Busy Week With Inflation, Retail Sales & Triple-Witch Opex

Mondays tend to be low-volume sessions.

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Every week, MrTopStep invites traders to an “Own the Close” contest where the closest guesstimate where the SPX will settle on Friday’s 4:00 cash close.

The winners get a free week’s access to the MrTopStep Chat and trading tools. Enter your guess now!

Our View

After a big week of ups and downs, last week the sellers took over the tape as bellwether Nvidia had a bad day on Friday. After a Goldilocks February jobs report and the S&P making its 17th new contract high in 2024 the over-extended, red-hot semiconductor group pushed technology and other hot stocks lower.

While my lean was to sell the higher-open, both the ES and the NQ initially rallied and I got stopped out near the highs of the day. As the PitBull said: I had the right idea, I just went too early.

The week ahead starts with no scheduled economic reports, but Tuesday’s CPI report should give investors a fresh look at inflation — which has been creeping higher lately and came in hot last month. Things pick up again on Thursday with the retail sales number and the Producer Price index (PPI), jobless claims and business inventories. Friday’s reports include the Empire State manufacturing survey, import price index, industrial production and consumer sentiment. Friday is also a triple-witching expiration.

Worth noting is that there are no Fed speakers this week.

Also worth noting is this great piece I read over the weekend, called Can the Nikkei’s record rally in Japanese stocks continue?

Our Lean

HandleStats warned there were going to be some big percentage moves in March and so far he has been spot on. Despite the current weakness and possible further downside, he still thinks we will close higher at the end of the month.

In most cases when the ES and NQ close weak — which they did — the markets rally on Globex. I have written many times about how the momentum traders get short on cases like Friday and 90% of the time the markets rally. That said, I’m not sure that’s the case today.

What I am sure about is Mondays are one of the lowest volume days of the week and if NVDA firms up we could see some type of short-covering rally. I can’t rule out buying weaknesses, but I think with Tuesday’s CPI number I have to sell the 30 to 40-point rips.

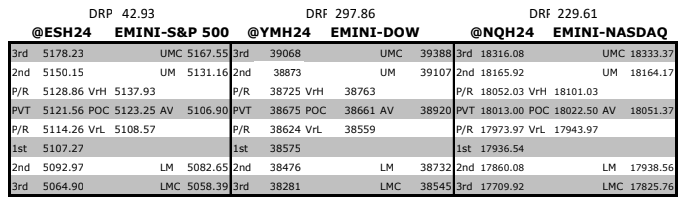

MrTopStep Levels:

