TODAY’S GAME PLAN: from the trading

desk, this is not research

DATA/HEADLINES 8:30ET Durable Goods Orders, Cap Goods Orders; 1:00ET 5 Year Auction

TODAY’S HIGHLIGHTS:

- Border Patrol seized 2,700+ lbs. of fentanyl *between* ports of entry so far this year; enough lethal doses

to easily wipe out the entire population of the US - Joe Biden’s dog Commander has bitten another US Secret Service employee

- The Hollywood writers’ strike ended

- US bank deposits fell for the first time since 1994, S&P said

World stocks ticked up as the global selloff in bonds eased with MSCI’s all-country index clinging to positive territory after its longest losing streak in over a

year. Worrying for many investors this week has been how bond yields have climbed despite weaker economic signals and how stock and bond losses are correlating again. China’s industrial profits rose 17.2% in August from a year ago. Australian CPI growth picked

up to 5.2%, as expected. Thailand raised its key rate 25 bps to 2.5%.

EQUITIES:

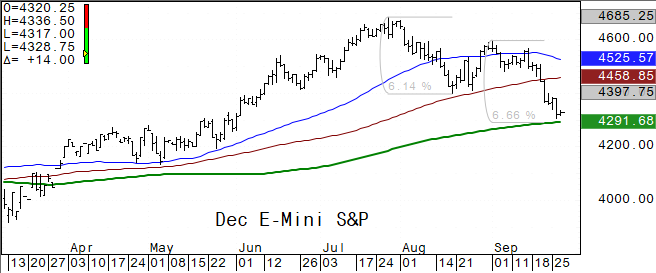

US equity futures gained along with Treasuries, a day after the Dow posted its biggest one-day percentage drop since March. The S&P 500 is on course for its worth month of the year with

September losses of more than 5%. Meanwhile, Senate Democratic and Republican leaders agreed Tuesday on a plan to keep the government open through mid-November and provide $6 billion in assistance to Ukraine. The plan to avert a shutdown on October 1 still

needs to overcome gridlock in the House. The Fed’s Kashkari said on CNBC this morning that he doesn’t know if Fed policy is restrictive enough and that it’s possible that the neutral rate may have moved up. He added that higher oil prices alone won’t warrant

more rate hikes and he is hopeful the Fed has done enough on rates…

Futures ahead of the bell: E-Mini S&P +0.3%, Nasdaq +0.3%, Russell 2000 +0.4%, Dow +0.3%.

Russell 2000 Growth versus Value holding on above the key 200 day moving average.

In pre-market trading, Costco (COST) falls 2% despite beating earnings estimates. The firm held back from commenting on the timing of its membership-fee increase. ChargePoint Holdings

(CHPT) gains 4.7% after UBS started coverage of the electric-vehicle charging company with a buy rating and $9 price target. Ginkgo Bioworks Holdings (DNA) jumps as much as 18%, extending gains after the health-care firm said it is collaborating with Pfizer

to develop new RNA drugs. Levi Strauss (LEVI) shares are up 1.3%, after Cowen started coverage on the apparel company with an outperform rating and $16 price target. Morgan Stanley says US midcap banks are “not out of the woods yet,” as it downgrades both

Valley National (VLY) and Zions (ZION) to underweight.

European gauges erased early gains to trade little changed as softer German and French consumer confidence prompted bond yields to fall. Germany and France indices are hovering near their

lowest levels since March, as investors remained concerned about the outlook for interest rates. The Stoxx 600 was little changed after tumbling to its lowest since early July in the previous session. Barclays Plc strategists said the outflows from European

stock funds look overdone given the outlook for corporate profits. Among individual names, H&M advanced after CEO Helena Helmersson cut costs and made progress reducing an inventory backlog that has plagued the Swedish retailer for more than seven years.

UK property shares slipped after Jefferies downgraded much of the sector as the work-from-home trend creates a surplus of space. Stoxx 600 +0.1%, DAX +0.05%, CAC +0.1%, FTSE 100 -0.05%. Technology +1.1%, Industrials +0.9%. Telecom -1.4%, Insurance -1.2%, REITs

-1.2%.

