Beware of The Fed Tape Bombs

March rate cut is off the table

Follow @MrTopStep on Twitter and please share if you find our work valuable!

Our View

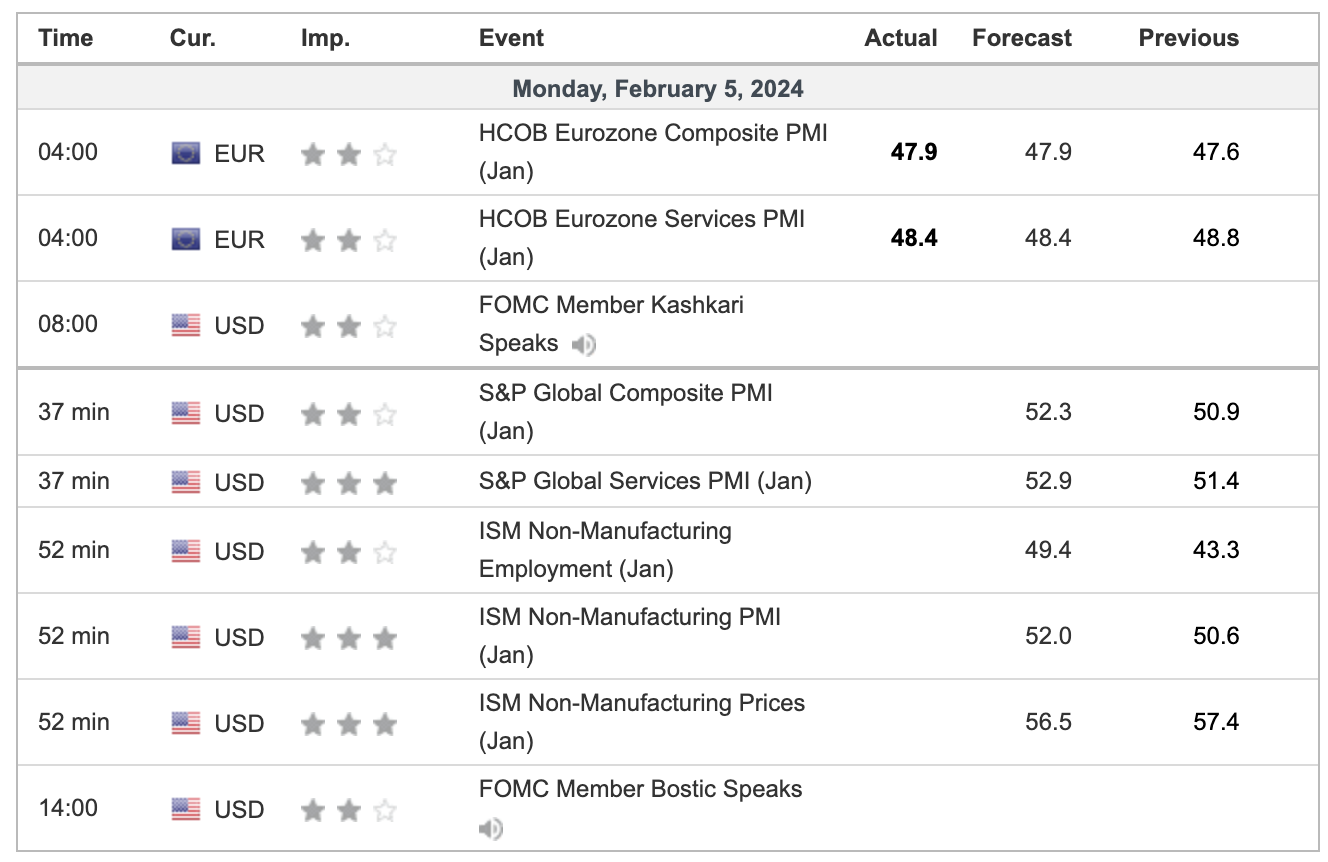

I’m going to keep this short. There are only 7 economic releases this week, but there is an overload of Fed speakers. 12 Fed governors speak and there’s a boatload of S&P earnings.

Jobs FRYday was predictable. Volume of over 250k contracts changed hands during Globex and there was a big juicy open to buy. The rule is to buy the open and hold all day and it worked like a charm. It doesn’t always happen like that, but when they do they tend to be big.

The ES has now rallied about 825 points off its November low. I was joking around in the trading room that the ‘ES will never go down’ — but of course, it will.

