‘Thin to Win’ in Focus Alongside the Jobs Report

Follow @MrTopStep on Twitter and please share if you find our work valuable.

Our View

The first two weeks of July have bullish tendencies, and with volume dropping as more people take time off for summer vacation, this low-volume upside grind should continue. When volumes are this low, it makes it easy for what I call “algo blips.” That said, volume should pick up this morning or at least for part of the day for the jobs report. I suspect this will favor the buyers on dips.

I read a story about the Fed not hitting its 2% target rate this year. Guess what? We already knew that… the PPT isn’t about to let the stock market fall very much even if it does. As for today’s jobs number, both the ADP Employment report and weekly jobless claims data pointed to easing labor market conditions ahead of Friday’s closely watched non-farm payrolls report.

Markets hope signs of weakness in the labor market will encourage the Fed to cut interest rates. That sounds bullish to me, but the ES traded down to 5502.75 at 10:00 AM on Tuesday, so in just a few hours (accounting for the holiday trading), the ES has rallied 95 points.

The S&P is up over 15%, and the NASDAQ is up nearly 21%, and… we are only 3 1/2 sessions into the second half of 2024. I think there is reason to be concerned, but that’s been the case all last year and so far, and the ES and NQ continue to charge higher.

Our Lean

The jobs number is not going to be easy, but I have to follow the MrTopStep Trading Rules 101, which says to “fade the jobs gaps in either direction.” I think it may be worth selling a big gap-up open if there is decent Globex volume before the 9:30 AM ET futures open.

The spoos have gone so far that I think they could gas out on any decent gap up. On the downside, if the ES sells off and is down before the 9:30 open, my tendency would be to be a buyer, but I would prefer it closer to the Globex low rather than 10 or 20 points off it. Look, the markets are in the stratosphere. No reason to overdo it today.

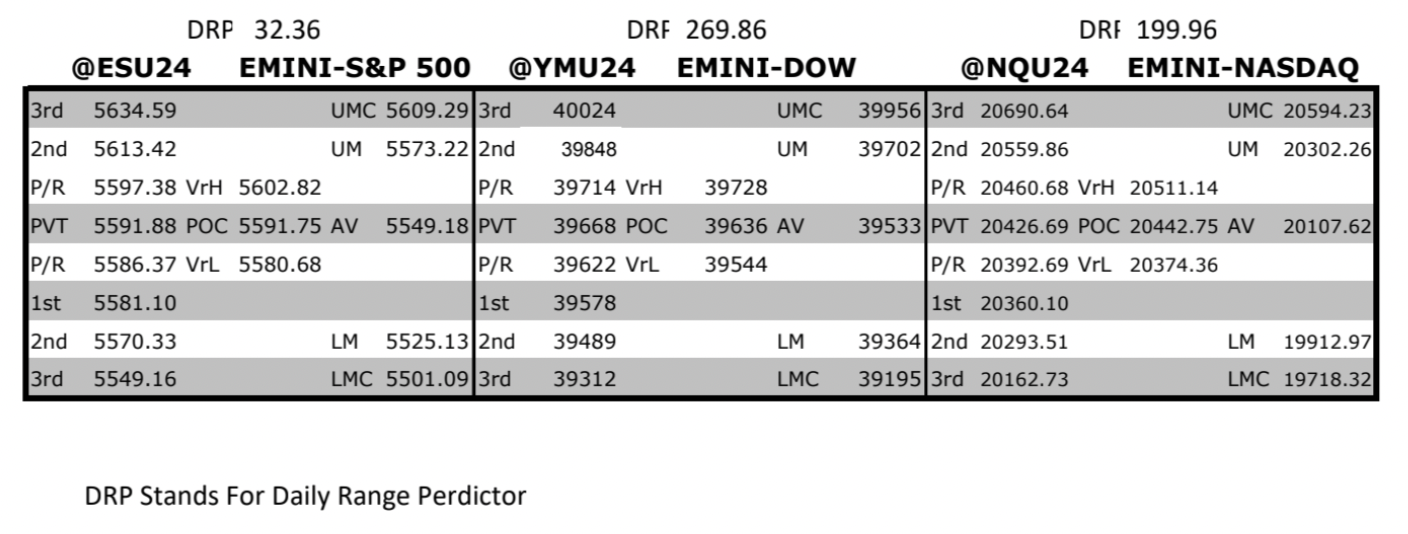

MrTopStep Levels:

