TODAY’S GAME PLAN: from the trading

desk, this is not research

DATA/HEADLINES 8:30ET Chicago Fed Nat Activity Index; 10:30 Dallas Fed Manf. Activity: 6:00ET Fed’s Kashkari speaks

TODAY’S HIGHLIGHTS:

- Costco plans to offer members access to medical care through a deal with online marketplace Sesame

- Asteroid chunks that may tell us about the earliest days of the solar system were recovered in the Utah desert

yesterday - The Yankees were eliminated from the playoffs for the first time since 2016

Global shares fell as fears over the health of China’s property sector aggravated investors’ concerns that global economic growth was slowing. The MSCI All-World

index edged lower and is heading for its worst monthly performance this year, with a 3.5% drop. S&P lowered its forecast for Chinese growth to 4.8% in 2023 from 5.2%, and to 4.4% in 2024 from 4.8%, and said fiscal and monetary stimulus had been limited so

far. China’s manufacturing sector is expected to return to expansion in September, with the purchasing manufacturing index forecast to rise above 50 for the first time since March, Goldman Sachs analysts said.

EQUITIES:

US equity futures are lower following the worst week since March with a messy picture of a looming government shutdown this week. If Congress does not pass spending bills for the coming

fiscal year that starts October 1, US agencies will have to shut down non-essential operations. Since 1981, the government has shut down 14 times. Republican holdout Matt Gaetz said he’s ready for a multiday government closure if that’ll get demands such as

conservative border policies into the budget. A possible government shutdown, the autoworkers’ strike, the resumption of student loan repayments, higher energy prices, and higher long-term borrowing costs are among risks that Powell noted in his press conference

last week. The FOMC will stay on hold until it’s ready to cut next year, Morgan Stanley’s chief US economist said.

Futures ahead of the bell: E-Mini S&P -0.2%, Nasdaq -0.4%, Russell 2000 -0.5%, Dow -0.3%.

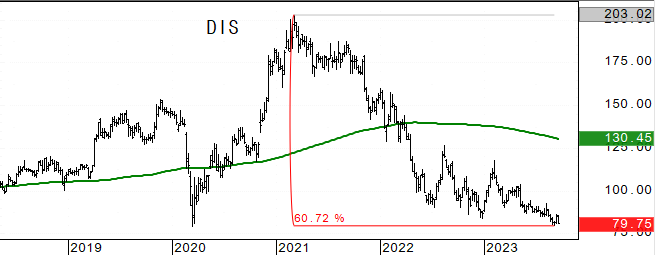

In pre-market trading, Film and entertainment stocks gain in premarket trading as striking screenwriters reached a tentative new labor agreement with studios including Disney (DIS) and

Netflix (NFLX). CarMax (KMX) rises 2.3% after Wedbush upgrades the used-car retailer to outperform from neutral amid improving market-share performance. Alector (ALEC) drops 3.6% after Goldman gives the clinical stage biopharmaceutical company its only sell

rating in an initiation note, citing “significant clinical risk.” Ardelyx (ARDX) rises 6.1% after its collaboration partner Kyowa Kirin won approval in Japan for the drug Tenapanor. ESS Tech (GWH) rises 5.8% on a collaboration with Honeywell to advance technology

development and market adoption of iron flow battery energy storage systems. Morphic Holding (MORF) falls 4.6% after BTIG downgraded the firm to neutral from buy. Amazon (AMZN +0.5%) will spend as much as $4 billion on a minority stake in generative AI start-up

Anthropic.

European stocks followed Asia lower with the Stoxx 600 falling 0.7%, dragged down by travel and mining shares. Rio Tinto fell as much as 5.2% as China’s property problems weighed on the

outlook for natural resources. Shares of Italian banks climbed after Bloomberg reported they’ll be allowed to avoid paying a controversial windfall tax introduced last month if they set aside additional capital reserves. Germany’s business outlook improved

slightly in September, while remaining at historically low levels. German IFO survey came in at 85.7 versus 85.2 and Spain’s PPI was higher at 1.2% versus 0.1% previously. DAX -0.9%, CAC -0.8%, FTSE 100 -0.9%. Travel -2.7%, Technology -1.3%, Autos -1.2%.