The 5000 to 5020 level is going to be tough and February tends to be a more bearish month on a seasonal basis. Over the past 10 years, it has been the second-worst month of the year, averaging a loss of 0.65%. Over the past 20 years, it has been the third-worst month of the year, averaging a loss of 0.36%.

As I have said many times, picking tops is one of the hardest trades you can make… but if I had a boatload of stocks that were going my way, I would sell some of them. I am not talking about blowing them out — I’m talking about paring them down by 20% to 25% and hope you are wrong about selling them because it’s a high-class problem.

As you know, I’m a bull but I ain’t no fool with the markets up so much in the last 3 months. If I’m right, you buy them back later in the month.

Our Lean

With the seasonally bullish first two sessions of February out of the way and the ES knocking on 5000, I think the bulls have to be careful.

Last night Federal Reserve Chairman Powell was on 60 Minutes and he confirmed what I have been saying: No March rate hike! But that is not the only thing this week. It’s the high level of Fed speak that will be bombarding the tape.

Maybe the Fed lowers interest rates in May, but I’m not even sure about that. What we do know is the idea that the Fed will lower rates 6 times this year is off the table. It’s still early in the game, but as I have said many times, 2024 is going to be a very volatile year.

I don’t know if the ES goes down right away, but I do believe that the ES and NQ see weakness throughout the month. Will it be earth-shattering? I doubt it. Our Overall Lean is switching to selling the rallies. That doesn’t preclude me from buying some 30 to 50-point pullbacks, but I think it’s time to start selling some rips.

Some of my key levels include:

Key level to watch for the next reversal is 4939.