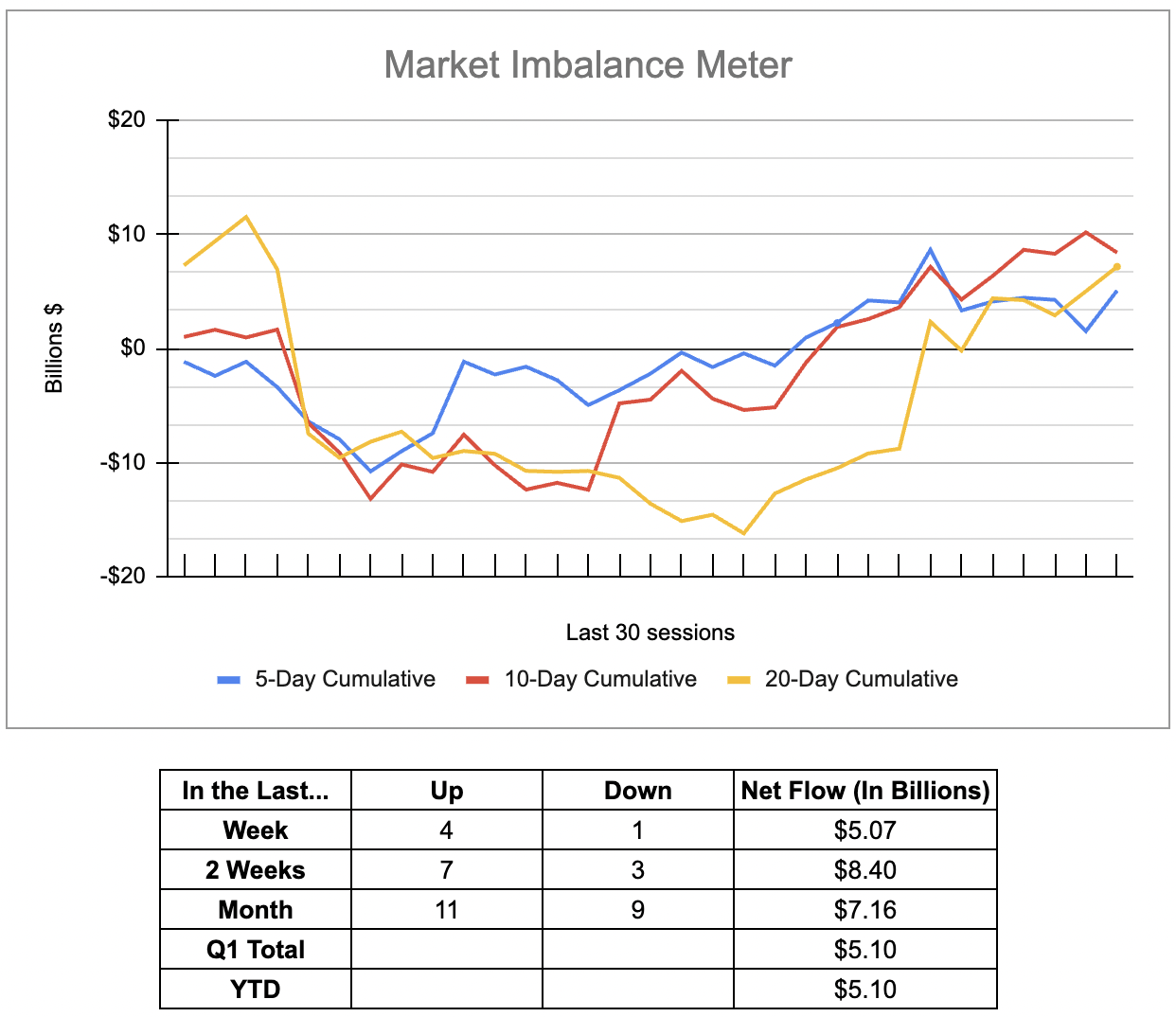

MiM and Daily Recap

ES recap

Part 1 of the Trading Day — What happens on Globex

The ES traded up to 5174.25 on Globex at 3:55 am, sold off down to 5148.75 at 8:30 as the February jobs report was released, rallied up to 5165.00, dropped down to 5141.50 at 8:30:06 and then rallied up to 5175.50 at 8:32:03. From there, it pulled back to 5161.50, rallied back up to a new high at 5179.00 at 9:05 and then dropped down to 5160.75 at 9:29:46 and traded 5165.00 — with 368k ES on Globex.

Part 2 of the Trading Day — What happens after the 9:30 open

After the open, the ES traded up to 5169.50, pulled back to 5163.25, and then rallied up to 5193.00 at 10:06. I can’t do all the little rips and dips because it will take too long but after the high, the ES dropped a few points and made a series of higher lows: 5192.25, 5192.00, 5189.25 at 10:58 and it was that print that set off a selloff down to 5151.00 at 11:32.

After the low, the ES short-covered up to a 5163.25 double top, sold off down to another low at 5147.75 at noon, rallied up to 5159.75 and got hit by more sell programs that pushed the futures down to 5131.00 at 1:01, rallied back up to 5143.50 and then sold of down to another new low at 5121.75 at 1:43. After the low, the ES did a small back-and-fill and rallied up to 5155.25 at 2:43.

Total day session volume is high, over 1.3 million ESH have traded on the day session. After the push up the ES traded down to 5147.00 at 2:59.

Part 3 of the Trading Day — What happens in the final hour

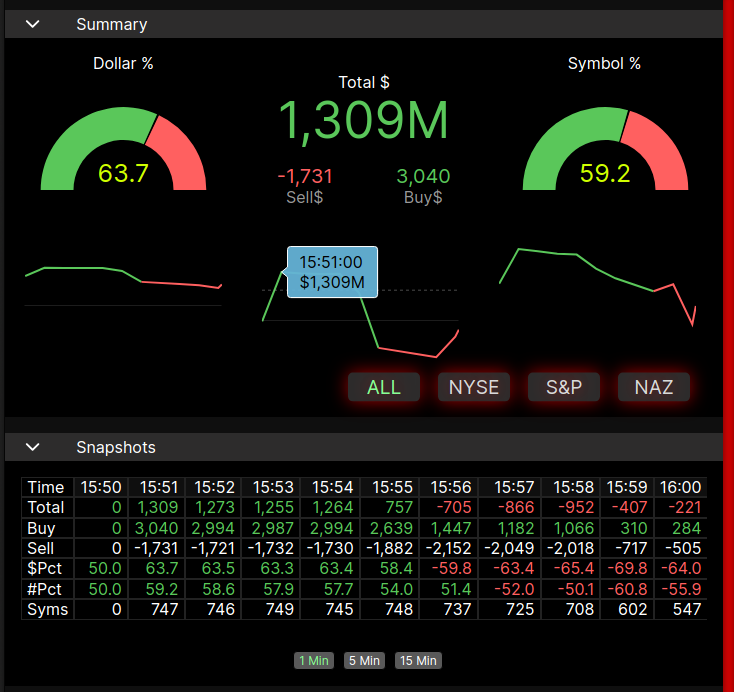

After 3:00, the ES traded up to a lower high at 5154.75 and then at 3:04, the ES dropped 12.5 points down to 5137.50, up ticked, made a 4 to 5 point back-and-fill, dropped down to 5128.50 at 3:30, traded back up to the 5139.00 level and then chopped in in a 4 to 6 point range and traded 5133.55 as the 3:50 cash imbalance showed $1.3 billion to buy and traded 5128.25 on the 4:00 cash close.

After 4:00, the ES rallied up to 5137.25 and settled at 5132.00, down 29.75 points or -0.58% on the day. The NQ settled at 18,056.00, down 260.25 points -1.42%. Oil closed down $1.08 or 1.37% at $77.85, and the 10 Yr Note (ZNM4) settled at 111.260, up +0.050 or 0.14%. Gold (GCJ4) settled at 2,186.20, up 21 points or +0.97% and Bitcoin (BTCH4) settled at 69,152, up 665 points or +0.97% on the day.

In the end, it doesn’t matter how good of a trader you are if your timing is off and that was me on FRYday. I had the right idea — a big rip on Globex, a big rip after the day session open, and then a 72-point drop from the high to the low — but I was too early.

In terms of the ES’s overall tone, it was all over the place. In terms of the ES’s overall trade, volume was the highest of the year: 368k ES traded on Globex and 1.706 million traded on the day session for a total of 2.092 million contracts traded.

Technical Edge

-

NYSE Breadth: 48% Upside Volume

-

Nasdaq Breadth: 55% Upside Volume

-

Advance/Decline: 56% Advance

-

VIX: ~15.75

Economic Calendar

For a more complete Economic Calendar see: https://mrtopstep.com/economic-calendar/

Comments are closed