How I’m Trading CPI Day

Stocks hit a little turbulence yesterday

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Every week, MrTopStep invites traders to an “Own the Close’ contest where the closest guesstimate where the SPX will settle on Friday’s 4:00 cash close.

The winners get a free week’s access to the MrTopStep Chat and trading tools. Enter your guess now!

Our View

I am a longer term bull, but things felt a bit overdone yesterday and I said it about the NQ early yesterday.

In the early goings there was a buy ES / sell NQ rotation and the ES seemed unaffected at first, but as the day wore on so did the Nasdaq, which got the best of the S&P and dropped 34.25 points from its high. I also mentioned how someone was laying into the NQ all day.

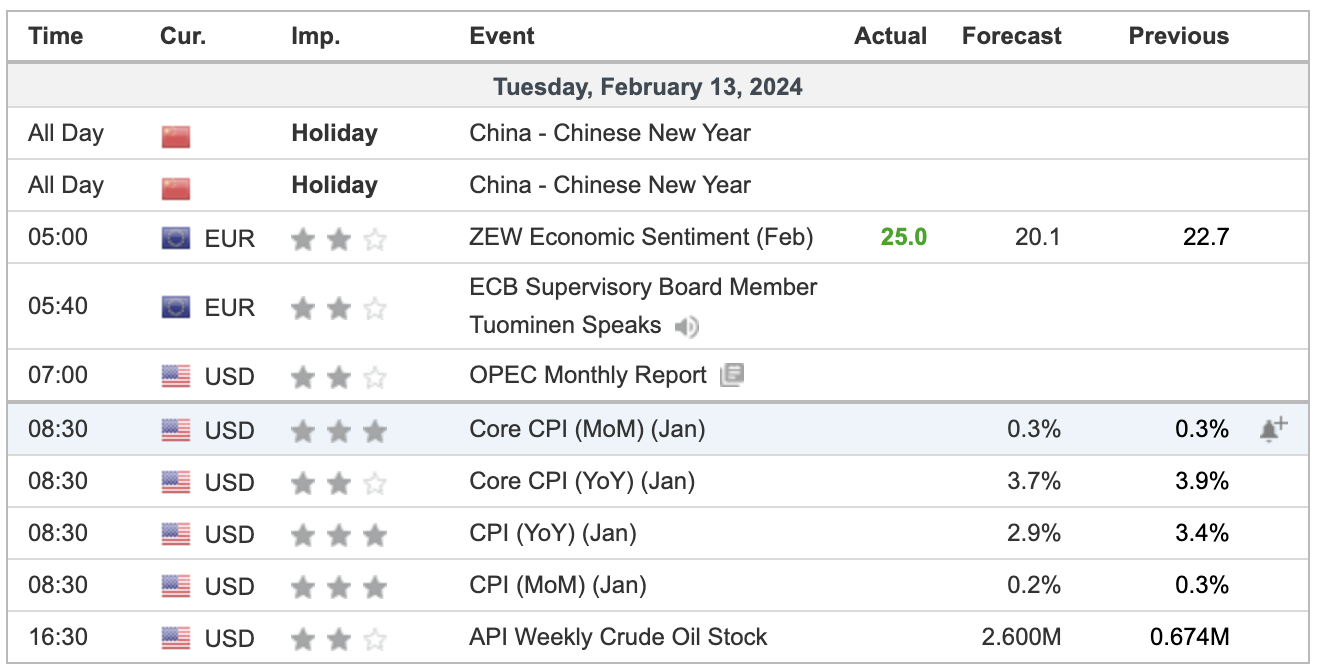

Today’s highlight is the Consumer Price Index (CPI) and according to Goldman Sachs, there could be minor revisions to the monthly core CPI inflation figures for the second half of 2023 which would align with the historical pattern of annual adjustments. The revisions are expected to reflect the significant slowdown in inflation experienced over the year, with a slight upward adjustment on average for the latter six months.