Asian equities rose, snapping a two-day drop, boosted by a rebound in Chinese stocks following strong economic data. The MSCI Asia Pacific Index inched higher by 0.1%, erasing an earlier

drop of 0.6%. Technology and health care stocks led the recovery. Stocks in Hong Kong and mainland China closed higher after data showed industrial profits rose in August for the first time in more than a year. Chinese developers, however, closed at the lowest

level in 12 years after Evergrande’s chairman was put under police control. Asian luxury-goods companies fell after Morgan Stanley cut their 2024 profit forecasts for the sector by 2% to 5%. Philippines +1.8%, Vietnam +1.4%, Hang Seng Index +0.8%, Topix +0.3%,

Sensex +0.3%, Taiwan +0.2%, CSI 300 +0.2%, Kospi +0.1%, ASX 200 -0.1%, Singapore -0.5%.

FIXED INCOME:

US Treasury yields slipped after hitting a 16-year high sparked by speculation the Federal Reserve will keep policy restrictive into next year, or longer. A “soft

landing” for the US economy is more likely than not, Minneapolis Federal Reserve Bank President Neel Kashkari said on Tuesday, but there is also a 40% chance that the Fed will need to raise interest rates “meaningfully” to beat inflation. 10 year yield is

lower by ~3bps after touching its highest level since October 2007 on Tuesday at 4.566%. 2 year yield -7bps at 5.06%; 2s10s +4bps. US session includes 5-year note auction poised to draw the highest yield since 2007; Tuesday’s 2-year sale stopped on the screws.

Auction cycle concludes Thursday with $37b 7-year note.

METALS:

Gold retreated for a third day as investors eyed a relentless surge in the dollar that’s weighing on the precious metal. Spot gold slipped below $1,900 on Tuesday

for the first time in a month. It has managed to avoid falling far beneath that marker for much of this year despite a surge in inflation-adjusted bond yields that would usually cause it to slump. Dip-buying around that price level has been persistent so far.

Later in the week, traders will look to the Fed’s favored inflation metric to provide direction for metals. The PCE deflator is predicted to show an easing of price pressures, which could give US policymakers more room to avoid hiking rates again. Spot gold

-0.3%, silver -0.3%.

ENERGY:

Oil resumed its climb on a tightening market. Data released Tuesday showed US crude oil stockpiles rose last week by about 1.6 million barrels, against analysts’

expectations for a drop of about 300,000 barrels. However, markets continued to worry about US crude stockpiles at the key Cushing, Oklahoma, storage hub falling below minimum operating levels. Further drawdowns at Cushing, the delivery point for US crude

futures, could also provide new upward pressure on oil markets as it would compound supply tightness stemming from supply cuts by OPEC+. The UK’s Rosebank oil and gas field has received the go-ahead, despite pressure from climate groups to block the development.

The field isn’t set to begin pumping fossil fuels until at least 2026. Wednesday’s announcement comes after Prime Minister Rishi Sunak watered down interim plans for the government’s 2050 net zero emissions target. WTI +1.9%, Brent +1.3%, US Nat Gas +2.6%,

RBOB +1.3%.

CURRENCIES:

US$ Index inched higher, gaining for a sixth straight session and hitting the highest since December 2022. The dollar’s renewed rise has once again triggered a domino

effect of official reaction across Asia’s currency markets. Bank Indonesia remained active in the market to support the rupiah, a BI official said today, while South Korea’s finance minister suggested that steps would be taken to boost the won if deemed necessary.

Meanwhile, investors were on the lookout for government intervention in the Japanese yen after it fell past the 149 per dollar mark on Tuesday for the first time in just under a year. Japan’s Finance Minister Shunichi Suzuki repeated he’s watching currencies

with a strong sense of urgency. US$ Index +0.2%, GBPUSD -0.15%, EURUSD -0.3%, USDJPY +0.05%, AUDUSD -0.5%, NZDUSD -0.4%, USDCHF +0.3%.

Bitcoin +2.4%, Ethereum +2.7%.

TECHNICAL LEVELS:

|

ESZ23 |

10 Year Yield |

Dec Gold |

Nov WTI |

Spot $ Index |

|

|

Resistance |

4457.00 |

5.500% |

2047.0 |

98.00 |

110.000 |

|

|

4417.00 |

5.325% |

2022.0 |

97.07 |

108.970 |

|

|

4399.00 |

5.000% |

1996.0 |

95.00 |

107.990 |

|

|

4354.00 |

4.710% |

1982.4 |

93.74 |

107.195 |

|

|

4335.50 |

4.565% |

1935.1 |

92.43 |

106.260 |

|

Settlement |

4314.75 |

1919.8 |

90.39 |

||

|

|

4305.00 |

4.180% |

1907.0* |

87.50 |

105.350 |

|

|

4291.00 |

4.000% |

1866/71 |

86.75 |

104.420 |

|

|

4245.00 |

3.750% |

1842.0 |

83.36 |

103.460 |

|

|

4225.00 |

3.530% |

1821.0 |

81.40/60 |

103.100 |

|

Support |

4200.00 |

3.265% |

1800.0 |

80.00 |

102.920 |

Colors within the report:

Green is always the 200 period (day, week).

