TODAY’S GAME PLAN: from the trading

desk, this is not research

DATA/HEADLINES 8:30ET CPI*; 1:00ET 30 year bond auction

August CPI expected +0.6%; Core +0.2%

TODAY’S HIGHLIGHTS:

- Libya storm death toll expected to swell as sea washes bodies ashore; death toll in city of Derna has risen

to more than 5,100 - US CDC recommends broad use of updated COVID-19 vaccines

- Vladimir Putin and Kim Jong Un met for the first time in four years

Global shares fell as markets braced for key US inflation data, with a spike in oil prices fueling anxiety that price pressures are proving more ingrained than hoped.

Markets are looking to US price data today that may show a third month of subdued core inflation, bolstering the case for the Federal Reserve to cease rate increases. That contrasts with the challenges faced in Europe as traders ramp up bets the ECB will hike

rates on Thursday amid growing concerns about persistently high inflation.

EQUITIES:

US equity futures fluctuated as traders awaited inflation data for clues on whether policy makers will keep rates higher for longer. While core CPI is seen cooling to 4.3% year-on-year

in August from 4.7%, rising energy costs are forecast to keep headline inflation elevated at 3.6%. And the latest spike in oil prices to 10-month highs is unlikely to escape the Fed’s attention. JPMorgan warned of an overpriced S&P 500 that was “disconnected”

from reality. Meanwhile, The UAW and the Big Three Detroit carmakers are still “far apart” on a new labor contract.

Futures ahead of the bell: E-Mini S&P -0.02%, Nasdaq -0.01%, Russell 2000 +0.2%, Dow -0.05%.

In premarket trading, Ford gained 2% following a double-upgrade from UBS. Apple fluctuated, giving up earlier gains, after China flagged security problems with iPhones, while saying

it isn’t barring purchases. This is the government’s first comments on the topic after news reports that authorities are moving to restrict the use of Apple products in sensitive departments and state-owned companies. Rocket Pharmaceuticals (RCKT) shares jump

25% after the gene-therapy developer said it’s in alignment with the US Food and Drug Administration on the global Phase 2 trial of RP-A501 for Danon disease. Workhorse (WKHS) rose as much as 32% after saying it received IRS approval as a qualified manufacturer

for the Commercial Clean Vehicle Credit. Elsewhere, Arm Holdings’ long-anticipated initial public offering is set to price today at the top end of its range or even higher, in what is set to be the largest listing of the year.

European equities are broadly lower with all sectors in the red as money markets boosted bets on ECB policy tightening. Markets in Europe were looking past the US data to a hawkish shift

in expectations for the ECB on Thursday, with bets now favoring a hike after a Reuters report that the ECB expects inflation will stay above 3% next year in its updated forecasts. Stagflation fears hit sentiment, after reports indicated that the region’s economy

was sinking further into a downturn while inflation was set to stay persistently high. Germany is set to predict an economic contraction for this year instead of growth, while data also showed the UK economy shrank at the fastest pace in seven months. Auto

stocks gave up earlier gains after the European Union said it was launching an investigation into Chinese subsidies for electric vehicles, amid concerns of possible retaliation from China. Retail -2%, Industrial Goods -1.3%, Food & Bev –1.1%. Media -0.05%,

Oil & Gas -0.1%.

Asian stocks slipped, with tech stocks in Japan and China leading the moderate decline as caution reigned ahead of a US inflation print. The MSCI Asia Pacific Index fell 0.2%, with Hitachi

and Alibaba among the biggest drags. A gauge of Chinese tech firms listed in Hong Kong headed for its longest run of losses since April, while a tech-heavy small-cap measure in South Korea dropped more than 1%. Philippines -1.3%, ASX 200 -0.7%, CSI 300 -0.6%,

Vietnam -0.6%, Nikkei 225 -0.2%, Hang Seng Index -0.1%, Kospi -0.1%. Sensex +0.4%, Taiwan +0.05%.