That should be good news right? We will see about that.

Our Lean

Right off yesterday’s open you could see a firmer ES vs. the NQ, but the real unwind ended up buying the RTY (up 1.8%) vs selling the NQ (down 0.60%). The other side of this is selling late-day weakness — i.e. momentum selling seldom works.

Based on the weak closing price action and the fact that the ES has closed higher 14 out of the last 15 weeks — and the VIX closed up 7.9% — one would think that yesterday’s rejection would lead to lower prices today.

The big show today is the 8:30 ET release of the Consumer Price Index. Should the ES gap 10+ points higher I am a seller, if the ES gaps 10+ or points lower I am a buyer. If neither works, I’m looking to sell the early rallies. There are a lot of sell stops building up under 5020. I know there is a risk of the ES going back up and I’m sure it will, just not today.

A lot of times late in the earnings cycle some of the positive near-term expectations dry up. After three-quarters of the earnings, they tend to start selling the positive results.

Our Lean: I am not saying it will, but I’m saying it could get a little messy today. I expect a big move before the 9:30 futures open and ideally I would like to sell a big fat gap up. I’m not bearish as much as I think the ES has gone up too far too fast. That all said, the ES usually rallies off a weak close overnight, let’s see how that pans out.

MiM and Daily Recap

ES recap

Like many Globex sessions recently, the ES was little changed and opened Monday’s regular session at 5043.00. After the open, the ES fell into a back-and-fill pattern between 5046.25 and 5041.25 until 11:25 when the ES rallied up to 5052.75, pulled back to 5049.75, and then rallied up to 5066.50 at 11:36. From there, it dipped and made a few lower highs at 5065.25, 5066.00 and 5065.75 at 1:22 and then dropped down to 5053.75, traded up a few points to the 5056.75 level and then dumped down to 5048.00 at 1:44. The ES then had a small back-and-fill and rallied up to 5053.50 at 2:14, then got whacked down to 5033.25, 32.25 points off the high of the day.