MiM and Daily Recap

ES Recap

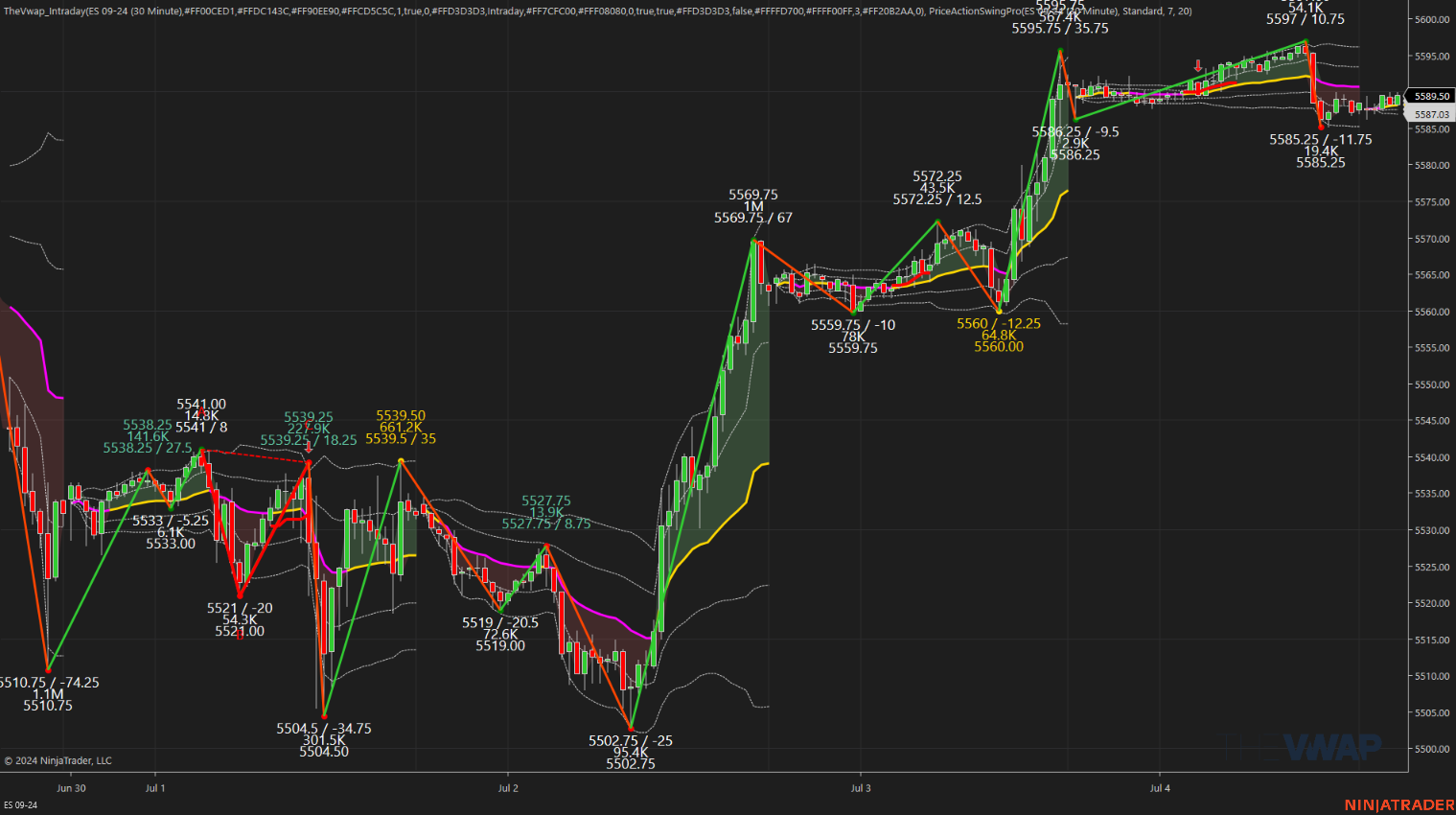

The ES traded down to 5559.75 and made a high at 5572.00 on Globex and opened Wednesday’s regular session at 5564.25. After the open, the ES traded 5562.25 and then “thin to win” took over and the ES rallied up to 5580.00 at 10:03, sold off down to 5571.00 at 10:15, rallied up to a lower higher at 5572.25, sold off down to 5568.00 at 10:30 and then rallied up to 5582.50 at 11:24. After the high, the ES pulled back to 5576.25, back and filled for the next 20 minutes and then a buy program hit and pushed the ES all the way up to 5589.00 at 12:24 and then slowly chopped down to 5583.25 at 12:51.

