Finally a Break Out of the Range. Can The Move Last?

Taking a chunk of profit on all of our open trades.

Follow @MrTopStep and @BretKenwell on Twitter and please share if you find our work valuable.

**If you did not see our midday update yesterday on profit targets and it’s applicable to your trading, please do so at your convenience.**

Our View

@RealTraderDave totally nailed the rally in the ES yesterday in the MrTopStep chat. I was dragging a long NQ from late Tuesday so after the opening drop I added to my NQ position. When they trend like they did yesterday, you just put your stop in and let it run.

As I write, all I can think about is this crazy range trade for most of 2023. The S&P has been (mostly) stuck between 4000 to 4220, but in the shorter term, it’s been stuck between 4120 to 4160 for weeks now. While I recall several periods where the S&P chopped in a narrow range, I don’t recall being at the same price for this long. I think this says the public is sitting it out right now and the short-term traders have taken over.

There has been another big shift of money moving out of the US back to Europe, which could be affecting the S&P. It doesn’t help that investors can park their money in interest-bearing investments and/or accounts and get 4% to 5%+ without the headache of equities.

At least for now I do not see a large move coming in either direction, despite making a big upside push yesterday.

Our Lean

One thing I’d like to point out is the outperformance of foreign equities. The Nikkei is back to its all-time highs (or just below them depending on if you adjust the contracts or not). Mexico (MXY) is at new highs, the DAX is just below its highs and the CAC recently made new all-time highs.

As for the US indices, the ES just hit its highest level since May 2, but couldn’t close above last week’s high of 4173.25. Let’s get through Opex and Powell.

Our Lean: I think you have to sell the early rallies today and buy the 20- to 40-point pullbacks. That said, I think it should be another day of choppy range trade.

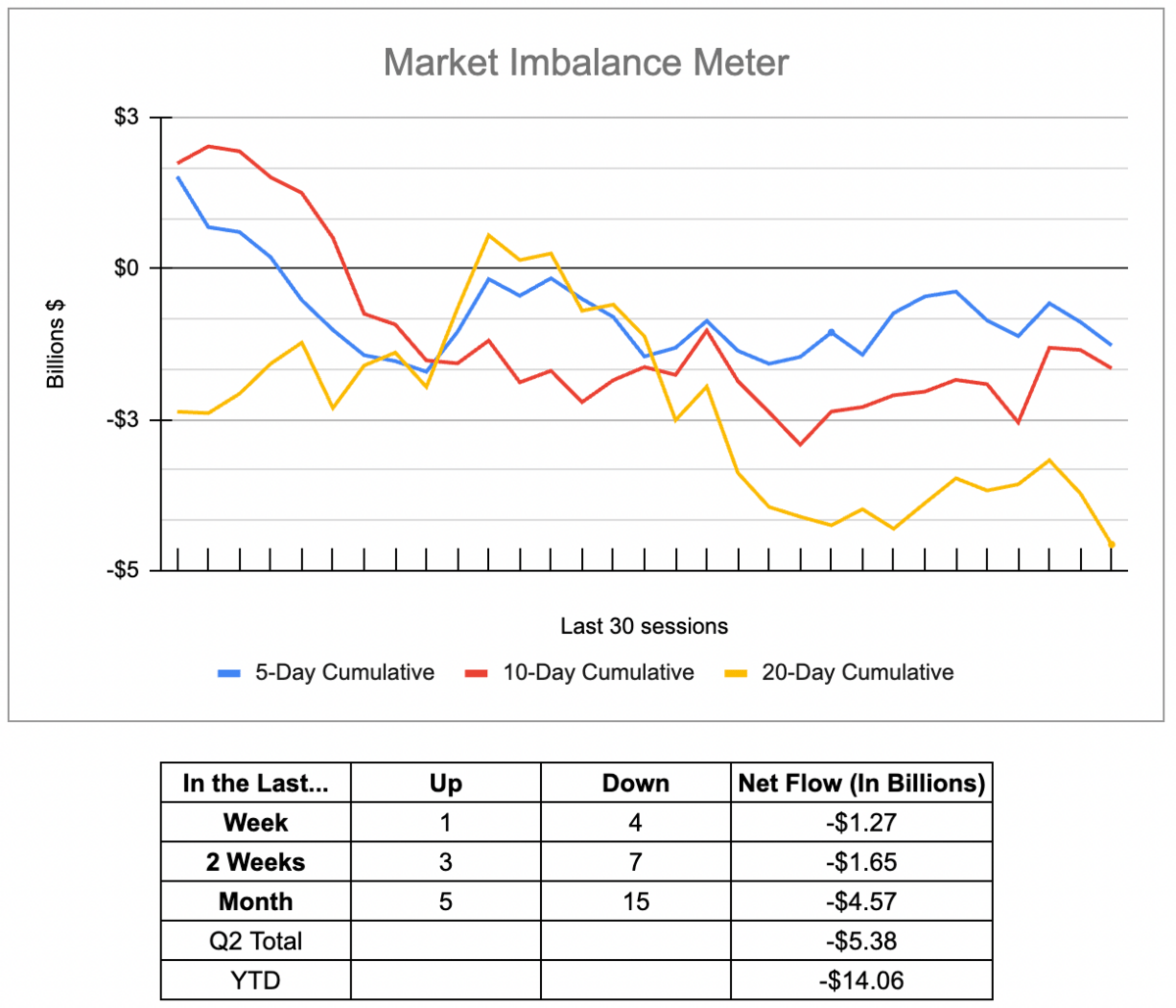

MiM and Daily Recap

The ES traded up to 4144.75 on Globex and opened Wednesday’s regular session at 4143.50. After the open, the ES printed 4144.25, sold off down to 4125.75 at 10:00 and then rallied back up to 4138.75 at 10:42, pulled back to the VWAP and then ripped up to 4148.25 at 11:18. From there, it dropped down to 4137.75 and then slowly rallied up to 4158.50 at 12:42, then made three separate higher highs at 4163, 4166.50 and 4172.50 at 1:11.

