Will September Seasonality Take Over?

The S&P is up slightly so far this month.

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Every week, MrTopStep invites traders to an “Own the Close” contest where the closest guesstimate where the SPX will settle on Friday’s 4:00 cash close.

The winners get a free week’s access to the MrTopStep Chat and trading tools. Enter your guess now!

Our View

I think the most astonishing part of the S&P and Nasdaq, regardless of the VIX, is how much they are moving. I am not sure what other time period it could be compared to other than after the Fed spent billions in QE during the credit crisis.

Last week, the Fed cut 50 bps, and Powell also acknowledged that inflation was still elevated. Everything has gone up in price, but does lower rates mean you will have more in your pocket at the end of the month?

Consider this:

-

Bonds have rallied 10.5% off the April 25th low.

-

Gold has risen significantly, with the price per ounce climbing by around 25% in 2024 to over $2,600.

-

Orange juice prices surged by more than 26% in 2024, with futures prices for orange juice concentrate hitting $4.95 per pound.

-

Water bills increased around 9% to 13.6%, depending on consumption and location.

-

Credit card interest rates continued to climb and are maintaining historically high levels. The average interest rate for new credit card offers reached about 24.74% in September 2024, up from 24.62% in the summer, with some borrowers paying as much as 32%.

-

Medical care benefits are projected to rise by 8.9%.

-

Full coverage car insurance increased by 26% in 2024, reaching $2,543 per year.

-

Homeowners insurance premiums in 2024 are expected to rise around 6%, bringing the national average to $2,522 (not Florida).

-

The average rent in the US increased from $1,435 in 2019 to $1,712 in 2024.

I think this list could go on and on, but do you really think lower interest rates will put a lot more money in your pocket every month? Sure, it cost less when there was zero borrowing cost, but those days are gone.

I know you are thinking to yourself that I never say anything good, but that’s not true; there is just way more bad news than good right now — even though the stock market doesn’t show it.

Our Lean

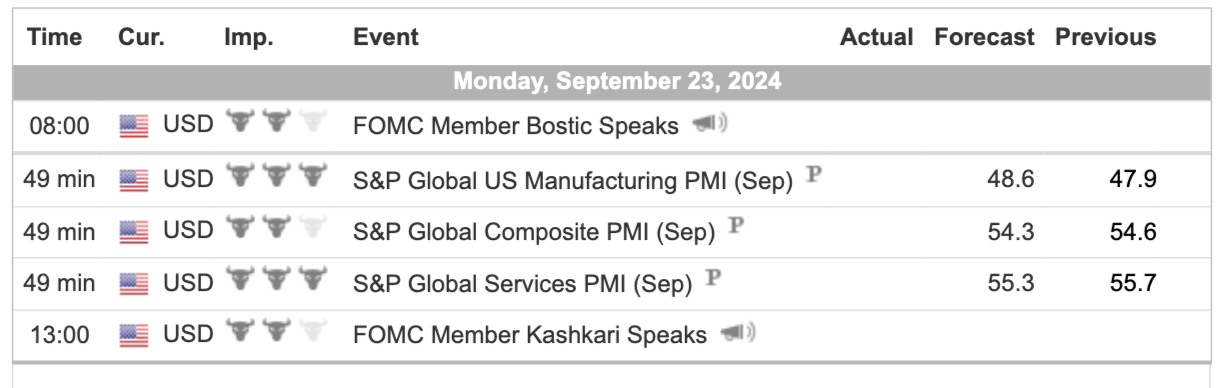

Can you believe there are six more trading sessions in September? I just want it to be over, but first, the Fed blackout is over, with 12 Fed speakers this week, and Powell speaking at 9:20 AM Thursday. There’s a total of 12 economic reports that end the week with the PCE number. So while it may slow a bit, the fluctuations won’t.

I think the theme is the negative seasonal stats that go on right into the end of the month. That doesn’t mean you can’t buy the right pullbacks, but I think the larger pops will have a tendency to fail. That said, the ES and NQ closed weak, so we should see some type of pop in Globex.