The ES traded up to 5595.75 at 1:00 after the imbalance showed $1 billion to sell and settled at 5591.00, up 28.25 points or 0.51%. The NQ settled at 20,419.50, up 174.75 points or 0.86%, gold settled at 2,365,60, up 32.20 points or 1.41%, crude oil settled at 83.82, up 1.01 or +1.22% and bitcoin settled at 61,210, down 1,595 points or -2.56% on the day.

After the Wednesday 6:00 pm Globex open, the ES traded 5560.00 at 8:40 am and rallied all the way up to 5595.75 at 1:00 PM. After the rally, the ES pulled back to the 5586.25 level and and then fell into a 7 to 10 point back and fill which carried into Thursday’s shortened holiday session which saw a slow grind up to a lower high at 5597.00 after 9:15 am and then sold off down to 5585.25 at 10:25, traded back up to 5590.00 at 11:15, sold off down to 5586.75 at 12:15, and traded 5591 at the close.

In the end, the first trading days of the new quarter/July have been very bullish. In terms of the ES’s overall tone, the NQ/Nasdaq has been the uncontested leader. In terms of the ES’s overall trade, total Globex volume and day session volume were not bad, 735k contracts traded on Tuesday and 786k on Wednesday.

Technical Edge

-

NYSE Breadth: 68% Upside Volume

-

Nasdaq Breadth: 65% Upside Volume

-

Advance/Decline: 68% Advance

-

VIX: ~12.50

Guest Post — Dan at GTC Traders

Trading is Gambling: An Accepted Academic Fact

Our work at ‘GTC Traders’ concerns itself with assisting new and aspiring traders transform their trading; by focusing on professional Quantitative concepts to improve their trading so they can begin to make real headway in accomplishing the goals they set for themselves.

And we are often amazed that many new traders do not accept a very, very simple truth. A truth that is entrenched and firmly understood by anyone in the world of Quantitative Finance.

Trading … is gambling.

I am even more amazed when I hear Trading Veterans … Traders I actually respect … try to claim that trading is ‘not gambling’. I recently heard a 40 year Trading Veteran try to argue that ‘Trading is not Gambling’.

Yes … it is.

And there is nothing wrong with that.

It seems that many confuse the topic of ‘gambling’, with that of being a ‘degen’ or degenerate gambler, who keeps feeding coins into a slot machine. Victims of variable impulse control.

We’re not discussing that cognitive psychological trap.

We are talking about understanding the concepts that make a professional gambler profitable, over an iteration.

Bankroll management.

Chip management.

Probability distributions and statistics.

Payout ratios (that in trading, you can set and control for yourself).

And this is not an opinion. Universities understand and embrace this viewpoint. Academics have researched, taught and expounded on our understanding of trading financial markets … as a quantitative, iterative gambling process.

Here is a nice little link to an essay by Stewart N. Ethier and Fred M. Hoppe that will take you through scores and scores of courses taught at Colleges and Universities regarding the mathematics of gambling. For those of you who will not read the full paper, a few excerpts …

“A fourth reason would be to offer a course on the mathematics of gambling as a subject in its own right, much as one might give a course on the mathematics of finance”

or when it quotes Bachelier in 1914, p. 6 of “Le jeu, la chance et le hasard” …

” … it is gambling that allows us to conceive of this calculus in the most general way; it is, therefore, gambling that one must strive to understand, but one should understand it in a philosophic sense, free from all vulgar ideas.”

or the many courses listed in the essay such as those at Stanford …

Stanford University: “Mathematics and Statistics of Gambling.” Offered in Spring 2018. Enrollment: 40, including 10 undergraduates and 15 graduate students from Mathematics/Statistics, and 15 from other departments. Prereq.: Undergraduate probability and undergraduate statistics. Intended for graduate students.

I could go through University Course, after Game Theory model, after published paper that backs up what we are saying.

This is not an opinion. This is an established fact.

Here … here’s a link to a paper that literally took me 10 seconds to find which discusses quantitative traders and gambling! There are myriads more.

In addition to the courses that we cite above? Scores of mathematical concepts and statistical outcomes are based on modeling gambling outcomes. We have “Gambler’s Ruin“, “The fallacy of the maturity of chances“, “Parrondo’s Paradox” and many others. All of which are studied and understood by quantitative traders.

