TODAY’S GAME PLAN: from

the trading desk, this is not research

DATA/HEADLINES ET 9:00 a.m: Fed’s Barr speaks, 10:00 a.m:

US July Wholesale Inventories, 1:00 p.m: Baker Hughes US Rig Count, 3:00 p.m: US July Consumer Credit

TODAY’S HIGHLIGHTS:

- NFL Fans Mocked Cris Collinsworth For His Take on Patrick Mahomes’s Greatness

- Widespread outage leaves Cash App and Square App users without access to their money

Global equities extended their losses on Friday. US futures inched lower, while stocks in Asia and Europe skidded after Japan reported its economy

grew less than earlier estimated in the last quarter. Equities extended declines on news that the US government has begun an official probe into an advanced made-in-China chip housed within Huawei Technologies’ latest smartphone. In Asia, Hong Kong scrapped

trading for the day due to a heavy rainstorm. Elsewhere, Janet Yellen has pledged more financial assistance for Ukraine ahead of the G-20 summit. She noted surprise strength in the global economy but gave a less upbeat view on China. The dollar pulled back

from a six-month high as dovish comments from Federal Reserve officials revived speculation that the central bank may keep interest rates at current levels. Oil prices fell, gold advanced, and Treasuries were little changed.

EQUITIES:

US equity-index futures fell on Friday amid growing concern over stretched valuations and worries that strong economic data could prompt a hawkish response from the

Federal Reserve. Apple shares were down 0.1%, mounting risks related to iPhone restrictions in China and a premium valuation make it unlikely for Apple shares to outperform in 2H, JPMorgan said in a Friday note. Apple has shed nearly $190 billion in market

value over the last two days. DocuSign gained 3.0% after the company reported second-quarter results that beat expectations and raised its full-year forecast for revenue and billings. AMC Entertainment fell another 3%, looking to extend its slide into the

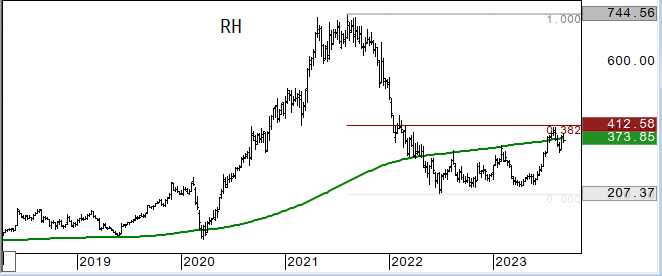

third day. Hudson Pacific Properties fell as much as 11% after it suspended its dividend due to the impact of the Hollywood strikes. RH -7%; guided for lower-than-expected revenue in the third quarter because of pressure on the luxury housing market. Earnings

reporting today include Kroger and Zscaler.

KR -1.7% : Kroger’s stock sinks after sales miss, $1.4 billion charge to settle opioid claims. Kroger and Albertsons Companies Announce Comprehensive Divestiture Plan

With C&S Wholesale Grocers, LLC, Kroger to Sell 413 Stores to C&S in Bid to Close Deal.

Futures ahead of the bell: E-Mini S&P -0.1%, Nasdaq -0.2%, Russell 2000 -0.03%, Dow -0.1%.

European stocks edged lower and were on course to extend their losing streak to eight consecutive sessions, the longest run of declines since 2016. Investors remain

cautious heading into the weekend as the US announces an official probe into Huawei’s new smartphone. The Stoxx 600 is down 0.6%, led by declines in the construction, chemical, and industrial sectors. German inflation eased to 6.4% in August, data from the

federal statistics office showed on Friday, confirming preliminary data. The figure is harmonized to allow for comparisons across the Eurozone. Elsewhere, Switzerland’s stock exchange is proposing major changes to its benchmark indexes, including increasing

the number of members of the blue-chip SMI by one third and updating the methodology for components. Shares of British IT services provider Computacenter were 15% higher at midday. Melrose Industries fell from near the top of the Stoxx 600 index in Thursday’s

session to the bottom in Friday trade, dipping 4.5% after reaching an all-time high. Stoxx 600 -0.1%, DAX -0.3%, CAC +0.09%, FTSE 100 -0.07%.

Stocks in Asia declined on Friday, heading for their first weekly loss in three as rising US-China tensions over technology and concern that the Fed may keep interest

rates higher for longer weighed on risk appetite. The MSCI Asia Pacific Index slid as much as 0.6%, with Tokyo Electron and TSMC being the biggest drags on the gauge. Japan’s benchmarks led losses, with the Nikkei 225 down more than 1%. Hong Kong’s markets

were shut down as the heaviest rainstorm since records began in 1884 hit the city. Japan grew at a 4.8% annual pace in the April-June quarter, below the earlier estimate of 6% growth, according to data released Friday. Much of that growth was driven by exports,

which rose nearly 13%, while private consumption fell 2.2% on weak investment spending. A separate report showed that wages declined in July for the 16th straight month, falling 2.5% from a year earlier. Notable movers included SK Hynix, slumping as much as

4.8%, KEE TAI Properties, falling 9.8% in Taipei, and Hanmi Pharm, advancing 7.6%, after Edaily reported that the Korean pharmaceutical firm is betting on weight-loss drugs for its future growth. Kospi -0.02%, ASX 200 -0.2%, Vietnam -0.1%, Nikkei 225 -1.1%,

Sensex +0.5%, Philippines +0.2%, Taiwan -0.3%.