Below 4939: 4920 – 4890 – 4872 – 4860 -4845 – 4812 – 4786 – 4772 – 4755 – 4735

Above 4968 – 4979 – 4987 – 5002

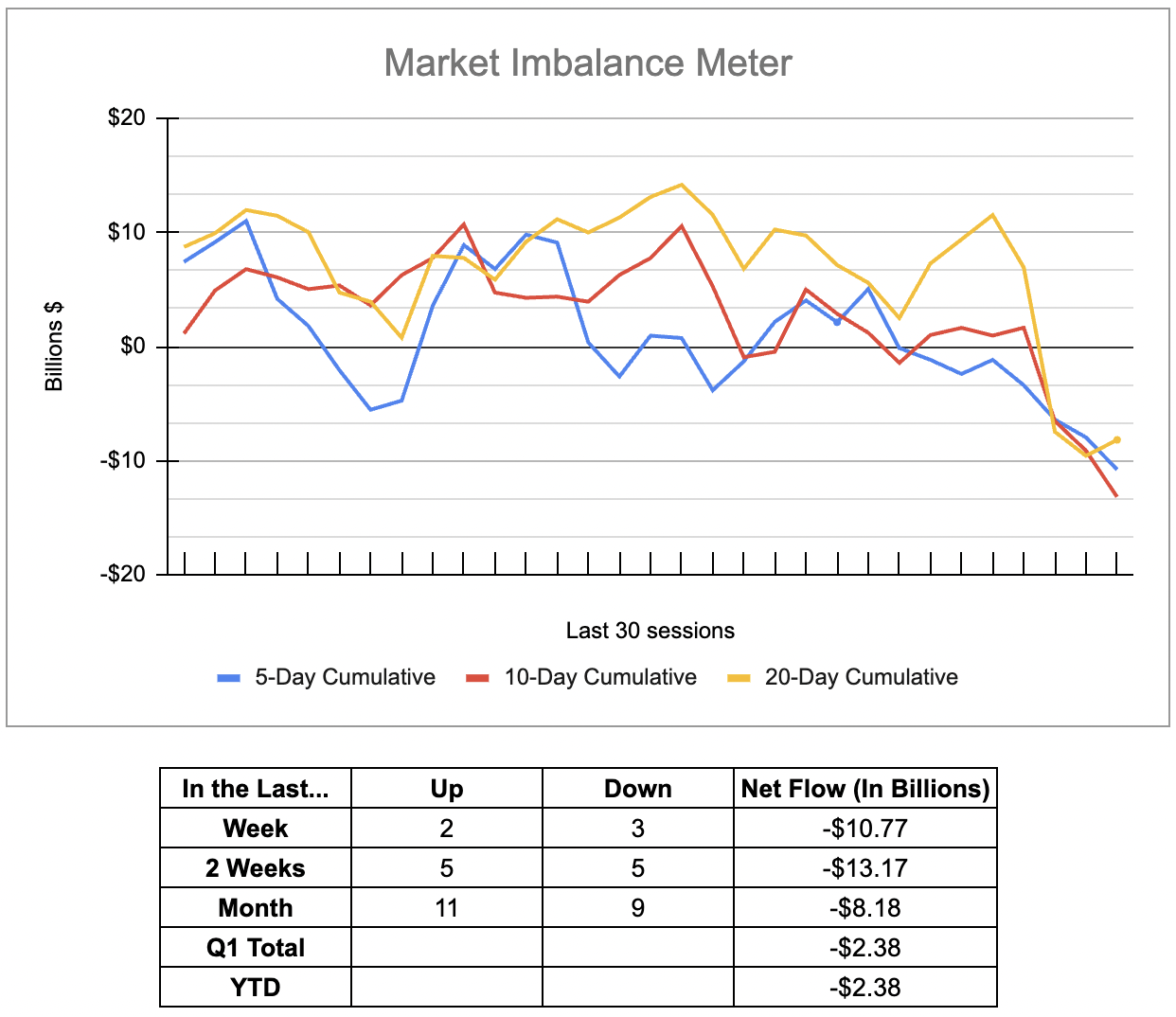

MiM and Daily Recap

ES recap

The ES sold off down to 4925.75 on Globex after the jobs number came in hot and opened Friday’s regular session at 4933.00. After the open, the ES traded 4929.00, traded up to 4945.75 at 9:49, pulled back to 4934.50, rallied up to a lower high at 4944.25, slowly edged down to 4936.25, rallied up to 4950.00, dropped down to 4939.75 at 10:34 and then in one bar rallied up to 4960.75. From there, the ES down-ticked and printed 4961.00, slowly back-and-filled its way up to 4962.25 at 11:13, traded 4962.00 at 11:27, pulled back to 4956.50 and then traded up to 4977.00 at 11:51. After the high, the ES pulled back to 4968.25 and then rallied up to another new high at 4983.50 at 12:40 and then got hit by a headline saying A U.S. Defense Official has told the Wall Street Journal that the Strike Campaign against Iranian and Iranian-Backed Forces in Iraq and Syria is expected to begin sometime this Upcoming Weekend.

That’s when the ES dropped ~25 points down to 4958.75 at 12:48, rallied up to 4982.50, traded back down to 4969.75 and then went on to make 5 new highs up to 4997.75 at 2:45. I warned the MrTopStep chat of the likelihood of selling late in the day. After the high, the ES sold off down to 4983.00 and traded 4987.50 as the 3:50 cash imbalance showed $2.6 billion to sell and traded up to 4990.75 and traded 4978.00 on the 4:00 cash close. After 4:00, the ES sold off down to 4972.00 at 4:15 and settled at 4972.75 on the 5:00 futures close, up 44.25 points or 0.90% on the day. The NQ made a high at 17,775.50 and settled at 17,6878.00, up 250.25 points or up 1.44% on the day

In the end, it was a total buy fest. In terms of the ES’s overall tone, it was firm all day but not as firm as the NQ. In terms of the ES’s overall trade, volume was strong, with a total of 1.862 million contracts traded.

Technical Edge

-

NYSE Breadth: 39% Upside Volume

-

Nasdaq Breadth: 43% Upside Volume

-

Advance/Decline: 31% Advance

-

VIX: ~14.25

ES

Levels from HandelStats.com

-

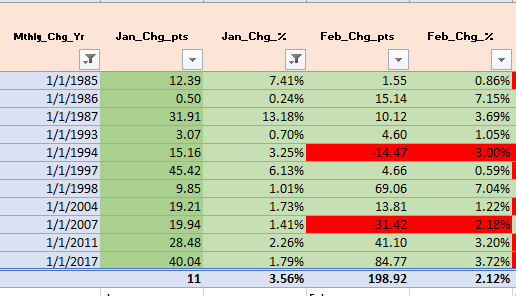

Almost anyway you look at it, February is a weak seasonal period.

-

Since 1970 it has been a net loser and since 2008 it has been a net loser. So I looked to see how it performed when the first 2 days were both up days. Since 1985 when that has occurred February, is up 12 and down 4.

I then looked to see if February was positive after the first 2 days and January was an up month. That happened 11 times and February ended up higher on the month 9 times.

Economic Calendar

Comments are closed