Folks, this is an accepted academic fact. One must treat professional trading? As gambling. Heck, the above article by Bachelier was written over 110 years ago! This is not a ‘new idea’, or a ‘revolutionary concept’. To dispute the idea, is analogous to believing you are in first place in a race. ‘The race of discussion’, which ended over a hundred years ago; as everyone else has lapped you and gone home.

We are not saying that to trade, you must become an expert in Markov chains for probability outcomes. We are not saying that.

But we conclude by trying to stress to new and aspiring traders that Trading? Is gambling. The sooner you accept this truth, and learn to become a good and talented professional gambler? The sooner your trading will improve.

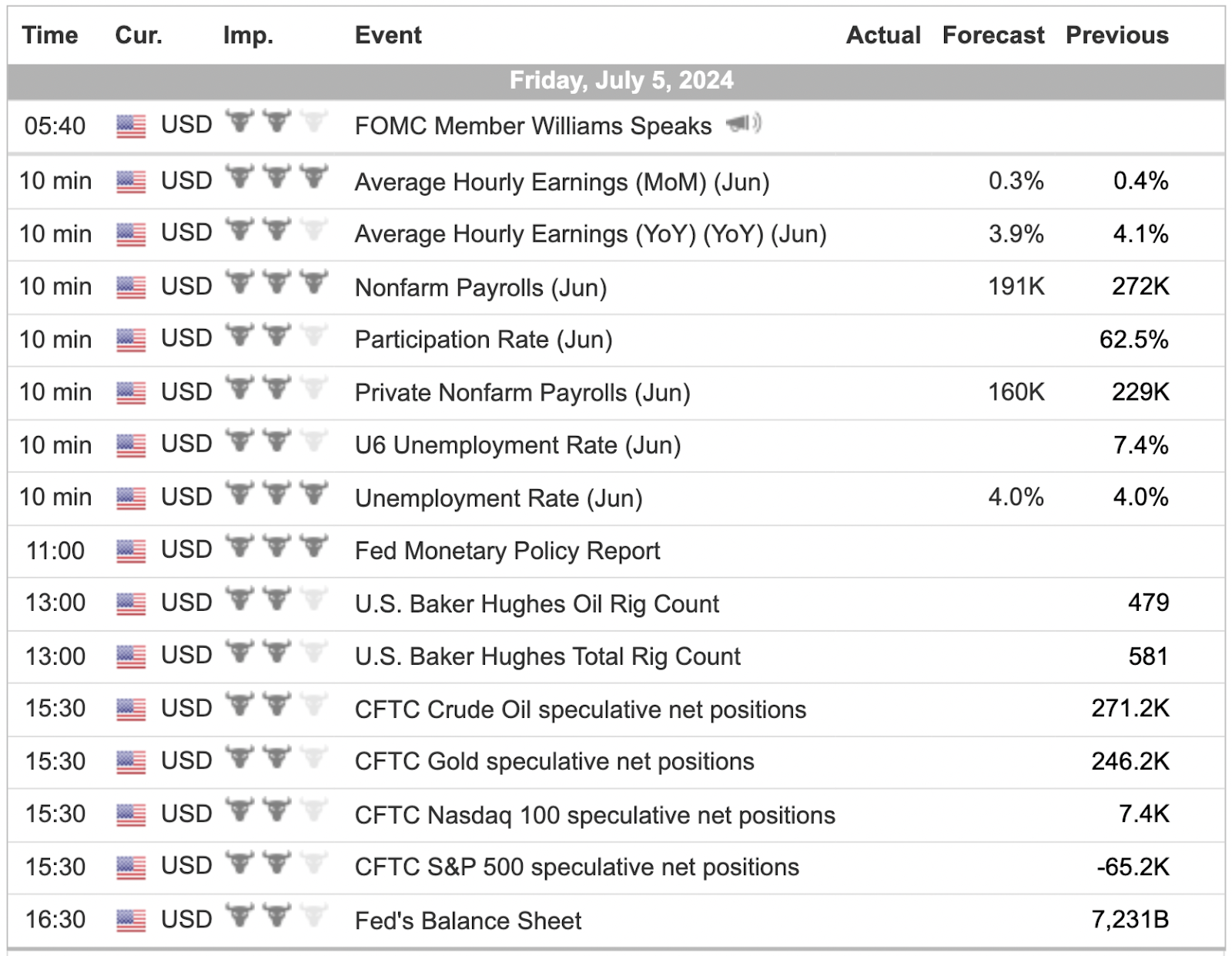

Economic Calendar

For a more complete Economic Calendar see: https://mrtopstep.com/economic-calendar/

Comments are closed