Market Review

Globex

| (ESH20:CME) GLOBEX Session | (ESH20:CME) Day Session |

| High 3128.50 | Opening Print: 3097.50 |

| Low: 3081.00 | High 3104.50 After Open |

| Volume: 380K | Low: 3019.75 AM |

| ES Settlement 3049.00 | |

| Total Volume 2.32 Million |

Wednesday’s S&P 500 (ESU20:CME) Recap

‘COVID19 City’

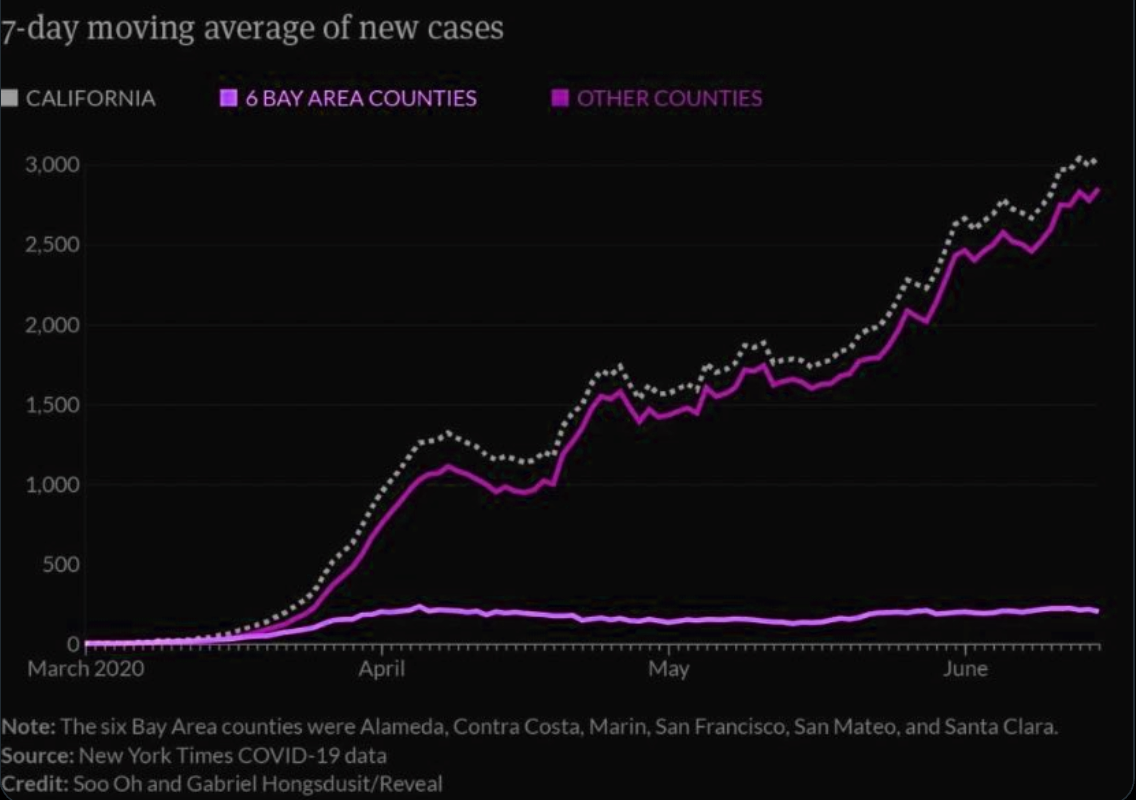

The S&P futures opened at 3097.50 on Wednesdays 8:30 CT futures open, traded up to 3104.50 at 8:41 and basically tanked as the markets waited on the California, Texas and Florida COVID19 numbers to be released. Initially, the ES dropped down to 3069.00 at 9:05, 35.5 handles off the high. After the low, the ES rallied up to 3082.75 at 9:28 and tanked again when Florida showed 5,400 new cases and the ES sold off 41 handles down to 3041.75 at 10:25. The ES rallied 8 handles up to 3059.25 at 10:32 and then tanked again down to 3019.75, one tick off my 3020 level I put in yesterday’s view. After the low, the ES rallied 34.25 handles up to 3954.00, sold back off down to a higher low at 3026.25 and then rallied back up 3047.00 at 1:35 CT. The ES then sold back down to 3033.50 at 1:52 and then ripped up to 3056.00 at 2:09 as the MIM showed over $300 million to sell. At 2:30 the ES traded 3047,99 as the MIM flipped from $300 mil to sell to $300 million to buy. The ES traded 3034.00 as the 2:50 CT cash imbalance FLIPPED to $2 billion to sell, traded 3040.00 on the 3:00 cash close and traded 3050.50 on the 3:15 futures close, down 62.25 handles or -2% on the day.

In terms of the ES’s overall tone, the large jumps in COVID cases across the US ‘spooked’ the markets. In terms of the day’s overall trade, volume was higher at 2.31 million.

