLS commissioner

-

-

Geopolitical Tensions:

-

Trump threatens India with steep tariffs over Russian oil purchases.

-

China pushed back on similar U.S. pressure—labeling oil demands a roadblock in trade talks.

-

Tariffs on Canada raised to 35%; other nations face 10–40% rates.

-

Mexico granted a 90-day tariff reprieve.

-

Exemptions: Goods en route before Thursday, aid items (food, clothing, medicine).

-

New 40% tariffs on transshipped goods.

-

-

Earnings (Premarket): ADM, BP, CAT, MPC, PFE, DUK, YUM, ZTS, and more.

-

Earnings (After Hours): AMD, RIVN, AMGN, SMCI, SNAP, TOST, SU, MOS.

-

Economic Calendar:

-

8:30 AM ET – Trade Balance

-

9:45 AM ET – S&P Global Services PMI

-

10:00 AM ET – ISM Services PMI

-

-

Volatility: Elevated. ES 5-day average daily range at 95.75 points.

-

ES Levels:

-

Resistance: 6527/32, 6566/71

-

Support: 6266/71, 6198/03, 5733/38

-

-

Whale Bias: None — overnight volume mixed.

-

Affiliate Disclosure: This newsletter may contain affiliate links, which means we may earn a commission if you click through and make a purchase. This comes at no additional cost to you and helps us continue providing valuable content. We only recommend products or services we genuinely believe in. Thank you for your support!

Disclaimer: Charts and analysis are for discussion and education purposes only. I am not a financial advisor, do not give financial advice and am not recommending the buying or selling of any security.

Remember: Not all setups will trigger. Not all setups will be profitable. Not all setups should be taken. These are simply the setups that I have put together for years on my own and what I watch as part of my own “game plan” coming into each day. Good luck!

This post goes out as an email to our subscribers every day and is posted for free here around 2 PM ET. To get your real-time copy, sign up for the free or premium version here: Opening Print Subscribe.

Comments are closed