Asian equities fell, led by a slump in Chinese stocks, as rising liquidation risks facing Evergrande renewed property-related concerns. Shares of the ailing China Evergrande plunged 21.8%

after the developer said it was unable to issue new debt due to an ongoing investigation into one of its subsidiaries, dealing a fresh blow to its restructuring plans. Country Garden fell more than 7% as investors nervously await its latest dollar bond coupon

payment on Wednesday. Adding to anxiety was news that Chinese authorities ordered Nomura’s head of China investment banking to not leave the mainland, in a move tied to a long-running probe into tech dealmaker Bao Fan. Investors are looking to early indicators

ahead of China’s Golden Week holiday period, which starts Friday. Japanese shares ended with gains, halting a multi-day losing run, as the yen’s weakness supported exporters. Stocks in Taiwan also gained after data showed industrial output fell 10.5% year

on year in August, less than expected. The MSCI Asia Pacific Index declined 0.5%. Vietnam -3.3%, Hang Seng Index -1.8%, CSI 300 -0.6%, Kospi -0.5%. Nikkei 225 +0.8%, Taiwan +0.6%, ASX 200 +0.1%, Sensex was flat.

FIXED INCOME:

Treasuries bear-steepen with long-end yields cheaper by up to 7bp on the day and 2s10s, 5s30s spreads near session wides heading into early US session. Treasuries

led by price action in core European rates, where German 10-year yields rise to highest since 2011. US 10-year Treasury yields nudged back close to 16-year highs, +6bps at 4.5%. 2s10s reached -62bp, least inverted since May 24. Another heavy US Treasury

debt auction schedule kicks off on Tuesday with a 2-year note sale – followed by a 3-year note auction on Wednesday and seven-years on Wednesday.

METALS:

Gold edged lower as Treasury yields rallied, with investors bracing for a prolonged period of elevated rates. Gold -0.1%, silver is flat.

ENERGY:

Oil fluctuated following last week’s decline after a hawkish Federal Reserve stance rattled global financial markets and raised oil demand concerns. Traders are increasingly

concerned that rising oil prices risk fanning inflation, which will make it difficult for policymakers to reduce rates anytime soon. China is gearing up for the Golden Week holiday from Friday, with the longer-than-usual break set to boost demand for jet fuel

in the biggest oil importer. More than 21 million people are expected to fly during the eight days, following record air-passenger traffic in July and August. WTI +0.03%, Brent is flat, US Nat Gas +0.5%, RBOB +0.2%.

CURRENCIES:

The US dollar is slightly higher after recording its 10th straight week of gains last week, its longest stretch since 2014. The euro also fell for a 10th straight

week, a first since its launch. The Japanese yen held near a 10-month low as Governor Kazuo Ueda in a speech today reiterated the central bank’s resolve regarding interest rates and said there was “very high uncertainty” over whether companies would continue

raising prices and wages. Swiss franc leads losses in G-10 as it remains under pressure after SNB kept rates unchanged last week. US$ Index +0.1%, GBPUSD -0.1%, USDJPY +0.2%, EURUSD -0.1%, USDCHF +0.35%, AUDUSD -0.3%, USDSEK -0.7%.

Bitcoin -1.5%, Ethereum -1.4%.