FIXED INCOME:

Treasuries were steady with the belly outperforming on the curve. 10-year yields around 4.24%, slightly richer on the day; 5-year yields are richer by almost 2bp on

the day. Markets are widely anticipating the Fed to leave rates unchanged at its September meeting; however, expectations for a November rate hike are around 42%, according to CME’s FedWatch tool. Key data released next week include the latest consumer and

producer price index reports.

METALS:

Gold edged higher, although still headed for a weekly loss after solid US economic data in recent days reinforced the case for the Federal Reserve to keep rates elevated,

denting the precious metal’s appeal. Gold +0.2%, Silver +0.2%.

ENERGY:

Oil prices edged higher and were headed for a weekly gain after supply curbs from OPEC+ leaders Saudi Arabia and Russia were extended for the rest

of the year. Elsewhere, Russia plans to reduce diesel exports from its key western ports by a quarter this month amid seasonal refinery maintenance and government efforts to keep more fuel at home to ease growth in domestic prices. WTI +0.7%, Brent +0.7%.

CURRENCIES:

The Dollar index inched lower; however, it is still up for an eighth week, its longest winning streak according to data going back to at least 2005. The offshore yuan

weakened toward its lowest on record against the dollar, as a cut to the daily reference rate for the managed currency stoked bets China is comfortable with a gradual depreciation. The yen is slightly stronger after dipping below 147 against the dollar amid

comments from Japan’s Finance Minister Shunichi Suzuki, stating he will appropriately address excessive moves in the foreign exchange market without ruling out any options. US$ Index -0.04%, GBPUSD +0.3%, USDJPY -0.1%, EURUSD +0.05%, AUDUSD +0.3%, NZDUSD +0.6%,

USDCAD +0.1%.

Bitcoin and other cryptocurrencies were lower on Friday, digital assets remained in a stagnant patch marked by some of the lowest trading volumes

in years. Bitcoin -0.6%, Ethereum -0.8%.

Colors within the report:

Green is always the 200 period (day, week).

Red is always 21,

Blue = 50,

Brown =

100 *Stars have added importance

UPGRADES:

- Adobe (ADBE) raised to buy at Mizuho Securities; PT $630

- Delek Logistics Partners (DKL) raised to neutral at Citi; PT $45

- First Solar (FSLR) raised to buy at Deutsche Bank; PT $235

- Gilead (GILD) raised to buy at BofA; PT $95

- Omega Healthcare (OHI) raised to buy at Mizuho Securities; PT $35

- Petrobras ADRs (PETR4 BZ) raised to outperform at Bradesco BBI; PT $15

- Spruce Bio (SPRB) raised to outperform at SVB; PT $9

- TC Energy (TRP CN) raised to equal-weight at Wells Fargo; PT C$47

DOWNGRADES:

- ABM Industries (ABM) cut to hold at Deutsche Bank; PT $43

- Clarivate (CLVT) cut to underweight at Barclays; PT $7

- Essex Property (ESS) cut to neutral at Citi; PT $260

- Summit Materials (SUM) cut to peerperform at Wolfe

INITIATIONS:

- Adtran Holdings (ADTN) rated new buy at M.M. Warburg; PT $18.22

- Arch Capital (ACGL) reinstated neutral at Goldman; PT $80

- Artemis Gold (ARTG CN) reinstated buy at Stifel Canada; PT C$11

- Asure Software (ASUR) reinstated buy at Stifel; PT $15

- Atossa Therapeutics Inc (ATOS) rated new overweight at Cantor; PT $5

- Axis Capital (AXS) reinstated sell at Goldman; PT $51

- ChargePoint (CHPT) rated new outperform at RBC; PT $9

- EVgo (EVGO) rated new sector perform at RBC; PT $5

- Everest Group Ltd (EG) reinstated buy at Goldman; PT $449

- Innovage (INNV) reinstated market perform at Cowen; PT $7

- Lucid (LCID) rated new sector perform at RBC; PT $6

- Mister Car Wash (MCW) reinstated outperform at William Blair

- P&G (PG) rated new market perform at William Blair

- RenaissanceRe (RNR) reinstated buy at Goldman; PT $242

- Snowflake (SNOW) rated new buy at DA Davidson; PT $200

- Surf Air Mobility (SRFM) rated new overweight at Piper Sandler; PT $4

- Vaxxinity (VAXX) rated new outperform at Baird; PT $7

- ZyVersa Therapeutics (ZVSA) rated new buy at HC Wainwright; PT $2.50

Data sources: Bloomberg, Reuters, CQG

No responses yet