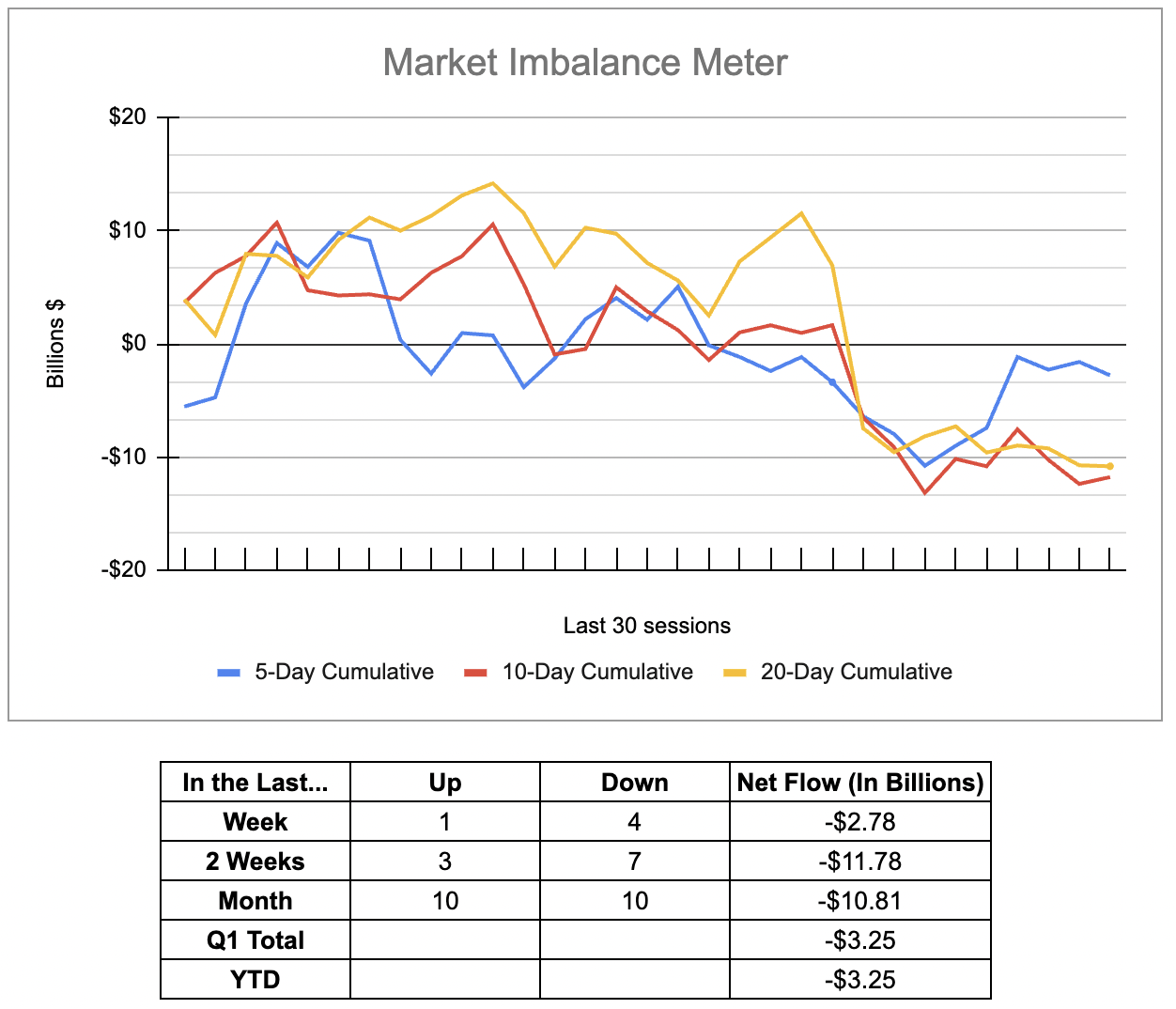

After the low, the ES rallied back up to the 5044.25 level and then dipped back down to a higher low at 5035.50 at 3:00 and then made a 5042.50 double top at 3:40 as the early imbalance showed $465 million to sell. The ES traded 5041.75 as the 3:50 NYSE order imbalance showed $720 million to buy, sold off down to 5036.75, and traded 5041.00 on the 4:00 cash close. After 4:00, the ES dropped down to 5032.50 and settled at 5035.75 on the 5:00 futures close, down 6.25 points or 0.12% on the day, the NQ settled at 17,918, down 108.75 points or 0.60% on the day.

In the end — and I hate to beat on this — but there was no volume, zip, notta and without the late drop it would have been well below a 1 million. In terms of the ES’s overall tone, it was firm in the morning and weak in the afternoon. In terms of the ES’s overall trade, volume was low: 142k traded on Globex and 969 million traded on the day session for a total of 1.111 million contracts traded.

For more info on accessing the MIM, please visit here.

Technical Edge

-

NYSE Breadth: 81% Upside Volume

-

Nasdaq Breadth: 73% Upside Volume

-

Advance/Decline: 77% Advance

-

VIX: ~14

ES

Notice how the ES hit the 261.8% retracement and faded.