MiM and Daily Recap

ES Recap

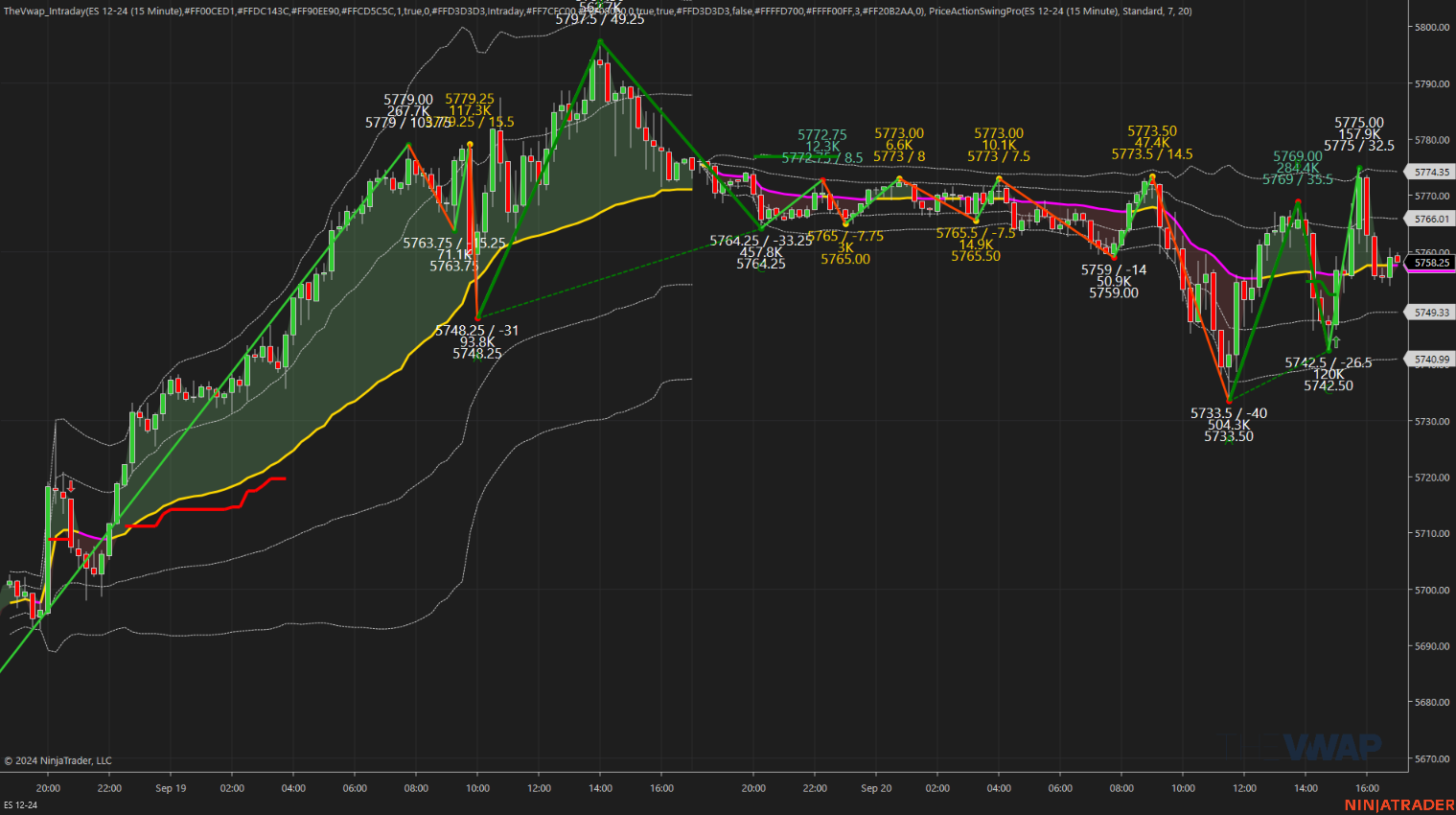

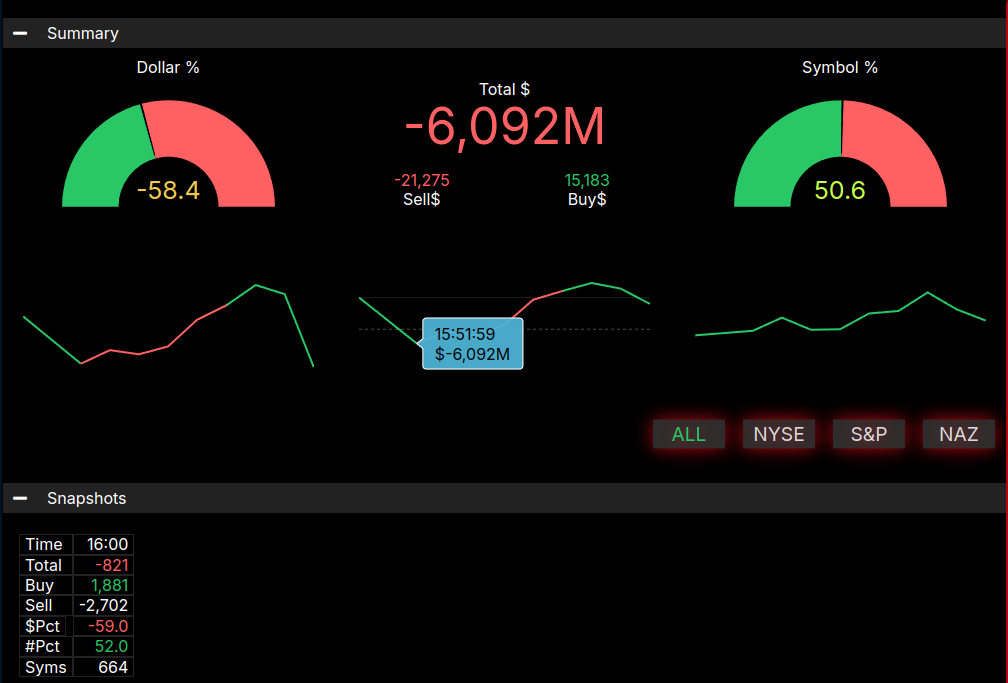

The ES rallied up to 5776.00 and then sold off to 5758.75 at 9:29, opening Friday’s regular session at 5760.50. After the open, the ES initially rallied to 5767.25, then sold off 21.75 points down to 5745.50. It rallied again by 14.25 points up to 5759.75, before dropping 26.25 points to the low of the day at 5733.50 at 11:20. Following this low, the ES rallied 34 points to 5769.00 at 1:36, then sold off 26.5 points down to a higher low of 5742.50 at 2:40. It then rallied 26.5 points to 5775.00, before selling off to 5765.76 at 3:49. It traded at 5767.25 as the 3:50 imbalance showed $6 billion to sell, before dropping to 5761.00 at 3:56 and settling at 5763.00 on the 4:00 cash close.

After 4:00, the ES sold off to 5757.75 at 4:09 and settled at 5758.25, down 19.75 points or -0.34%. The NQ settled at 20,015.50, down 72.50 points or -0.36%. Crude oil (CLZ24) settled at 71.25, up 0.09 points or +0.13%. The 10-year note settled at 114.235 (unchanged). Gold (GCZ4) settled at 2,647.10, up 32.5 points or +1.24%. Bitcoin (BTCV4) settled at 63,370, down 510 points or -0.80% on the day.

In the end, everything went pretty much as expected. In terms of the ES’s overall tone, it acted way better than the NQ. In terms of overall volume, volume was decent at 1.44 million ESZ’s traded.

Technical Edge

-

NYSE Breadth: 42% Upside Volume

-

Nasdaq Breadth: 53% Upside Volume

-

Advance/Decline: 34% Advance

-

VIX: ~16.25

ES

ES Daily

Economic Calendar

For a more complete Economic Calendar see: https://mrtopstep.com/economic-calendar/

Comments are closed