FIXED INCOME:

Treasuries are lower amid bigger losses in bunds after a report that the European Central Bank expects inflation to hold above 3% next year. Focal points of the US

session are August CPI data and 30-year bond sale, following decent demand for Tuesday’s 10-year note auction. Tuesday’s 10-year stopped on the screws as it drew highest yield since 2007. 2 year yield is flat; 10 year yield +2bps.

METALS:

Gold prices were steady and held near the lowest in over two weeks before inflation data that’s expected to give a clearer picture of the US interest-rate path. Expectations

for a hot reading on August inflation have helped drive the US dollar higher alongside Treasury yields. The double-whammy has weighed on gold. Spot gold -0.1%, silver -0.8%.

ENERGY:

Crude oil extended 10-month highs after the IEA warned supply cuts by Saudi Arabia and Russia will create a “significant supply shortfall through the fourth quarter.”

However, the lack of cuts at the start of next year would shift the balance to a surplus, the agency said, highlighting that stocks will be at uncomfortably low levels, increasing the risk of another surge in volatility in a fragile economic environment. OPEC

on Tuesday stuck to its forecasts for robust growth in global oil demand in 2023 and 2024. The IEA estimates 2023 global demand to grow by 2.2 million bpd, while OPEC expects growth of 2.44 million bpd. WTI +0.6%, Brent +0.6%, US Nat Gas +0.7%, RBOB -0.4%.

CURRENCIES:

Currency markets are relatively quiet with the US$ Index steady ahead of the inflation data. The pound extended declines to a three-month low after the UK economy

shrank at the quickest pace in seven months in July as strikes and wet weather hit activity harder than expected. EURUSD slipped, after nearing one-week highs on the Reuters story which was published late on Tuesday. Markets now favor a rate hike from the

ECB on Thursday with a 75% probability, up from less than 50% last week. US$ Index +0.05%, GBPUSD -0.15%, EURUSD -0.15%, USDJPY +0.2%, AUDUSD -0.2%, USDCHF +0.2%.

Bitcoin +0.4%, Ethereum +0.2%.

TECHNICAL LEVELS:

|

ESZ23 |

10 Year Yield |

Dec Gold |

Oct WTI |

Spot $ Index |

|

|

Resistance |

4597.50 |

5.325% |

2040.0 |

97.07 |

108.500 |

|

|

4573.00 |

4.710% |

2029.0 |

93.74 |

107.990 |

|

|

4551/53 |

4.500% |

2004.0 |

91.30/50 |

107.195 |

|

|

4528.00 |

4.375% |

1996.0 |

90.00 |

105.883 |

|

|

4519.00 |

4.360% |

1978.4 |

89.18 |

105.380 |

|

Settlement |

4513.75 |

1935.1 |

88.84 |

||

|

|

4503/05 |

4.050% |

1927.9* |

84.08 |

103.100 |

|

|

4474/82 |

3.940% |

1907.0* |

81.62 |

102.370 |

|

|

4437.00 |

3.725% |

1866.0 |

79.10 |

101.700 |

|

|

4425.00 |

3.680% |

1842.0 |

76.31 |

100.710 |

|

Support |

4350.00 |

3.500% |

|

73.56 |

100.000 |

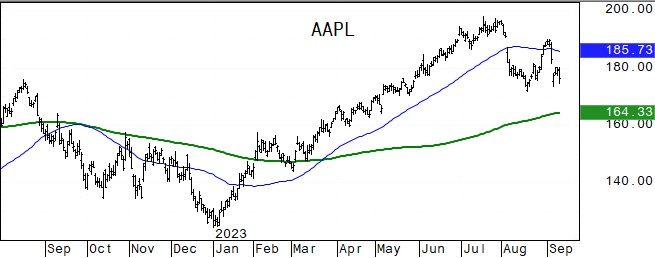

Colors within the report:

Green is always the 200 period (day, week).