ES Daily

Guest Post

Niels at Tradrr

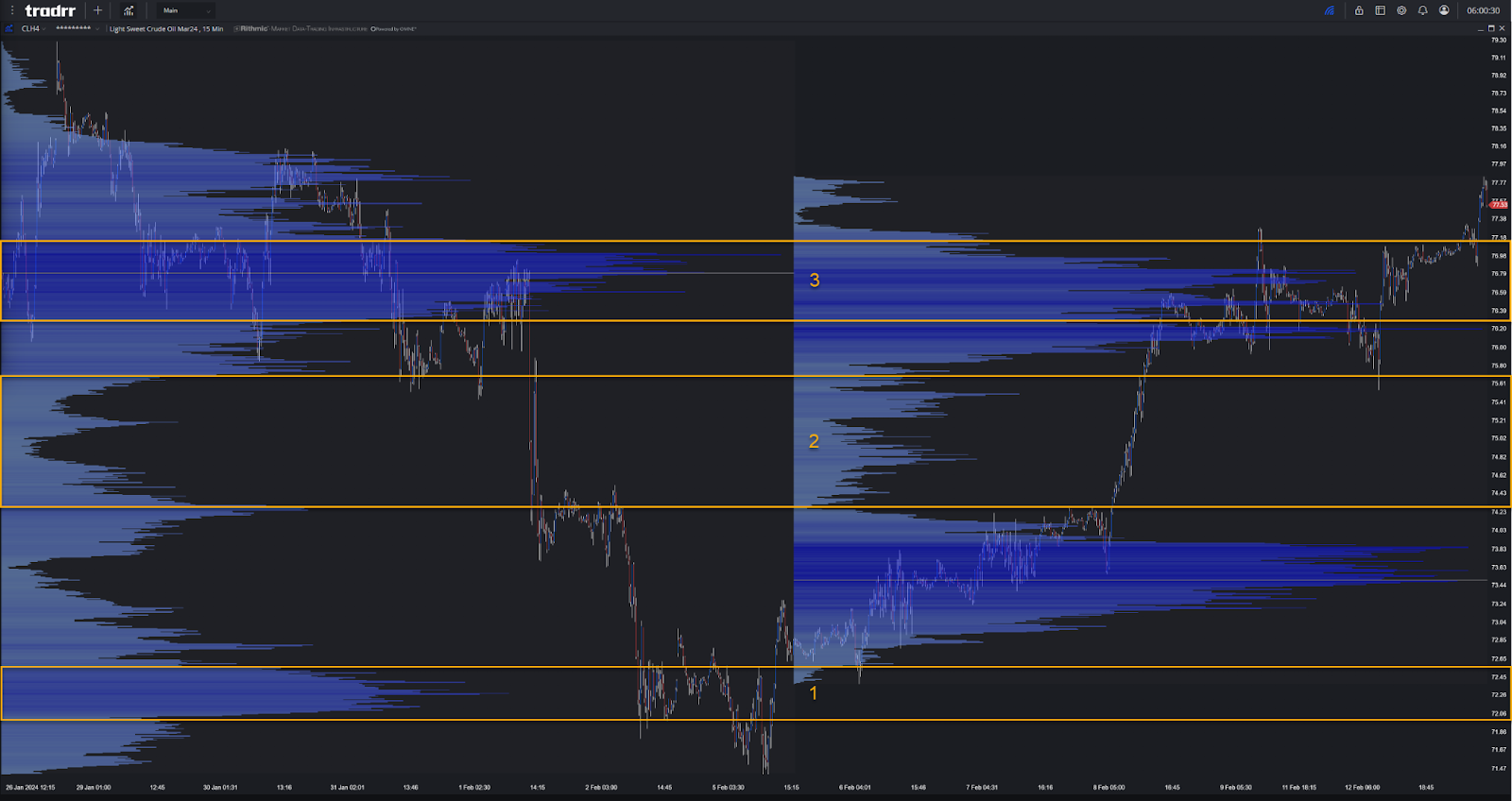

Following the start of last week’s short-term bottom for CL we ground up until Feb 8th allowed us to fly through the start of the month’s spike down and left over poor structure, not to mention the flat bottom on the first profile that should make for an area of interest should selling return.

Continuing on there was a withholding of an opportunity to really fill in the previous profiles valleys well enough to consider the current profiles structure to maintain and holding ability should the Wednesday Crude Oil Inventories report a significant buildup of said inventory.

The other end being should there be a decline of said inventory and having come back into the previous profiles point of control we could gain some momentum to begin attacking January 28th’s gap up 45* degree angled profile topper.

Economic Calendar

Comments are closed