DATA/HEADLINES: 8:30ET Weekly Jobless Claims (1.33M exp vs 1.508M prior), GDP (Revision), Durable Goods (+10.1% exp vs -17.7% prior), Trade in Goods; 9:30ET Fed’s Kaplan speaks; 11:00ET Fed’s Bostic speaks; 1:00ET 7yr auction; 2:00ET Mexico Central Bank Interest Rate Decision: expected to cut Overnight Rate by 50bps to 5.00%; 4:30ET Bank Stress Tests Released Continuing claims are expected to remain higher than 20 million. Fitch Ratings removed Canada’s AAA credit rating yesterday on account of the government’s substantial Covid-19 emergency spending. UK PM Spokesman: UK To Reverse Lockdown Easing If Needed To Contain Virus.

TODAY’S HIGHLIGHTS: Stocks are on a bumpy path after surging to a three-month high in early June, as optimism about stimulus measures and economic recovery battle with concerns about the effects of rising coronavirus cases. The International Monetary Fund projected a deeper recession and slower recovery for the global economy than it anticipated two months ago. The IMF now estimates a contraction of 4.9% in global gross domestic product in 2020, lower than the 3% fall it predicted in April. A global tally of COVID-19 infections crossed 9.33 million, with Australia recording its biggest one-day rise in COVID-19 cases in two months. The United States posted its second-largest increase in cases since the crisis began. Germany’s coronavirus infection rate fell to the lowest in almost three weeks, easing concerns that local outbreaks would prompt a resurgence of the pandemic. Australia recorded its largest spike in cases since April.

Economic Calendar

Closing Prices

In the Tradechat Room

MiM

Another big selling MOC at 15:50 with an understated MiM but a 3B sell reveal which created a 12 point candle. That bounce-back 15:55 trade did a complete retrace. We are still in rebalance for the Rut.

Reminder: June is Russell 2000 reconstitution month. Here is the schedule for that:

- Friday, May 8 – “rank day” – Russell US Index membership eligibility for 2020 reconstitution determined from constituent market capitalization at market close.

- Friday, May 22 – “query period” begins – preliminary shares & free-float information for Russell 3000 Index constituents are published daily & queries welcomes (query period runs through June 12)

- June 5 – preliminary US index add & delete lists posted to the FTSE Russell website after 6 PM US eastern time.

- June 12 & 19 – US index add & delete lists (reflecting any updates) posted to the FTSE Russell website after 6 PM US eastern time.

- June 15 – “lockdown” period begins – US index adds & delete lists are considered final

- June 26 – Russell Reconstitution is final after the close of the US equity markets.

- June 29 – equity markets open with the newly reconstituted Russell US Indexes.

Questions? Please email me: Marlin@mrtopstep.com

Get the skinny when we get it: Join the MiM.

Chart of the Day

Top Stories on MTS Overnight:

- Why ABM Industries (ABM) Stock Might be a Great Pick

- Wirecard has filed for insolvency after a…

- Earnings Preview: Jefferies (JEF) Q2 Earnings…

- 10 Thursday AM Reads

- Thursday: Unemployment Claims, GDP, Durable Goods

- Editorial: NM’s public health emergency law needs…

- MarketWatch: Need to Know

- Lyft Benefits From Increase in Ride Volumes amid Pandemic

- Market Wizards Remembered – Marty Schwartz

- A better chance for success

- DOT: Vehicle Miles Driven decreased 40%…

- Major Silicon Valley VCs are slamming President…

- Alaska Air Group (ALK) Q4 Earnings in Line

- How to Read the MiM

Our View

Did the S&P ‘Catch’ COVID19?

I don’t need to read the Wall Street Journal to know that the markets are on ‘shaky ground’. Coronavirus cases are accelerating across the United States. The ES has been going up for weeks on weak economic data and new money being put to work in technology stocks. As I have said a few times in the past several days; I do not believe the current sell-off is part of the ‘retest / hard sell-off’ everyone has been clamoring about. It’s a tough game that takes no prisoners.

Our view, the end of the quarter rebalance should be for sale but I want to remind everyone of one thing; the ES will sell off one day and possibly two days but getting three lower closes in a row is a very difficult task. That said, our lean for the ES is to buy a lower open for a scalp If the ES opens sharply higher, like up 30 I may look at short sales but I get the feeling the algos chase some buy stops at least in the first part of the day. The big question is will there be a MrTopStep walk away at quarter-end? And lastly, I don’t think it’s a great idea to go long over the weekend. COVID19 cases are going to explode higher.

Danny Riley is a 39-year veteran of the CME trading floor. He has helped run one of the largest S&P desks on the floor of the CME Group since 1985.

Market Vitals Technical Analysis

Did you know that your premium membership gives you access to our Market Vitals? Click on the image below and get today’s key levels.

As always, please use protective buy and sell stops when trading futures and options.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Decisions to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

No responses yet