From 11:27, the ES rallied from 4144 to 4175.75 in one hour and 10 minutes and made two more higher highs at 4176.27 and 4179 at 1:58. The ES gradually pulled back to the 4164.75 level as the early imbalance showed $591 million to sell and then rallied up to 4173.75 as the 3:50 cash imbalance showed $360 million to sell. It traded up to 4175.25 at 3:57 and traded 4171.50 on the 4:00 cash close. After 4:00, the ES traded in a narrow range and settled at 4171 on the 5:00 futures close, up 48.50 points or 1.2% on the day.

In the end, the ES the MrTopStep trading rule that “it takes days and weeks to knock the S&P down and only one to bring it back,” was in play. In terms of the ES’s overall tone, with the exception of the roughly 20-point drop after the open it was very firm. In terms of the ES’s overall trade, volume was higher at 1.5 million contracts traded.

Technical Edge

-

NYSE Breadth: 81% Upside Volume (!)

-

Advance/Decline: 78% Advance

-

VIX: ~$16.75

A nice upside breadth push yesterday as most S&P instruments cleared last week’s high. We will need the SPY and SPX to hold that weekly-up rotation today and will need the ES to go weekly-up in the process (it is during Globex). Otherwise, the range trade may not be finish quite yet.

S&P 500 — ES

4175-ish is still a bit of a hurdle, but if the ES can clear it, ~4200 is the next significant area.

ES Daily

-

Pivot: ~4175

-

Upside Levels: 4198-4206, 4220, 4242

-

Downside levels: 4150, 4120, 4110-12

SPY

Into the top of key resistance, SPY needs to go daily up over $415.86 and hold above that level to open the door to our next upside levels.

SPY Daily

-

Pivot: $415 to $416

-

Upside Levels: $417.50 to $418.30, $421

-

Downside Levels: $414, $411.50, $409

SPY 30, SPY 60 min

On an intraday basis, I will be looking to buy a dip in the SPY and SPX. Above are the 30-min and 1-hour charts. A dip down to the 10-ema could be attractive.

SPX

SPX Daily

-

Pivot: ~4155

-

Upside Levels: 4167-70, 4187, 4195-4200

-

Downside Levels: 4140, 4125

QQQ

Not much more we can ask for out of the Nasdaq/QQQ. Into the 50% retrace from the 52-week low to the ATH.

Here’s a weekly chart for more perspective. ~$334.50 is the August high and could be in play, before a potential push to $350 (in time).

QQQ Daily

NQ

An absolutely perfect push from the NQ here. If riding this through 13,600, congrats. Use some caution as we enter a key extension area though.

NQ Daily

-

Downside Levels: 10-ema + 13,450-75, ~13,300

Open Positions

-

Bold are the trades with recent updates.

-

Italics show means the trade is closed.

-

Any positions that get down to ¼ or less (AKA runners) are removed from the list below and left up to you to manage. My only suggestion would be B/E or better stops.)

-

** = previous trade setup we are stalking.

Down to Runners in GE, CAH, LLY, ABBV, AAPL, MCD & BRK.B

-

META — Trimmed ⅓ between $237 and $239, down to ½ size after $240 trim, down to ⅓ size at $243+

-

Can be down to a runner. Ideally looking for a push through $245 (maybe can get down to ¼ size then) and fish for a move toward $250.

-

-

CRM — Took time, but got our $207-$208 trim down to a 60% position, Can actually trim down to ½ size on anything over $210 or yesterday’s HOD. I would love to see $212.50-ish.

-

Raise stops to Break-even or $200.

-

-

AVGO — long from weekly-up at ~$633 — first trim near $640, second trim at $645+, third trim $650 to $655+

-

Absolutely picture perfect trade here. Down to ⅓ or ¼ and would love to fish for that $675 extension to dump the last part into.

-

Manage how you’d like from here. Stops raised to Breakeven at least and preferably to a profitable level

-

-

UBER — long from $37.50 or below — Would love to trim some today on a daily-up move and into the $38.50 area.

-

If we get that we can bump up our stop from the $36 level up to either $37 or Break-even.

-

Go-To Watchlist

Feel free to build your own trades off these relative strength leaders

Relative strength leaders →

-

MCD, PEP & KO, WMT, PG — XLP

-

LLY, CAH

-

NVDA, CRM

-

MSFT, AAPL, META

-

LULU, CMG

-

FSLR

Relative weakness leaders →

-

PYPL

-

MET

-

CF, MOS

-

PFE

-

GLOB

Economic Calendar

Disclaimer: Charts and analysis are for discussion and education purposes only. I am not a financial advisor, do not give financial advice and am not recommending the buying or selling of any security.

Remember: Not all setups will trigger. Not all setups will be profitable. Not all setups should be taken. These are simply the setups that I have put together for years on my own and what I watch as part of my own “game plan” coming into each day. Good luck!

Update your email preferences or unsubscribe here

© The Opening Print

228 Park Ave S, #29976, New York, New York 10003, United States

No responses yet