Red is always 21,

Blue = 50,

Brown =

100 *Stars have added importance

UPGRADES:

- American Electric Power (AEP) raised to neutral at Ladenburg Thalmann

- Ford (F) raised to buy at UBS; PT $15

- ImmunoGen (IMGN) raised to overweight at JPMorgan; PT $22

- North West Co (NWC CN) raised to buy at TD; PT C$41

- Summit Materials (SUM) raised to strong buy at CFRA; PT $44

- UMB Financial (UMBF) raised to overweight at Piper Sandler

- WesBanco (WSBC) raised to outperform at Hovde Group; PT $30

DOWNGRADES:

- Acelyrin (SLRN) cut to equal-weight at Morgan Stanley; PT $19

- Ball (BALL) cut to neutral at Credit Suisse; PT $58

- Ecopetrol ADRs (ECOPETL CB) cut to neutral at Citi; PT $12.50

- Oracle (ORCL) cut to neutral at JPMorgan; PT $100

- Tapestry (TPR) cut to neutral at Redburn; PT $33

- Ultrapar ADRs (UGPA3 BZ) cut to neutral at Goldman; PT $4

INITIATIONS:

- Albemarle (ALB) rated new outperform at Haitong Intl; PT $240

- Ares Commercial (ACRE) rated new equal-weight at Wells Fargo; PT $10

- Athabasca Oil (ATH CN) rated new buy at Stifel Canada; PT C$5

- Atlantic Union (AUB) rated new overweight at Stephens; PT $36

- B&G Foods (BGS) rated new underperform at Cowen; PT $10

- Beyond Meat (BYND) rated new underperform at Cowen; PT $10

- Cactus (WHD) rated new neutral at JPMorgan; PT $60

- Campbell Soup (CPB) rated new market perform at Cowen; PT $45

- Charles River (CRL) rated new market perform at Cowen; PT $212

- Conagra (CAG) rated new market perform at Cowen; PT $32

- Expro Group Holdings NV (XPRO) rated new overweight at JPMorgan; PT $30

- Fortinet (FTNT) rated new overweight at Capital One; PT $74

- Freshpet (FRPT) rated new outperform at Cowen; PT $90

- General Mills (GIS) rated new market perform at Cowen; PT $70

- Gorman-Rupp (GRC) rated new buy at Northcoast; PT $40

- Hershey (HSY) rated new outperform at Cowen; PT $250

- Hostess Brands (TWNK) rated new market perform at Cowen; PT $34

- ICF International (ICFI) reinstated market perform at William Blair

- Icon (ICLR) rated new outperform at Cowen; PT $306

- Immunocore ADRs (IMCR) rated new buy at Needham; PT $75

- J M Smucker (SJM) rated new outperform at Cowen; PT $158

- Kellogg (K) rated new market perform at Cowen; PT $63

- Kraft Heinz (KHC) rated new market perform at Cowen; PT $35

- Lamb Weston (LW) rated new outperform at Cowen; PT $125

- McCormick (MKC) rated new market perform at Cowen; PT $87

- Mondelez (MDLZ) rated new outperform at Cowen; PT $82

- NV5 (NVEE) rated new outperform at William Blair

- Redwire (RDW) rated new buy at Roth MKM; PT $10

- SQM ADRs (SQM/B CI) rated new buy at Citi; PT $85

- Seacoast Banking (SBCF) rated new equal-weight at Stephens; PT $23

- Stingray Group (RAY/A CN) rated new buy at Desjardins; PT C$9

- Tetra Tech (TTEK) rated new outperform at William Blair

- Tko Group (TKO) rated new buy at Guggenheim; PT $130

- Tko Group (TKO) rated new buy at Roth MKM; PT $132

- Towne Bank (TOWN) rated new equal-weight at Stephens; PT $23

- TreeHouse (THS) rated new market perform at Cowen; PT $45

- Uranium Energy (UEC) rated new speculative buy at TD; PT $6

- Utz Brands (UTZ) rated new outperform at Cowen; PT $18

- Veeco Instruments (VECO) rated new buy at Citi; PT $35

- Vital Farms (VITL) rated new market perform at Cowen; PT $13

Data sources: Bloomberg, Reuters, CQG

No responses yet