TECHNICAL LEVELS:

|

ESZ23 |

10 Year Yield |

Dec Gold |

Nov WTI |

Spot $ Index |

|

|

Resistance |

4501.00 |

5.500% |

2083.5 |

98.00 |

|

|

|

4472.00 |

5.325% |

2047.0 |

97.07 |

108.500 |

|

|

4455.00 |

5.000% |

2022.0 |

95.00 |

107.990 |

|

|

4442.00 |

4.710% |

1996.0 |

93.74 |

107.195 |

|

|

4400.00 |

4.500% |

1982.2 |

92.00 |

105.880 |

|

Settlement |

4361.00 |

1945.6 |

90.03 |

||

|

|

4348/50* |

4.140% |

1934.5* |

87.50 |

104.460 |

|

|

4331.00 |

4.000% |

1907.0* |

83.00/50 |

103.100 |

|

|

4305.00 |

3.750% |

1866.0 |

82.25 |

102.680 |

|

|

4288.00 |

3.530% |

1842.0 |

81.40/60 |

101.950 |

|

Support |

4245.00 |

3.265% |

1821.0 |

76.75 |

100.910 |

Colors within the report:

Green is always the 200 period (day, week).

Red is always 21,

Blue = 50,

Brown =

100 *Stars have added importance

- Upgrades

- (AZN LN) AstraZeneca ADRs Raised to Buy at Jefferies; PT $80

- (BEP-U CN) BEP US Raised to Strong Buy at Raymond James; PT $37

- (BIP) Brookfield Infrastructure Raised to Strong Buy at Raymond James

- (CWAN) Clearwater Analytics Raised to Buy at Loop Capital; PT $25

- (DOW) Dow Raised to Overweight at JPMorgan; PT $55

- (KMX) CarMax Raised to Outperform at Wedbush; PT $90

- (MSFT) Microsoft Raised to Neutral at Guggenheim

- (NU) Nubank Raised to Neutral at Bradesco BBI; PT $8

- (RKT) Rocket Cos. Raised to Hold at CFRA; PT $8

- (SEE) Sealed Air Raised to Buy at Citi; PT $41

- (ZGN) Zegna Group Raised to Buy at BofA

- Downgrades

- (FL) Foot Locker Cut to Hold at Jefferies

- (FMC) FMC Corp Cut to Neutral at Redburn; PT $97.96

- (HRMY) Harmony Biosciences Cut to Sell at Goldman; PT $31

- (MORF) Morphic Cut to Neutral at BTIG

- (NKE) Nike Cut to Hold at Jefferies; PT $100

- (PAA) Plains All American Cut to Underweight at Barclays; PT $15

- (PAGP) Plains GP Cut to Underweight at Barclays; PT $15

- (SPLK) Splunk Cut to Peerperform at Wolfe; PT $157

- (URBN) Urban Outfitters Cut to Hold at Jefferies

- (VACC) Vaccitech ADRs Cut to Equal-Weight at Morgan Stanley; PT $3.25

- Initiations

- (ALEC) Alector Rated New Sell at Goldman; PT $4

- (AMAM) Ambrx Biopharma ADRs Rated New Market Outperform at JMP; PT $15

- (ANGO) AngioDynamics Rated New Buy at HC Wainwright; PT $19

- (BE) Bloom Energy Rated New Buy at HSBC; PT $22

- (BLDP CN) Ballard Power Systems Rated New Hold at HSBC; PT C$6.07

- (CART) Maplebear Rated New Peerperform at Wolfe

- (FMBH) First Mid Bancshares Inc Rated New Outperform at KBW; PT $34

- (GLNG) Golar LNG Resumed Neutral at Citi; PT $27

- (GTLS) Chart Industries Rated New Buy at HSBC; PT $212

- (HDSN) Hudson Technologies Rated New Buy at Canaccord; PT $15

- (IVN CN) Ivanhoe Mines Reinstated Equal-Weight at Morgan Stanley; PT C$13

- (PLUG) Plug Power Rated New Buy at HSBC; PT $11

- (RBLX) Roblox Rated New Add at Sealand Securities

- (SANA) Sana Biotech Rated New Market Outperform at JMP; PT $9

- (UPST) Upstart Rated New Hold at Needham

Data sources: Bloomberg, Reuters, CQG

No responses yet