Red is always 21,

Blue = 50,

Brown =

100 *Stars have added importance

- Upgrades

- (ANET) Arista Networks Raised to Hold at CFRA; PT $200

- (CBSH) Commerce Bancshares Raised to Equal-Weight at Morgan Stanley

- (DOCU) DocuSign Raised to Hold at HSBC; PT $42

- (GH) Guardant Health Raised to Overweight at Piper Sandler; PT $40

- (HRZN) Horizon Technology Raised to Neutral at Compass Point; PT $10.50

- (IP) International Paper Raised to Hold at Jefferies; PT $33

- (JCI) Johnson Controls Raised to Buy at HSBC; PT $69

- (JKHY) Jack Henry Raised to Buy at DA Davidson; PT $174

- (LBRT) Liberty Energy Raised to Outperform at ATB Capital; PT $21.50

- (LILA) Liberty Latin America Raised to Sector Perform at Scotiabank

- (PEY CN) Peyto Exploration Raised to Sector Outperform at Peters & Co

- (PKG) Packaging Corp Raised to Hold at Jefferies; PT $142

- (PODD) Insulet Raised to Buy at CFRA; PT $175

- (PSA) Public Storage Raised to Buy at Goldman; PT $310

- Downgrades

- (BURL) Burlington Stores Cut to Hold at Gordon Haskett; PT $137

- (BYRN) Byrna Technologies Cut to Market Perform at Raymond James

- (COOK) Traeger Cut to Underweight at Morgan Stanley; PT $3

- (ICPT) Intercept Pharma Cut to Neutral at HC Wainwright; PT $19

- (ICPT) Cut to Hold at Canaccord; PT $19

- (M) Macy’s Cut to Hold at Gordon Haskett; PT $13

- (SPLK) Splunk Cut to Neutral at BTIG

- (SSB) SouthState Corp Cut to Hold at Truist Secs; PT $73

- (TRUE) TrueCar Cut to Neutral at BTIG

- (VLY) Valley National Cut to Underweight at Morgan Stanley; PT $8.50

- (WOLF) Wolfspeed Inc Cut to Hold at CFRA; PT $42

- (ZION) Zions Cut to Underweight at Morgan Stanley; PT $32

- Initiations

- (ALLK) Allakos Rated New Market Outperform at JMP; PT $11

- (CHPT) ChargePoint Rated New Buy at UBS; PT $9

- (COFS) COFS US Rated New Neutral at Janney Montgomery; PT $24

- (CRGY) Crescent Energy Co Rated New Overweight at Stephens; PT $17

- (CRSP) Crispr Therapeutics Rated New Buy at Mizuho Securities; PT $82

- (CRSP) Rated New Buy at Mizuho Securities USA

- (GRNT) Granite Ridge Resources Rated New Overweight at Stephens; PT $8

- (HAS) Hasbro Rated New Overweight at Morgan Stanley

- (LEVI) Levi Strauss Rated New Outperform at Cowen; PT $16

- (MAT) Mattel Rated New Overweight at Morgan Stanley; PT $27

- (MCB) Metropolitan Rated New Outperform at Hovde Group; PT $50

- (MLEC) Moolec Science Rated New Buy at Roth MKM; PT $5

- (MODG) Topgolf Callaway Brands Rated New Underweight at Morgan Stanley

- (NUVL) Nuvalent Rated New Buy at Stifel; PT $65

- (PGNY) Progyny Rated New Buy at Canaccord; PT $46

- (SN) SharkNinja Rated New Outperform at William Blair

- (SOUN) SoundHound AI Rated New Buy at DA Davidson; PT $5

- (TWST) Twist Bioscience Rated New Buy at Berenberg; PT $27

- (VSTM) Verastem Rated New Buy at B Riley; PT $21

- (WEC) WEC Energy Rated New Sector Perform at RBC; PT $95

Data sources: Bloomberg, Reuters, CQG

No responses yet